OKX Options Trading allows you to trade European options on Bitcoin and Ethereum. Crypto options are contracts that help you manage volatility and market behaviour. With OKX, you can enjoy potential profits while mitigating risks; however, losses are an inherent aspect of trading.

To begin with OKX, set up an account and familiarise yourself with the various contract specifications. Options can be classified into in-the-money (ITM), at-the-money (ATM), and out-of-the-money (OTM), determined by the difference between the strike price and the price of the underlying asset.

When engaging in options trading, it’s essential to understand the option premium; this is the price at which an option is bought or sold.

Combining expert knowledge and careful market analysis allows you to maximise your trading experience using OKX options. Ultimately, your success in crypto options depends on your strategy, market trend awareness, and risk tolerance.

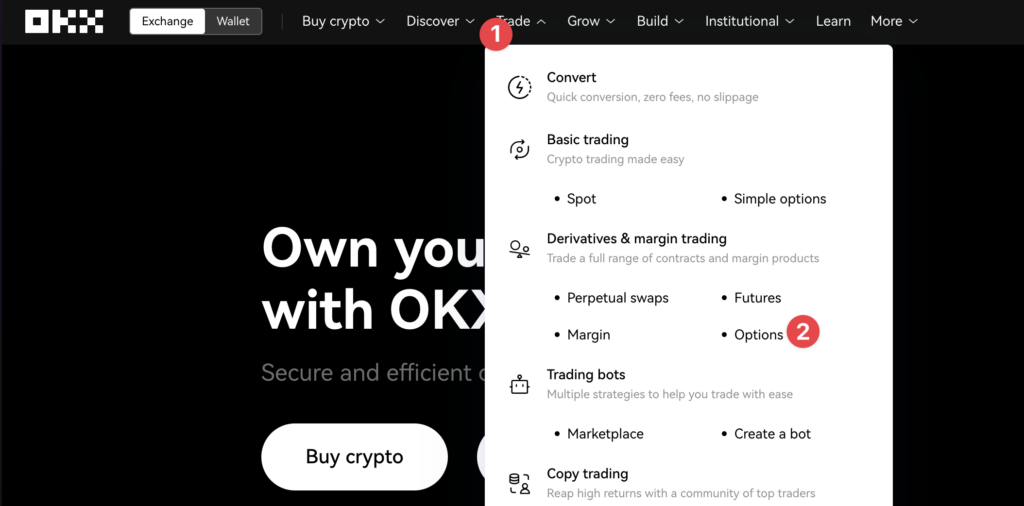

Trading Options on OKX

Options Market Analysis

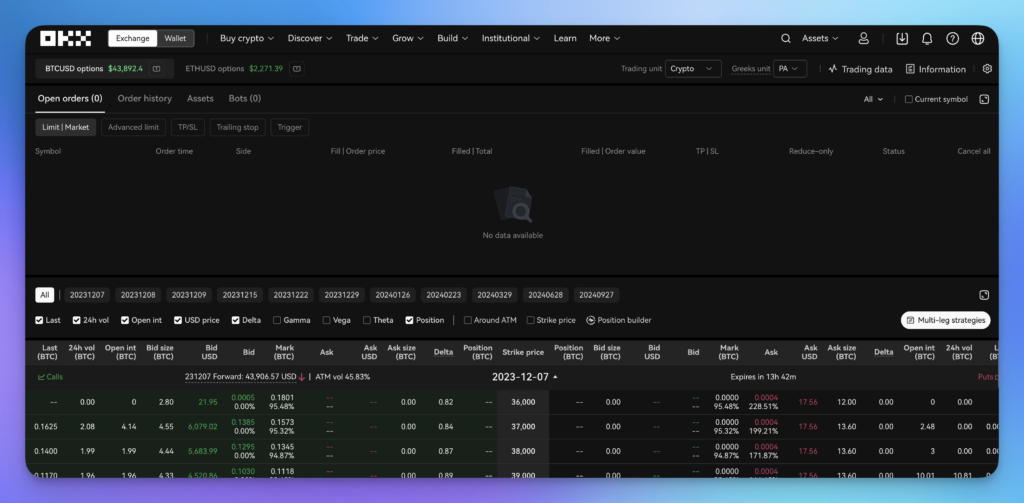

When trading options on OKX, it’s essential to analyse the market. Consider factors like volatility, liquidity, and underlying asset trends.

