OKX offers a variety of crypto trading bots designed to help you automate your trading strategies and maximize potential returns. These intelligent, pre-built trading bots allow you to trade effectively even when you’re not actively monitoring the market.

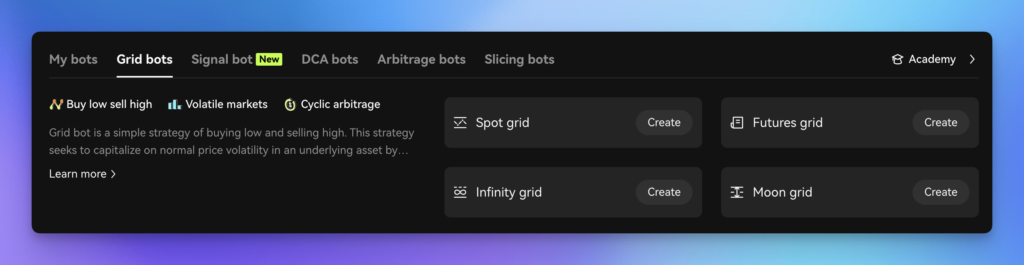

Each OKX trading bot offers its own unique functionality tailored to suit various trading scenarios. For instance, Grid bots can assist in volatility trading, while Arbitrage bots help exploit price discrepancies between markets.

To use these bots on the OKX platform, simply set the desired parameters, such as entry and exit prices, order sizes, and the bot’s specific algorithm settings. This will enable the trading bot to automatically execute trades on your behalf, freeing up time while potentially increasing your returns through efficient market operations.

Types of OKX Trading Bots

Spot Grid Bot

The Spot Grid Bot on OKX helps you automate your trading in the spot market. It’s designed to buy low and sell high within a predefined price range. This grid bot applies a pre-set number of sell and buy limit orders distributed evenly between the upper and lower price limits. As you set your parameters, it can effectively manage your investments in a fluctuating market.

Futures Grid Bot

The Futures Grid Bot is similar to the Spot Grid Bot but operates in the futures market. It allows for both long and short positions, and you can leverage your trades to maximize your potential gains. This bot establishes multiple buy and sell orders within a specified price range, helping you take advantage of market volatility.

DCA Bot

Using the Dollar Cost Averaging (DCA) strategy, the DCA Bot systematically invests your funds at predetermined intervals. It enables you to spread purchases over time, mitigating the effects of market fluctuations and reducing the impact of poorly timed purchases. The DCA Bot on OKX can be applied to both spot and futures markets, with the Spot DCA (Martingale) Bot and the Futures DCA (Martingale) Bot.

Smart Portfolio Bot

The Smart Portfolio Bot provides a simple way to diversify your investments based on your trading goals. By allocating your funds to different crypto assets, you can reduce risk while still participating in the market’s potential gains. You can easily configure and adjust your preferred investment ratios and let the bot manage your portfolio efficiently.

AI Strategy Bot

OKX’s AI Strategy Bot utilizes advanced artificial intelligence algorithms to identify the most optimal trading strategies for your chosen cryptocurrency pair. By continuously analyzing market data, trends, and other factors, the AI Strategy Bot helps to maximize your potential returns while minimizing risk.

Recurring Buy Bot

The Recurring Buy Bot is an automated bot designed to make periodic purchases of a specific cryptocurrency, allowing you to invest in a gradual manner. You can set the frequency, amount, and duration of your purchases, helping you implement a disciplined investment strategy while potentially taking advantage of price fluctuations.

Creating a Trading Bot on OKX

To create a trading bot on OKX, first, log in to your account and access the trading bot feature. OKX offers various trading strategies for their bots, such as Spot Grid, Futures Grid, Spot DCA (Martingale), Futures DCA (Martingale), Infinity Grid, Moon Grid, Recurring Buy, Smart Portfolio, and Peak Sniper.

Choose a trading strategy that suits your needs, and then select a trading pair to apply the strategy. Trading pairs on OKX include popular cryptocurrencies like BTC/USDT, ETH/USDT, and many others. Once you’ve chosen a strategy and trading pair, simply follow the platform’s guidelines to set up the bot’s configuration, such as entry, exit points, and investment amount.

Remember to keep an eye on your bot’s performance, adjusting settings as needed to optimize your returns.

Key Features of OKX Trading Bots

OKX trading bots offer a variety of features to help you automate your crypto trading strategies. In this section, we will discuss key features, including backtesting, profit sharing, and customization options.

