Best Crypto Exchanges for High Volume Traders

There’s no exact metric or qualifier for a ‘high volume trader.’ As a rule of thumb, though, we could say you’re a high-volume trader once you’re frustrated by trading fees. Then, when 0.2% here or 0.1% there becomes noticeable, you’re almost certainly in high volume territory.

High-volume traders measure costs and volumes by different yardsticks, so don’t worry too much about how large your monthly trading volume needs to be. There’s no minimum entry requirement for this, except that you have surpassed the Tier 0 or beginner level fees on a cryptocurrency exchange.

We set out four qualifiers for a good place to trade on for high-volume traders. Note that through this article, we’ll use the term rebates in places where trading fees have inversely become rewards for providing so much liquidity to a platform. We’ve only chosen platforms where the primary activity is spot trading, as it’s possible to get even lower fees on some futures or spot trading websites. Finally, high-volume exchanges would not be complete without a wide range of cryptocurrencies, like Bitcoin, Litecoin, and Ethereum.

Ranking methodology – How we decided which exchanges to consider

Our Top-Ranked Crypto Exchanges for High Volume Traders

Nobody can accuse Binance founder and young Chinese billionaire Changpeng Zhao of lacking ambition. Since its 2017 launch, Binance has set a course for success, creating a global entity that has completely reshaped the cryptocurrency trading market. Binance leads the pack by far in trading volumes among Bitcoin exchanges, processing more Bitcoin transactions than the next 20 biggest crypto exchanges combined.

The facts regarding this exchange are phenomenal, and what that means is that any high-volume traders who are looking for a place to buy, sell, and swap coins know exactly where to come. Other cryptocurrency exchanges are forced to drop their transaction costs, offer unique altcoins, create bulletproof security, or innovate services, all with the risk that Binance might come along and do it bigger and better soon.

Originally based in China, Binance now has offices and registered addresses worldwide, with the company being run from the Cayman Islands and Malta, as well as by talented remote workers. As China banned cryptocurrencies, the relocation was political, and Changpeng Zhao didn’t want to see his vision crumble. Quite the opposite took place, and now users can enjoy a maximum of 0.1% maker and taker fees, a highly competitive figure in this industry. High-volume traders will see their fees drop considerably, as will those who pay their fees in BNB (25% discount) or engage in Binance’s referral scheme (20% discount). The minimum fees payable are just 0.012% for makers and 0.024% for takers.

Is it all smooth sailing at Binance?

If we find fault with Binance, it’s in their past security performance, with a May 2019 breach seeing 7,000 BTC line hackers’ pockets. It’s worth $40m at the time, it’s now valued at over $250m, and Binance had to refund it from their own profit margins and insurance fund. Whereas many of the best cryptocurrency exchanges can collapse after a big hack like that, Binance used it as a launchpad, working hard to become more secure, more trustworthy and set a new standard for exchanges.

However, the problem remains that in crypto, there’s a common belief that nothing is ‘too big to fail,’ including the entire industry itself. Those who survived the 2017 crash can confirm. So, for many high-volume traders, a huge exchange like Binance gives them a reason for concern. The biggest exchanges are the biggest targets, not just for hackers but for regulators too. Fortunately, Binance is the top dog right now, and that doesn’t look likely to change in the short term.

American traders, if you’re not familiar with Gate.io, it’s time to bring you up to speed. Despite having a registered address in Virginia, Gate’s roots lay in China, founded under bter.com in 2013. After the Chinese government started banning Bitcoin and other crypto activities, major Chinese exchanges left for new beginnings. Rebranding in Virginia as Gate.io, this cryptocurrency exchange now offers an immense English, Korean, and Japanese platform. Gate.io introduced long-awaited partnerships with liquidity providers Banxa, Mercuryo, and Simplex to enable debit and credit card purchases directly to crypto wallets. This is great news for high-volume traders looking for a cryptocurrency exchange that can sell them some coins as well as facilitate trades.

Quick Look

- 0.2% maker and 0.2% taker fees for beginners

- Pay fees in GT for 25% discount below Level 10

- From VIP Level 10, fees paid in GT receive a 45% discount

- Maker rebates of -0.005% start at 40,000 BTC ($2.3bn) or 50,000 GT ($100k)

