The KuCoin Exchange has a competitive fee structure for both, market makers and takers for spot trading, with a base fee of 0.1%. This makes KuCoin an attractive option for traders seeking low fees and deep liquidity across an extensive list of supported cryptocurrencies.

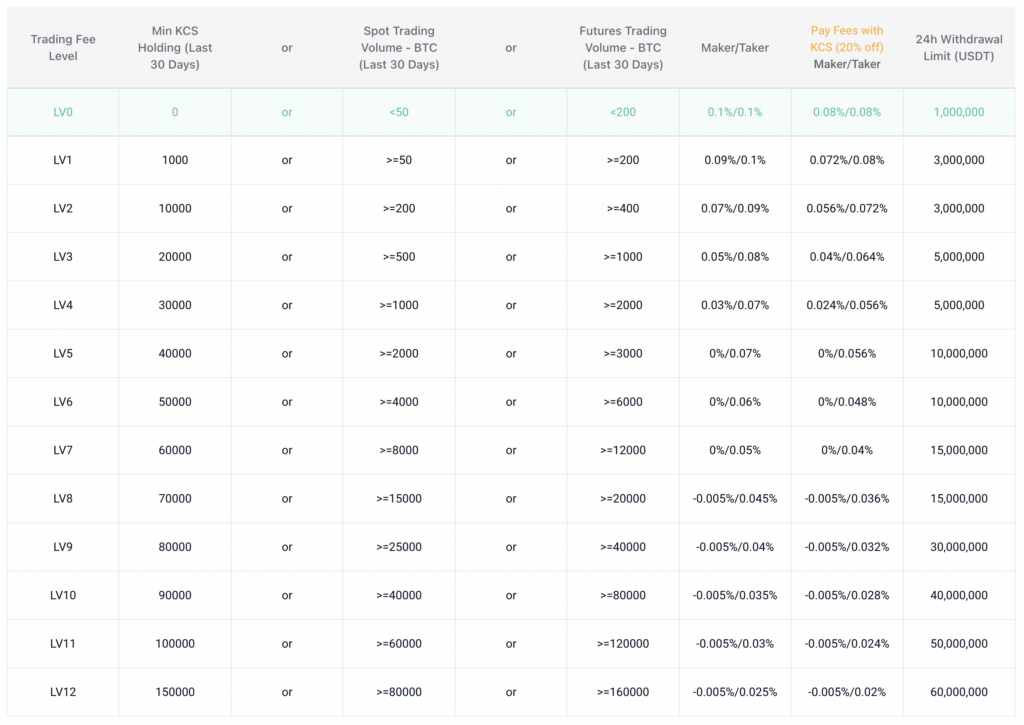

The KuCoin fee structure is divided into different levels, with each level offering larger discounts. You can view your current level by clicking on the ‘Fee’ button in your account section on KuCoin. As you increase your trading volume or hold more of KuCoin’s native cryptocurrency (KCS), you may be eligible for additional fee discounts.

Here’s a brief overview of all KuCoin fees:

- Trading fees: For spot trading, the base fee is 0.1% for both market makers and takers. The fee may decrease depending on your trading volume and fee level.

- Futures and margin fees: KuCoin offers trading with leverage, which involves fees associated with futures and margin trading. These fees vary depending on the assets you’re trading and your account level, so always be aware of the associated costs when trading leveraged assets.

- Deposit fees: KuCoin generally does not charge deposit fees. However, traders should be aware of network fees associated with certain cryptocurrencies when depositing, as these are beyond KuCoin’s control and may impact your total cost.

- Withdrawal fees: When withdrawing assets from your KuCoin account, you’ll incur a fee depending on the cryptocurrency you’re withdrawing. This fee is typically associated with network costs and varies depending on the blockchain network.

