The OKX API is a powerful tool that allows developers to access various trading functionalities offered by the OKX cryptocurrency exchange platform. By harnessing the power of the API, you can easily create custom applications to manage your digital asset trading and optimisation strategies.

Getting started with the OKX API is simple, as it supports REST and WebSocket API connections. This enables developers to efficiently access spot, margin, contracts, and options trading data for over 100 digital currencies.

Crafting a secure and efficient application is essential, which is why considering factors such as proper authentication, security practices, and advanced features will further enhance your development experience with the OKX API.

Key Takeaways

- The OKX API enables custom applications for digital asset trading and management

- Supports REST and WebSocket API connections for efficient data access

- Prioritise security and additional features for an optimised development experience

Getting Started with OKX API

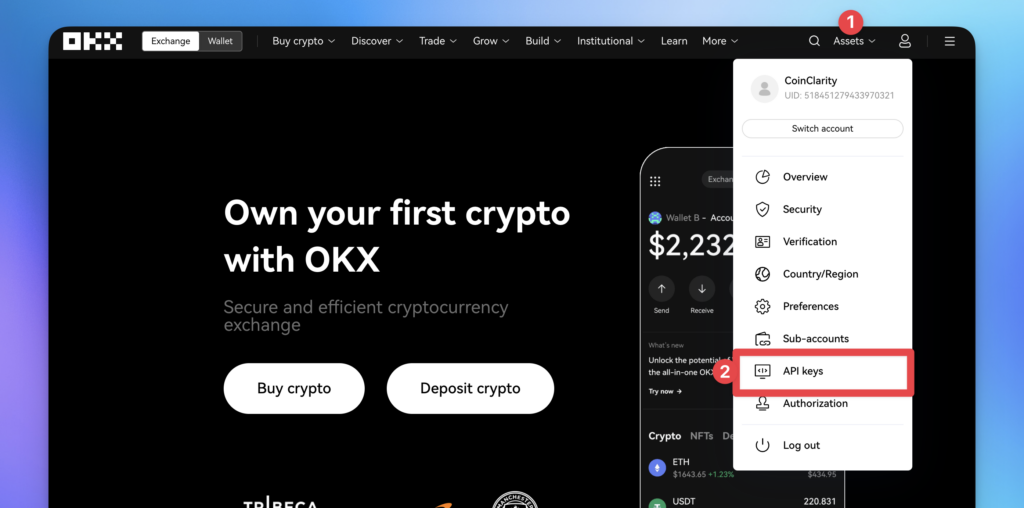

API Key Setup

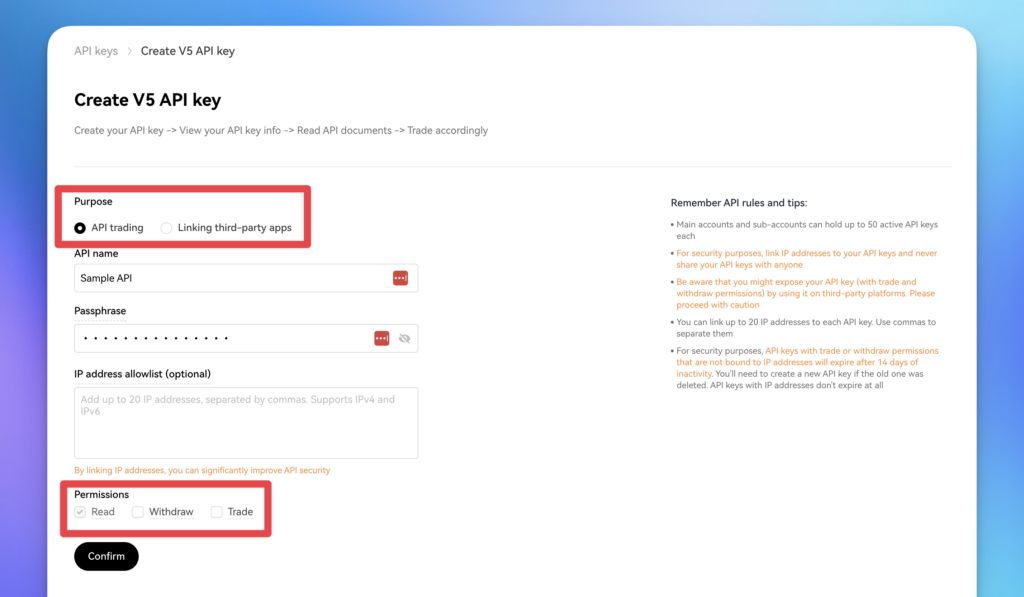

Do not give trade or withdraw permissions to apps you do not know and trust.

To use the OKX API, you must create an account on the OKX platform. Once your account is set up, you can generate your API key.

API Documentation

Familiarising yourself with the OKX API documentation is crucial to understanding the various endpoints and available features. It covers REST and WebSocket APIs, providing information on market data, trading, and account management.

Environment Setup

You can set up your development environment after obtaining your API key and understanding the API documentation. Select a programming language and appropriate libraries to interact with the OKX API. Multiple open-source client libraries are available for popular languages like Python, JavaScript, and more. Remember always to implement necessary security measures, such as SSL encryption and proper API key management, while developing your application.

API Functionality

Market Data Access

OKX API provides access to real-time market data. You can retrieve information on trading pairs, price trends, and order book depth for spot, margin, contracts, and options. This enables your trading applications and algorithms to make informed decisions.

Order Execution

The API allows you to execute orders on the OKX platform efficiently. Automate your trading strategies using various order types, block trades, and spread trades quickly. OKX Trading Bots can further assist you in refining your automation strategies and boosting your profits.

Account Management

Utilising the OKX API grants you the ability to manage your account effectively. You can create and manage API keys, view trading balances, and handle sub-account transfers. This streamlines your operations, ensuring you can focus on making strategic trades.

Development with OKX API

API Libraries

OKX provides comprehensive API documentation, making it easy for developers to start. Libraries for various programming languages, such as Python and JavaScript, are available. This allows you to choose the best language for your specific needs.

Sample Code

To further assist in your development, sample code is available for reference. The sample code repository provides examples for common scenarios and tasks, ensuring a smooth beginning for your work with the OKX API.

Error Handling

When working with the API, be prepared to handle errors and exceptions. OKX utilises HTTP status codes and error codes to communicate issues. Appropriate error handling is essential for a robust and resilient application. In case of an error, you should implement a logic to retry, halt or handle it accordingly.

Keep track of limitations such as rate limits, which are in place to protect the integrity of the service. Be mindful of these limits and plan your requests to avoid unnecessary errors.

Security Considerations

API Security Best Practices

It is crucial to prioritise security while using OKX API. To do so, bind API keys to specific IP addresses. This way, you can limit access to authorised devices.

Furthermore, configuring the main and sub-accounts appropriately is necessary to enhance security. This process should be done before trade executions.

Rate Limiting

It’s essential to implement rate limits to protect the API from abuse. Monitoring the number of requests made within a set time frame enables a smooth functioning system.

A temporary block could be imposed if you exceed the predetermined request limit. This measure ensures every user’s fair access to OKX API.

Data Encryption

Maintaining a secure communication channel is vital for protecting sensitive information. Implement data encryption in transmission to prevent unauthorised access.

When possible, use HTTPS to ensure secure communication. These security measures can significantly help safeguard your OKX API operations.

Advanced Topics

WebSocket API

OKX offers a WebSocket API that provides real-time data updates. This enables you to efficiently access market data, such as prices, order book depth, and trades. The WebSocket API lets you stay up-to-date on market movements without constantly polling REST endpoints. Check out the WebSocket API documentation for detailed information on usage and available channels.

Algorithmic Trading

Consider using algorithmic trading techniques on the OKX platform to enhance your trading strategies. These automated trading processes can help you optimise your trading outcomes. There are various algorithms to choose from: market making, arbitrage, or more sophisticated ones.

Historical Data Analysis

OKX API allows you to access historical data for backtesting your trading strategies. You can retrieve past data for different spot and derivative instruments, such as candlestick patterns, trade history, and order book depths. Analysing historical data can assist you in fine-tuning your trading algorithms and understanding patterns in the market. Be sure to familiarise yourself with the API endpoints for historical data retrieval as part of your research process.