Best Low Fee Crypto Exchanges

Novices in the crypto trading world quickly realize they’re getting ripped off on fees by their exchange. For Coinbase users, it could be the 2% crypto-to-crypto commission. Or Kraken user’s spreads sometimes reach up to 10%. Whatever the case, when a trader realizes that moving exchange platforms could improve their profit margins, they must then ask the question, ‘Where can I trade with the lowest fees?’. The questions don’t stop there, though, because rock-bottom fees might not translate into a quality platform with good liquidity, a wide selection of crypto, and a reputable security past.

Considering everything we know about cryptocurrency exchanges and what makes them fantastic or forgettable, we’ve put together the following factors to consider:

Ranking methodology – How we decided which exchanges to consider

In-Depth Breakdown of the Best Low Fee Exchanges

Binance surged past all competitors and became the world’s best and biggest exchange in less than four years. Daily crypto trading volume now regularly surpasses $25 billion, an extraordinary sum that reflects their sheer market dominance. It hasn’t been all smooth sailing though, in May 2019, hackers managed to escape with 7,000 Bitcoin, though this was a wake-up call in truth. They needed to improve their security measures, and as a result, Binance redoubled their efforts; they’ve been effectively bulletproof since.

Quick Look

- The world’s biggest exchange

- Low fees starting from 0.1% (maker and taker)

