Coinbase vs. Gemini: Which US Crypto Giant Wins?

In this comparison piece, two of the giants of the cryptosphere face off. It’s Coinbase vs. Gemini, Armstrong vs. Winklevoss, clashing to see which of the two most user-friendly US-compatible cryptocurrency exchanges will come out on top.

Gloves on, it’s time to start this head-to-head and find out which is the better crypto exchange, Coinbase or Gemini.

Note: Coinbase does not report trading volume numbers.

Coinbase vs. Gemini is a riveting comparison because they both aim to drive in the same lane: a fully U.S. government compliant crypto exchange that is extremely user friendly — not to mention the top on-ramp to Bitcoin and crypto for beginners. So, let’s examine if Gemini is a worthy Coinbase alternative.

Coinbase vs Gemini Fees

For people looking to accumulate and hodl until bitcoin is a million dollars, fees aren’t necessarily a critical issue. For active traders, however, fees can add up quickly. On top of typical trading fees, most exchanges have some assortment of deposit and/or withdrawal fees. These fees generally depend on the way customers are making deposits & withdrawals, like credit or debit cards, bank transfers, etc.

Coinbase Fees

The ease-of-use on Coinbase has attracted millions of first-time crypto-buyers, many of whom are blissfully unaware of Coinbase’s industry-topping fees, making them the most expensive Tier 1 Cryptocurrency Exchange to work with.

The fees you will pay will be the greater of either A or B:

A: 1.49% of the total purchase via bank transfer or 3.99% for debit and credit card purchases

Or

B: Coinbase’s flat fee for small crypto-purchases (anything under $200):

- $0-10 – fee: $0.99 | €0,99 | £0,99 | C$.99

- $10-25 – fee: $1.49 | €1,49 | £1,49 | C$1.49

- $25-50 – fee: $1.99 | €1,99 | £1,99 | C$1.99

- $50-200 – fee: $2.99 | €2,99 | £2,99 | C$2.99

Essentially, the 1.49% and 3.99% fees don’t kick in until the purchase/deposit is over $200, so a $1,000 via debit card would incur a considerable $39.90 fee.

Other fees include:

- A 0.5% markup on the market price, known as ‘the spread’

- A 2% fee for crypto-to-crypto conversions

- A 1% withdrawal fee, plus a network fee to help the crypto-miners enact the transaction

Gemini Fees

Gemini has waived their deposit fees for bank transfers (thanks to Plaid), wire transfers, and crypto transfers.

The first 10 withdrawals each month are free for individuals, after that, users pay:

- 0.001BTC (approx. $22) to withdraw Bitcoin

- 0.001ETH (approx $0.60) to withdraw Ethereum

- Other fees, depending on the type of crypto being withdrawn

Trading fees are measured by 30-day USD trading volume. The bigger your trades, the lower the fees:

| 30-DAY TRADING VOLUME IN (USD NOTIONAL) | TAKER FEE | MAKER FEE | AUCTION FEE |

| 0 | 0.35% | 0.25% | 0.25% |

| ≥ $500,000 | 0.25% | 0.15% | 0.20% |

| ≥ $2,500,000 | 0.25% | 0.15% | 0.10% |

| ≥ $5,000,000 | 0.15% | 0.10% | 0.10% |

| ≥ $10,000,000 | 0.15% | 0.10% | 0.00% |

| ≥ $15,000,000 | 0.10% | 0.00% | 0.00% |

| ≥ $50,000,000 | 0.075% | 0.00% | 0.00% |

| ≥ $100,000,000 | 0.05% | 0.00% | 0.00% |

| ≥ $250,000,000 | 0.04% | 0.00% | 0.00% |

| ≥ $500,000,000 | 0.03% | 0.00% | 0.00% |

Winner of the Fee Battle

The Gemini crypto exchange wins this category. Unfortunately, Coinbase’s fees are too high, whereas Gemini seems more interested in keeping costs as friendly as possible.

Before we move on…

We’ve mentioned ‘maker’ and ‘taker’ fees here, so we must explain them:

- A maker adds liquidity to the market, so when they try to trade cryptocurrencies, the order is not fulfilled immediately and instead sits in the order book. These orders pay lower fees.

- A taker, on the other hand, is someone whose order is fulfilled straight away, so they remove liquidity from the market, which is why they pay a higher fee.

Signup and KYC Experience

KYC, or ‘Know Your Customer,’ is customers’ personal information to make deposits and trade crypto. Some crypto exchanges require very little information, making it easy and fast to sign up and trade. However, others may require additional information upfront or in additional steps after the initial signup has been completed. Typically, these additional steps will raise a customer’s deposit and/or withdrawal limits, making it easier to move larger amounts of crypto.

Let’s take a look at the KYC processes for Gemini vs. Coinbase.

