FTX.US vs Binance.US: Who’s the American Winner?

Howdy Americans! Since both of this article’s parent companies offer global platforms, we thought it would be a good idea to zoom in on North America and look at their US-only exchanges, how they differ, and which might be best for you if you’re stateside.

We’ll be running through the trading fees, how to sign up, how well designed each platform is, how you can make purchases and deposits, and much more.

Fees

FTX.US Fees

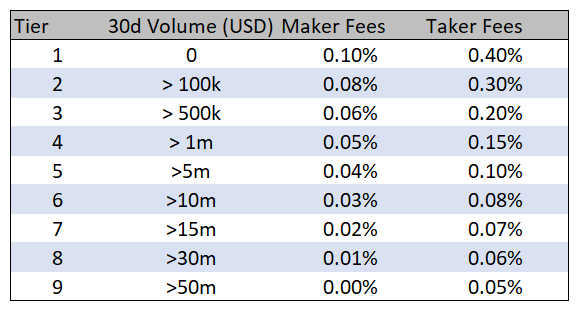

Please note that FTX.US and FTX boast completely different tiered fee structures, so it’s important not to confuse them. As you can see in the table below, beginners with less than $100,000 in monthly trading volumes will pay 0.10% for the maker fee and 0.40% for the taker fee. To clear that up:

- Market makers: Those who provide the liquidity for trades to go through

- Market takers: Those taking the liquidity by making a purchase at the current market price (market order)

FTX.US Tiered Fee Structure

Exchanges typically prefer makers and so often reward them with preferable fees, as is the case here. What’s also good to know is that fees for spot market trading are charged in the base/target currency for makers and the quote currency for takers. Let’s explain:

- Market makers trading ETH/USD will place a limit order that provides liquidity and when the order is later fulfilled, will pay their fees in ETH (which they are selling)

- The market takers on the same ETH/USD trade would pay their fees in USD on a market order

Please note that unlike when using FTX.com, owning FTT tokens will not earn you reduced or zero fees on the FTX.US crypto exchange. The FTT token is not a permitted cryptocurrency in the US and is a utility token designed for use only on FTX.com.

Binance.US Transaction Fees

Binance.US, however, does use the same fee structure as Binance, the parent company and well-known platform (if you haven’t heard of Binance, it’s the world’s biggest exchange by a country mile).

That fee structure is very cost-effective and starts at 0.1% for both makers and takers – a rate that is among the cheapest in the industry. To add to that value, Binance.US also offers its users the opportunity to discount their fees by 25% by paying them in Binance Coin (BNB). Some users who bought BNB early and cheaply prefer this option because they’ve already made such a profit on the coin that their transaction fees are negated.

We’ll cover purchases in a later section, but if you were looking for the instant buy or sell transaction fee, the figure is 0.5%.

Binance vs FTX: Binance.US is cheaper and offers better discount opportunities.

Sign Up & KYC Experience

Easy FTX.US Onboarding

- Head over to FTX.US and click ‘Register’ in the top right-hand corner

- Provide your email address and a password, tap on ‘Click to Verify’, accept the terms of service, and then confirm your details by clicking ‘Sign Up’

- FTX then requires 2FA as part of their security protocols, showing a vested interest in the personal safety management of FTX account holders. Authy or Google Authenticator are recommended

