7 Best Crypto Futures Exchanges for 2024

Cryptocurrency futures trading has become an essential part of the crypto market. This trading method allows users to speculate on the future price of digital assets. Traders can also leverage their positions, potentially amplifying their gains.

With the increasing popularity of crypto futures, numerous exchanges provide advanced tools and features to cater to both beginners and experienced traders.

Selecting the right platform can significantly impact a trader’s success, offering various options in terms of fees, leverage, and asset choices. This article aims to guide you through the best crypto futures exchanges available in 2024, helping you make informed decisions for your trading needs. By examining key features and benefits, you can find a platform that aligns with your trading strategies and goals.

1) Binance Futures

Binance Futures stands out as one of the premier platforms for crypto futures trading. It offers an industry-leading matching engine, ensuring efficient and quick transactions. This is crucial for traders aiming to capitalize on rapid market movements.

The platform provides unmatched trading volume and liquidity. This means that users can execute large trades with minimal slippage. High liquidity also helps to maintain fair prices, making it a reliable choice for both beginner and advanced traders.

Binance Futures supports various types of contracts, including perpetual and quarterly futures. Such a variety allows traders to choose the best instrument that aligns with their strategies and risk tolerances.

Security is a top priority on Binance Futures. They utilize advanced security measures to protect user funds and data. This makes it a trustworthy platform in the volatile world of cryptocurrencies.

Additionally, Binance has introduced a Portfolio Margin Program. This program broadens the margin scope to include balances on different wallets, enhancing the collateral options for users.

2) Kucoin Futures

KuCoin Futures is one of the leading platforms for trading crypto futures. It allows traders to buy and sell cryptocurrency contracts. This platform is known for high trading volumes and user-friendly features.

KuCoin offers a variety of futures markets with competitive fees. Traders can expect leverage options to maximize their positions. High leverage means both higher potential gains and increased risks.

KuCoin broke into the top 5 global futures exchanges. This information is according to CoinMarketCap. The platform has also been highlighted in Forbes as one of the best crypto exchanges.

In 2022, KuCoin raised $150 million in investments. This brought the total valuation to $10 billion. This significant investment underscores the platform’s growth and reliability.

KuCoin Futures uses a risk management system. This system helps protect traders with large positions. It requires them to deposit more funds as their positions grow, offering added security.

The platform is ideal for both new and experienced traders. It combines ease of use with powerful trading tools. These features make KuCoin Futures a strong choice for crypto futures trading.

3) Bybit

Bybit is a leading platform for trading crypto futures. It is known for its user-friendly interface and robust security features.

The platform offers a variety of futures products, including perpetual and quarterly contracts. Traders can access up to 100x leverage, making it attractive for those looking to maximize potential returns.

Bybit has competitive fees, charging just 0.05% per trade. This can significantly reduce trading costs over time. Additionally, the exchange provides high liquidity, ensuring smooth and efficient trading even during volatile market conditions.

Bybit’s platform is licensed and regulated, which adds a layer of trust and reliability. With over 400 trading pairs, it offers extensive options for diverse trading strategies.

The exchange also features regular trading tournaments and promotions, adding an exciting element to trading. Bybit’s customer support is available 24/7, providing timely assistance to users.

4) Gate.io

Gate.io is a prominent crypto exchange founded in 2013. Known for its wide range of trading options, it supports spot, margin, and futures trading. traders have access to over 650 different cryptocurrencies, making it an attractive option for those looking to diversify.

Gate.io offers two kinds of futures contracts: USDT-margined and BTC-margined. These contracts provide flexible trading opportunities. It is recognized for its user-friendly interface and advanced trading tools like stop-limit orders and trailing stop orders.

The exchange is appreciated for its competitive trading fees. For example, the maker fee is -0.025%, and the taker fee is 0.075%. Users can also get fee discounts by using points.

Gate.io maintains a strong focus on security and transparency. It recently released its Proof of Reserves report, showing $4.3 billion in assets with a 115% reserve ratio. This commitment to security and transparency helps build trust among its users.

5) OKX Futures

OKX Futures is a robust platform for trading crypto futures. It offers a wide range of futures contracts, making it a versatile choice for traders. The exchange supports delivery and perpetual futures, as well as options, ensuring various strategies can be employed.

OKX is notable for high liquidity, with a daily trading volume exceeding $10 billion in the derivatives market. This ensures that users can execute large trades without significant slippage. Competitive fees further enhance the trading experience.

The platform offers weekly, biweekly, and quarterly futures contracts. This flexibility allows users to align their trading activities with different time frames, catering to both short-term and long-term strategies.

Users can access leverage up to 200x on OKX Futures, enabling them to amplify their positions. While this provides opportunities for significant gains, it requires cautious risk management.

OKX’s interface is user-friendly, making it easier for both beginners and experienced traders. The fees are low, with a 0% maker fee and a 0.01% taker fee in the futures market.

