Binance Review

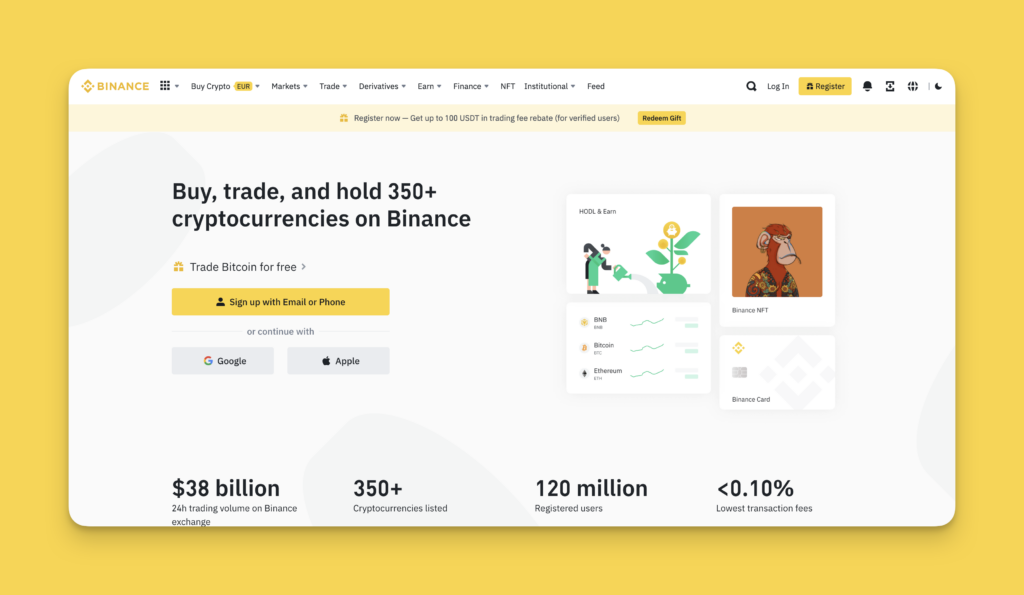

World's largest crypto exchange, known for its wide range of trading options, low fees, and strong security features.

Binance is known for its wide array of over 350 tradable cryptocurrencies for worldwide customers and low trading fees.

Binance also offers incentives such as fee discounts for using its own coins, referral bonuses, and VIP status for trading particular assets. Although the platform has invested in security features like two-factor authentication, its parent company's reputation has been impacted by ongoing legal challenges and regulatory issues.

General Overview

- Low Fees

- Wide Selection of Cryptocurrencies

- Extensive Trading Tools and Options

- Robust Security Features

- Educational and Extra Features

- Regulatory Issues

- No Built-in Digital Wallet

- Expert-Friendly Platform

Binance Deposit & Withdrawal Methods

| Deposit | Withdraw | Speed | |

|---|---|---|---|

| Apple Pay | Instant | ||

| Google Pay | Instant | ||

| Bank Transfer (ACH) | 1-3 days | ||

| Wire Transfer | 1-3 days | ||

| Debit Card | 1-3 days | ||

| SEPA | 0-5 days |

For deposits, users can use credit/debit cards after completing KYC/AML verification, which involves providing personal documents and phone number verification.

Alternatively, funds can be transferred from other crypto wallets by ensuring the correct network selection or through the P2P platform, which involves direct exchanges between users. Binance also supports deposits through its partners using methods like Visa and Mastercard, with transaction fees ranging from 1.99% to 3.5%. Additionally, users can deposit fiat currencies like EUR and USD, with SEPA bank transfers in Europe offering high limits and minimal fees.

Withdrawing crypto on Binance can be done via the app or website, requiring users to select the correct cryptocurrency and network, enter withdrawal amounts, and check transaction details carefully to avoid losses. Networks include BEP2, BEP20, ERC20, among others. The process is similar on both platforms, emphasizing confirming network compatibility with the recipient address. Transaction times vary depending on the blockchain and network traffic.