Backtesting

With the backtesting feature, you can test your trading strategy on historical market data before applying it to live trading. This helps you evaluate the performance of your strategy and make adjustments, if necessary, to improve its success rate.

Profit Sharing

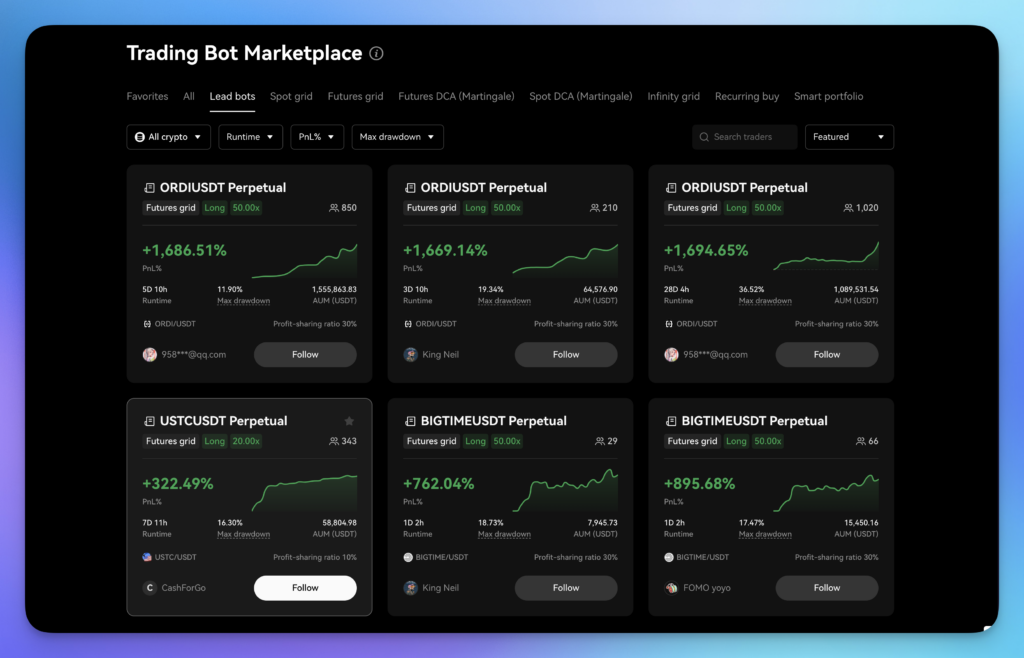

Profit sharing is another unique feature of OKX trading bots. Some bots in the marketplace allow creators to share a percentage of their profits with users who copy their bot’s settings. This encourages a community-driven approach to creating successful trading strategies and promotes the exchange of ideas between traders.

Customization Options

OKX trading bots offer various customization options, enabling you to tailor your automated trading strategy to suit your needs:

- Grid bots allow you to buy low and sell high with predefined parameters.

- Signal bot enables you to trade based on signals from specific providers or the marketplace.

- DCA bots help you dollar-cost average your investments over time.

- Arbitrage bots enable you to take advantage of price differences between exchanges.

- Slicing bots automate position entry and exit strategies based on predefined ranges.

Managing Risks with OKX Bots

Stop Loss

OKX trading bots allow you to integrate stop loss orders into your trading strategy, helping to protect your investments from potential losses. With stop loss orders in place, you can minimize the high degree of risk associated with cryptocurrency trading. By setting thresholds, your trading position will be closed automatically if the price of the asset drops below the predetermined level.

Price Volatility Management

Cryptocurrency markets are known for their price volatility, causing asset values to fluctuate greatly and sometimes even become worthless. To manage price volatility risks, OKX bots use advanced strategies such as Dollar-Cost Averaging (DCA) and Grid Trading. These techniques enable you to spread your investments across multiple price points, reducing the impact of sudden price movements on your portfolio.

- DCA: Dollar-Cost Averaging involves investing a fixed amount into a specific asset at regular intervals, regardless of the price. This strategy averages out the cost of your investments over time, minimizing the risk of poor market timing.

- Grid Trading: Grid trading involves setting up a series of buy and sell orders within a predefined price range. As the price moves within the range, the OKX bot executes your orders, capturing profits from the market’s ups and downs.

By leveraging the advanced risk management features of OKX bots, you can confidently navigate the challenging world of cryptocurrency trading while keeping your investments secure.

