How to Set Up a Stop Loss on Binance

In this article you will learn about what a stop-loss is, when to use it, and how to set up a stop loss on Binance.

Before we go into how to place a stop-loss order on Binance, let’s dive into what a stop loss order is and why you want to place one.

What is a Stop-Loss (or Stop-Limit) Order?

A stop-loss order is an order to sell a specific coin when it reaches a certain price. The goal behind the stop-loss order is to limit an investor’s loss from becoming too great. There is also a stop-limit order which differs from a stop-loss order, as there is a price limit of when the order is actually triggered as opposed to the stop-loss order which is triggered at any price below your targeted price point.

Advantages of Using a Stop-Loss

Some really great advantages of using a stop-loss order are that it is completely free to use, it costs nothing to set up a stop-loss order and you only pay your fees/commissions when the order is completed. It can be used to lock in unrealized gains.

“Unrealized gains” is when your asset has increased in value but has not been yet sold for profit. It also serves as a discipline in trading as it allows you to take your emotions out of a stock or coin as some people can get attached to their portfolio. It also allows peace of mind and to not have to constantly monitor your position. Stop staring at the screen and go eat some lunch!

Disadvantages of Using a Stop-Loss

Now there are some disadvantages to a stop-loss order. You have to know what market you are in and do your research. Short-term movement in price can trigger your stop-loss order.

Volatile markets fluctuate daily and can trigger your order if not placed properly, so make sure that you pick a price that won’t get picked up by day-to-day fluctuation. If you know that your stock or coin tends to fluctuate 5% daily, then it would be a good idea to put a stop-loss order that is 10% below the price.

How to Set Up a Stop-Loss on Binance (Step-by-Step)

As mentioned earlier, there is a difference between a stop-loss order and a stop-limit order. The difference between the two orders is that the stop-limit has a specific price to be sold at. The stop-limit order is the method that Binance uses for placing stop-loss orders. So let’s show an example of a stop-limit order on Binance that can minimize potential losses.

For example, you just bought LINK at $11.5883 as you believe that it is close to reaching a support level at $11.1602 and you think the price will rise.

But just to be safe, because you never know, you might be wrong and the price could hit the support level and continue to drop, let’s run through how to aet up a stop-limit order on Binance.