- Over 1,100 trading pairs

- Praised for innovation

- Great discounts for high-volume traders

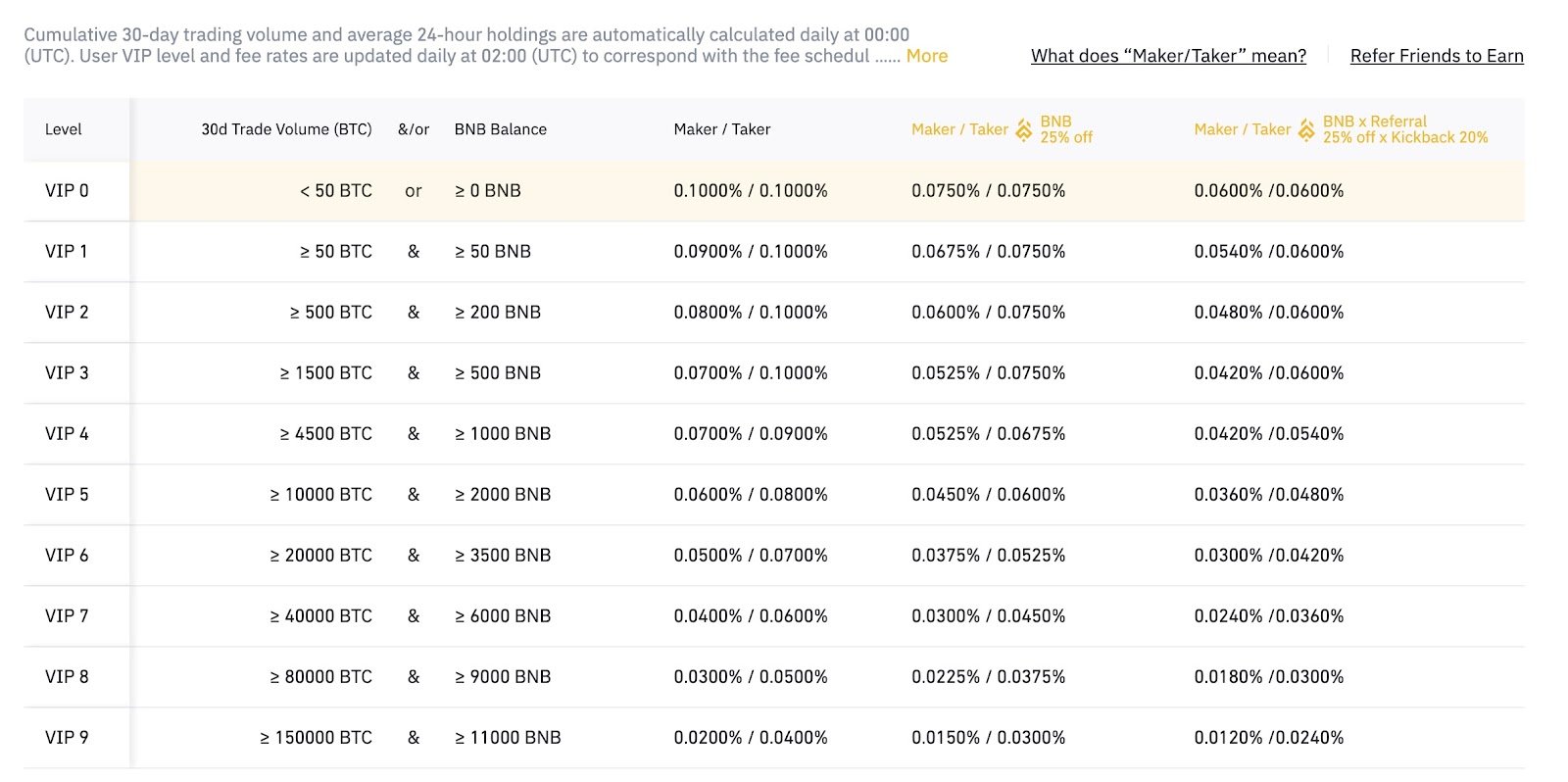

What about fees? You’d think a company that has virtually cornered the crypto exchange marketplace would consider increasing their fees. Still, no, at 0.1% for both makers and takers (tier 0), their fees are among the industry’s lowest. The exchange fees drop, too, with the lowest possible fees to the highest volume traders being a minuscule 0.012% and 0.024% for makers and takers, respectively. To unlock the minimum fees, users will need to pay their trading fees in BNB and participate in the user referral scheme.

Between starting writing this piece and finishing it, one new coin and three market pairs were added, totaling 345 coins and 1,141 trading pairs. With new cryptocurrencies and market pairs added to the cryptocurrency exchange every single day, it makes it a little hard for us to report an accurate real-time figure.

Note that there’s no deposit fee, but withdrawal fees are charged based on the cryptocurrency moved away from the platform. The withdrawal fee for each is minimal.

See the full schedule below or explore it here.

Hold up, what is a maker fee and a taker fee?

Cryptocurrency exchanges need to make money, right? So, they can’t offer 0% fees to everybody, that wouldn’t be sustainable. Instead, what they do is they add a small percentage charge to each fulfilled trade that you make. Here’s an example.

You want to buy $100 worth of Bitcoin (BTC) with your Tether (USDT). The current price of Bitcoin is $60,000. You don’t want to buy Bitcoin at this price; you’d rather wait until it reaches $50,000. To do that, you place a limit order, and in doing so, you become a market maker. A maker is someone who provides liquidity to the exchange before their transaction takes place; in this case, you are providing $100 of Tether liquidity. Since crypto exchanges need liquidity to make swaps happen fast, makers are rewarded with slightly lower fees than takers, perhaps 0.08% instead of 0.1%.

Market takers are those who are more than happy to execute their trades at the current market price and, in most instances, pay slightly higher trading fees to the exchanges for this convenience. This is because they are the ones taking liquidity away from crypto exchanges when trading their cryptocurrencies.

Why did Binance win?

- Perfect place for beginner traders to get started.

- Fees so small you wouldn’t notice them.

- BNB discount and referral scheme incentives.

- No deposit fees.

- Excellent liquidity and trade volume for Bitcoin, Ethereum & more.

- The $4-5 billion-plus Bitcoin passing through Binance each day is more than most crypto exchanges process in a week.

- Impressively, Bitcoin only represents around 7% of their spot trading, representing low BTC dominance.

- Dozens of options for fiat currency deposits and payments, including credit card.