- High-volume traders can provide liquidity for additional benefits

- 548 coins, 1235 pairs

- Never hacked

- Excellent mobile app

- Margin trading and lending options

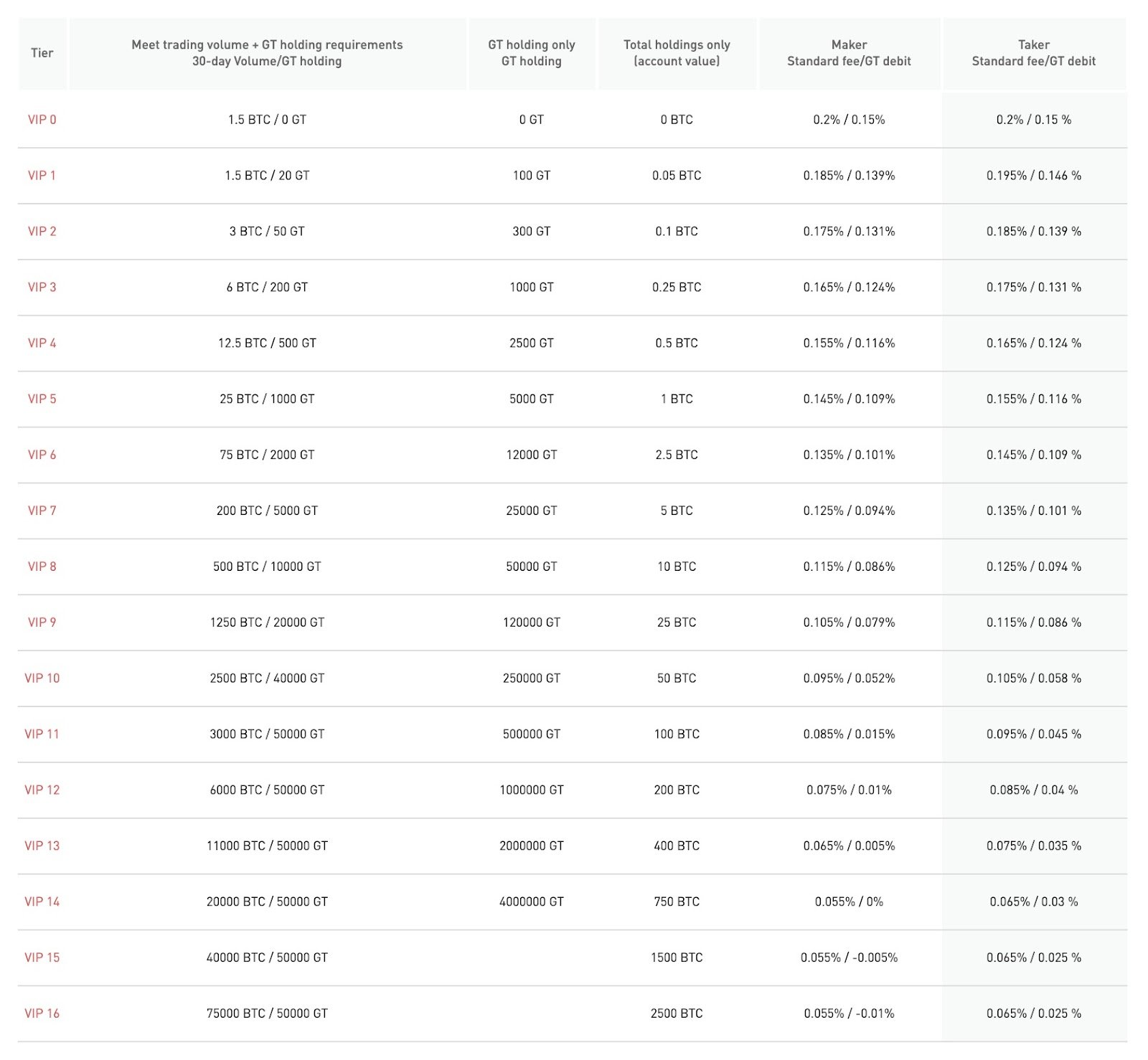

What about the fees? 0.2% for beginner makers and takers is a good start, but for high volume traders, this Bitcoin exchange offers a very friendly 16-tier fee schedule that incentivizes making bigger and bolder trades. All fees can be discounted by 25% if paid in GT, Gate.io’s native utility token; however, once you reach VIP tier 12, the discount increases to 45%.

Like FTX, there is a rebate system, but rather than through liquidity mining (that’s a different reward system), the rewards are maker rebates applied based on the value of completed monthly trades. Tier 15 and 16 both offer rebates:

- Tier 15: -0.0005% when trading 40,000+ BTC or 50,000+ GT & account value is more than 1,500 BTC

- Tier 16: -0.001% when trading 75,000+ BTC or 50,000+ GT & account value is more than 2,500 BTC

High-volume traders are unlikely to be disappointed by Gate’s opportunities, as it has one of the best cryptocurrency exchange market listings, with 548 cryptocurrencies and 1235 exchange pairs. They add so many coins and pairs that this information can quickly become out of date. This wide range of choices is currently helping Gate.io steal users from their closest rivals, Huobi and OKEx.

Finally, Gate.io has held the first position as the best crypto exchange for securely trading cryptocurrencies for over 2 years now. See more about that here.

FTX is the brainchild of Sam Bankman-Fried, a prolific crypto investor and Blockfolio, SushiSwap, and Alameda Research owner. FTX has rapidly gained a loyal following in just two years, thanks to the low fees and highly attractive reward system for beginners and high-volume traders. On particularly busy days, 24-hour trade volume tips over $1 billion.