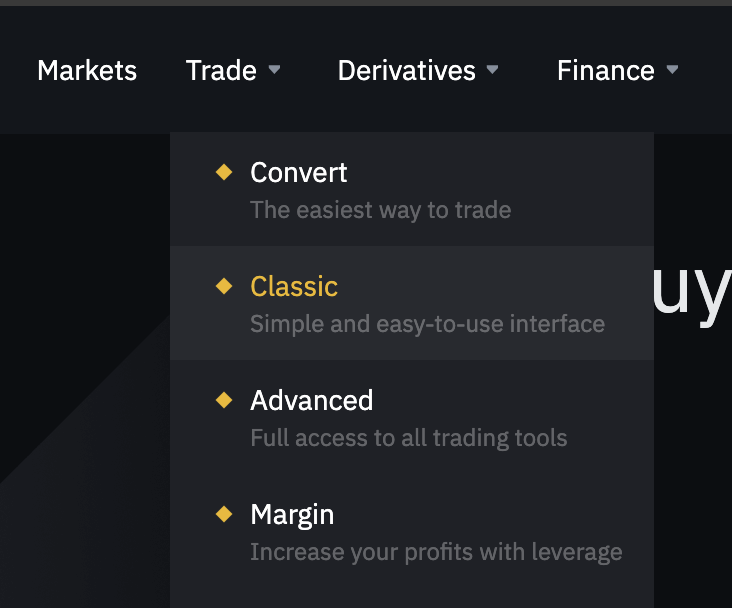

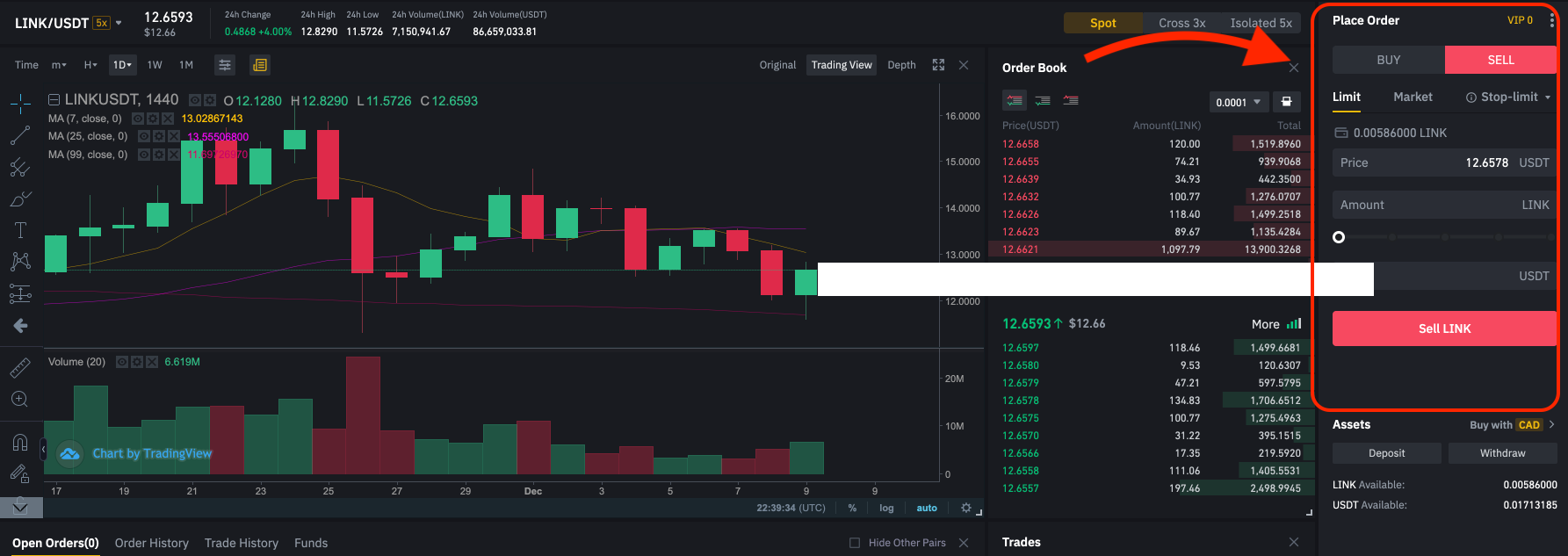

STEP 1. You need to go into the market tab of Binance. Make sure you choose either classic or advanced to have the option to put in a stop-limit order.

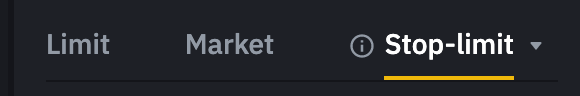

STEP 2. Now go over to the sell tab on the right and click stop-limit.

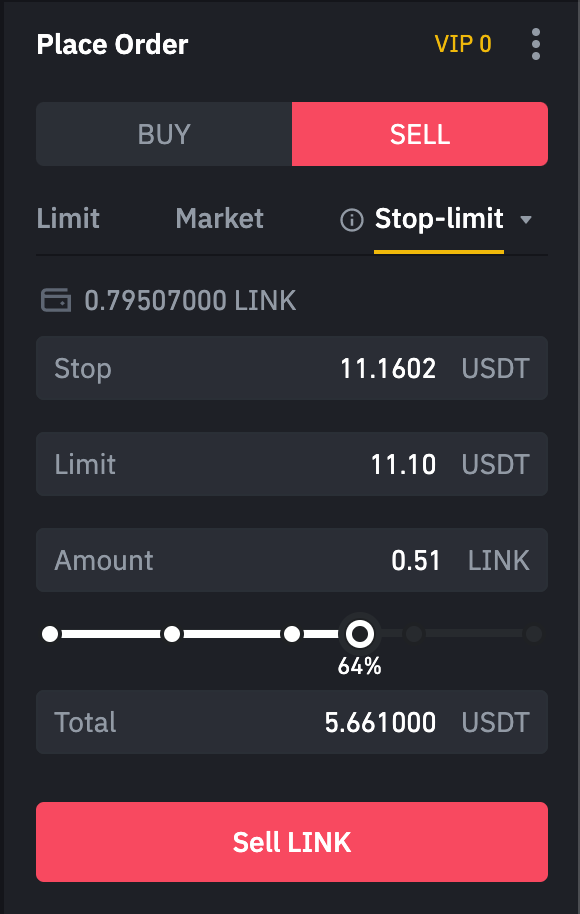

Once you have this tab ready, you can now enter in the prices of which you want to sell LINK at if the prices drop more than you want it to allow. So let’s enter in the prices that we are going to use in this example.

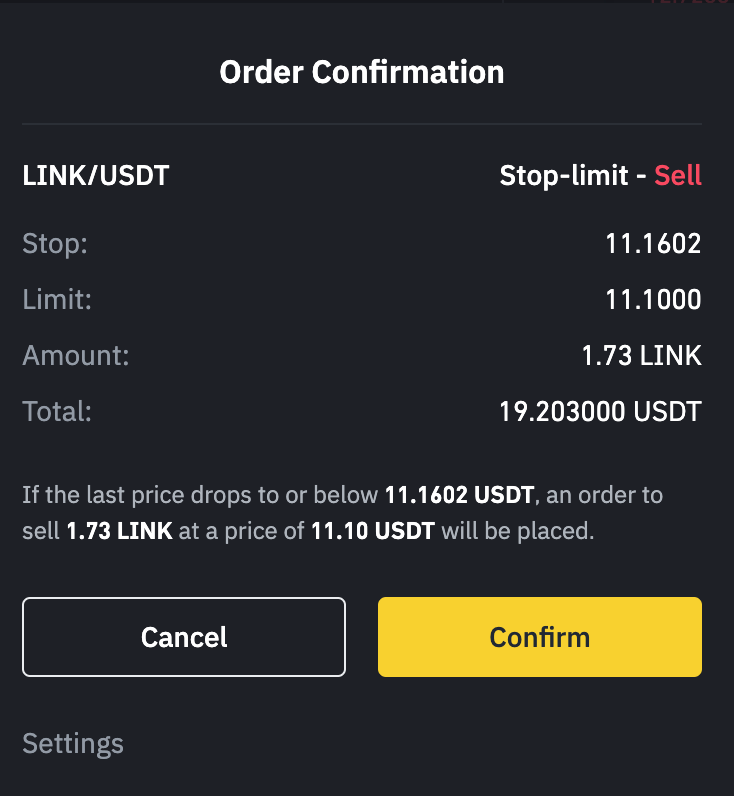

STEP 3. For stop price, we are going with $11.1602 like we mentioned before because we believe that it could be a potential support level and if it breaks through that the price could drop a lot more. And for the stop-limit price we’ll put $11.10 which is just below our stop price.

This means that if the price of LINK reaches the stop price of $11.1602 a limit order of $11.10 will be put on the order book. The reason why this is very useful, is it allows you to make sure your order is placed in time before the price drops below your selling price.

One thing to note here is that just because your stop price got triggered doesn’t mean that your limit order will fill. If the market price reaches the stop price but doesn’t reach the limit price, your order will just become an open limit order to sell at $11.10 and won’t complete until the price reaches that point.

Now let’s go through and finish the order.

STEP 4. Put however much you want to sell of your LINK position and then press the big red button “Sell LINK”. Confirm your transaction.

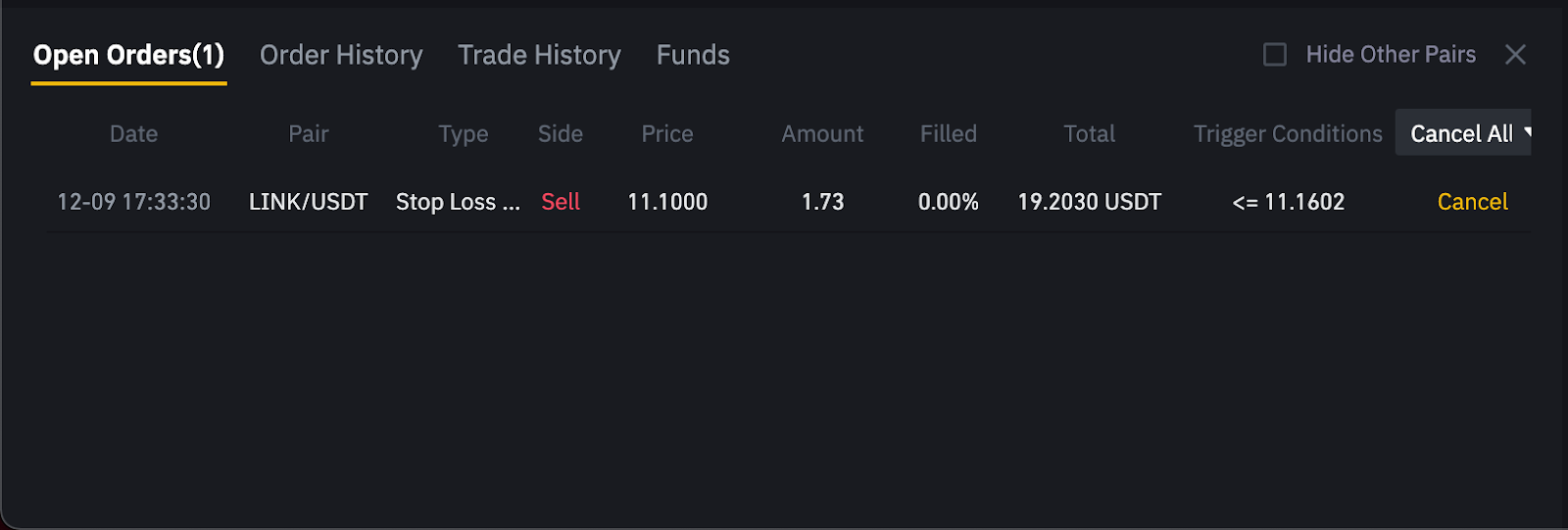

Your order will now be placed in the tab under “Open Orders”, where you can see all the information about your transaction.

Perfect! You have now set up a stop-limit order as a failsafe if your strategy or assumption of LINK’s price going up, is wrong.