Trustworthiness: 9.5/10

If you’re an American or US resident reading this, you’ll already know the cryptocurrency world isn’t quite as accessible as it is to our friends over the pond. Regardless, crypto exchanges and trading platforms like Gate.io are doing their best to ensure we don’t get left behind. They provide a great experience with a massive range of altcoins (any cryptocurrency that isn’t Bitcoin) and trading pairs to enjoy. Due to the altcoin selection, which is currently boasting 548 coins in 1235 pairs, we believe this is the top bitcoin exchange in the United States.

Quick Look

- Low fees starting from 0.2% (maker and taker)

- Cheap withdrawal fees (0.0005 BTC)

- Possible for multi-billion monthly traders to earn rebates

- Hacked by a suspected white-hat hacker (someone who hacks for the greater good rather than personal gain)

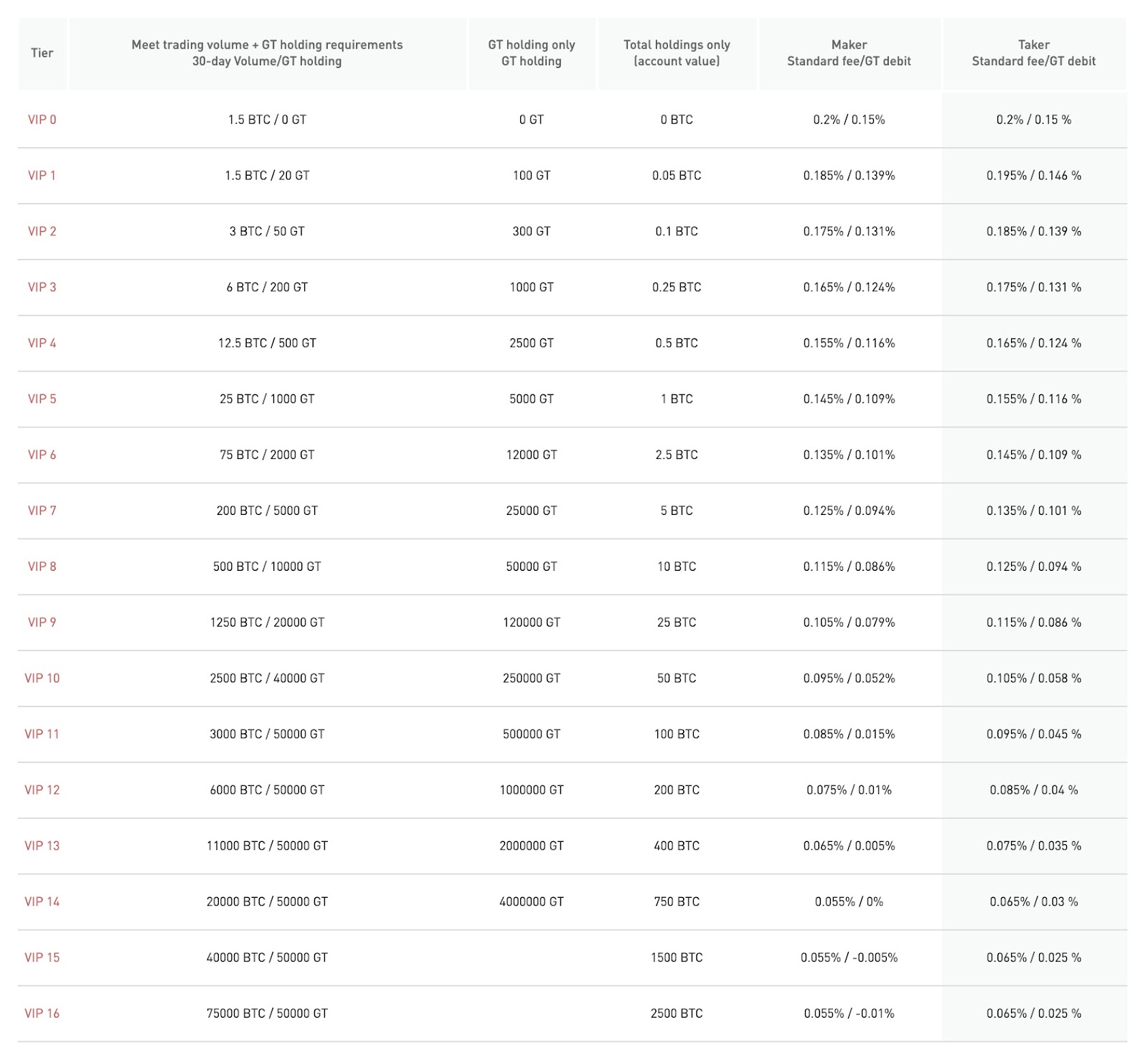

What about their fees? Trading fees are below the industry average, which depending on who you ask, varies from 0.25% to 0.4%, so you’ll find Gate.io’s 0.2% taker fee and 0.2% maker fee quite agreeable. To benefit from even lower costs, users can use Gate’s native utility token, GateToken (GT), to pay their trading fees. At the lower end of the fee schedule (VIP 16), the minimum payable fees are -0.01% for makers and 0.025% for takers. These fees are pretty low. To give some idea of what that represents:

VIP 16 – Bitcoin & GT Discounts

- Monthly trading amount: 75,000 BTC (approx $4bn USD) or 50,000 GT (approx $90,000)

- Must be holding more than 2,500 BTC total

- Maker fee: -0.01% (this is a reward, not a fee)

- Taker fee: 0.025%

So, if you’re in this category, a transaction fee on a $4 billion order would, in fact, reward makers with $400,000, or, in turn, it would charge takers $1m in fees. This is why market makers can profit on some exchanges simply by moving around funds and providing liquidity.