Placing Options Orders

Select the appropriate option type and specify the contract size to place an options order. Remember, the price is determined by the bid-ask spread and the order’s margin requirements.

Risk Management Techniques

In options trading, understanding the dynamics of crypto is crucial. To minimise losses:

- Start by setting realistic goals.

- Employ stop-loss orders to sell options automatically once a specific price is reached.

- Diversify your portfolio to spread risk across various assets.

Utilise proper position sizing based on individual risk tolerance. Implement hedging strategies to provide a safety net against unfavourable market movements. Regularly monitor your positions and adjust as necessary.

Profit Optimisation

Seek liquidity in trading to ensure smooth transactions and mitigate slippage. Margin trading and portfolio margin can enhance buying power. Focus on high-probability trades by identifying potential market trends—Utilise tactical strategies, such as delta hedging and solid risk management techniques.

Apply technical and fundamental analysis to make informed trading decisions. Be patient and disciplined, sticking to your trading plan. Combining these methods allows you to maximise your profits while controlling your risks in options trading.

Advanced OKX Options Features

Portfolio Margin

With OKX Options Trading, you gain access to a Portfolio Margin system. This feature allows you to enjoy reduced margin requirements and lower risk levels for your trades.

Efficiently leveraging portfolio margin can increase your profits on crypto options trading while managing your risks and strategising for optimal results.

Options Analytics

OKX’s Options Analytics provides insightful tools specifically designed for options traders. These tools enable you to predict market trends and maximise your profits.

With unique analytics and technical indicators, you can easily make informed decisions and achieve impressive results on your options contract trading journey.

Enhancing Trading With OKX APIs

API Functionality

OKX APIs enable traders to access a variety of functionalities. They help enhance your crypto trading experience on the platform. With these APIs, you can retrieve extensive data about the marketplace, including trade data, exchange rates, and market depths.

Through their robust APIs, OKX allows you to perform many trading actions. Some examples include automated trading, account management, and withdrawals. For a detailed understanding of the functions available, consider visiting our guide about OKX APIs.

Automation With APIs

By harnessing the power of OKX APIs, you can automate various aspects of your crypto trading, increasing efficiency and reducing human error. For instance, you can create customisable trading bots that execute trades based on specific conditions.

APIs offer the potential for advanced traders and those with a background in programming. Developing a trading bot or algorithm tailored to your needs can take your trading to the next level, allowing you to focus on strategy and analysis. Plus, you can stay connected to the market 24/7 and make the most of the volatile crypto marketplace.

Frequently Asked Questions

What is the contract multiplier specification for options on OKX?

The contract multiplier for options trading on OKX varies depending on the specific option. Please refer to the OKX Options Trading page for detailed information on contract specifications.

How does one participate in the OKX market maker programme?

To participate in the OKX market maker programme, you must apply and meet the required criteria. Visit the OKX Trading Guide or contact their support team for more details on eligibility and application processes.

Can traders access zero trading fees for options on OKX, and if so, how?

Yes, accessing zero trading fees for options on OKX is possible through their tiered fee structure. Users with higher trading volumes receive better fee discounts, potentially reaching zero fees. Consult the OKX fee schedule for more information.

What arbitrage opportunities are available on OKX, and how are they utilised?

Arbitrage opportunities on OKX may arise from price discrepancies between trading pairs or market inefficiencies. To utilise these opportunities, traders often buy low in one market and sell high in another to profit from the price difference.