Advanced Trading Bot Strategies

Arbitrage Trading

Arbitrage trading involves exploiting price discrepancies between different exchanges or markets for digital assets. By leveraging OKX trading bots, you can automate your arbitrage strategies, benefitting from market inefficiencies. The bots can be set up to monitor price differences across various platforms and execute trades when opportunities arise. It’s essential to consider transaction fees, latency, and liquidity when employing this trading strategy.

Leverage Trading

Leverage trading enables you to amplify your potential profit by borrowing funds to increase your investment exposure. OKX trading bots can help you manage leverage positions in both spot and futures markets. With OKX, you can trade various digital assets, including stablecoins and derivative products like contracts and options.

To illustrate, you can utilize your trading bot to automate in the following manner:

- Spot trading: The bots can be configured to strategically enter and exit positions in the underlying asset, such as Bitcoin or Ethereum, maximizing your profits while minimizing risk.

- Futures trading: Your trading bot can help you open and close futures contracts based on pre-determined criteria. These contracts allow you to speculate on the future price of an asset without owning it directly.

- Options trading: OKX trading bots can also manage options positions, a type of derivative contract that gives you the right, but not the obligation, to buy or sell an asset at a specified price before a set deadline.

By incorporating advanced trading bot strategies into your portfolio, you can optimize your investment approach while taking advantage of opportunities in the fast-paced world of digital assets.

OKX Bot Marketplace

The OKX Bot Marketplace is a platform that offers a wide range of trading bots to help you automate your crypto trading strategies. These bots include grid trading bots, dollar cost averaging bots, arbitrage bots, and slicing bots for larger accounts.

Through the marketplace, you can easily discover top-performing bots, copy their strategies, and customize them according to your preferences. By connecting your OKX account, you’re able to put your crypto trading on autopilot, potentially increasing your earnings and saving time.

The OKX Bot Marketplace has a large user base, contributing to its diverse selection of bots and strategies. This variety allows you to find a bot that fits your trading style and risk tolerance. Moreover, the ongoing growth in volume and data available in the marketplace enables continuous improvement of the available bots.

To get started with the OKX Bot Marketplace, simply create an account on the OKX platform and explore the available bots and strategies. With a vibrant community of bot creators and traders, you can always find new ideas and expert insights to help you succeed in your crypto trading journey. Don’t hesitate to make the most of this innovative tool and take your trading strategies to the next level.

Integrations and Tools for OKX Bots

TradingView Integration

OKX bots can be seamlessly integrated with the popular charting platform, TradingView. This integration enables you to apply various indicators, analytics tools, and real-time data to enhance the efficiency and accuracy of your bot. To set up the integration, you’ll need to establish a connection between your OKX bot and the TradingView charting software.

Indicators and Analytics Tools

Leveraging robust indicators and analytics tools is crucial for optimizing your bot’s performance. With OKX bots, you can utilize a wide array of indicators, such as:

- Moving Averages (MA)

- Relative Strength Index (RSI)

- Bollinger Bands

- Moving Average Convergence Divergence (MACD)

These, as well as many other analytics tools, offer valuable insights into market trends, helping you fine-tune your trading strategies for maximum efficiency and speed. The integration with TradingView ensures that you have access to reliable data, making your decision-making process more data-driven and precise.

Portfolio Management with Bots

OKX trading bots allow users an effective way to manage and grow their crypto portfolios. Among the available bots, the Smart Portfolio trading bot at OKX supports automatic portfolio rebalancing to ensure your investments are strategically distributed across various assets.

To set up a smart portfolio, you can specify the assets and amounts you want in your investment. By doing so, the bot will automatically make adjustments according to the specified rebalancing triggers. These triggers include time-based, threshold-based, and manual triggers.

In the context of the spot market, the bot helps you trade various cryptocurrencies while maintaining your desired portfolio distribution. Similarly, for perpetual swaps, the trading bots can manage your positions in various contracts to maintain a balanced exposure to different assets.

Some popular strategies provided by OKX trading bots are as follows:

- Grid trading

- Arbitrage trading

- Moon grid

Remember to choose the best strategy aligned with your investment goals and risk tolerance. By leveraging the power of OKX trading bots, you can effectively manage your crypto portfolio and make data-driven decisions to maximize potential gains.

Legal and Tax Considerations

When dealing with trading bots, such as those offered by OKX, it’s important to be aware of both legal and tax considerations. In general, the use of trading bots is perfectly legal, as they are tools designed to help investors automate their trading strategies. Most countries, including the U.S., have established legal frameworks for financial technology, and trading bots fall within these guidelines.