Coinbase KYC

Coinbase is compliant with both Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, which more or less means performing ID verification during the onboarding.

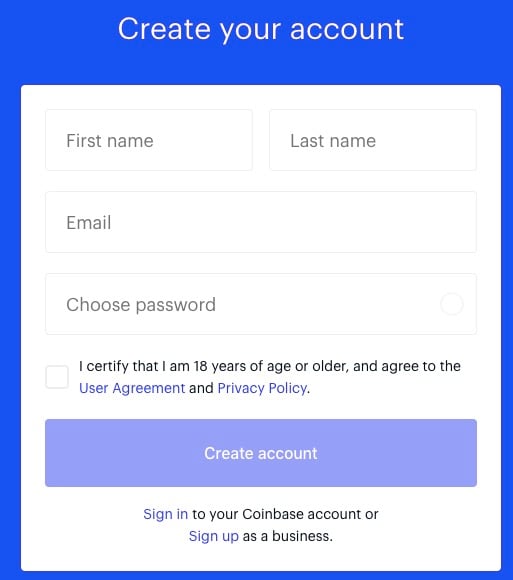

Six steps to get signed up on Coinbase:

Wait a few days for approval; then you’re ready to go.

- Create an account with your name, email address, password, and location. Agree to the terms and conditions and wait for email verification.

- Click the email link to verify your email address, then re-enter your password

- Provide your phone number and verify it with the 7-digit code that Coinbase texts to your phone

- Provide further details, including:

- Your name

- Date of birth

- Address

- Reason for using Coinbase

- Source of funds

- Occupation

- Employer

- Last digits of SSN (for US users)

- You will receive an email asking you to verify your identity. This can be done with a passport, ID card, or driving license

- Connect to a payment method once approved

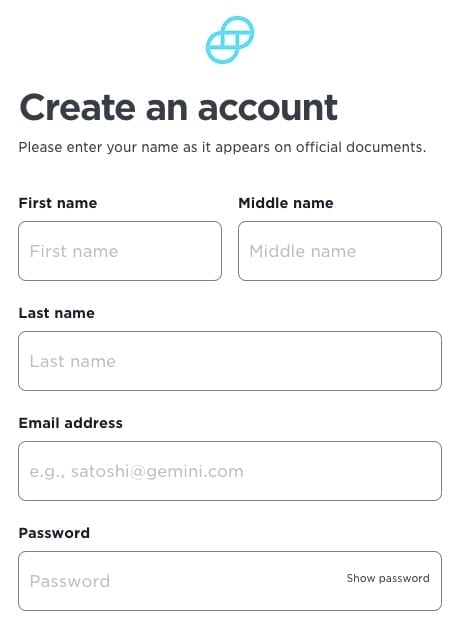

Gemini KYC

Gemini also goes through the KYC and AML compliance procedures, but it doesn’t stop there. They also want to connect to your bank and see a personal document.

- Create an account with your email address, password, and full name

- Verify your email address with the received code

- Provide your location and phone number, then submit the verification code that is texted to you

- This is the step where A LOT of potential customers walk away – Gemini asks you to log into your online banking. As long as the bank account has the same name you’ve provided to Gemini, it will be fine, and of course, your username and password are safe

- Submit one document for your identity (passport or driving license) and one document for your address (bank statement or utility bill)

- Once approved, connect to a payment method and get trading

Winner: In the Gemini vs. Coinbase KYC matchup, Coinbase is the winner. Gemini’s banking permissions could be deemed invasive.

Ease of Use & Feel of Website/App

This category compares the UX and UI of each website. Is it easy on the eyes or a complicated mess? How are things organized? Can new users find what they’re looking for easily, or does it require a degree in Archaeology? Let’s compare Gemini vs. Coinbase…

