Best European Bitcoin Exchanges

Europeans get the best experience of the crypto world thanks to how Bitcoin-friendly the EU is. Think about it; there are the crypto-loving islands of Malta and Cyprus. There’s the innovative crypto-nation of the Czech Republic, and there’s even a guy trying to start his own country called Liberland, which would run on crypto (in theory). Europe is a Bitcoin haven. Europeans don’t have to suffer the regulations faced by Americans, the 55% tax rate applied to the Japanese, or the complex taxing procedures imposed on Australians and their asset holdings.

Knowing what we now know, is there any trading platform or cryptocurrency exchange in particular where Europeans enjoy this relative freedom? We’ve found a few of the continent’s finest choices.

Ranking methodology – How we decided which exchanges to consider

Our Top-Ranked European Exchanges

Cryptocurrency exchanges need to do a few things very well to win admirers and traders. They need low fees, strong security, a user-friendly website or app, and a lot of ambition. Binance has it all and more. In fact, among all of the top cryptocurrency exchanges, there isn’t one that can boast more cryptocurrencies (385) or market pairs for trading (1,205) than Binance. 31 of those trading pairs are EUR-to-crypto, an excellent range for any European citizen thinking of doing some cryptocurrency trading on this exchange.

Quick Look

- 62 of the 293 trading pairs are EUR-to-crypto!

- Office in London

- Maker fee: 0.16%

- Taker fee: 0.26%

- Free SEPA deposits, €1 minimum, 0-3 business days

- Worldwide EUR deposits can be made through Bank Frick, Fidor, and Etana Custody

- In January 2021, to meet the growing demand in Europe, Kraken launched a new mobile trading app for traders of all levels and abilities

- Purchased Dutch cryptocurrency exchange Clever Coin in 2016 for an undisclosed amount

Beginners will find Binance among the best crypto exchanges for low fees, with only a few niche platforms able to better the 0.1% maker and taker fees on offer to low-volume beginners. Those who purchase Binance Coin (BNB) can unlock a 25% discount on their trading fees, and a further 20% is available to those who refer friends to the platform. Those who trade large volumes can unlock exceptional discounts in the long term.

With tens of billions of Euros flying through the platform every day, it’s no great surprise that the exchange offers some of the best liquidity, but how does it fare in terms of payment methods, bank transfer options, and more. Let’s see:

- Free deposits on the SEPA network

- Credit or debit card purchases (3DS enabled)

- Bank card deposits charged at 1.8%

- iDEAL deposits cost €1.30 each

- advcash is free to use

- Etana costs just 0.1%

- P2P trading opens up hundreds of payment options (PayPal, Revolut, Transferwise, etc.) which offer widely varying fees depending on the method and the terms agreed with the other party

- The Simplex network also offers account holders the opportunity to purchase cryptocurrency immediately at a 3.5% fee, though the market prices may differ from those provided by Binance, as the liquidity is sourced differently

It’s predicted that the EUR profits in 2021 will go well clear of €500m, making Binance more profitable than all of the other exchanges in this article combined. It also gives encouragement to the idea that Binance will one day dominate the European market and steal some of Kraken’s customer base. There are already 13.5m traders signed up, which represents a good percentage of the estimated 100-120m crypto holders in the world.

Before we forget, the Binance Visa Card gives users a crypto-loaded debit card in almost every European country, and with up to 8% cashback on purchases. Here’s how it works.

Our final point relates to geographic locations. Binance has now registered addresses or opened offices in Istanbul, London, Jersey, Paris, Berlin, and Moscow, which does a great job covering Europe and the major European fiat currencies. On Binance, you’ll find services for currencies like the Polish Zloty, Swedish Krona, Russian Ruble, Norwegian Krone, Hungarian Forint, Swiss Franc, and more.

Now, let’s move on to a European exchange that may be small in size but which makes up for that in countless ways.

Moving on to our 2nd place cryptocurrency exchange.

Europeans searching for the best cryptocurrency exchange should look for a couple of things: a friendly mobile trading interface, lots of EUR trading options, low transaction fees, and plenty of options for turning fiat money into cryptocurrencies such as Bitcoin and Ethereum. There’s none better than Kraken. Six million members would seem to agree.

Quick Look

- It caused an enormous stir when they left China in 2018, relocating initially to Malta

- Opened offices in Istanbul, London, Jersey, Paris, Berlin, and Moscow

- The world’s biggest cryptocurrency exchange

- 31 different EUR-to-crypto trading pairs

- Lowest trading fees in this article, starting at 0.1% for both makers and takers

- Free deposits on the SEPA network and with advcash (ADV)

- 1.8% deposit fee with Visa and Mastercard

- €1.30 per deposit with iDeal

- 0.1% fees with Etana

- Great competitions for European users, like this one

Thanks to Kraken’s eurocentric approach to cryptocurrency trading, millions of Europeans use the platform. They boast 62 EUR-to-crypto trading pairs, more than any other exchange by quite a long way. On top of that, they offer the best liquidity for EUR/BTC (Euro to Bitcoin), making it the no-brainer place for Bitcoin holders in the EU. Speaking of the EU, with the European Union offering quite a relaxed approach to cryptocurrency (more on this right at the bottom of this article), it’s an attractive market with more than twice the population of the US, and it was only time before a dominant force presented itself. Fortunately for Kraken, this EUR/BTC dominance has been a thing for several years, despite the emergence and might of Binance and Coinbase.

