Spot trading on OKX is a popular and straightforward way to buy and sell cryptocurrency. As a leading crypto exchange, OKX offers a user-friendly platform that makes trading a breeze, even for beginners.

Understanding how to navigate the OKX crypto exchange and execute trades effectively is crucial for a successful trading experience. With a range of trading tools and features, including P2P trading, debit and credit cards, and support for multiple payment methods, OKX has everything you need to get started.

One of the critical aspects of trading on OKX is the emphasis on security and protection. With various safety measures, OKX ensures that your funds and transactions are secure as you engage in spot trading.

Key Takeaways

- OKX provides an accessible platform for engaging in spot trading of cryptocurrencies.

- Users can use various trading tools, payment methods, and advanced features.

- Security measures make spot trading on OKX a safe and protected experience.

Understanding Spot Trading on OKX

What is Spot Trading?

Spot trading is a common form of trading in the cryptocurrency market that involves buying or selling digital assets. In contrast to other types of trading, you trade assets immediately at the current market price.

Advantages of Spot Trading

One key advantage of spot trading is its simplicity. As a beginner, you’ll find it easier to understand and execute trades. Moreover, spot trading is less risky than other forms of trading, as positions are held over an extended period and aren’t leveraged.

Differences Between Spot and Derivatives Trading

Spot trading focuses on immediate transactions, while derivatives trading on OKX involves taking positions that depend on the future value of an asset. In derivatives trading, you’ll encounter financial instruments like futures and options, which can result in higher gains or losses due to leverage. Conversely, spot trading involves directly exchanging digital assets, making it a more straightforward option for crypto enthusiasts.

Executing Trades on OKX

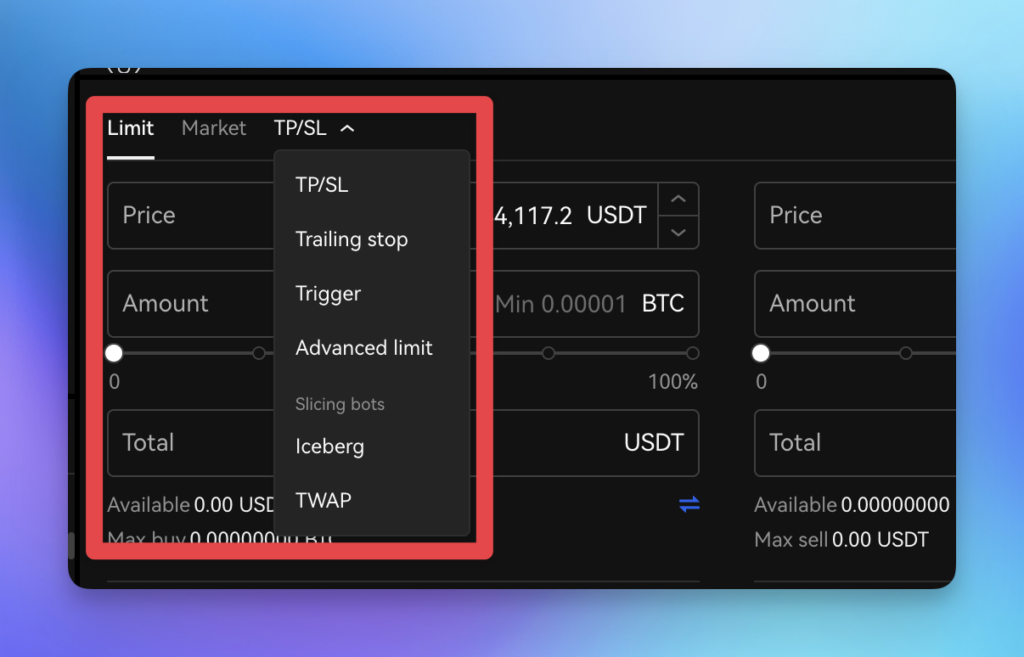

Types of Orders

When you trade on OKX, you have various order types. Limit orders and market orders are the most common. By using limit orders, you define the price at which you’re willing to buy or sell a cryptocurrency. On the other hand, market orders execute trades instantly at the current market price.