While Binance doesn't charge fees for crypto deposits, commissions are applied when depositing from other wallets. Also, while deposit limits are not restricted, withdrawal limits depend on the user's KYC level and vary by country. Users should always verify all transaction details to prevent the loss of funds.

Binance Fees

Binance fees vary based on the type of transaction and user status. The platform's fee structure is designed to be competitive, with several nuances depending on the transaction type, user's trading volume, and use of Binance Coin (BNB).

Trading Fees:

-

- Standard trading fee: 0.1% for both taker and maker.

- Discount for Binance Coin (BNB) users: 25% off on spot trading fees.

- Tier 0 trades (specific Bitcoin pairs): Zero fees.

- VIP Program: Offers reduced fees for high-volume traders.

Withdrawal Fees:

-

- Crypto withdrawals: 0.0005 BTC per BTC-withdrawal, with fees varying by cryptocurrency. For example, Tether USDT fees range from $0.8 to $3.2, while Bitcoin fees are 0.0002 BTC.

- Fiat withdrawals: SWIFT bank transfers for USD incur a $15 fee, SEPA bank transfers in the EURO region cost as low as 1 EUR, and Visa/MasterCard bank card transfers charge 1.8%.

Deposit Fees:

-

- Cryptocurrency deposits: Free of charge.

- Fiat deposits: Fees vary based on the transfer method, with some methods like direct bank transfers and Advcash mostly free of charge.

Special Promotions:

-

- Zero maker and taker fees for trading BTC on the BTC/TUSD spot and margin trading pair as part of a promotion.

Binance Pay Services:

-

- Specific Binance Pay services have updated fee rates effective from mid-2023.

Additional Fee Reduction Strategies:

-

- Holding BNB in the account for a 25% discount on trading fees.

- Using the futures trading platform, which offers lower fees.

- Participating in referral programs.

How to Sign Up for Binance

Users have the option to sign up using their email address, phone number, or directly with an Apple or Google account. It's important to select the account type carefully, as it cannot be changed after registration.

- Go to Binance Website: Visit the Binance website and click on 'Register'. Choose your preferred registration method (email address, phone number, Apple, or Google account).

- Enter Email/Phone Number: If registering with an email or phone number, enter the details. Optionally, if referred by a friend, enter their Referral ID. Agree to the Terms of Service and Privacy Policy, then click 'Next'.

- Verification Code: Receive a 6-digit verification code via email or phone. Enter this code within 30 minutes and submit it.

- Create Password: Create a secure password for the account. It must have at least 8 characters, including at least one uppercase letter and one number. Click 'Next'.

- Account Creation Confirmation: Upon completing these steps, the Binance account is successfully created.

Pros Explained

- Low Fees: Binance offers relatively low trading fees, providing an appealing option for investors.

- Wide Selection of Cryptocurrencies: More than 150 tradable cryptocurrencies for U.S. customers and over 350 for international users.

- Extensive Trading Tools and Options: Offers real-time charting tools, multiple order types, and trading views, allowing flexibility and control for experienced traders.

- Robust Security Features: Includes two-factor authentication (2FA), address whitelisting, and device management.

- Educational and Extra Features: Binance provides a comprehensive learning platform, NFT platform, and more, enhancing the overall user experience.

Cons Explained

- Regulatory Issues: Binance has run into legal and regulatory trouble in several countries, including an ongoing investigation in the U.S.

- No Built-in Digital Wallet: Unlike some exchanges, Binance does not have its own dedicated crypto wallet, recommending Trust Wallet instead.

- Expert-Friendly Platform: The platform can be confusing, especially for new users, due to its numerous features and options.

By this point, just about everybody who has ever traded cryptocurrency has heard about Binance. This in itself is quite a feat as Binance themselves have only been around for about 3 years. Under the leadership of founder and CEO Changpeng Zhao, Binance has grown from a crypto-only exchange to a massive financial services provider and one of the biggest fiat-to-crypto exchanges worldwide. Having an account at Binance is pretty much essential for anybody who considers themselves to be a cryptocurrency trader or investor.

Why Choose Binance?