OKX supports a wide array of cryptocurrencies, including over 200 different digital assets. This extensive list ensures traders have access to various markets and can diversify their portfolios.

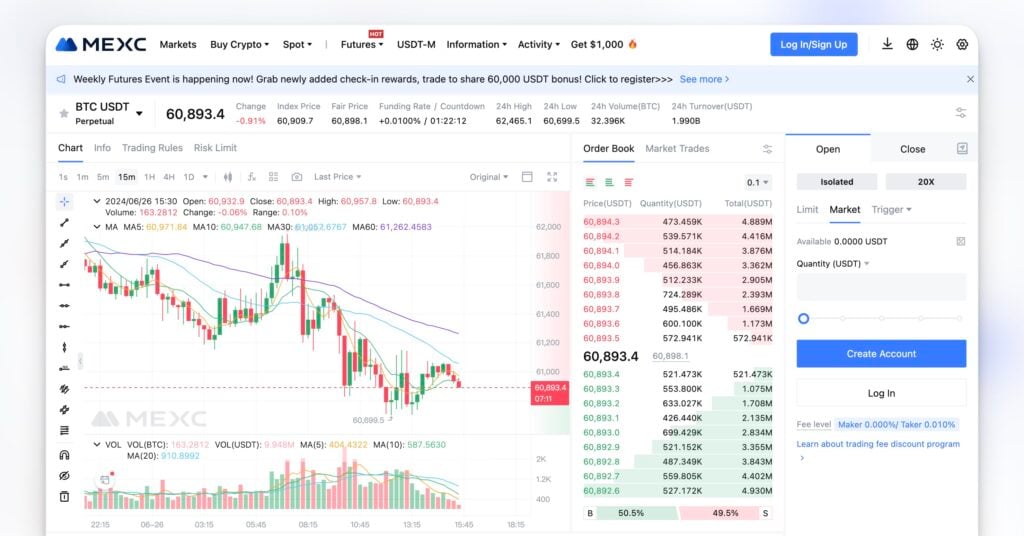

6) MEXC

MEXC is a well-known cryptocurrency exchange, particularly praised for its futures trading services. The platform offers two types of perpetual products: USDT-M, which uses USDT as collateral, and COIN-M, which uses the underlying crypto as collateral. This allows traders to choose the option that suits their needs.

MEXC is known for its high performance and global liquidity. It attracts a large number of traders due to its stable and secure environment. The platform handles a significant trading volume, reportedly nearing $7 billion, which places it among the top exchanges.

A standout feature of MEXC is the leverage it offers. Traders can enjoy up to 200x leverage on futures, making it an attractive choice for those looking to maximize potential gains. Though high leverage carries higher risks, it also provides significant opportunities for experienced traders.

The exchange also supports a wide range of cryptocurrencies. Beyond Bitcoin and Ethereum, users can trade altcoins linked to NFTs, DeFi, GameFi, and the Metaverse. This diversity ensures that traders have many options.

MEXC focuses on providing a user-friendly interface. Their app is available on iOS, Android, and Windows, making it convenient for users to trade on the go. This accessibility contributes to its popularity among both new and seasoned traders.

7) Bitget

Bitget is a crypto exchange platform known for its diverse trading options. It was founded in 2018 and has since become a popular choice for traders. Bitget offers futures trading, spot trading, margin trading, P2P, and copy trading.

One of the main features of Bitget is its low trading fees. Non-VIP users face a 0.02% maker fee and a 0.06% taker fee. For those who trade more frequently, there are tiered rate benefits under the VIP Level tab in the account profile.

Bitget supports over 550 digital currencies, including well-known ones like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). This wide range of options allows traders to explore and invest in various cryptocurrencies.

Bitget’s user interface is also user-friendly, making it suitable for both beginners and advanced traders. The platform’s robust security measures add an extra layer of trust and reliability for its users.

Understanding Crypto Futures

Crypto futures are financial instruments that allow traders to speculate on the future price of cryptocurrencies like Bitcoin and Ethereum. These contracts come with several benefits such as leverage, but they also come with risks including market volatility and potential for large losses.

What Are Crypto Futures?

Crypto futures are contracts that obligate the trader to buy or sell a specific quantity of a cryptocurrency at a predetermined price on a future date. This allows traders to speculate on price movements without having to own the actual cryptocurrency.

Through futures contracts, traders can go long (bet that a cryptocurrency’s price will rise) or go short (bet that the price will fall). Futures are traded on various exchanges and come with features like leverage, allowing traders to control large positions with a relatively small amount of capital.

Benefits of Trading Crypto Futures

Trading crypto futures offers the advantage of leverage, meaning traders can control large positions with a fraction of the total value.