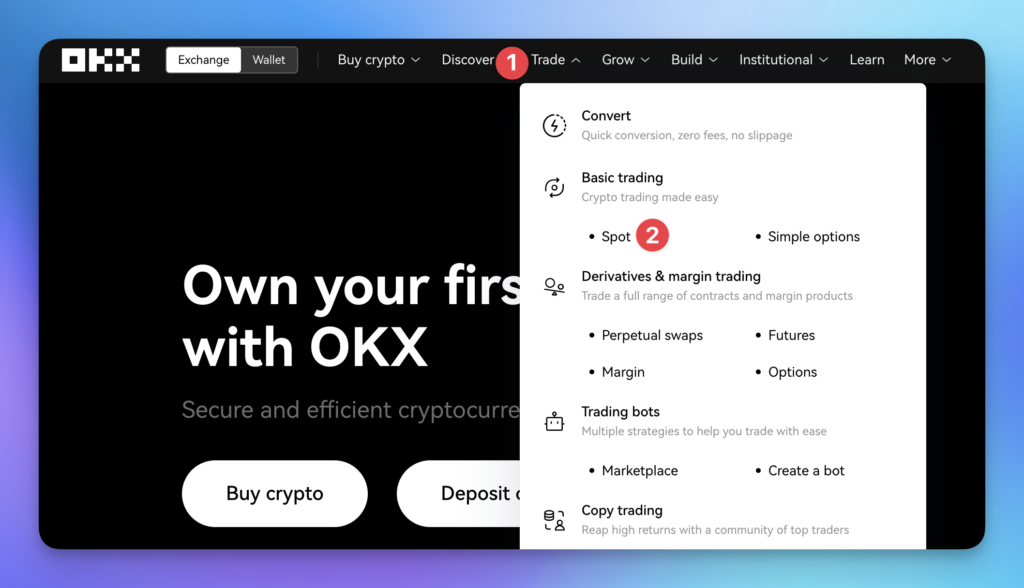

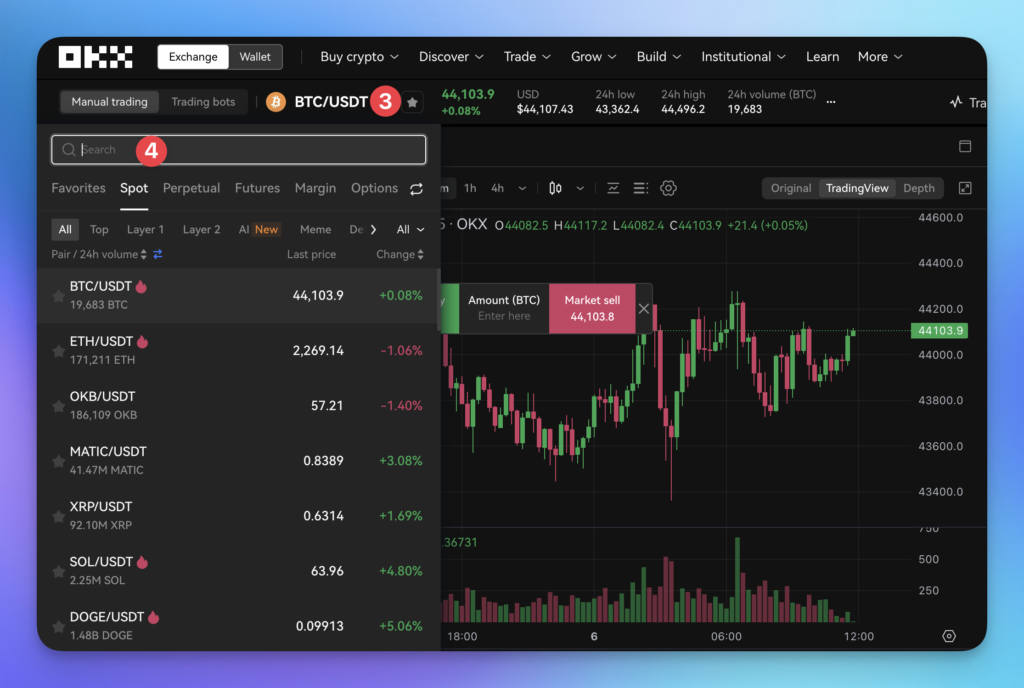

Using the Trading Interface

To access OKX’s spot trading interface, click on the ‘Trade’ tab at the top of the platform. You can select your desired trading pair, such as BTC/USDT. When placing an order, remember to input your desired cryptocurrency amount and the limit price if it’s a limit order. The OKX Crypto Converter can help you with price conversions if needed.

Trade Execution Tips

Before executing your first trade, take a moment to analyse market trends and familiarise yourself with the trading interface. Feel free to use available tools and resources, like charts and order books, to make informed decisions. Lastly, stay updated with cryptocurrency news and monitor the movement of trading pairs you’re invested in.

OKX Trading Tools and Features

TradingView Integration

OKX integrates with TradingView, a popular charting and analysis platform. This allows you to access advanced charting tools and customise your trading experience. The integration lets you analyse the market efficiently and make informed decisions using real-time data.

Trading Bots

OKX offers powerful trading bots to automate your trading strategies. These bots have seven different strategy modes to cater to various trading goals. Trading bots can help manage your trades when you’re not around and potentially enhance your profit margins.

Advanced Order Types

OKX provides various advanced order types to suit your trading needs. Some of these include:

- Limit orders: You set a predefined price at which you’d like to buy or sell a specific asset. Your order will only ex when the market reaches your set price.

- Market orders: The trade is executed immediately at the best available market price.

- Stop orders: Used to minimise loss or protect profits. Your order executes when the market price reaches a pre-determined level.

These advanced order types, combined with TradingView integration and trading bots, enhance your trading experience and flexibility on the OKX platform. Remember to explore other features like their trading bot marketplace and APIs to personalise your trading strategies further.