With over 13 million monthly users and 170+ coins listed, Binance is the industry standard for cryptocurrency exchanges everywhere. Opening an account is incredibly easy, exchange fees are low, and the number of different coin pairings is astounding. Pretty much every notable cryptocurrency is traded here and can be purchased using a huge assortment of fiat (national) currency options, as well.

Binance is the biggest exchange for Bitcoin when going by volume and liquidity, as well as many other top-rated cryptocurrencies. Binance is also rated as the biggest exchange overall based on a metric determined by total web traffic, average liquidity, and volume.

The totality of these accomplishments means that you will be hard-pressed to get a better deal when making a trade at any other cryptocurrency exchange.

History of Binance

Founded by trading software developer Changpeng Zhao, Binance launched in July 2017 after raising $15 million during an ICO. Less than 8 months later, Binance was declared the world’s biggest cryptocurrency exchange by trading volume, making it probably the biggest and most well-known success story among cryptocurrency exchanges. The company moved from China to Japan in 2017, citing the need to operate in a more regulatory-friendly atmosphere.

Binance was available in the U.S. up until July 2019 when they announced they would no longer be servicing U.S. customers. Instead, they would have to re-register with a different website, binance.us, which is partnered with blockchain forensics firm Chainalysis and KYC/AML tool provider IdentityMind. The move to split the customer base was not only to obtain compliance with U.S.-based regulations but also so Binance could expand its range of leverage products (which U.S. customers are forbidden to access).

In April 2020, Binance acquired Coinmarketcap.com, determined to convert even more of its users into customers. Today, Binance is bigger than ever thanks to the remarkable leadership of CEO Zhao. Known as “CZ” on Twitter, Zhao is quite an active personality, regularly engaging in lively discussions with other well-known leaders of the cryptocurrency community. It’s hard to imagine what Binance could possibly do to continue its amazing streak of growth, but if its history is any indicator of the future, it will likely find a way.

Getting a Binance Account

- How to Register an Account

Getting started trading at Binance is incredibly easy as it only takes an email address to create an account. After clicking “Register”, simply enter an email address and then verify it using the code sent to your email. This is all you need to withdraw up to 2 BTC (or its equivalent in altcoins) per day on Binance.

- How to Get Verified

You will need to verify your identity if you plan to deposit fiat (national) currency into your Binance account. Most likely, you will be creating a Personal account, which will require the following:

- Personal info: includes full name, date of birth, and residential address.

- Personal identification: includes submission of a valid ID (passport, driver’s license, or identity card) which you can take a picture of using a webcam, upload a picture, or even take a picture using your mobile device).

- Facial info: you will also need to provide Binance with a selfie while holding your ID in hand, which can also be done either via webcam or mobile device. Be sure that your entire ID and face are both clearly visible in the picture.

Note that while you can start withdrawing up to 2 BTC worth of crypto per day from your account immediately, you can up this limit to 100 BTC per day by completing the above verification and submitting verification of your residence as well.

Making a Purchase

After first registering an account, you will be presented with 3 different options to fund your account:

- Deposit fiat. Binance accepts national currency deposits in USD, EUR, GBP, RUB, ZAR, UAH, HKD, KZT, TRY and NGN. Methods of deposit include bank transfer, Advcash, Perfect Money, Epay and Payeer. There is a 1.5% fee for bank transfer deposits and a 3% fee for credit card deposits. Fiat deposits can be made by selecting your “Spot Wallet” and clicking “Deposit” next to the coin you will be depositing.

- Deposit crypto. The easiest way to fund your account is by depositing a cryptocurrency. There is never a fee for depositing a crypto, and they support over 170 coins as deposit options. Crypto deposits can be made by selecting your “Spot Wallet” and clicking “Deposit” next to the coin you will be depositing.

- Buy crypto with your credit card. You can purchase crypto straight away (without having to place orders and make trades) using Binance’s “Buy Crypto” option. The payment channels supported include Simplex (Visa, MasterCard), Koinal (Visa, MasterCard, UnionPay), and BANXA (Visa MasterCard, bank transfer). This is the easiest way that there is to purchase crypto using your national currency.