KuCoin Spot Trading Fees

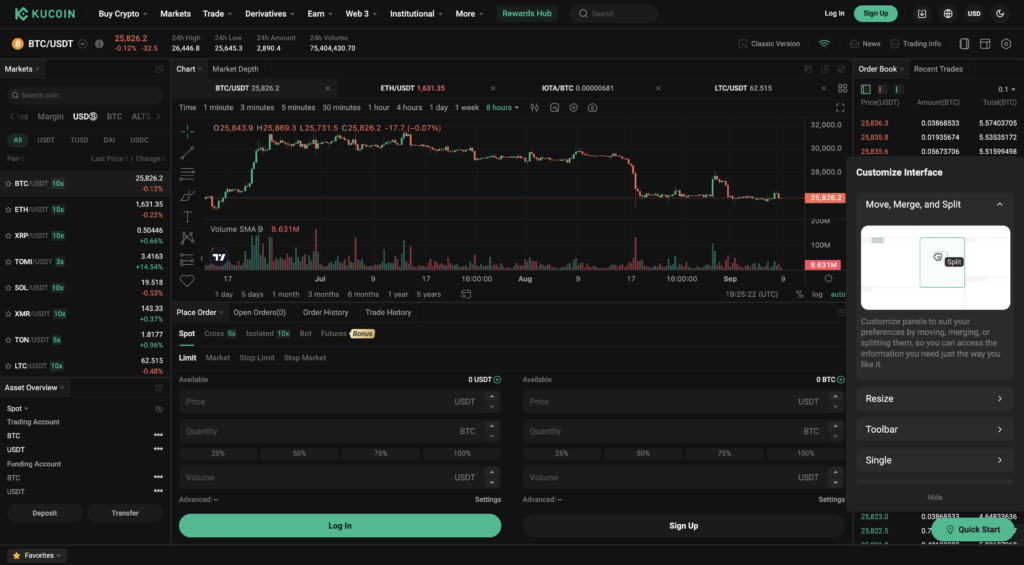

As mentioned above, KuCoin offers competitive spot trading fees. Spot trading fees are charged for both market makers and takers, with a base fee of 0.1% for each. The trading fee depends on your trading volume and fee level. To find your current fee, visit KuCoin’s official website and log in. Once logged in, click the “Fee” button or visit the trading fee page.

The higher your trading fee level is, the lower your trading fee will be. KuCoin’s fee structure encourages more trading, as your fees decrease with increased trading volume.

- Base fee: 0.1% for both market makers and takers

- Dependent on trading volume and fee level

- Higher trading fee level results in lower fees

KuCoin Futures Trading Fees

In addition to spot trading, KuCoin also offers futures trading. Futures trading fees are different from spot trading fees and usually vary based on the specific contract and product you’re trading. The taker and maker fees can be found on the KuCoin Futures page.

It’s essential to be aware of the fees associated with futures trading before jumping in, as these fees can significantly impact your overall trading experience. Just like with spot trading, your futures trading fees are influenced by your trading fee level and volume.

KuCoin Deposit and Withdrawal Fees

Deposit Fees

KuCoin deposit fees are generally free. This means you won’t incur any additional costs when transferring your cryptocurrencies to your KuCoin account. The exchange accepts a wide range of cryptocurrencies, making it convenient and easy for traders to get started.

Withdrawal Fees

KuCoin withdrawals however, do come with some fees. These fees are commonly referred to as “transaction fees” or “network fees.” It is important to note that these fees may vary depending on the cryptocurrency chosen for withdrawal, as each coin has its specific network conditions and fees associated with it.

Fee Discounts and Incentives

In this section, we will explore the various discounts and incentives offered by KuCoin, which can help you reduce your trading fees.

KCS Tokens and Fees

KuCoin offers its native token, KCS (KuCoin Shares), which provides utility within the platform. By holding KCS tokens in your account, you can enable the ‘KCS Pay Fees’ function to receive a significant discount on your KuCoin trading fees. When you use KCS to pay for your fees, you are granted a 20% discount on the standard trading fee.

Additionally, holding KCS tokens in your account can also help you meet the minimum KCS holding requirement for various VIP levels. Higher VIP levels further lower your trading fee rates.

How to Lower Your KuCoin Fees with the VIP and Market Maker Programs

KuCoin’s VIP program is designed to reward users for their trading volume and KCS holdings. As a VIP member, you can benefit from lower trading fees than regular users, and the more you trade, the more you save. The program has multiple levels, each with a specific trading volume or KCS holding requirement. You qualify for a higher VIP level by meeting the higher requirements for either trading volume or KCS holdings.

Additionally, KuCoin offers a Market Maker program for professional traders and institutions. A market maker places orders on the order book, adding liquidity to the market, while a market taker removes liquidity by executing trades against existing orders. By participating in the Market Maker program, you can significantly reduce your KuCoin fees as both a market maker and a market taker.

By holding KCS tokens and taking advantage of the VIP and Market Maker programs, you can greatly reduce your KuCoin trading fees. Make sure to keep track of your trading volume, KCS holdings, and current VIP level to maximize your savings.

Special Order Types and Their Fees

Margin Trading Fees

When margin trading on KuCoin, traders encounter a different set of fees compared to spot trading. Margin trading allows you to borrow funds, thus amplifying your trading position. However, this also means that you’ll need to pay interest on the borrowed funds. The exact interest rate for each cryptocurrency varies; it is essential to be aware of these rates to make informed trading decisions.

Limit and Market Orders Fees

Two of the most common order types you’ll use on KuCoin are limit orders and market orders. A limit order is an order placed to buy or sell a specified quantity of assets at a specified limit price or better. On the other hand, a market order is executed immediately at the best available price in the market.