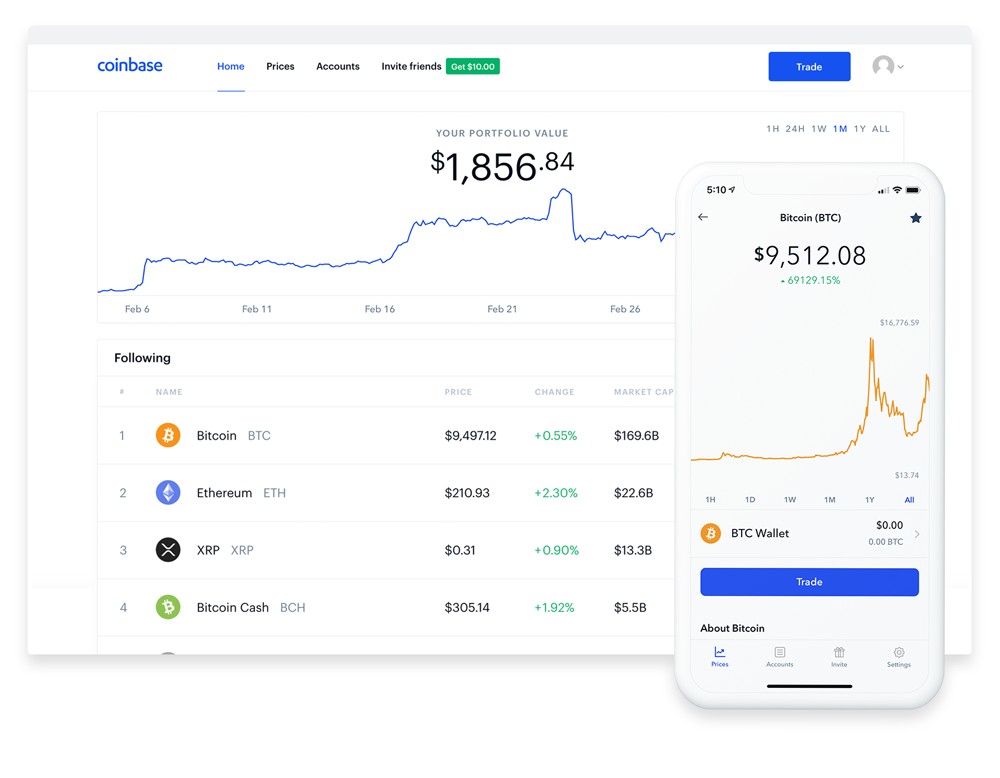

Coinbase

Coinbase is not a typical cryptocurrency exchange (check out Coinbase Pro if you want to use their exchange). Rather, it’s an aesthetically pleasing site designed to facilitate purchasing and selling popular cryptocurrencies easily. If that is their primary goal, and we are judging them on ease of use, they pretty much get a perfect score. Buying cryptocurrency on Coinbase couldn’t be easier. In fact, we are pretty sure it could pass the Grandma Test.

Gemini

Gemini is just a tad more corporate, ‘wordy,’ and comfortable using financial jargon. Survive this, and it’s actually a straightforward site and seamless app. You will quickly see why it’s growing in popularity, especially for beginners. Cut through the red tape of the sign-up process, and you’ll enjoy access to a cryptocurrency exchange where deposits, purchases, and withdrawals are all simplified.

Winner: It’s a tie. Both Coinbase and Gemini are great in this department and had they both launched at the same time; it’s hard to say which one would have grown faster or been more popular with beginners. But, arguably, Coinbase would about edge it in their favor.

Deposit Methods

This section will discuss the different options for funding accounts at Gemini and Coinbase. Every exchange allows crypto deposits from other wallets, so what we’re really discussing here is fiat deposits. What deposit options do they offer, and how easy are they to use?

Coinbase

Deposits are possible via:

- Bank transfer (ACH)

- Wire transfer

- SEPA Transfer

- Ideal/Sofort

- Connected bank account (the bank process that Gemini pushes users to do in the sign-up process is an optional feature for Coinbase users and allows faster bank deposits)

- Cryptocurrency/digital assets from another wallet

Gemini

Deposits are possible via:

- Connected bank account transfer (as explained in the setup process) on the ACH network

- Wire transfer

- Cryptocurrency/digital assets from another wallet

Winner: In the Gemini vs. Coinbase deposit options category, Coinbase is the winner. They offer the same services as Gemini, plus more.

Instant Buy Options (Buying with credit or debit card)

Coinbase

Debit card payments are the only method for instant purchases on Coinbase.

Gemini

Bank account transfer (ACH) is instant with Gemini if you have hooked your bank up with your Gemini account. In fact, you can start trading before your transfer has even finished processing.

Winner: Coinbase. Transactions with a debit card feel much like online shopping, a more comfortable experience for most.

Trading Experience: Gemini vs Coinbase

Coinbase

For real cryptocurrency trading, you’d have to visit Coinbase’s trading product ‘Coinbase Pro.’ Unfortunately, Coinbase is more of a shop than a trading platform. Users who choose to trade here, knowing Coinbase’s extortionate fees, will have a pretty bad time regularly shooting themselves in the foot.

Gemini

Gemini’s trading view is more advanced than Coinbase but more simplistic than competitors like Binance and Bitfinex. For example, you’ll be able to see some order book views, price information, and 24-hour data, as well as various other tidbits of information, all on one screen.

Winner: Gemini. The display options and order confirmations are more detailed.