To further stamp their place in the European market, back in 2016, Kraken acquired Clever Coin for an undisclosed amount. The Dutch exchange, its services, and its customer base were all absorbed into Kraken and at a very convenient time, as Clever Coin was experiencing payment issues and needed a solution. This acquisition proved to be a great asset to Kraken as it allowed them to expand in Europe with fewer hurdles.

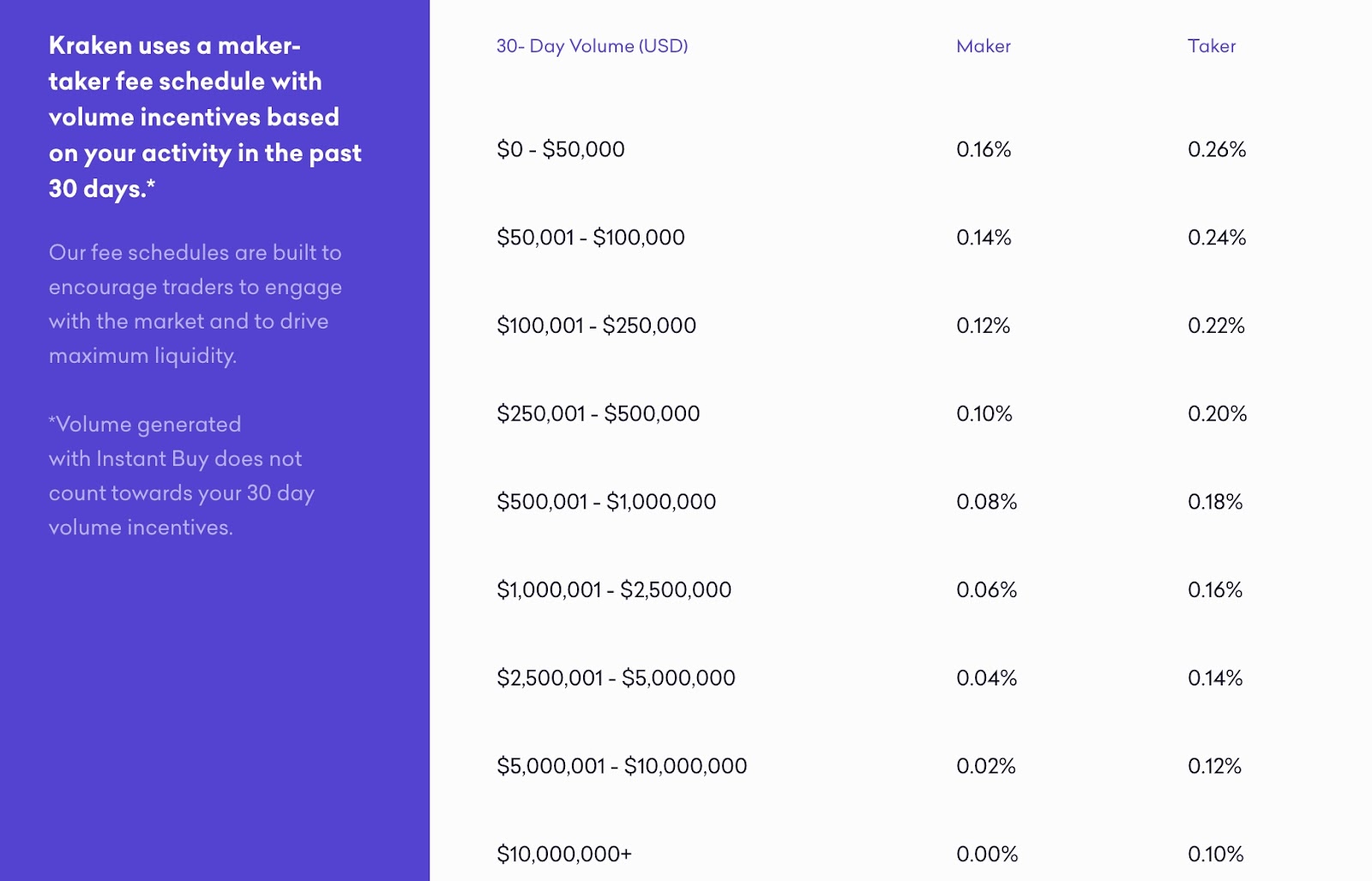

As a European trader on Kraken, you’ll get access to the very friendly fee structure, starting at 0.16% for makers and 0.26% for takers on cryptocurrency pairs (such as Bitcoin to Ethereum). However, for those making trades with stablecoin pairs (like USDT) or fiat currencies (like EUR), the fees start at 0.2%. As you trade more and your trading volume increases over the course of the month, these fees will reduce.