If you want to deposit fiat currency or make purchases using a credit card, you will need to undergo the ID verification procedure as outlined above. Crypto deposits, on the other hand, require no verification whatsoever. Binance started out initially as a crypto-only exchange, so most of its service areas are geared toward crypto/crypto exchanges.

Making a Trade

Binance offers a flexible array of trading options: everything from making a simple cryptocurrency swap to placing stop-limit orders to margin trading. The first thing you will want to do is find the coin you wish to trade. This can seem daunting as a beginner but once you get the hang of sorting through Binance’s giant assortment of trading pairs, it will become obvious where to find what you are looking for.

Clicking “Markets” in the top navigation bar will bring you to the first screen of coin pairings, which are divided up into the following tabs:

- BTC Markets: Bitcoin-backed coin pairings

- BNB Markets: Binance Coin-backed pairings

- ALTS Markets: Altcoin-backed pairings, including those backed by Ethereum (ETH), TRON (TRX), and Ripple (XRP)

- Fiat Markets: national currency and stablecoin-backed pairings, including EUR, RUB, TRY, ZAR, NDN, Tether (USDT), USD Coin (USDC), Paxos Standard Token (PAX), TrueUSD (TUSD), Binance USD (BUSD), Binance KRW (BKRW), Rupiah Token (IDRT)

There are currently 175 different BTC-backed coin pairings which can be sorted by a number of criteria. All of the other alternative-backed markets have significantly less selection (and usually volume) but you can often save a step by trading them if they are one of your deposit options. For example, if you deposited ETH into your account and want to buy EOS, it is much easier to trade using the ETH/EOS pair than first trading your ETH for BTC and then trading the BTC/EOS pair.

Spot vs. Derivative Markets

Binance trading options are divided into two categories which are broken down into several subcategories.

Spot Markets are where the most common types of trades happen in which one coin, token or asset is traded for another. Here are the different trading screens available for Spot Markets:

- Basic. This allows for the instantaneous conversion of one cryptocurrency into another based on the best available market rates. Sometimes known as a “swap,” Basic Spot Market trading does not require any sort of trading experience or background knowledge. Just select the coins you wish to swap and Binance will let you know the price and rate which you will receive. There’s no faster way to exchange coins.

- Classic. This is the standard order book interface that allows people to place market, limit and stop-limit orders. Current buy and sell orders are listed in the left column, a basic trading chart is shown in the middle, and different coin pairings as well as your trading history are shown in the right column. Underneath the chart is the order entry screen.

- Advanced. Similar to the Classic screen but has a bigger chart area by default and several technical analysis overlay options. It also has line drawing options so you can perform your own analysis on the displayed chart. Overall, it is a bit more sleek and customizable than the Classic screen, designed for those who prefer to focus on technical aspects and attempt to time their trades.

- OTC. Short for “Over the Counter,” this type of trading is for those who wish to place very large orders and get an instant quote for the entirety of the order. It takes into account several different factors when generating the quote; mainly the exchange rate between the two coins and the volume available on the orderbook.

- P2P. Short for “Peer to Peer,” this option allows you to trade crypto for fiat currency from a 3rd party provider. The transaction is mediated by Binance so you don’t run the risk of getting ripped off. There are several different fiat currencies available that aren’t readily available for deposit, which means it is possible to buy coins using a fiat currency that may not otherwise be supported using Binance’s other options.

Derivatives Markets involve the trading of financial products that are not cryptocurrencies themselves. These products cannot be moved off Binance as they exist only on the exchange and serve to achieve goals that cannot be accomplished with cryptocurrencies. The Derivatives Markets include:

- Futures. With futures trading, you are more-or-less betting on what the price of BTC will be at a certain close date, with all trades settling on the spot price of the chosen crypto at the time of close. Binance will allow you to leverage a trade up to 125x worth of USDT, which means that putting up 100 USDT as collateral in a trade can be leveraged all the way up to $12,500. Both long and short positions can be opened and closed at any time. Opening a long position if you believe the price of the coin will go up. Opening a short position if you believe the coin price will go down.Note: Futures trading with extreme leverage is highly risky as your position runs the risk of being liquidated if the market makes even a small turn in the wrong direction. A liquidation will cause you to lose all of your collateral, so it is recommended to start using only small amounts of leverage (5-10x) when just getting started. Coins available for futures trading include BTC, BCH, ETH, XRP, EOS, LTC, TRX, ETC, LINK, XLM, ADA, XMR, DASH, ZEC, XTZ, BNB, ATOM, ONT, IOTA, BAT, VET, NEO, QTUM, IOST, and THETA.

