Derivatives trading is a significant aspect of the cryptocurrency market. OKX, a popular crypto platform, offers traders a range of derivative products.

With OKX, you can trade various cryptocurrency derivatives, including futures, perpetual swaps, and options. These products enable traders to speculate on the price of assets like Bitcoin without owning the underlying asset directly.

Key Takeaways

- OKX provides a wide range of cryptocurrency derivatives for trading.

- Traders can engage in futures, perpetual swaps, and options on the platform.

- Our in-depth OKX review highlights helpful information on fees, safety, and trading methods.

Click here to visit OKX’s derivative dex platform.

Understanding OKX Derivatives

Types of Derivatives on OKX

OKX derivatives trading is an arrangement where buyers and sellers agree to trade a specific asset based on cryptocurrency, like futures or perpetual contracts, at an agreed price and quantity at a particular time in the future. These contracts mainly derive their value from underlying cryptocurrencies like Bitcoin or Ethereum.

Perpetual Swaps Vs. Futures

Perpetual swaps and futures contracts are the two major types of derivatives available on OKX. Perpetual swaps are unique as, unlike futures trading, they do not have an expiry date, providing traders more flexibility. Nevertheless, both products are leveraged, meaning you can increase your potential gains or losses by trading with a margin.

Options Trading Essentials

Options trading is an advanced investment strategy enabling you to trade European options on Bitcoin and Ethereum. These crypto options are contracts that assist in managing market volatility and risks when trading digital assets. A strong understanding of these contracts benefits a successful trading experience on OKX.

OKX Derivative DEX

OKX Derivative DEX is a decentralised exchange built on its own Ethereum Layer 2 network. It employs Zero-Knowledge Proof (ZKP) technology for user privacy and asset security. This DEX offers self-custody of funds, allowing you to manage your assets independently. The platform integrates ZK-Rollups, an essential scaling solution that provides increased throughput, instant transaction finality, and transaction strategy privacy.

OKX Derivative DEX mainly supports cross-margin trading of USDC-margined contracts, sharing margins, and offsetting gains and losses against each other. The settlements are all conducted in USDC.

Key Features:

- Layer 2 Network: The Ethereum Layer 1 network has limitations in transactions per second and network fees. Layer 2 network improves the trading experience by enhancing scalability, speed, and cost-efficiency.

- Self-Custody: Directly transferring assets from your wallet to custody via smart contracts ensures that you are not reliant on third-party custodians.

- Fast Withdrawal: Funds are sent directly from the liquidity pool with an execution time of approximately 20 minutes and a 0.1% fee compared to standard withdrawal, which takes about 12 hours.

DEX Perpetual Contracts:

The maximum leverage for mainstream cryptocurrencies such as BTC and ETH is 20x, while other crypto assets like SOL have an upper limit of 10x. Calculating profit for long and short positions involves the contract size, number of contracts, multiplier, and mark price.

Managing your risks is essential when trading on the OKX Derivative DEX. Therefore, you can set “Take Profit” and “Stop Loss” along with “Reduce Only” options to safeguard your investments.mpa The platform may automatically cancel your orders if your account risk is too high or the low margin rate.

Various effective mechanisms help improve your trading experience, including Good-till-cancelled (GTC), Post Only (Only Maker), Fill or Kill (FOK), and Immediate or Cancel (IOC) orders.

OKX Derivative DEX is a robust platform offering privacy and security for trading derivatives on a Layer 2 network. Its features include using ZK-Rollups technology, self-custody, fast withdrawal, and effective mechanisms, providing an enhanced user experience in the ever-evolving world of crypto trading.

How to Trade Derivatives

Margin Trading Explained

Margin trading allows you to trade assets using borrowed funds. In this process, you open a position with a fraction of the total trade value, and the platform provides the remaining funds as a loan.

On OKX, you can trade various crypto derivatives, such as futures and perpetual contracts. These contracts are agreements between a buyer and a seller to exchange an asset at a specific price, quantity, and time in the future.

To get started with derivatives trading on OKX, follow these simple steps:

- Register: Create an account on OKX and complete the verification process.

- Select the appropriate mode: Ensure that your account is in the correct mode for trading derivatives, either live trading (0) or demo trading (1).

- Deposit funds: Add the desired amount of cryptocurrency into your account for trading.