Quick Look

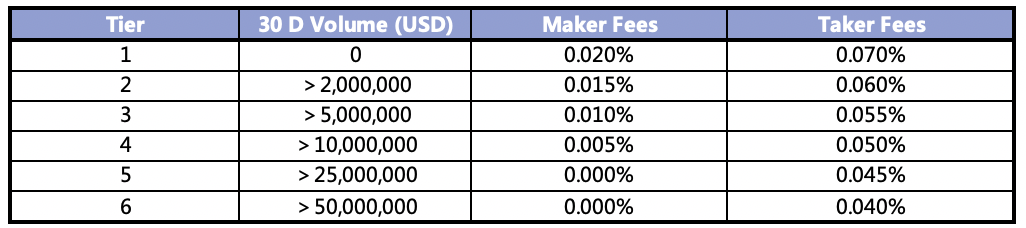

- 0.02% maker fee and 0.07% taker fees

- Trading more than $25m worth of cryptocurrency per month unlocks 0% maker fees and 0.045% taker fees.

- Staking 1m FTT ($39m) offers great rewards, such as -0.003% rebates, 5000% bonus votes, and 14% airdrop increase, plus 40% rebates on your referral’s fees

- Never been hacked

- Daily trade volume regularly increasing — now around $1bn

- No withdrawal fees for crypto (network charges only)

- 196 coins, 391 exchange market pairs

- New and improved mobile app

- Margin trading enabled

This is the best cryptocurrency exchange for high-volume traders because it was made specifically for them. Coinbase and Gemini target beginners, Binance targets the general trader, Deribit targets futures trading, and Gate.io targets altcoin hunters; FTX specifically aims to be the best exchange for high volume traders.

The initial 0.02% and 0.07% maker-taker fees are the lowest in the industry. For example, you’d have to trade over $100m per month on Coinbase Pro to unlock fees lower than FTX. On FTX, however, trading just $25m a month rewards users with 0% maker fees and 0.045% taker fees, truly rock bottom commissions that no rival crypto exchange is willing to meet.

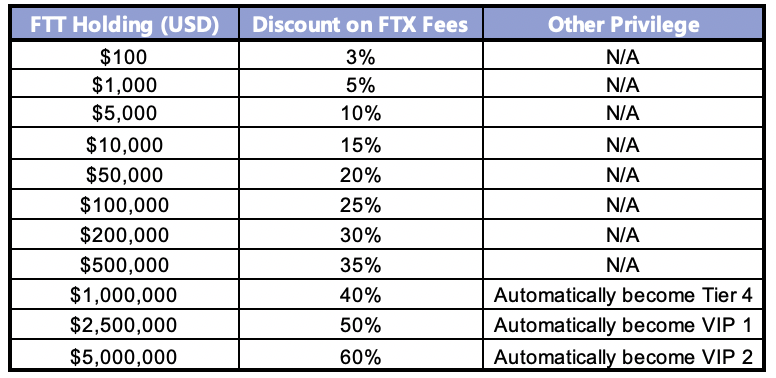

Many Bitcoin and crypto exchanges release their own native token to present further reward or investment opportunities to their traders. That’s exactly what FTX Token (FTT) is, and by staking as little as 150 FTT ($6,000), you can be rewarded for providing liquidity to the trading platform. However, the rewards are minuscule at -0.0005%. Scaling up the FTT liquidity providing, those who stake 1m FTT ($39m) can gain -0.003% rebates, 5000% bonus votes on website governance, a 14% airdrop increase free tokens, and 40% of your referral’s trading fees.

High-volume traders can also purchase and hold FTT for some extraordinary fee discounts. Apply the discounts shown in the table below to the fee schedule above, and ultimately, you’re paying virtually nothing.

A few more facts:

- FTX has never been hacked

- There are no deposit or withdrawal fees for cryptocurrency

- There are 196 cryptocurrencies and 391 trading pairs

- Exchange rate? There are no fees on conversions, even for FX trading pairs

What have we learned about these trading platforms?

High trading volumes + small user base = perfect for high volume traders

Each of these crypto exchanges has low website traffic in comparison to its daily volume. By contrast, Kraken has four to five times more users than KuCoin and receives approximately the same daily volumes. Why? Because KuCoin’s fee structure appeals to high-volume traders.

The best cryptocurrency exchanges aren’t always the biggest

While we do love Binance, the best overall exchange, it’s not on this list because it’s the best exchange for middle-ground traders and is not perfectly tailored to high-volume users. Coinbase Pro, the second-largest exchange, has fees too high even to be considered.

High volume cryptocurrency trading is done best with multiple incentives

What do all of these four crypto exchanges have in common? A native utility token — FTT, GT, KCS, and BTMX. They then use these cryptocurrencies to offer enormous discounts, staking, dividends, and more, bringing high-volume traders to the platform. Choose wisely.

Best of luck out there.