- Leveraged Tokens. Leveraged Tokens are a much simpler way of longing or shorting the market as you only need to buy the token corresponding to the direction in which you believe the market is going to move. Currently, Binance only offers 2 Leveraged Tokens: BTCUP (long the BTC market with 3x leverage) and BTCDOWN (short the BTC market with 3x leverage). The advantages of using these tokens over Futures leverage trading are a much more measured approach to leveraging and the fact that you can never lose all of your trading capital.

Market vs. Limit Orders

It is important to know the difference between these two types of orders before attempting to make a trade, as not knowing what you are doing could end up needlessly costing you a whole lot of money unexpectedly.

- A Market Order is an order to buy a coin at the best available price. It is executed instantly and incurs what is known as a “taker” fee. Whatever amount of coins you are buying, the order will be filled according to what prices are available in the order book. When placing large-sized market orders, it is important to make sure there is enough liquidity in the order book so you don’t have to pay sky-high prices to complete the order.

- A Limit order is an order placed on the exchange to obtain a certain amount of coins at a certain price and incurs a maker If a buy limit order is put in at a price below the lowest selling price, it will remain there until a seller puts in a market order to buy from it. If you put your buy price too low or your sell price too high, you may have to wait a while for your order to get filled (or forever, depending on how far away it is from the bid/ask spread (buy/sell orders closest to one another and which way the market moves).

- A Stop-Limit order is used to trigger a buy or sell order once a coin reaches a specified price. For instance, let’s say the price of BTC is currently $9,500 but you want to buy it at a cheaper price. If you put in a Stop-Limit order with a Stop of $9,400 and a Limit of $9,350, a limit order will be placed for $9,350 once the price drops to $9,400.

- An OCO order is used to place a Limit and Stop-Limit order at the same time, meaning that one order cancels the other (thus OCO, for “one cancels other”) after one of the orders is triggered. Likewise, if one order is canceled, the other order will be canceled as well.

Margin Trading

Margin trading is similar to Leveraged trading except that you are borrowing coins from a 3rd party at a set rate in order to increase the size of your position. You will notice that both the Classic and Advanced Spot trading screens have options for Margin trading. In a way, Margin trading is sort of like a hybrid between Spot and Derivatives trading as you are placing leveraged orders on the spot market.

The profits you make will be denominated in the coin which you are trading; however, you must of course pay back the coins you have borrowed (with a small interest fee) before you can make a withdrawal. Like Leveraged trading, you also run the risk of getting margin called, which is the same thing as getting liquidated (complete loss of capital if the market swings too far in the wrong direction).

Supported Coins

Binance offers the biggest selection of tradable cryptocurrencies or tokens compared to other exchanges of its magnitude. This is one of the reasons why they are so successful and popular with crypto traders everywhere. Their coin pairings – even for some of the more obscure, lower-ranked altcoins – tend to have a lot of trading volume and liquidity as compared to many other exchanges, meaning quite often there simply isn’t a better place to get a good deal when it comes to buying or selling cryptocurrencies.

With support for about 175 coins/tokens and 600 different pairings, it is unreasonable to list every crypto and its pairings for the sake of this guide. However, what we can do is list some coins whose #1 exchange by volume and liquidity (as determined by the market cap) is Binance. This means you probably won’t find a better deal on an exchange for these coins anywhere else the web has to offer.