- Choose a contract: Select the derivative instrument you wish to trade, such as futures or perpetual contracts.

- Determine your margin: Decide the margin level where you are comfortable trading, depending on your risk tolerance. Note that higher margins involve higher risks.

- Place your order: Enter the contract details, including the asset, contract type, quantity, and price.

- Monitor your positions: Keep track of your open positions and manage them accordingly, closing or adjusting as necessary.

Remember, both gains and losses are magnified in margin trading, so trade cautiously and consider using risk management tools like stop-loss orders. Happy trading!

Order Types & Execution

Market Orders Vs. Limit Orders

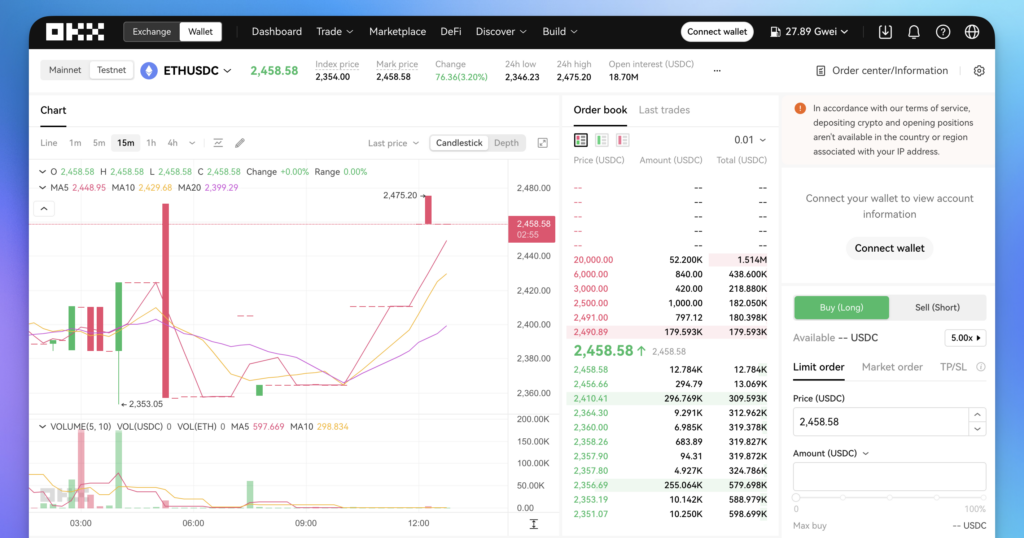

In derivatives trading on OKX, there are two primary order types: market orders and limit orders. Market orders execute immediately at the current market price, while limit orders allow you to set a specific price you want to buy or sell.

When placing a limit order, you set the order quantity and the highest acceptable buying price or the lowest selling price. If the market price meets your expectations, the system executes the transaction at the best price within the limited price range.

Understanding Leverage

Leverage allows you to trade more significant amounts of a financial asset without committing the total value of the position. On OKX, you can select the leverage level for your trades, which will determine the amount of margin required for your positions.

Remember, using leverage can amplify both profits and losses. Trading with high leverage increases the risk of liquidation, so always understand the potential consequences of leveraging your trades.

Risk Management

Calculating Profit and Loss

When trading derivatives on OKX, knowing how to calculate your profit and loss (P&L) is crucial. To do this, consider the difference between your positions’ entry and exit prices.

The P&L is calculated as (exit price – entry price) x quantity for a long position. Conversely, the P&L is (entry price – exit price) x quantity for a short position. Keeping track of P&L helps you make informed trading decisions.

Utilising Stop Loss and Take Profit

Managing risks is essential when trading derivatives, and two tools that can help are stop-loss and take-profit orders. Stop-loss orders limit potential losses by closing a position when the market reaches a specified price.

On the other hand, take-profit orders secure gains by automatically closing a position when the market reaches your target profit level. By utilising these tools, you can manage risks and protect your investments.

Hedging Strategies

Hedging strategies can also help manage risks in derivative trading. You can offset potential losses by opening an opposing position to your initial trade.

For example, if you have a long position on a crypto asset, you can open a short position on a related futures contract. This way, if the market moves against your initial trade, the loss would likely be offset by the profit from your opposing position. Implementing such strategies helps reduce overall exposure and manage risks effectively.

