OKX futures trading is an increasingly popular market for cryptocurrency enthusiasts. As a global crypto exchange, OKX offers traders opportunities to participate in futures contracts with top cryptocurrencies such as Bitcoin, Ethereum, Polkadot, Solana, and Chainlink.

These contracts allow investors to speculate on the price movements of various digital assets. Through OKX, traders can access deep liquidity, enabling efficient futures trading and increasing potential profits.

Key Takeaways

- OKX offers futures trading with top cryptocurrencies, attracting a global audience.

- The platform provides deep liquidity and expanded features to improve trading experiences.

- Risk management, advanced strategies, and market analysis are crucial to successful futures trading.

Getting Started with OKX Futures

Registering an Account

To begin trading futures on OKX, you need to create an account. Visit the OKX website and sign up by providing a valid email.

Funding Your Account

Once your account is created, proceed to Deposit and Withdraw under the Assets tab. Then, select a suitable cryptocurrency to transfer into your newly created OKX account.

Verification Process

After funding your account, go through the verification process by visiting the Account Security section. Complete the Identity Verification steps to gain access to all features of OKX Futures Trading.

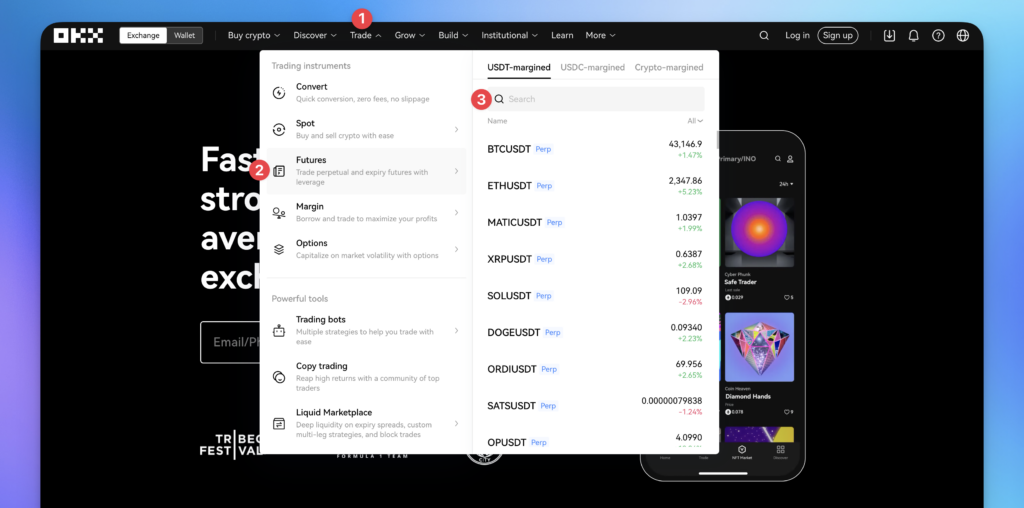

Futures Trading on OKX

Types of Futures Contracts

Futures trading on OKX offers various contract options to suit your needs. You can trade crypto futures, benefit from the ever-growing market, and access trillions of dollars in volume and liquidity worldwide.