- Top tier coins: Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), EOS (EOS), Bitcoin Cash (BCH), Litecoin (LTC), Chainlink (LINK), Binance Coin (BNB), Stellar (XLM), Cardano (ADA), Monero (XMR), Dash (DASH), TRON (TRX), Tezos (XTZ)

- Mid tier coins: VeChain (VET), Ontology (ONT), Basic Attention Token (BAT), Neo (NEO), Qtum (QTUM), Cosmos (ATOM), ICON (ICX), THETA (THETA), Lisk (LSK), Waves (WAVES)

- Smaller coins: IOST (IOST), Matic Network (MATIC), Ravencoin (RVN), Algorand (ALGO), Enjin Coin (ENJ), Zilliqa (ZIL), BitTorrent (BTT), Nano (NANO)

- Microcap coins: WazirX (WRX), Solana (SOL), Metal (MTL), Elrond (ERD), Ripio Credit Network (RCN), IoTeX (IOTX), Band Protocol (BAND), Theta Fuel (TFUEL)

- Stablecoins: Tether (USDT), Paxos Standard Token (PAX), Binance USD (BUSD), USD Coin (USDC), TrueUSD (TUSD)

The above list only represents the most heavily traded 25% of Binance’s total offerings. Binance has a long tradition of adding coins it finds to be unique or potentially valuable, maintaining an ethos of letting the “little guy” get a fair shot of being listed on a big exchange. This means that its number of listings is outwardly expanding, with more additions than delistings taking place on a yearly basis.

Trading & Withdrawal Fees

For new traders, both Maker and Taker fees will start at 0.075%, which is quite small and reasonable for a cryptocurrency exchange. Maker fees are those accrued when a Limit order trade is made. Taker fees are those accrued when a Market order trade is made. You do not incur fees for simply placing a Limit order. The more trades you make, the higher your VIP level goes, and the lower these fees will become.

Crypto withdrawal fees vary from coin to coin but are generally pretty modest compared to many of their competitors. Binance has traditionally been pretty fair in this regard, unlike some exchanges which seem to derive an undue amount of income from having unreasonably high fees. The fee for withdrawing BTC is currently 0.0004 BTC, which may change depending on how much traffic there currently is on the Bitcoin Network. The withdrawal fee for all other coins is much less expensive, which is typical of a cryptocurrency exchange. The withdrawal fee for all dollar-pegged stablecoins is 1.22 (roughly $1.22).

The fee for fiat withdrawals is usually pretty low or else zero, but you may be charged additional fees on the end of your financial services provider.

Binance Special Features

Binance is not just a cryptocurrency exchange. It is chock full of additional features related to cryptocurrency, including research, financial management, staking, global markets, charities, project incubation and launchpad, savings, and even mining with their own mining pool. Within the Binance website is pretty much everything related to crypto finance that could possibly be imagined, as they have branched out well beyond acting as an exchange over the last 3 years. A few of the most interesting of these features include:

- BinanceDEX. Hosted on binance.org, this is a decentralized exchange that operates independently from human intervention. It has numerous coin pairings that cannot be found on the main exchange and has no sort of registration or identification process. Instead, users create their own wallet file, use it to move BNB or BTC for trades, and conduct their trades through a series of smart contracts.

- Binance Info. This feature provides important background information on all the coins currently listed at the exchange. It’s a good place to go to find relevant details on a coin before considering trading it. You can also read Binance’s in-depth research reports on certain coins or read the latest news about your favorite ones.

- Binance Launchpad. Here it is possible to invest in the newest ICOs or IEOs before they hit the markets. Binance is very selective in choosing which token-based projects they will host in this section. Some well-known projects released on the Binance Launchpad include BitTorrent Token (BTT), Matic (MATIC), Elrond (ERD), and WazirX (WRX).

Security

In general, security is taken quite seriously by Binance, with users having the usual options of implementing 2-FA through a security key, authenticator app, or text message. Binance was famously the victim of a hacking of 7,000 BTC in 2019, but the exchange covered all of its losses and ensured that the balances of its users were not affected. Founder and CEO Changpeng Zhao assures customers that their funds will always be safe, thanks to the exchange’s large security fund designated to cover future hacking incidents.

It is highly recommended that you activate 2-FA on your account if you plan to store funds there. You also have the option to review devices logged in to your account, review your account’s activity, and set up an anti-phishing code that will be displayed on any emails received from Binance. You can also create a customized list of approved withdrawal addresses using the Whitelist feature. This will help guarantee that your funds can only be withdrawn to certain addresses pre-approved by you.