Security and Protection

Securing Your Account

When it comes to spot trading, safeguarding your digital assets is crucial. It’s essential to secure your account on OKX to protect your funds. Start by enabling two-factor authentication (2FA) to add an extra layer of protection. Additionally, utilise strong, unique passwords and routinely change them.

Understanding OKX’s Security Measures

OKX takes security seriously by implementing robust measures to shield your assets. They store users’ digital assets in a multi-signature cold wallet system to prevent unauthorised access. Furthermore, OKX adopts real-time monitoring, which promptly detects and addresses suspicious activities.

By understanding how OKX’s security measures work, you can have peace of mind knowing that your investments are safeguarded. Remember, combining these features with your diligence in securing your account will ensure safe spot trading experiences on OKX.

Managing Finances and Risks

Utilising Portfolio Management

Managing your finances on OKX Spot Trading involves a combination of practical strategies and tools. One strategy is diversifying your cryptocurrency portfolio across various digital assets and market sectors. Doing this effectively reduces the risk associated with concentrated positions in a single asset.

The OKX trading platform is a helpful tool which offers primary cryptocurrencies and multiple trading pairs at low fees. The fee structure ranges from -0.010% to 0.1%, providing a cost-effective solution for diversification.

Risks associated with Spot Trading

While Spot Trading in cryptocurrencies brings potential opportunities, it also comes with risks. Market fluctuations are part of the experience, and preparation for them is essential. Avoid borrowing excessively for Margin Trading since it can increase potential gains and losses.

Another factor to be mindful of is the financial condition of the cryptocurrencies you trade. A sound understanding of the underlying technology and the team behind the asset helps make informed decisions about trading these digital assets.

