Best Exchange To Buy Bitcoin Using A Credit Card

If you’re aching to get yourself some crypto, but payday is still a couple of weeks away, it might be tempting to use your credit card and make that purchase. Of course, you should only risk what you can afford to lose, a popular mantra in the crypto world, but we know you’re aware of the risks. So, back to that credit card sitting in your wallet. When you search the internet looking for the right place to buy Bitcoin using a credit card, it’s not that straightforward. Too many blogs with too much misinformation. Too many choices and the quality ones aren’t apparent.

In this piece, we want to set the record straight, so we’ve found the best Bitcoin broker that accepts credit cards for mobile users, for American users, for maximalists, and for those who like stock trading as well as crypto. We will also introduce one option that lets you pay for crypto with virtually anything (even a car!).

Ranking methodology – How we decided which exchanges to consider

Our Top-Ranked Credit Card-Friendly Exchanges

This capability to buy Bitcoin with a credit card on Binance comes from its partnership with Simplex. It builds upon pre-existing purchase and deposit methods such as cash advances, wire transfers, and bank deposits. The charges for using debit and credit cards to purchase cryptocurrency start at 3.5% or $10, depending on which is higher than the order amount. There’s a typical waiting time of 10-30 minutes before the digital assets reach the wallet. Simplex sets the brokerage prices based on information from their liquidity partners if there’s a disparity between market price and credit card price.

Quick Look

- Accepts: Visa & Mastercard

- 3.5% or $10 credit card usage fee, whichever is the greater of the two

- 10-30 minutes for crypto to be deposited in the wallet

- Partnered with Simplex, a well-trusted liquidity provider

- 24 different cryptocurrencies for sale by credit card

- Offers a debit card with up to 8% cashback

Binance also offers debit cards to their users, with up to 8% cashback on purchases. These debit cards can be convenient, too, as they offer alternative solutions for buying and selling crypto, completing a loop somehow.

For our readers in the United States who may be familiar with Binance.US, the American version of the exchange, you may be disappointed to know that credit card companies have not partnered with Binance US to provide this payment method (yet).

The Winklevoss twins, who are most well-known for conceptualizing Facebook and winning millions of dollars from Mark Zuckerberg in a groundbreaking trial, are the brains behind Gemini. After the Facebook trial concluded, they invested millions of their settlement money into Bitcoin, which turned the twins into billionaires after massively blowing up in value.

Wanting to continue their successful cryptocurrency journey, they set about making the most legitimate, respect-worthy, and institutionally recognized crypto exchange. They’ve done a fantastic job on those fronts, and the mission has been accomplished (in the US, at least). For those who want to buy Bitcoins with their fiat currencies, there are few better options than Gemini; plus, the platform comes with the bonus of being fully insured against theft and hackings.

Quick Look

- Accepts: Visa, Mastercard, & American Express

- Fees: ~0.5% convenience fee, plus a fee depending on the order amount, starting from $0.99

- Bitcoin purchases are delivered typically in under an hour

- Interestingly, Gemini also offers its credit card scheme to its members!

Peace of mind is achieved for all account holders. Institutions will also find that Gemini is tailored to their needs, being registered in all US states and having SOC1 and SOC2 certifications.

So, what about the credit card fees?

Unlike their rivals, fees are a little complicated on Gemini. The first thing to know is that each credit card order will incur a 0.5% convenience fee. Be mindful, however, that this 0.5% is a spread, so it is simply 0.5% more than Gemini’s market price, and, since the market price is constantly changing, the 0.5% figure can vary slightly due to the variable price at the time of the web order and the price at the time of fulfillment.

Next is the transaction fee, which will not change depending on whether you wish to buy Bitcoin with credit card providers Visa, Mastercard, or American Express. What will affect the transaction fee is the order amount, as seen below:

| Web Order amount – USD | Transaction fee – USD |

| ≤ $10.00 | $0.99 |

| > $10.00 but ≤ $25.00 | $1.49 |

| > $25.00 but ≤ $50.00 | $1.99 |

| > $50.00 but ≤ $200.00 | $2.99 |

| > $200.00 | 1.49% of your Web Order value |

A $1,000 order of Bitcoin with a credit card would already have the fees included in the $1,000, so it can be difficult for users to break down exactly how much they’ve spent on fees. However, we can see that $14.90 has gone on the transaction fee and $5 on the convenience fees, meaning that rather than receiving $1,000 of BTC, you would receive $980.10 worth of BTC for $1,000. This is an excellent return with an order of this size. Binance would charge $35.

What about the process and versatility?