- Provide your country or jurisdiction and continue

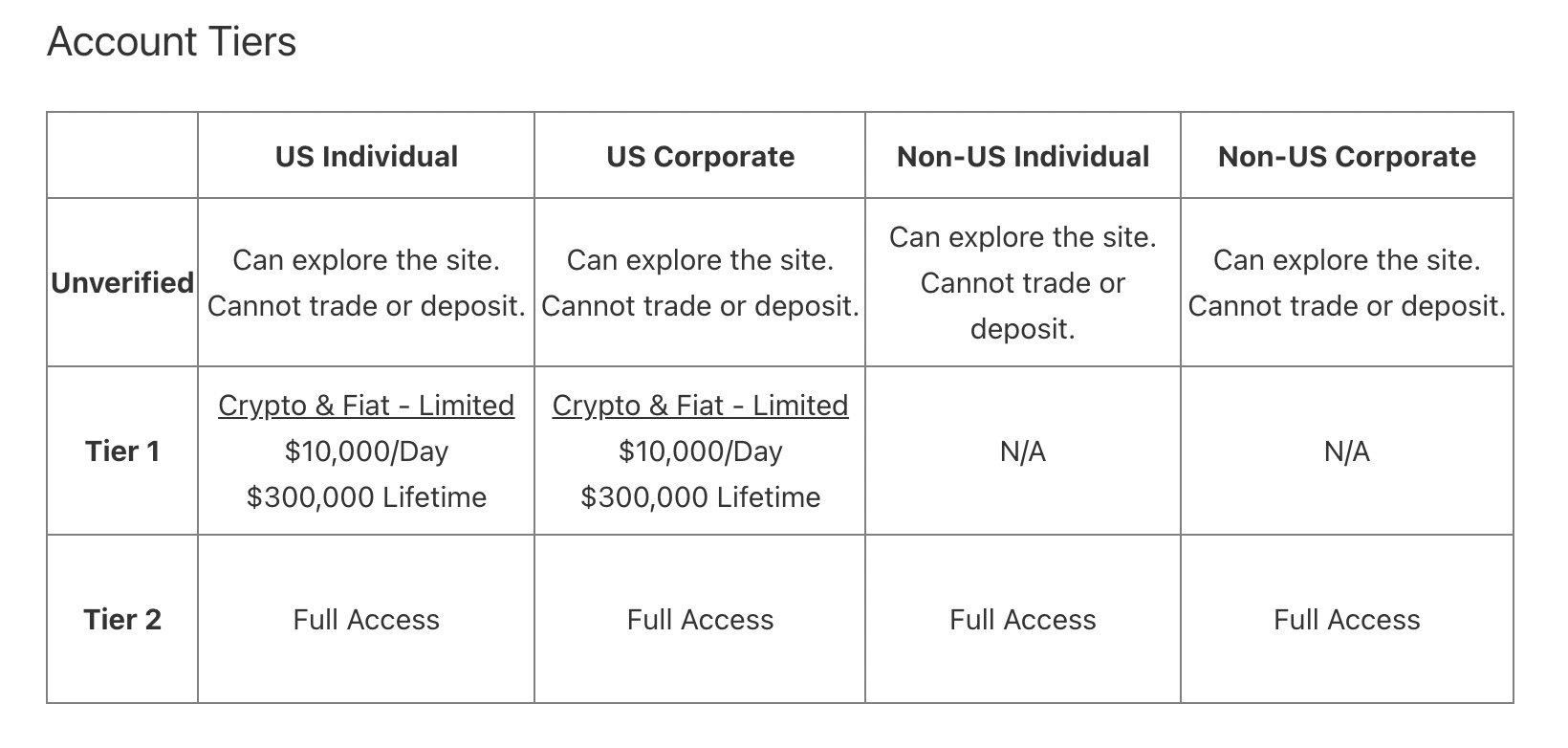

- Your account is now created, but without verification (KYC), there are no trading options to enjoy

- To get KYC underway, first, click on your email address in the top right-hand corner and then on ‘Wallet’

- Find the option to ‘Increase Withdrawal Limits’

- The KYC process will now begin, asking you for various bits of personal information, like your name, place of residence, date of birth etc. These details will get you to level 1 KYC

- Level 2 KYC will require you to submit identity documents, such as your passport or driver’s license, a proof of address document like a bank statement, a selfie to confirm your appearance, and will even ask you for your source of funds

KYC level 2 applications are sometimes auto-approved but can take up to 3 days to go through if the system feels that your case needs further review.

How to make a Binance.US account

- Click here to go to the Binance.US website

- Find the ‘Get Started’ button and click it

- Provide your email address and password where indicated

- After clicking ‘Create Account’, go to your email and tap the ‘Verify Email’ link from Binance.US

- KYC checks are mandatory and the system will want to ensure that your personal information matches the information on your documents, so they will ask for a copy of your passport or driver’s license

- You’ll also need to prove your address by uploading a photo or scan of a document issued within the last 90 days, such as a utility bill or bank statement

- SMS 2-Factor Authentication will come next, protecting your account from unwanted access

Binance vs FTX: They’re not too dissimilar; let’s call it a tie.