Liquidity and Slippage

Liquidity plays a crucial role in OKX Spot Trading. A liquid market has enough participants to facilitate smooth transactions without causing substantial price impact. However, illiquid markets can lead to slippage, which is the difference between the expected price of a trade and the actual price at which it’s executed.

To minimise the effects of slippage, consider using limit orders that allow you to set a specific price for your trades. These can be particularly helpful when dealing with less liquid markets or placing large orders. Remember to remain cautious and stay informed about market conditions to effectively manage your finances and risks while trading on the OKX platform.

Trading Fees Structure

OKX offers competitive trading fees in the industry, charging 0.08% for makers and 0.10% for takers in spot trading. The platform uses a tiered fee structure that depends on the number of OKB tokens you hold. Holding more OKB allows you to advance to higher tiers and benefit from reduced trading fees. Visit the OKX trading fee structure breakdown for more details.

Withdrawing and Deposit Fees

While the fees for spot trading are comparatively low, there may be deposit and withdrawal charges depending on the cryptocurrency involved. Each crypto asset has its own fee structure, so you must check the specific cost for your chosen coin.

How to Reduce Trading Costs

Reducing trading costs on OKX is achievable by holding OKB tokens. As you accumulate more tokens, you’ll move up in tiers, lowering trading fees. This way, you can enjoy cost-efficient spot trading on the platform.

Building a Trading Strategy

Market Analysis

Before diving into OKX spot trading, it’s essential to analyse the market. Start by studying chart patterns, trends, and trading volume.

Creating a Trading Plan

A solid trading plan is crucial for success in the crypto market. Consider entry and exit points, risk management, and trading pairs.

Leveraging Historical Data

Utilise historical data to help develop your strategy. This data can provide valuable insights into the past performance of various trading pairs.

- Risk: Be aware of potential risks and monitor the market volatility.

- Trading Bots: Automate your strategy with trading bots, available on OKX.

- Data: Use data-driven strategies to make informed decisions.

- Learn More: Improve your knowledge by studying trading resources.

- Trading Pairs: Research different trading pairs to identify opportunities in the market.

Staying Updated with Market Trends

In addition to improving your trading skills, it’s crucial to stay updated with the latest trends in the market. Keeping up with cryptocurrency news, regulatory updates, and market analysis will broaden your perspective and ensure you can make informed decisions on the OKX trading platform.

Consider exploring various sources of information, such as blogs, podcasts, and social media channels. By staying in touch with the market, you’ll strengthen your trading strategy and maximise your potential in spot trading.

Remember, knowledge is power in the dynamic field of trading. Ensure you continue to learn and stay updated to find success in the OKX platform’s various trading opportunities.

Frequently Asked Questions

How can I start spot trading on OKX?

To begin spot trading on OKX, you must create an account, complete the verification process, and deposit your preferred cryptocurrency or fiat currency.

What are the steps to perform a spot trade accurately?

First, select the trading pair you’d like to trade, such as ETH/BTC. Then, choose the appropriate order type (market, limit, or advanced) and specify the quantity and price. Finally, submit your order and monitor the progress.

Can I trade Ethereum and Bitcoin on OKX without incurring trading fees?

Yes. OKX charges trading fees ranging from -0.01% to 0.1% for spot trading. You can reduce fees by holding the platform’s native token, OKB, participating in various promotional events, and even getting paid a rebate to trade if you reach whale status.

What risks are associated with spot trading, and how can I safely trade?

Spot trading involves market volatility, price fluctuations, and other risks. To trade safely, you should properly understand the asset, use stop-loss orders, and practice risk management techniques such as position sizing and diversification.

How do I convert Bitcoin to USDT on the OKX platform?

To convert Bitcoin to USDT on OKX, go to the trading interface, select the BTC/USDT trading pair, and submit a “sell” order for your BTC at the current USDT price.

Does OKX provide live pricing information for BTC/USDT transactions?

Yes, OKX offers real-time pricing information for all its trading pairs, including BTC/USDT. You can find this information on their platform’s trading interface or via their API.