Reputation & Security

Coinbase

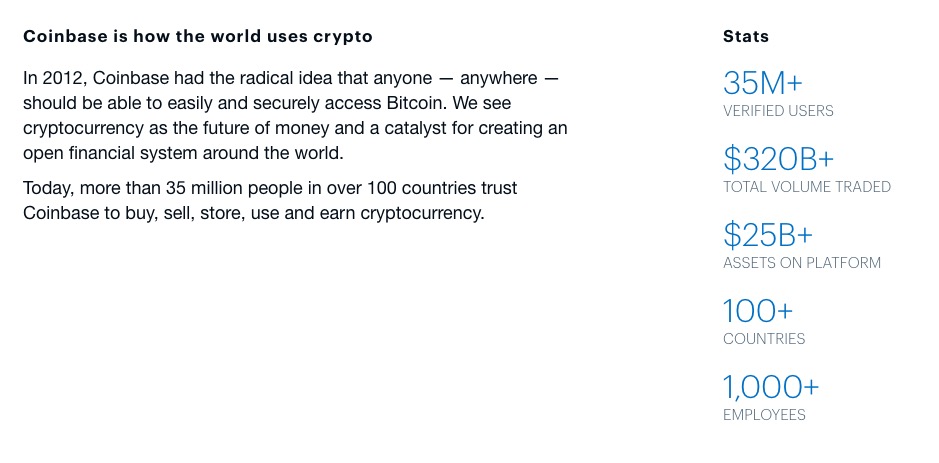

Coinbase is the go-to platform for first-time crypto-purchasers, thanks to the simplicity, the marketing, and the great user interface. Unfortunately, their reputation suffers due to the verification times, the custodial wallet, the sky-high fees, but security measures redeem them, as the exchange has never been successfully hacked or compromised.

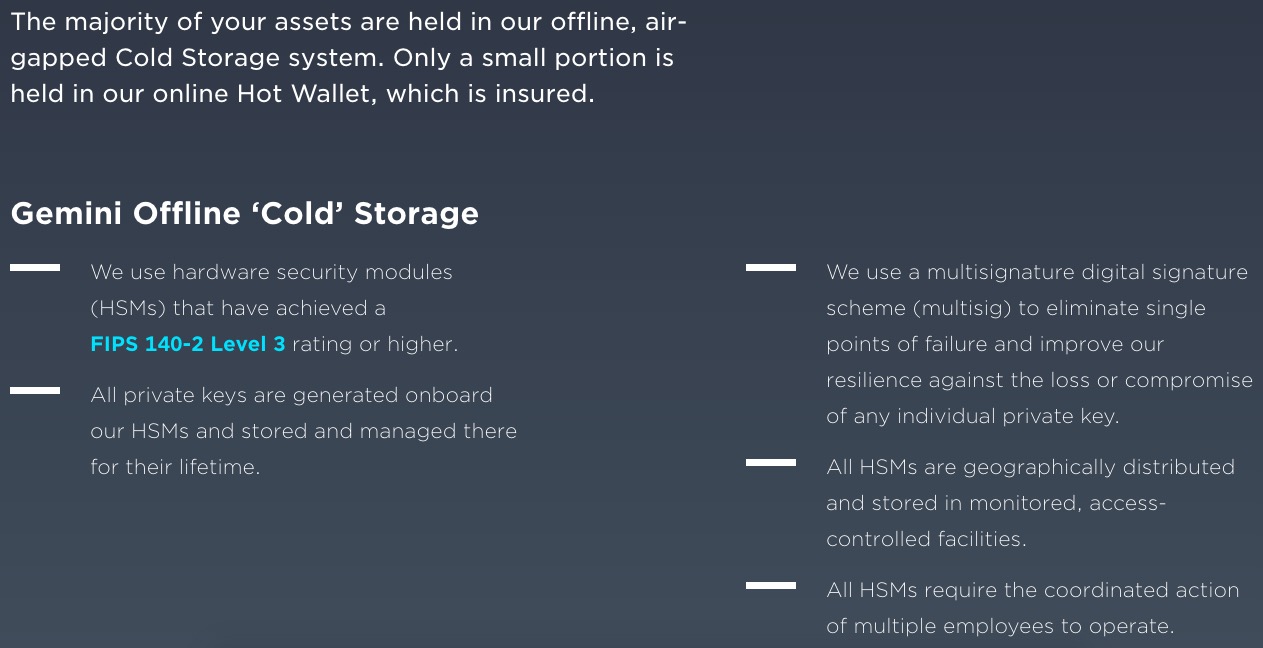

Gemini

Gemini has earned due respect for its ultra-legitimate high-security approach, the first US exchange for passing their SOC 1 Type 1 and SOC Type 1 and 2 exams. Like Coinbase, they have never been hacked or compromised. However, this attention to regulations and personal data also works against them, with traders who want greater levels of privacy finding the measures a bit invasive.

Winner: Coinbase. Eight years of quality services and high security have given them one, if not the best, reputation in the industry.

Is Coinbase or Gemini Better?

With both crypto trading apps so similar, our analysis’s defining features come down to fees and coins available.

Gemini wins in both of these battles.

Visit Gemini to get started trading on this attractive Coinbase alternative.