This ability to magnify gains is one reason why futures are popular among traders. They also provide the flexibility to hedge against price fluctuations in underlying assets.

Futures markets are generally highly liquid. High liquidity levels make it easier for traders to buy and sell contracts at any time. Additionally, futures can be a strategic tool for portfolio diversification, spreading risk across different financial instruments.

Risks Involved in Crypto Futures

Trading crypto futures carries several risks. This is primarily due to the high volatility of cryptocurrency prices. This volatility can lead to significant losses quickly, especially when using leverage.

Another risk is liquidation. This happens when a trader’s position is automatically closed if the market moves against them significantly. This can happen rapidly, resulting in the loss of the initial margin and any additional funds in the margin account.

There are also regulatory risks. Different countries have varying regulations regarding crypto futures. These can affect market access and trading terms. Traders must be aware of these risks and employ strategies to manage them effectively.

How to Choose a Crypto Futures Exchange

Selecting the right crypto futures exchange can greatly impact your trading success. Key factors to consider include security features, trading fees, and the user interface.

Security Features to Consider

Security is paramount in cryptocurrency trading. Look for exchanges with two-factor authentication (2FA), cold storage for funds, and encryption protocols. Exchanges like Kraken and Binance are known for their advanced security measures.

Check if the platform undergoes regular third-party audits and penetration testing. Insurance policies that protect user funds against hacks or other security breaches are also crucial. Avoid platforms with a history of security issues.

Trading Fees and Costs

Trading fees can eat into your profits, so it’s essential to know the cost structure. Fees are generally categorized into maker and taker fees. Maker fees apply when you add liquidity to the market, while taker fees apply when you remove liquidity.

Compare the fees of different exchanges. For example, Binance typically has lower fees compared to competitors. Additionally, look for hidden costs such as withdrawal and deposit fees. Some platforms offer discounts if you hold their native tokens or trade in large volumes.

User Interface and Experience

A user-friendly interface can make or break your trading experience. The platform should be intuitive and easy to navigate. Look for features like customizable dashboards, one-click trading, and detailed charting tools.

Exchanges like OKX and Bybit offer beginner-friendly interfaces with robust functionalities. The platform should also have a responsive customer support team to assist with any issues. Mobile compatibility is another plus for trading on the go.

Advanced Trading Strategies

Advanced trading strategies in crypto futures can significantly enhance profitability. Focus on leveraging and margin trading, hedging against risks, and applying technical analysis to make more informed decisions.

Leverage and Margin Trading

Leverage allows traders to control a large position with a small amount of capital. For example, with 10x leverage, $1,000 can control $10,000 worth of crypto futures. This amplifies both potential gains and losses.

Managing margin requirements is crucial in leveraged trading. Exchanges like BitMEX and Binance Futures offer different leverage levels, so it’s essential to understand the specific terms and conditions of each platform. Traders should always monitor their positions to avoid liquidation, which occurs when market moves deplete their margin.

Hedging Strategies

Hedging involves taking positions in futures contracts to offset potential losses in the spot market. For instance, if a trader holds Bitcoin and expects its price to drop, they can open a short futures position. This way, if Bitcoin’s price decreases, the gains from the short position can offset the losses in the spot market.

This strategy is particularly useful during periods of high market volatility. Properly executed, hedging can minimize risks and provide more stable returns. However, it requires a thorough understanding of both the spot and futures markets.

Technical Analysis for Futures

Technical analysis uses historical price data and trading volume to forecast future price movements. Popular tools include moving averages, Relative Strength Index (RSI), and Bollinger Bands.

For example, a trader might use the 50-day moving average to identify trends or the RSI to spot overbought or oversold conditions. By applying these tools to futures trading, traders can make more informed entry and exit decisions.

It’s also important to analyze patterns like head and shoulders or double tops and bottoms. Mastery of technical analysis can enhance one’s ability to predict market trends and make profitable trades.

Frequently Asked Questions

Choosing the right crypto futures exchange can be complex. Key factors include platform reliability, fees, and ease of use, especially for beginners.

What are the best crypto futures platforms in the USA?

Coinbase International and Kraken are excellent choices for US users. Coinbase International offers a user-friendly interface while Kraken provides a wide range of futures markets with perpetual contracts backed by US dollars. Both platforms are reputable and cater to different trading needs.

What are the best crypto futures trading platforms for beginners?

For beginners, Binance Futures and Bybit stand out. Binance Futures is known for its comprehensive tutorials and robust customer support. Bybit offers a solid platform with intuitive design and risk management tools. Both are suitable for those just starting out in crypto futures trading.

How do beginners decide on the best exchange for crypto futures trading?

Beginners should consider factors like user interface, educational resources, and customer support.

Platforms like Binance Futures provide detailed guides and support, making them ideal for those new to crypto futures.

It’s also important to check the fees and the range of available cryptocurrencies to ensure a good fit.