Mobile Apps

Binance offers mobile apps for both Android and iOS devices. It can be downloaded from the Google Play Store, the Apple Store, or alternatively, an Android version can be downloaded straight from the Binance website. Most of Binance’s main features can be accessed from the app, including direct purchases, margin trading, leveraged futures trading, and crypto staking. It even offers advanced trading options like placement of trailing stop orders on Futures trades, multi-option contract trading, and an option target price function.

Binance Coin (BNB)

Binance Coin (BNB) is the native utility coin for the exchange, meaning it can be used to lower trading fees and access special features of the website. BNB is also used to power the Binance DEX which is a next-generation decentralized exchange that operates independent of the main Binance exchange. Originally launched as an Ethereum token, BNB was sold to investors during an ICO, 11 days before the launch of the exchange in 2017.

For years, “token burns” took place to reduce its overall supply and thus add scarcity to the total amount in circulation. In April 2019, Binance Coin moved to its own blockchain, with old token holders receiving the new coin in a 1:1 swap. Even before the move, BNB has been a serious hit among cryptocurrency traders, achieving a multi-billion dollar market cap less than 2 years after its introduction, and currently the 9th biggest coin in terms of total market cap.

Finance

The Finance menu tab consists of 5 different items:

- Savings. This feature acts kind of like a medium-interest savings account. Here you can lock up certain amounts of coins here and allow Binance to use them for their own purposes and receive interest on them. There are two types of savings plans: flexible (can be canceled at any time) and locked (coins are unavailable during the entirety of the locked period and early withdrawal incurs a penalty).

- Staking. You can stake certain Proof of Stake (PoS) coins on Binance and receive close to what you would normally receive from staking them in your own wallet. PoS coins tend to pay out higher rewards than the interest to be accrued through the Savings feature.

- Binance Pool. Connect to Binance’s mining pool and have your mining rewards go straight to your Binance account. The coins currently being mined by the pool are BTC, BCH, and BSV, and the potential mining reward for each coin is displayed, varying by how many terahash (TH) you are willing to supply the pool.

- Debit Card. Like Coinbase and a few other exchanges, Binance now offers its own debit card that can be topped up using BTC or BNB. A very recent release, the Binance Debit Card is still in its beta stages and only exists in virtual form. You can sign up for the waitlist now and Binance will let you know when the card is available for purchase in your country.

- Crypto Loans. Binance also provides a loan service where you can borrow USDT or BUSD by putting up certain coins as collateral. Loans come at reasonable interest rates and can be made for different periods between 7 and 90 days. Coins accepted as collateral include BTC, BCH, XRP, ETH, EOS, and LTC.

Benefits of Using Binance

- Massive selection of coins and tokens with high volume and liquidity.

- Simple registration process — personal info not needed until surpassing the 2 BTC/day withdrawal limit.

- One-stop shop for trading options, including everything from coin swaps to high-leverage trading.

- Trustworthy: will not run away with user coins, has a reputation for caring about the welfare of their customers.

Limitations of Binance

- Not available for users in the U.S. (must use binance.us).

- Somewhat cluttered by having a huge array of options and tradable items (not necessarily easy to find exactly what you are looking for).

- Prone to sudden changes that may leave users no longer eligible to use the exchange (in spite of this, Binance will almost always let customers still access their wallets and withdrawal their coins after changes to meet regulatory compliance have been made).

- Users are more often subject to phishing attempts than other exchanges.

Wrapping it Up

In summation, there’s pretty much nothing Binance can’t do as a cryptocurrency exchange. Launched in 2016, they have gone from being a tiny startup to the world’s biggest exchange, and they don’t appear to be slowing down any time soon. The breadth of services that Binance has to offer is simply unparalleled when it comes to any other single organization. They provide new customers with an extremely low barrier to entry, making it possible for just about anybody to create an account within a matter of minutes. Binance’s security features and customer service are top-notch, as is the overall user experience they provide, and we really have a hard time coming up with anything bad to say about them.