While trading bots like those on OKX can provide great benefits, you should also be mindful of your tax obligations. Navigating the tax implications of crypto trading bot transactions is a crucial aspect of being a responsible and compliant trader. By understanding the tax considerations and staying updated with evolving regulations, you can optimize your returns while meeting your tax obligations. Just remember, it’s always wise to consult with a professional for personalized tax and legal advice for your specific situation.

Understanding Crypto Market Dynamics

To successfully navigate the world of crypto trading, it’s crucial to understand the market dynamics. In the ever-changing cryptocurrency landscape, factors such as volume, traders, and normal price volatility play significant roles.

Volume is a key indicator of market activity, as it represents the number of cryptocurrencies being exchanged. This can impact the likelihood of price fluctuations and market opportunities. For instance, the more traders utilizing an OKX trading bot, the higher the volume and potential for strategic decision-making. This in turn affects the stability and growth of various cryptocurrencies.

These market dynamics also involve the behavior of traders, who are constantly making decisions based on risk management and trend analysis. By using AI-driven crypto trading bots like OKX, one can stay ahead by leveraging available information, such as that provided by signal bots and grid bots. These bots help eliminate emotional biases, ensuring consistent and disciplined trading.

Understanding these dynamics allows you to capitalize on market opportunities and optimize your trades across various cryptocurrencies and exchanges. The key to effectively using trading bots like OKX is to stay informed and adaptable, making data-driven decisions in the face of normal price volatility.

Customizing OKX Trading Bots

Moon Grid Configuration

Moon Grid is a powerful variation of grid trading bots on OKX that aims to profit from market fluctuations while minimizing risks. To customize a Moon Grid bot, first, select your desired crypto asset and adjust the price range, grid levels, and invested amount. This will help you optimize the bot according to your preferred trading volume and risk tolerance.

Arbitrage Order Settings

OKX offers Arbitrage Bots for users who want to take advantage of price discrepancies between different markets. To set up an Arbitrage bot, choose the crypto assets and markets to monitor for arbitrage opportunities. Also, define the order size and maximum spread to maintain control over your trades. Keep in mind that a higher trading volume can potentially return more profits, but also carries increased risks.

Iceberg Order Tactics

Iceberg orders are used to divide large orders into smaller ones, concealing the total order size. This tactic is often employed by Slicing bots on OKX. When configuring a Slicing bot, set the total order amount and determine the single order quantity. By breaking down your order into smaller parts, you can minimize the impact on the market and enhance your trading strategy.

Remember to monitor your customized bots and adjust their settings accordingly to stay aligned with your goals in the ever-changing crypto market.

Frequently Asked Questions

What features should you look for in an OKX trading bot?

When selecting an OKX trading bot, look for one that offers customizable strategies, risk management features, and ease of use. Make sure the bot supports the trading pairs and markets you’re interested in and has a proven track record of profitability.

How do OKX arbitrage bots maximize profits?

OKX arbitrage bots identify and capitalize on price discrepancies between different markets, allowing you to profit from the price differences. These bots continuously monitor multiple markets, execute trades quickly when opportunities arise, and help in managing risk by employing stop-loss and take-profit features.

What are the advantages of using grid trading on OKX?

Grid trading on OKX allows you to place multiple buy and sell orders at different price levels, capturing profits from market volatility. This strategy helps minimize risk and works well in sideways or fluctuating markets. OKX offers various grid bots like Spot Grid, Futures Grid, and Infinity Grid for different trading objectives.

Can you engage in copy trading with an OKX bot and what are its benefits?

Yes, you can engage in copy trading with OKX. Copy trading enables you to follow, learn from, and replicate the strategies of successful traders. It reduces the time and effort required to develop your own strategies and can provide diversified portfolio management options.

How does automated trading compare between OKX and other platforms like Binance and Bybit?

Automated trading on OKX offers a range of pre-built trading bots, compatible with various strategies and market conditions. Similarly, platforms like Binance and Bybit also offer trading bots, with their features and functionalities varying across platforms. It’s essential to research and compare these platforms based on factors like fees, supported trading pairs, and ease of use before making a decision.

What considerations should be made when evaluating the profitability of AI trading bots?

When assessing AI trading bots, consider factors like historical performance, adaptability to changing market conditions, and the amount of human intervention required. It’s essential to understand risk management features and test the bot’s performance in a simulated environment before deploying it in live markets. Being cautious of unrealistic or overpromised results is crucial.