Ease of Use & Feel of Website or App

FTX.US – Paying Attention to UX/UI

In a remarkable blog published on their English, Turkish, and Portuguese websites, the FTX development team talk at length about their careful mastery of UX and UI and why it is so prominent in the FTX ecosystem. What’s at first striking is the humility with which they accept that this journey started from a place of weakness:

“Some things came naturally to FTX. For example, product design has always been a relative strength of ours and will likely continue to be. User interfaces and experience were way less obvious to us, though, and it’s taken us a while to develop our thinking on them.”

They go on to explain their feedback process and how it informs the web design:

“So we now treat UI and UX feedback very differently than before. If a customer has a complaint about a feature and we can’t figure out what’s going on, we’ll do the following:

- Try doing exactly what the customer was doing, and see if anything frustrates us

- Try walking the customer through their usage, ask really specific questions, and see if we can lead them to where they get frustrated

- Think about the backlogged set of UX changes we want to make, and see if any of those would fix it”

“We’ve come to take UI feedback very differently:

- UI matters; the website being attractive makes it a more pleasant experience

- UX probably matters more: there’s nothing worse than wanting to do something and not being able to

- A lot of UI feedback is secretly UX feedback: “the website is visually overwhelming” probably means, at least in part, that we put unimportant buttons on the homepage and hid important ones in settings menus that are never read.”

As a result of their attention to detail, they offer some of the industry’s most impressive TradingView interfaces, margin trading, lending services, and more. It is available in 49 US states, with New York excluded from accessing its crypto markets.

“Acoustic” Binance.US

Binance.US is essentially an acoustic version of Binance. It’s a simplistic, stripped-down, and straightforward crypto exchange. To some, this is great, but for those who have used the main Binance user interface, it feels a little bare and is missing many of the tools that make Binance so popular. FTX.US also suffers from the same issues. American traders might feel a little shortchanged in this regard.

Still, Binance.US is popular in 43 US states. While it has removed margin trading from its platform, there are many excellent staking opportunities to enjoy and help you earn interest in your digital assets. Connecticut, Hawaii, Idaho, Louisiana, New York, Texas, and Vermont are the seven states excluded.

Binance vs FTX: FTX takes this round.

Deposit Methods

Getting your funds into FTX.US

Just a reminder that KYC will be required before FTX.US will allow you to make any USD deposits; however, once that has been processed and verified, you gain access to 4 different deposit methods for fiat currencies.

- Wire Transfer – Deposit fees (and withdrawal fees) via wire are 1%, with a minimum and maximum cap of $5 and $35 respectively. Stablecoin deposits are free

- ACH Transfer – the first transfer is free, after that, it’s typically $0.50 per transaction (though FTX are known to waive fees at times)

- Debit or Credit Card – Fees are variable but are known to hover around 3%

- Silvergate Exchange Network (SEN) – small charges apply, but there is the added advantage that the SEN works on weekends and holidays whereas wires don’t

You can also deposit cryptocurrency if you have some already in an external wallet, though bear in mind that the cryptocurrency must be compatible with FTX.US. Unfortunately, there are only 22 different cryptocurrencies on the platform.

Making deposits on Binance.US

Binance.US is also quite supportive for users who want to deposit fiat currency. Experienced traders will likely have been through this process plenty of times, but for beginners, you need to make sure you have at least 10% more money in your bank account than you’re trying to transfer, or it will get blocked.

You will then be able to transfer your fiat currency to Binance.US using a simple user interface via:

- ACH – no fee

- Wire Transfer – $15 per transaction

- Debit Card – 4.5% per deposit/withdrawal (credit cards are not permitted)

Binance vs FTX: There’s not a lot of difference here. Let’s call it a tie.

Instant Buy Options (Buying with a Credit or Debit card)

Making purchases on FTX.USz

They do have an OTC service, though, which is a kind of institutional trading spot for those looking to spend a serious amount of money on coins or who want to sell a large number of digital tokens. There’s no minimum transaction amount expressed, but the industry average is around $25,000.

You can’t make instant purchases of crypto on FTX; you can use FTX to accept crypto as a payment method on your website, thanks to FTX pay. See more here.