There is a small withdrawal fee for each cryptocurrency charged in that coin, but it’s reportedly around 40% lower than most direct competitors. Deposits are free.

If there’s one downside, it would be that the 24-hour trading volume is low compared to behemoths like Binance, at around $400m per day. When you spread this among so many cryptocurrency choices and markets, it creates common liquidity issues in theory, but we’ve had no problems from our experience.

Binance vs Gate.io – Why is Gate.io 2nd?

We are SUPER bullish about Gate.io here in the US, backing it to become the crème de la crème of exchanges for US traders. It’s certainly headed that way for the global market, too, so as trading volume increases and trading fees decrease (wishful thinking), they may become a serious name in this industry.

| Gate.io | Binance | |

| Tier 0 Maker/Taker fees | 0.2%/0.2% | 0.1%/0.1% |

| Trading pairs | 1235 | 1141 |

| Cryptocurrencies | 548 | 345 |

| Trading volume (daily) | $400m avg. | $25bn avg. |

| USA Friendly | Yes | No* |

| Security record | Zero hacks | 7,000 BTC Lost |

| Offers a DEX | No | Yes |

| Yield Farming, Staking, Lending | Yes | Yes |

| Deposit fees | No | No |

*Binance does offer a secondary platform called Binance.US for American traders

Check out the full fee schedule here:

Trustworthiness: 9/10

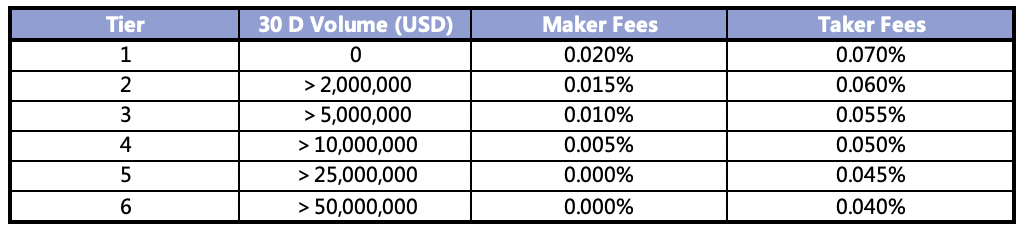

FTX has become a steady and popular cryptocurrency exchange with users worldwide, but sadly, not in the US or sanctioned countries. This crypto trading platform has the lowest fees of any exchange that meets our ranking criteria, and in fact, we were hard-pressed to find any rival exchanges that could come anywhere close (well, maybe one, as you’ll see later). It’s pretty hard to see how they even turn a profit with a 0.02% maker fee and a 0.07% taker fee.