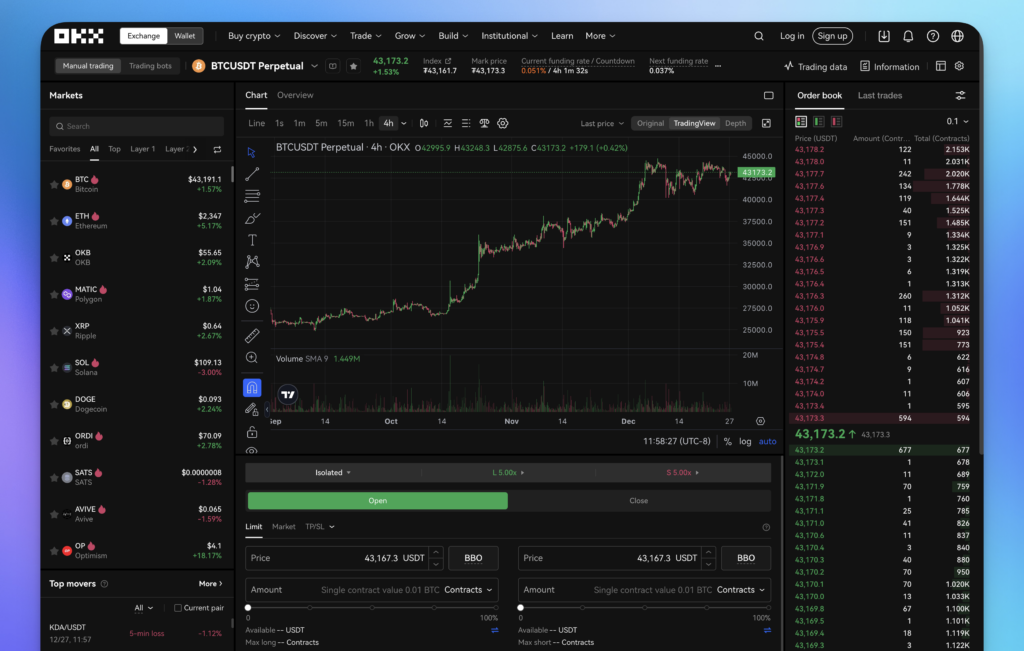

The Trading Interface

OKX has an intuitive trading interface to manage your futures contracts. The platform provides essential features like market prices, open interest, and order types, making it user-friendly and efficient for trading.

Order Types

OKX supports multiple order types for your convenience:

- Limit orders: Set a specific price you want to buy or sell.

- Market orders: Execute your trade instantly at the best available market price.

- Stop orders: Protect your positions with automatic triggers at a predetermined price level.

You can benefit from greater flexibility and control over your futures trading on OKX using these different order types.

Risk Management

Leverage and Margin

When trading on OKX Futures, you have the option to utilise leverage. Leverage increases your buying power, allowing you to control a larger position with a smaller initial investment.

However, higher leverage comes with greater risk. If your trade moves against you, it may lead to losses multiplied by your chosen leverage level.

Maintaining adequate margins in your account is essential to prevent automatic liquidation. OKX offers different margin modes, like cross-margin and fixed-margin, to help you manage risk effectively.

Stop Loss Strategies

To protect your investment, consider using stop-loss orders. This order type automatically closes your position when the market hits a predefined price level, limiting potential losses.

Example:

- You open a long position at £10,000 with x10 leverage.

- You set a stop loss at £9,500.

- If the market falls to £9,500, your position will be closed, protecting you from further loss.

Remember to adjust your stop loss level as the market moves in your favour to secure your profits.

Risk Assessment Tools

OKX provides risk assessment tools to help you evaluate potential risks and mitigate them accordingly.

- Mark Price: A reference price used to calculate unrealised profit or loss, liquidation, and stop loss triggers. It helps to avoid forced liquidations caused by sudden market fluctuations.

- Risk Level: OKX calculates your account’s risk level by considering your total margin balance, unrealised profit or loss, and open positions. Monitoring this level is crucial to avoid exceeding your risk tolerance.

Stay informed about your trades and market conditions, and adjust your risk management strategies accordingly to protect your investments on OKX Futures.

Advanced Trading Strategies

Hedging with Futures

You can use futures to hedge your positions in the volatile cryptocurrency market. You can protect your investments against potential price drops by opening a short contract.

Meanwhile, opening a long contract allows you to manage risks regarding price increases. Properly executed hedges can mitigate losses during market downturns and maximise profits during uptrends.

Spread Trading

Spread trading involves taking simultaneous long and short positions on closely correlated assets. You can profit from their relative performance by taking advantage of the price difference between the two assets.

For instance, you might go long on BTC/USD and short on ETH/USD. This strategy capitalises on the price differences between Bitcoin and Ethereum while minimising overall market risk.

Algorithmic Trading

Algorithmic trading utilises computer algorithms to automate trading decisions based on predefined parameters. This approach offers multiple benefits, including increased speed, reduced human error, and the ability to execute complex strategies.

Popular algorithmic trading tools on OKX include futures grid trading bots and Futures DCA (Martingale) bots. These can buy and sell contracts automatically, helping you optimise your trading strategies and generate consistent returns.

Remember to choose the right risk profile (conservative, moderate, or aggressive) and test your algorithms thoroughly before deploying them in live markets.

Futures Market Analysis

Technical Analysis

To succeed with OKX futures trading, familiarise yourself with technical analysis. By examining historical price charts and various indicators, you can identify patterns that may predict future price movements.

Some popular technical analysis tools include moving averages, RSI, and Fibonacci retracements. Utilise them in combination to develop a solid trading strategy.

Fundamental Analysis

Fundamental analysis goes beyond price charts and focuses on the underlying factors that can affect the value of cryptocurrencies. Examine the technology team and use cases behind the projects you are trading.

Stay informed about industry news and updates and any upcoming events or developments related to the projects. This can help you decide whether to go long or short on the futures contracts.

Sentiment Analysis

Sentiment analysis involves assessing the overall market sentiment towards a particular asset. By monitoring social media, news articles, and community forums, you can identify trends and shifts in sentiment that influence the market.

Tools like Google Trends, Reddit, and Twitter can be useful in gauging public opinion and detecting market sentiment changes. Maintain a balanced perspective and use sentiment analysis alongside technical and fundamental analysis to make more informed trading decisions.