Purchasing crypto on Binance.US

Binance.US might be the best crypto exchange that only serves US residents, and that’s because it offers so many great purchasing methods. The crypto sphere is full of great places to trade cryptocurrencies, but brokers are often in short supply.

Here are the accepted payment methods for exactly 50 different cryptocurrencies:

- USD Balance

- ACH

- Wire Transfer

- Debit Card

- OTC (Over The Counter)

Binance vs FTX: Binance.US is US traders’ best cryptocurrency exchange for purchases.

Trading Experience

Simplified Trading with FTX.US

If you’re used to FTX.com and are switching to FTX.US, perhaps because of regulations or relocations, you might be disappointed to see that some advanced trading instruments won’t be there:

- Leveraged tokens

- Perpetual Futures Contracts

- Tokenized stocks (decentralized finance stock trading)

- Volatility index trading (crypto derivatives)

Despite these things facing exclusion, you’ll still gain access to 22 cryptocurrencies, 46 trading pairs, low trading fees, high trading volume, and plenty of market volatility to capitalize on.

FTX is widely recognized as the best derivatives exchange on the market, but that reputation pretty much ends there, as FTX.US cannot be used for that. It does, however, have a significant margin trading platform for those that meet the minimum asset threshold. Overall, it’s an awesome place to trade, with a straightforward and clean TradingView that hasn’t been stripped and simplified, unlike their advanced trading products.

Trading with Binance.US

Binance.US has a much wider selection of coins (61) and trading pairs (119) than FTX.US, which gives users a bit more flexibility when trading. In addition, the overall trading experience is improved by having a decent selection, as it means the relatively low depth of choice does not limit you. The parent platform, Binance.com, by comparison, boasts over 380 coins, with new tokens being added all the time and deep liquidity for over 1,400 trading pairs.

Trading options flourish on Binance.US by choosing whether to use a basic and simplified order form or an advanced interface with all of the bells and whistles.

When it comes to buying and selling, the process of trading in your fiat-for-crypto, or vice versa, is a pleasant experience.

Binance vs FTX: Binance.US wins this round.

Reputation and Security

FTX Reputation

Unlike Binance, FTX has never been hacked. The trading platform, which is incorporated in Antigua and Barbuda, with headquarters in Hong Kong, is run under the steady and well-respected guidance of Sam Bankman-Fried. SBF, as most know him, is so well respected that he was given SushiSwap. This decentralized platform for liquidity pools and DeFi trading pairs that its founder hacked to steal the development fund. Once the funds were recouped, the trusty SBF gave the platform to get things back on track.

FTX benefits from the same trust and quality, and so when it began to encroach on US regulations (it is not regulated in the states), they built the impressive US-only FTX.US as a counter-measure.

Aside from 2FA and KYC checks, users can benefit from:

- Whitelisting IPs

- Whitelisting wallet addresses

- Support from Chainalysis

- More than $200m in a ‘Backstop Liquidity Fund’ in case of disaster

The word on Binance.US

As mentioned above, Binance was hacked for 7,000 BTC in 2019. You’d think it would be hard to overcome such a large loss, but it forced Binance to see themselves under a new lens and redouble their security efforts. Since then, the entire exchange has gone from strength to strength. Binance.US has never been hacked, but since it was formed in 2017, it predates the hack, and so by association suffers from a bit of reputational damage.

This exchange is designed to offer a regulated and straightforward version of the central Binance platform to support their traders in the US market.

As for security, here’s a user security guide that Binance.US themselves wrote.

Binance vs FTX: With zero hacks, FTX edges this round.

FTX vs Binance: Who is our winner?

This isn’t an easy call to make, as both crypto exchanges offer serious quality, reliability, and regulation to the US market. However, with better purchasing methods, BNB trading fee discounts, and a more comprehensive selection of cryptocurrencies and trading pairs, it’s hard to overlook Binance.US as the winner.

At the same time, when we see the impressive trajectory that FTX is on, it’s one of the few exchanges that can compete with Binance for market share. If it commits to including a brokerage and adding more coins to the platform, then the battle between these two platforms can come to life in the future. As it stands, FTX seems to be the best option for US-based margin traders, if high margin trading is your activity of choice, and those in states excluded by Binance.US (Connecticut, Hawaii, Idaho, Louisiana, Texas, and Vermont).