OKX Trading Tools & Features

OKX offers a wide range of trading tools designed to cater to traders of all skill levels.

Trading Bots and Automation

OKX provides users with trading bots to help automate their crypto trading strategies. These bots have various features to enhance your trade execution efficiency and profitability. Using these trading bots, you can set up specific entry and exit conditions, allowing you to take advantage of market opportunities without constantly monitoring your positions.

APIs for Advanced Users

For advanced users looking to create custom trading applications or leverage their algorithms, OKX offers a robust API. This API enables you to integrate your trading tools with the OKX platform, giving you greater control over your trades and deeper insights into market data. With the API, you can execute trades, fetch order details, and access historical data to facilitate more responsive and precise decision-making.

OKX Earn Products

OKX offers a variety of passive income solutions through their Earn products. One such product is OKX Simple Earn, which allows you to earn interest on your idle assets. For those interested in more actively participating in the ecosystem, you can explore OKX’s staking options to earn rewards on supported tokens. Additionally, OKX provides on-chain Earn opportunities, granting you access to a wide range of DeFi protocols and apps to diversify your income streams further.

Utilising these tools and features can significantly improve your trading experience on OKX, assisting you in navigating the global cryptocurrency markets more confidently and effectively.

OKX Derivatives Fees & Funding

Understanding OKX Fee Structure

OKX offers a tier-based fee structure for derivatives trading, differentiating between regular and VIP users. Regular users’ fees are based on their total OKB holdings, while VIP users’ fees depend on their 30-day trading volume and daily asset balance. Fee tiers are updated daily, providing flexibility in trading costs.

Various products, such as futures contracts and perpetual swaps, may have distinct fees. OKX-Derivative DEX perpetual swaps, for example, use a funding fee mechanism to align the market price of the swap with the spot price.

Deposit and Withdrawal Methods

Depositing and withdrawing on OKX can only be done using cryptocurrencies, as the platform does not support fiat currency deposits directly. Various cryptocurrencies, such as BTC, ETH, and USDT, can be deposited and withdrawn from the platform.

Fiat-to-Crypto Transactions

It is important to note that to trade on the OKX platform, users must convert their fiat currency into cryptocurrency first. There are numerous methods available for conversion, such as using your Visa or Mastercard, but the specific process may differ based on your location.

Once you have converted your fiat money into a cryptocurrency, such as USDT or BTC, you can use that cryptocurrency to trade on the OKX platform. Funding your account with cryptocurrency enables you to trade various financial products, including futures and perpetual contracts, on the exchange.

Frequently Asked Questions

Is derivatives trading profitable?

Derivatives trading can be profitable, but it depends on your trading strategies, market knowledge, and risk management. Crypto derivatives, such as futures and perpetual contracts, offer traders the opportunity to profit from market fluctuations.

How does leveraging affect potential profits and losses in derivatives contracts?

Leverage amplifies both potential profits and losses in derivatives contracts. Higher leverage allows you to control a larger position with a smaller amount of capital, increasing the potential for higher returns. However, it also increases the risk of significant losses if the market moves against your position.

What are the primary benefits of trading crypto derivatives over traditional financial instruments?

Crypto derivatives offer several advantages over traditional financial instruments, including increased market accessibility, the ability to trade 24/7, and exposure to a rapidly growing asset class. Additionally, crypto derivatives often have lower fees and can be traded with leverage, offering potentially higher returns.

How can traders manage risk effectively when trading derivatives on the platform?

Effective risk management is crucial when trading derivatives. Some methods for managing risk include setting stop-loss orders, using proper position sizing, and incorporating risk-reward ratios into your trading strategy. Additionally, educational resources are available to help traders improve their skills and understanding of the market.

What steps should new traders take to begin trading derivatives responsibly?

New traders should start by educating themselves about derivatives, market mechanics, and risk management. Consider paper trading or starting with small positions to familiarise yourself with the process. It’s also essential to stay up-to-date with regulatory compliance and research the platforms and exchanges you plan to use.

How often does the platform undergo updates or maintenance that could affect derivative trading activities?

The frequency of updates or maintenance varies across platforms. It’s essential to stay informed about any scheduled maintenance or potential disruptions, as these events may temporarily affect trading activities. Most platforms communicate this information via their website, newsletters, or social media channels.