Overall, when you scale Kraken, Binance, Bitstamp, and CEX.io to the same size, it’s pretty evident that Kraken is the elite crypto exchange for European investors. For security reasons, too, Kraken can boast the top prize because they have never been hacked, despite many attempts. Binance and Bitstamp, on the other hand, were both hacked prior, and for significant amounts of Bitcoin too (7,000 Bitcoin and 19,000 Bitcoin, respectively). CEX.io seems to score quite highly on security, too, with no known hacks; however, it is a much smaller target than all of the others and presumably flies under the radar as a result.

What sort of fees can Kraken users expect to pay?

When it comes to purchasing cryptocurrencies directly from Kraken, there are 61 different coins available. For users who want to make a direct and instant purchase using their credit or debit card, the cost is 3.75% + a fixed €0.25 charge per transaction. This is pretty fair and relatively consistent with prices around the industry.

When making a bank transfer and depositing funds into your fiat exchange wallet, Kraken is entirely free for every bank except for Bank Frick (sorry if you’re from Liechtenstein and bank with them). European users will typically make a SEPA transfer, with a minimum amount of €1, which takes 0-3 working days; however, Fidor Bank (an online German bank) offers instant deposits. The bank transfer processing time for worldwide SWIFT transfers can take up to five days, typically when sending fiat currencies internationally.

If there is a negative to Kraken’s charges, it’s the spreads, which is the difference between the market price and the price the brokerage service sells the cryptocurrency for. Most crypto exchanges with a brokerage offer the same selection of crypto assets for sale, such as Bitcoin, Litecoin, Ethereum, etc. When you offer more than 50 coins for direct purchase, there begin to arise liquidity issues, where each purchase affects the price significantly. To counteract this or offset it, the exchange adds on a small margin of profit. In the past, this margin, which we call the spread, has been as much as 10% on Kraken, meaning that no matter how friendly the fee structure, purchasing crypto products is an expensive endeavor.

Third, in our list of the best European Bitcoin and crypto exchange platforms, we have the delightful British exchange CEX.io. Now, don’t let their small size mislead you, because what they lack in numbers, they make up for with immaculate service, especially for European and US users.

Quick Look

- London, Gibraltar & New Jersey offices

- 0.15% maker fee

- 0.25% taker fee

- 4m+ registered users, mainly in Europe and the UK

- Recently expanded to the US in 48 states

- 105+ cryptocurrencies, 225+ trading pairs

- 25+ different EUR-to-crypto pairs

CEX.io is one of the best crypto exchanges because it hasn’t stopped maintaining its core ideals of reliability, quality, and efficiency, in pursuit of creating the ultimate service for its users. If you’re worried about liquidity due to the comparably low volumes, fear not. CEX.io’s management team has forged excellent strategic partnerships with liquidity providers to solve this problem.

We’ve been a fan of CEX.io for years and have watched its rise with great enthusiasm as it now enters its 8th year of operation and continues to build robust products, attract new users, and grow its daily trading volumes. In just a few months, we’ve seen the average trading volume triple, and that coincides with a report from CEX.io that since halving their GBP deposit fees, they’ve seen a 68% rise in deposits!

Why is CEX.io among the best cryptocurrency exchanges for Europeans?

Let’s start with the fees. At just 0.16% for makers and 0.25% for takers, they are marginally more cost-effective than Kraken, which is excellent, but what makes them stand out is how low their card fees are! Card deposits are just 1.49% for GBP and 2.99% for EUR (and USD), significantly less than Binance and Kraken. Oh, and bank transfers are free.

Along with low fees comes a great selection of 83 cryptocurrencies, featuring all of the big names in the industry, combined into a total of 180 trading pairs, among which 25 of the pairs are EUR-to-crypto, and 16 are GBP-to-crypto.

What is the EU’s stance on cryptocurrency?

It’s safe to say that the European Union and the European Commission are both favorable towards cryptocurrency and the Blockchain and recognize the importance of legal clarity and regulatory frameworks for the industry as a whole.

The aim is to create a pan-European framework that all countries can agree on, with new market rules, regulations, and legal agreements.

There are also mentions of:

- A digital Euro

- A new EU law on crypto assets that don’t qualify as “financial instruments”

- A pan-European Blockchain regulatory sandbox (a kind of collaborative think tank for testing solutions in a safe manner

With that being said, all of the exchanges we listed will benefit the beginner and ensure a solid BTC purchase experience. Good luck out there, European friends.