We’ve spoken only of the US Dollar, but your Gemini exchange account is also compatible with AUD, CAD, EUR, GBP, HKD, and SGD. On top of the fiat currencies on offer, credit card payments will allow Gemini users access to a wide range of cryptocurrencies, with 40 different coins to purchase directly. Interestingly, only DAI and Gemini Dollar are listed as compatible stablecoins on this platform, mainly due to the unpopular position that US regulation has taken on USD-pegged digital assets. Most purchases are delivered to your account within an hour. However, liquidity issues can slow this down. Overall, the purchase process is straightforward and friendly, appealing to private traders and institutions alike.

Credit payment cards, pending…

Gemini has a credit card, with users offered cashback rewards and various other perks for making credit card payments through their service. These exclusive Gemini credit payment cards are offered in partnership with digital lending experts WebBank, though you’ll need to join a waiting list to get a hold of one.

Rather than selling your cryptocurrencies directly from their brokerage, KuCoin, which famously shied away from fiat services in the past, has now teamed up with a range of payment providers to encourage and enable credit card payments. As one of the most versatile and popular cryptocurrency exchanges, this is something to celebrate, and in true KuCoin style, they’ve made their options comprehensive and enjoyable to users.

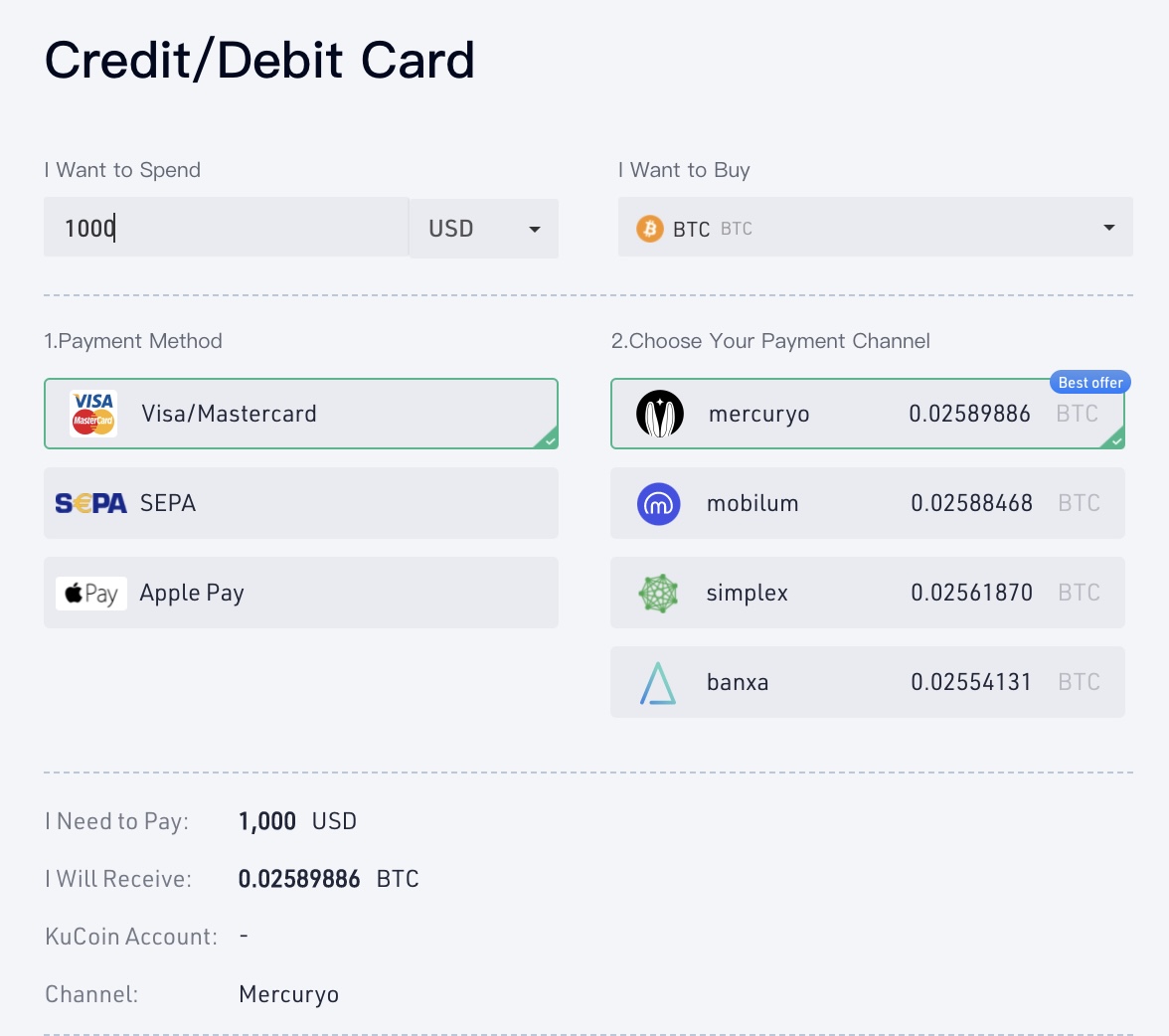

First of all, users can pay by Visa, Mastercard, SEPA, and Apple Pay. Since SEPA is for EUR bank transfers, and Apple Pay is a way of storing your credit, debit card, or other payment information in your phone, let’s move past these. Users can select Visa or Mastercard (sorry, American Express users) as their credit card provider.

How to buy Bitcoin with Credit Cards

Let’s walk you through the process (see the photo for reference).

- In the ‘I want to Spend’ box, type in how much crypto you’d like to buy. We’ve put $1,000 as it’s a nice clean figure to use as an example.

- In the ‘I Want to Buy’ box, you can see a drop-down menu containing 30 different cryptocurrencies for direct purchase, though be aware that some fiat-to-crypto combinations might not have the liquidity to function yet. We tested this out and found very few examples, which is a good sign. Users will discover USDT and USDC in this list, the only stablecoins sold by KuCoin.

- Next, choose your payment method, which, as we agreed, should be Visa/Mastercard, unless you have a credit card connected to your Apple Pay, which you can choose at your discretion.

- Finally, ‘Choose Your Payment Channel’ gives four popular and trusted liquidity providers – Mercuryo, Mobilum, Simplex, and Banxa. Each of these has different credit card fees:

- Mercuryo: 3.95%

- Mobilum: 2.9%

- Simplex: $10 min fee or <5% fee for crypto orders over $200

- Banxa: $0 fees (but higher spreads, which is why you receive the least BTC)