Quick Look

- 0.02% maker and 0.07% taker fees — one of the most economical price structures ever

- Never been hacked

- The daily trading volume is regularly increasing — now around $1bn

- No withdrawal fees for crypto (network charges only)

The daily trading volume for the exchange has grown steadily in recent months, and on hectic days it breaches the $1bn mark, proving that offering the lowest fees can work wonders. Despite these positive trends, FTX is definitely slept on. Few people seem to give it the praise it deserves, especially when you consider it sits on the “never been hacked list” of crypto exchanges (they own Blockfolio, though, which was hacked).

A combination of 195 cryptocurrencies spun into 391 market pairs means there’s a pretty comprehensive range of altcoins, though not as extensive as exchanges like Binance or Gate.

For users trading over $50 million per month, maker fees drop to 0%, and taker fees reduce to 0.04%. An additional liquidity provider scheme can turn that 0% into -0.003% to provide rebates. The opportunity to discount fees as the volume increases are how a cryptocurrency exchange like Gate or Binance would attract institutional investors.

Why did FTX make our top 3?

With a natural-born leader like Bitcoin billionaire Sam Bankman-Fried at the helm, we expect to see FTX become the absolute envy of other crypto exchanges. Of course, the rock-bottom fees help, but it goes beyond that. This is a bitcoin exchange and trading platform that offers so many excellent investment instruments that it’s hard to know where to start, but thanks to excellent UX and UI, it’s easy to begin. There are a few payment options for users who want to buy Bitcoin directly, but they’re not that straightforward and typically charge a service fee. This is one of the few crypto exchanges that avoid fiat currency deposits and credit card payments, incentivizing crypto transactions instead.

Trustworthiness: 8.5/10

What is a rebate?

When exploring a crypto exchange platform such as Gate.io, KuCoin, or Ascendex, you might find it odd when looking at their transfer fees to see the top tiers for the high-volume traders have negative fees. How can you charge -0.001%? You can’t. Instead, you give them some of their money back, except it’s not money; it’s cryptocurrency! So if you are a maker placing huge (like, huge-huge!) orders in crypto that don’t immediately fill, you can expect some rebates. Remember, all of these fees and percentages work out on a rolling 30-day basis.

Imagine you traded $5bn worth of cryptocurrency on one exchange in a single month to provide further context. You’d likely be a huge institutional client managing one of the world’s biggest portfolios. Wouldn’t you want some additional incentive for using a platform? A rebate is a bit like cashback. The percentage is small, but 0.001% of $4bn is $40,000, which could pay someone’s salary. Would it not encourage you to stay, or, if you saw a rival exchange was offering rebates, would it not encourage you to move?

What have we learned?

In the introductory paragraph, we mentioned that many people looking to migrate their funds and trading activities over to a new platform do so because the most popular on-ramps into crypto, like Coinbase and Gemini, are also the most expensive to use. It’s a catch-22.

So, now that you’ve seen our top three winners, you can decide for yourself which of these cryptocurrency exchanges is best for you and your Bitcoin.

Alternatively, we can answer some simple questions that might help you:

- What’s the best crypto exchange for Americans who want the lowest fees possible: Gate.io

- What’s the best crypto exchange for an altcoin hunter: Gate.io

- Which crypto exchanges offer the lowest fees overall: FTX & AscendEX

- Which exchange has the best brokerage service with the lowest fees for buying crypto directly: Binance

- Which exchange is the most trustworthy: FTX

- Which of these crypto exchanges give rebates: KuCoin, FTX, Gate

- Which of these Bitcoin exchanges offers the best Bitcoin liquidity: Binance

- Which of these Bitcoin exchanges offers the highest Bitcoin dominance: FTX >35%

- Which of these crypto exchanges offers the best futures and derivatives contracts for Bitcoin: FTX

- Which of these exchanges trades Bitcoin at the lowest price: AscendEX

- Which of these cryptocurrency exchanges is the best for credit card users: Binance and KuCoin

To get started with our winner, visit Binance here: