The Best Bitcoin Exchanges in South Africa

We’ve looked through all the trusted and top-quality cryptocurrency exchanges and assessed numerous data points to bring you the best places to buy, sell, or trade Bitcoin in South Africa. The Rainbow Nation is one of the most crypto-friendly spots on the African continent. The country takes a vastly different approach to most African nations, many of which are doing their utmost to stop banks from processing transactions. Instead, South Africa is embracing cryptocurrencies with regulators predicting that the country will experience a surge in Blockchain activity and catch up with Nigeria, Kenya, and Ghana for trading volumes.

The most popular Bitcoin exchange in South Africa is P2P, whereby traders make transactions directly with one another rather than trading on the central exchange. By doing this, they can avoid a lot of regulation, which is great in some ways, but risky in others. The continent’s problems with inflation, corruption, and underground economics have damaged it so many times in the past, so much so that regulators fear cryptocurrency will offer yet another sting in the tail unless regulation can be fast-tracked. So for traders and Bitcoin exchanges in South Africa, crypto is seen as an investment asset with taxable qualities — a positive quality.

With the most advanced financial sector on the continent and a crypto-boom impending, it’s a great time to look at Bitcoin exchanges in South Africa and decide which one to sign up for. Fortunately, Coin Clarity is here to give you a guiding hand. Firstly though, here’s what we believe a great Bitcoin exchange offers.

Winners

Let’s Talk About Crypto in South Africa

What’s the current state of crypto trading in South Africa?

In South Africa, cryptocurrency exchanges could not be any more different.

Firstly, there is Luno, the best native South African crypto exchange, helping many people in the Rainbow Nation enter the crypto world and get their foot in the door. It is trustworthy, educational, safe, and easy to use, building a solid rapport with users.

At the other end of the spectrum, there is Africrypt, owned by two brothers. You might have seen this name before in the news, as the owners are currently fugitives on the run after vanishing with $3.6 billion (USD) worth of crypto. Even worse, they told users on their cryptocurrency exchange in South Africa that Bitcoin and other coins were hacked, but not to alert the police (to buy themselves time). As it stands, the authorities in South Africa are doing their best to track down the brothers and the missing Bitcoin, partly by asking exchanges to keep an eye out should anyone try to sell BTC.

Why was ZAR delisted from major platforms?

The simplest way to explain it is that ZAR is not currently considered a ‘High-Level Standard’ fiat currency. Another reason is that it suffered from poor liquidity on most of the major platforms. It’s notoriously difficult for users in South Africa to deposit ZAR into digital wallets. Without making bank transfers, there’s little incentive for a trader to hold ZAR in their web wallet.

Unfortunately for Africa’s most progressive crypto nation, digital currencies are just a little harder for exchange users to get their hands on due to this change. Whether ZAR and other currencies will feature on Binance, KuCoin, and other exchanges again is pure speculation.

Diving Deeper Into Our Winners

With almost 400 cryptocurrencies to buy, sell, trade, and hold in a highly secure digital wallet, Binance is the trading hotspot for most South African Bitcoin enthusiasts. Cryptocurrency traders watched on as Binance went from little-known obscure Chinese exchange to the world’s number one Bitcoin trading platform in less than a year, between 2017 and 2018. For South Africans, the movement of Binance from China to the Cayman Islands and Malta didn’t affect them much, but the moment that caught their interest was in October 2019, when Binance launched their P2P exchange.

With this introduction of a P2P service, South African crypto and Bitcoin enthusiasts could buy crypto from one another using a credit or debit card, depending on the payment gateway they chose. Binance P2P or C2C (however you wish to call it) allows users to use their payment or transfer method off-platform, putting the funds in escrow until both parties have confirmed the transaction. Thanks to this, transactions are smooth, converting ZAR in a bank account to BTC in a digital wallet without additional commissions or transaction fees. Furthermore, once the BTC is received, it’s tradable, giving South Africans access to an enormous market.

Quick Look

- Most cryptocurrencies available for trading at 380+, as well as over 1,200 trading pairs

- South African Rand (ZAR) can be spent and earned on Binance P2P, which allows you to become a broker with zero commissions or fees and make use of your debit or credit card

- ZAR trading pairs were delisted in April 2021 but could reinstate in the future

- Trading fees on the regular exchange start at 0.1% and drop lower based on BNB holdings or referral scheme participation

- There is no digital wallet for ZAR

How flexible is Binance with ZAR?

Binance has functionality with over 40 fiat currencies. Still, there is no possibility for the deposit and withdrawal of ZAR for the South African Rand. All ZAR trading pairs were delisted in April 2021, which means South Africans are now encouraged to use the P2P exchange and make payments with their credit card, debit card, or digital payment gateway.

Despite the recent decoupling of ZAR and Binance, the platform’s P2P exchange remains the best place to trade crypto in the Rainbow Nation. Zero trading fees and zero commission fees allow users to get their hands on crypto with the payment method of their choice, allowing them access to the world’s best cryptocurrency trading platform. Trading fees on the main exchange start at 0.1% and drop from there with discounts available for those holding BNB or referring new users.

What other features make Binance our best exchange in South Africa?

- Over 380 cryptocurrencies to trade, with 1,300+ trading pairs to choose from

- Choose from a simple trading interface or an advanced one

- Margin trading available

- Futures, Options, and Cryptocurrency Derivatives are all on Binance

- A secure digital wallet that can hold cryptocurrencies as well as fiat currencies (though no ZAR right now)

- Savings accounts are available to help make an income on coins you don’t want to sell

- Crypto lending and loans are both available on the platform

- Low fees, high volumes, and great liquidity

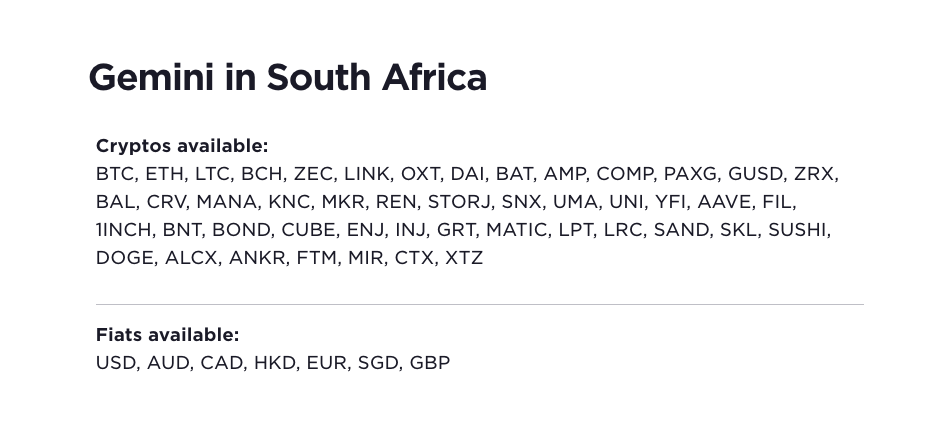

After expanding their cryptocurrency services into every state in the US, Gemini is now focused on global domination, offering services in several other countries, including South Africa. To take it back a step, though, Gemini is the brainchild of the Winklevoss twins, whose $11m cryptocurrency investment in 2013 is now estimated to be worth billions of dollars. Along the way, they’ve sold some Bitcoin to fund their cryptocurrency exchange venture, which started with the primary goal of becoming the most regulated, most legit, most secure, and most well-insured option in the market.

Quick Look

- Based on security, insurance, and legitimacy, Gemini is targeted mainly at institutional investors and savvy individuals who want a trading platform they can trust

- Transaction fees for purchases under $200 USD can be quite high

- There is no digital wallet for ZAR

Gemini offers pretty fair fees for a cryptocurrency exchange — it’s cheaper than Coinbase on average but more expensive than Binance and KuCoin (keep scrolling to read about the crypto trading experience there). Trading fees are 0.35% for takers and 0.1% for makers, with purchases made by a debit card charged at 3.49%. In truth, transaction fees vary based on Gemini’s algorithm. The payment method, amount, and even the coin bought all affect the transaction. For users in South Africa who want to spend their Rand (ZAR), there’s also the need to pay a foreign exchange fee. The ZAR converts to USD before converting to BTC (or whichever cryptocurrency brokered). This FX conversion is a necessary evil if you wish to buy Bitcoin in South Africa, as few top-tier exchanges offer a ZAR digital wallet.

Ready to get started on Gemini?

With Gemini listing more and more coins, including interesting DeFi tokens and large market cap cryptocurrency projects, this is a great place to buy Bitcoin in South Africa and start your trading or investing journey. Getting set up is fast and efficient, though you will need to give up some of your data and info, including uploading copies of your ID (this is standard for all exchanges when buying crypto).

One thing that Gemini is excellent at is being a custodian of crypto. Many traders worldwide want to look after their cryptocurrency. They don’t trust exchanges to do it for them, but as Gemini has never been hacked, they can boast a reliable custody service. In this industry, every hack-free exchange can boast exceptional levels of security, but the moment there’s a compromise in security, their reputation tarnishes. The mobile app offers all sorts of encryption tech, security features, and institutional-grade protection measures, too, giving each trader the reassurance they need that they won’t have any issues with their account.

Why is Gemini 2nd on this list?

We could have given Gemini a promotion to first place. Still, without a P2P exchange like the one offered by Binance, Gemini must rely on its institutional appeal through an advanced security and legitimacy reputation to attract traders concerned about market risk (hackings in particular). However, the point of sale is very good, making it very easy for users to see the price of what they’re buying, how much they’re going to spend, and how long the transaction will take.

We’ve placed Gemini above Coinbase because their trading platform is built-in and offers lower fees for trading. Purchase and sale or withdrawal fees are also slightly lower than Coinbase, though neither offers bank transfers as a funding method for South Africans.

As the United States’ golden child of crypto, Coinbase has become world-famous, perhaps the first household name in the cryptocurrency exchange marketplace. That fame carried to South Africa, where Coinbase is one of the most popular places to buy and sell coins, such as Bitcoin, Ethereum, and Ripple. Part of the popularity comes from the exceptional security standards that Coinbase has set for the industry, having never been hacked and often compared to the banking industry regarding how well they protect customer funds and information. On top of this zero-hack history, most funds are stored offline in cold storage, likely protected by armed guards and multiple vaults.

Quick Look

- The world’s biggest Bitcoin broker, known best for its setup as the best place for beginners to buy Bitcoin in South Africa and 100+ other countries

- Offers a sister cryptocurrency exchange called Coinbase Pro, which is granted access to your Bitcoin holdings for trading and boasts much lower transaction fees

- While you can’t make purchases by credit card, debit cards are absolutely fine, though the charge is as high as 3.99% (not including the spread)

- There is no digital wallet for ZAR

The online crypto funds are insured, too, as are EUR, GBP, and USD funds on the platform. Because of the regulations of offering a Pound, Dollar, or Euro bank account and how Coinbase stores funds, it must offer fiat currency insurance. Unfortunately for South Africans who don’t have USD, EUR, or GBP, Coinbase does not offer a ZAR fiat wallet, so you will need to make crypto purchases directly with your South African debit card. Card transactions are charged at 3.99%, which is pretty steep but on par across all broker platforms. Remember that you have the chance to buy and sell via debit card on Coinbase, so if you purchase some Bitcoin, you can sell it later and it will arrive on your debit card in the same manner.

Coinbase has become a popular platform in South Africa to mitigate market risk in protecting cryptocurrency traders from hackers and being the most accessible place for beginners to get started. Beginners on the platform who get hold of funds may then look to progress into trading, hoping to buy and sell cryptocurrencies as the prices rise and fall. For this purpose, Coinbase, with its 2% crypto-to-crypto transaction fee, might be the most convenient place but also the most expensive. Fortunately, they acquired the popular exchange GDAX and rebranded it, introducing their users to Coinbase Pro, now the second-most used exchange in the world. South African Bitcoin traders frequent this platform due to its 0.5% trading fees and how their Coinbase and Coinbase Pro accounts offer ultra-convenient cross-functionality.

Why is Coinbase 3rd on our list?

- Users can view all of their cryptocurrency holdings with a ZAR valuation, giving them an accurate representation of their worth.

- Coinbase Pro offers a unique trading platform, though, like Binance, there are no ZAR trading pairs.

- Staking is a service offered by Coinbase to help users make a passive income from their crypto.

- No other service can boast the same level of ease and user-friendliness as Coinbase.

Coin Clarity’s Sleeper Pick

It’s a shame 2021 has seen most of the major exchanges delist the Rand (ZAR) which is a major blow to traders in South Africa who have conversely seen their country become increasingly tolerant towards the cryptocurrency trading industry and exchanges in general. We’ve provided some info in the next section to try and explore why there are issues with ZAR, but first, let’s throw some praise on our sleeper pick, KuCoin.

Users in South Africa who want to spend their hard-earned Rand at a trusted broker and Bitcoin exchange will be pleased by the functionality of KuCoin. With the option to use Visa/Mastercard (debit or credit), SEPA, Apple Pay, or Google Pay as payment methods, this is a great start and is massively complemented by the three ZAR-supporting liquidity providers: Simplex, Mercuryo, and Mobilum. In addition, there are more than 30 cryptocurrencies available to purchase directly, with at least one of the three liquidity providers offering a quote to users for the transaction.

Quick Look

- Partnered with Simplex, Mercuryo, and Mobilum to allow users to purchase crypto by debit or credit card in South Africa

- Offers a P2P exchange, though South African Rand (ZAR) is currently delisted due to reported instability with the fiat currency as well as liquidity issues (scroll to the bottom of this article to learn more)

- KuCoin does not require KYC checks to trade, though you will need to go through the process to purchase crypto from their liquidity providers, Simplex, Mercuryo, and Mobilum

- With over 380 cryptocurrencies and 750 trading pairs, KuCoin has one of the top selection of altcoins on the market, as well as excellent Bitcoin liquidity

- The cryptocurrency exchange software itself is one of the best, offering a well-designed and visually pleasing mobile and browser platform

- There is no digital wallet for ZAR or any other fiat currency

Let’s discuss KuCoin P2P

In essence, KuCoin P2P works the same as Binance P2P, though with arguably fewer payment choices, fewer cryptocurrencies, and fewer supported fiat currencies. Like all P2P exchanges, it relies on being busy and bustling to succeed, and well, it isn’t really. There’s a small liquidity issue, coupled with the delisting of ZAR, which means this aspect of the platform is not utilized correctly. In the future, we’d like to hope that it recovers, but for now, looking at the list of interested buyers and would-be sellers, it seems that most of the users have moved over to Binance P2P.

KYC Free Trading on KuCoin

Those who have already signed up on some cryptocurrency exchanges will be fully aware of the need to go through KYC checks, essentially an ID verification process. It’s a necessary nuisance in this industry, though generally only required for using a broker service, to stop people from trying to launder money. For example, KuCoin allows users to trade on the P2P exchange without KYC, offering a daily limit of $2,000.

Trading on KuCoin does not require giving up any personal information — all you need to share is an email address, username, and password. Once you’ve got hold of some cryptocurrency, you can start trading, and with over 380 coins to choose from, from Bitcoin to Doge, combining into 750+ market pairs, you’re going to find something worth investing in. If you are looking to trade your way to some Bitcoin in South Africa, KuCoin is an excellent place to do it, as it has one of the top 10 liquidity ratings for BTC in the world. Trading fees are 0.1% on KuCoin for new users, dropping to zero for high-volume traders.

There you have it. The top contenders for South Africa’s best exchanges. Best of luck out there!