- Regardless of which liquidity provider you choose, you will need to go through KYC checks if it is a first-time purchase. This typically involves providing copies of your passport, driver’s license, or national ID, as well as a load of personal information to ensure you’re not funding terrorism or laundering money!

Thanks to the versatility of their partnerships, buying Bitcoin with a credit card is well-facilitated by the KuCoin exchange. They manage to negate the direct responsibility of selling crypto and focus on what they do best, providing an exchange service.

Exploring some of the terms and themes in this article

What is a spread?

In Trader’s English, the spread is the difference between the highest bid offer and the lowest ask offer on a cryptocurrency exchange’s order book. On market pairs with inferior liquidity or activity, it sometimes happens that there is a temporary standoff when the spread is too high, meaning nobody is willing to pay the lowest price asked for a cryptocurrency. This is one meaning of the spread.

When we talked about the spread regarding credit card payments for Bitcoin, we are applying a similar theory, but it’s not quite the same thing. Let’s say, for example, the market price for 1 Ethereum (ETH) is $2000, but Crypto.com has a spread of 3%. This means they’re going to sell 1 Ethereum to you at $2,060 (2000 x 1.03). If you then try to make a credit card purchase of $2000, what you will receive instead of 1 whole ETH, is $2000 worth of Ethereum at $2060, giving you around 0.9708 ETH.

What are stablecoins?

The most common stablecoins are USDC, USDT, BUSD, DAI, TUSD, and PAX. Each of these is referred to as stable because they are able to maintain a pretty consistent peg to the US dollar.

PAX is unique among them because exchanges which partner with Paxos are able to offer a wire transfer method that automatically converts your dollars into PAX (which are worth one dollar). Traders who prefer to buy Bitcoin with their credit cards will not see much value in this service, but for those who are used to making wire transfers, this is an exciting opportunity.

What does the future look like for those who want to buy Bitcoin with a credit card?

We want to be transparent here; it’s not looking too groovy. The demand for buying crypto is going to increase, that’s a given, but in particular, we see a decline in credit card payments. The most prominent example of this comes from Coinbase, which slowly removed credit cards from their payment options (for most countries), with this warning message attached: “Coinbase no longer supports linking new credit cards, and some card issuers are blocking cryptocurrency purchases with existing credit cards. If you have a credit card linked already, your bank may charge additional fees for Coinbase credit card purchases. We encourage affected customers to switch to a debit card.”

In the future, if you want an exchange that allows you to buy Bitcoin with credit card options, you’ll most likely need to use an exchange that has forged partnerships with liquidity providers, such as KuCoin. In the meantime, these awesome credit-card-friendly exchanges will do just the trick. Best of luck out there.