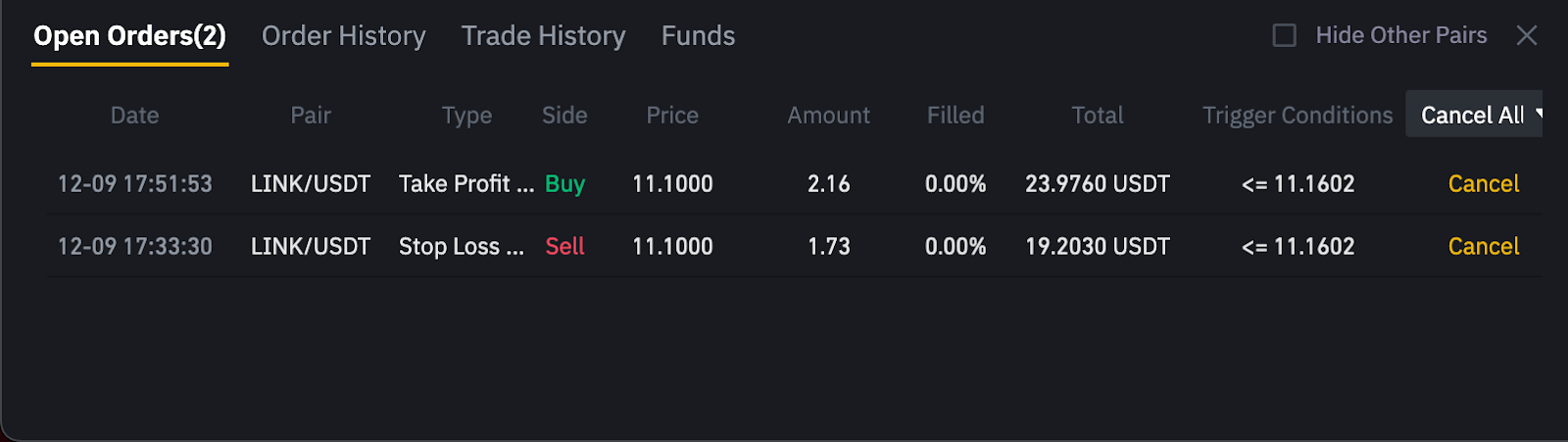

What if you bought LINK at a much lower price and you want to make sure that your unrealized gains are protected and you get out of the trade to keep as much profit as you can. You would use the stop-limit order the same way.

The only difference is when you got in the trade and if you are in the profit. Your mindset is just different.

Instead of thinking, “if the price reaches x-number, I’ll sell to not lose more money” your mindset is, “if the price drops to x-number price, I will take my profit before it goes lower.”

Tip: Using Stop-Limit Orders to BUY

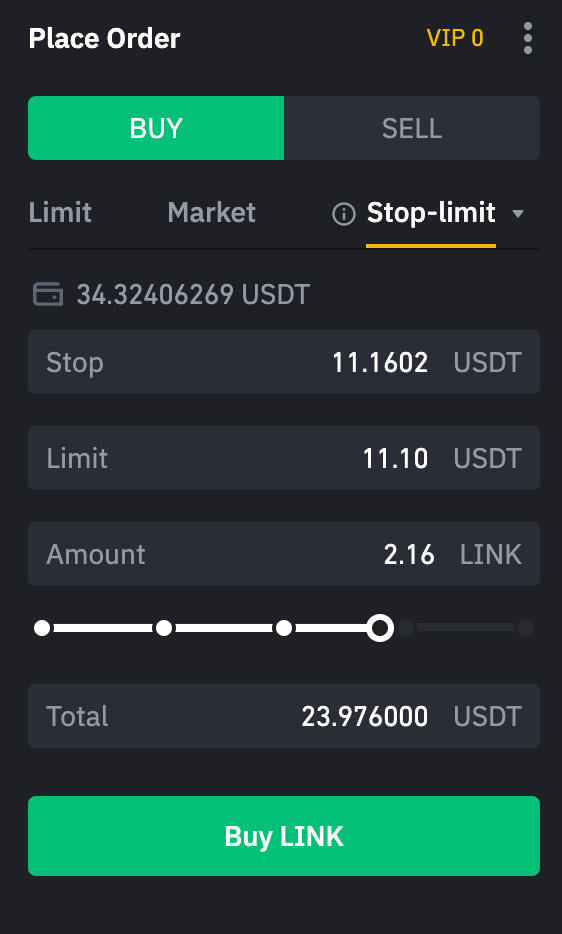

Here’s an extra tip. Let’s flip things around now, what if you are trying to buy when it is at a better price?

You can use the stop-limit to place buy orders.

Step 1. It’s the same process as above, just make sure you are in the “buy” tab. Again, the stop price is the price at which the limit order will be placed on the order book and be open for trading and the limit price is the price at which you are willing to buy.

So now you’ve learned how to set up two orders from two different perspectives and positions. Stop-limit orders are very useful when implemented correctly and with the right strategy. Whether you are trying to minimize losses or protecting your profits, using a stop-loss order on Binance can be a great tool to add to your trading skills and strategy.

I hope these examples help you when deciding when and where to use a stop-loss order or a stop-limit order and how to use it on the Binance exchange.