Both limit orders and market orders have a base trading fee of 0.1% for both market makers and takers for spot trading. This means, regardless of which order type you choose, you’ll be paying the same trading fees on KuCoin.

Iceberg Order Fees

Another order type available on KuCoin is the iceberg order. An iceberg order is used to mask the total size of a large order, dividing it into smaller visible portions. This can help to avoid substantial impact on the market price due to the large order size.

For iceberg orders, KuCoin fees are not explicitly mentioned on the website. However, it is safe to assume that they might follow a similar fee structure as the limit and market orders unless explicitly stated otherwise.

KuCoin Fees vs Other Cryptocurrency Exchanges

Among the various crypto exchanges available, KuCoin stands out with its competitive fee structure and range of supported cryptocurrencies. Let’s compare the KuCoin fees with other popular exchanges like Coinbase and Binance.com.

KuCoin Fees

- Trading fees: KuCoin charges a base fee of 0.1% for both market makers and takers for spot trading, which is among the lowest in the market. As your trading level increases, fees can decrease further. For instance, at level 5, trading fees can be as low as 0% for makers and 0.07% for takers.

- Deposit and withdrawal fees: KuCoin supports multiple deposit methods, including cryptocurrencies and fiat. Most cryptocurrencies have no deposit fees, and the platform strives to keep withdrawal fees low. Withdrawal fees depend on the specific cryptocurrency being withdrawn.

Coinbase Fees

- Trading fees: Coinbase is known for its relatively high trading fees, which vary depending on the method of purchase and the user’s location. Typical fees can range from 1.49% to 3.99%. Moreover, Coinbase Pro, targeted at more experienced traders, has a maker-taker fee structure with fees ranging from 0.04% to 0.50%.

- Deposit and withdrawal fees: Coinbase charges fees for both deposit and withdrawal of funds, depending on the method used. Most deposits made through wire transfers or ACH incur fees, while cryptocurrency deposits are free. Withdrawals also have varying fees, depending on the chosen method.

Binance.com Fees

- Trading fees: Binance.com offers a flat trading fee of 0.1% for both makers and takers. However, users can receive a discount on trading fees by holding Binance Coin (BNB). The discount starts at 25% in the first year and decreases over time. Additionally, Binance offers a VIP program with lower fees and other benefits for high-volume traders. The VIP levels range from 0 to 9 and are determined based on the user’s trading volume and BNB holdings.

- Deposit and withdrawal fees: Binance.com does not charge deposit fees for cryptocurrency deposits. However, fees for fiat deposits vary depending on the payment method. Withdrawal fees also vary depending on the cryptocurrency being withdrawn and the network used. Binance provides a fee schedule for various cryptocurrencies on its website. Additionally, users can receive a discount on withdrawal fees by holding Binance Coin (BNB).

When compared to Coinbase, it’s clear that KuCoin fees are significantly lower. This makes it an attractive option for traders seeking to minimize costs. Additionally, KuCoin’s support for a wide range of cryptocurrencies can provide more opportunities to diversify your portfolio.

Compared to Binance.com, KuCoin’s fees are quite similar. They both start at .1% and offer lower fees depending on VIP levels and native coin holdings. There are slight differences between the two, but most traders should consider other aspects of each exchange to be more important than negligible fee differences.

Keep in mind, however, that each platform offers its unique set of features and benefits. While cost efficiency might be your primary concern, you should also consider factors like user experience, security, and customer support when selecting a crypto exchange. By comparing multiple exchanges and understanding your own priorities, you can make an informed decision that best meets your needs.

Frequently Asked Questions

What are the deposit fees on KuCoin?

There are no deposit fees on KuCoin. You can deposit cryptocurrencies into your KuCoin account for free. However, when depositing a fiat currency, you might incur a fee from your bank or payment provider. Check with your bank or payment provider for any fees they may charge.

How much does it cost to transfer funds on KuCoin?

The base KuCoin trading fee is 0.1% for both market makers and takers for spot trading. The fee for transferring funds within the platform depends on the type of trading you’re doing, such as spot, margin, or futures trading.

What are the fees for withdrawing fiat currencies?

KuCoin does not directly support fiat currency withdrawals; you must convert your fiat to a cryptocurrency before withdrawing. KuCoin withdrawal fees vary depending on the cryptocurrency you choose to withdraw. For example, the BTC withdrawal fee is 0.0004 BTC.

How can I reduce my transaction fees on KuCoin?

One way to reduce your KuCoin transaction fees is by holding their native token, KCS (KuCoin Shares). You can also upgrade your trading level by verifying your account and increasing your trading volume, which reduces your KuCoin trading fees.

What is the BTC withdrawal fee on KuCoin?

The BTC withdrawal fee on KuCoin is 0.0004 BTC. This fee is deducted directly from your withdrawal amount when you process your transaction.