OKX Loans offers a versatile platform for cryptocurrency enthusiasts who are looking to borrow top cryptocurrencies while providing other crypto assets as collateral.

Key Takeaways

- OKX Loan Services feature a user-friendly platform for borrowing top cryptocurrencies.

- Numerous benefits such as quick conversions, zero fees, and no slippage can be availed.

- Innovation and adaptability are key features of the OKX Loan Services platform.

Overview of OKX Loan Services

OKX Loan Services offers a range of innovative financial products tailored for the modern crypto user. In this section, we will explore the loan products available and the eligibility criteria for borrowers.

Loan Products Offered

Bitcoin and USDT Loan: Borrow top cryptocurrencies like Bitcoin, USDT and others using your crypto assets as collateral. This versatile loan offering allows you to trade or earn with borrowed funds. See our review of OKX to view all available crypto assets.

Eligibility Criteria

Before taking advantage of the plethora of loan products offered by OKX, you should be aware of the eligibility criteria:

- Account Verification: Users must be fully verified on OKX to access the different loan options.

- Collateral Requirement: Most loan products require collateral in the form of cryptocurrencies, such as Bitcoin or Ethereum. The minimum and maximum collateral requirements may vary depending on the specific loan product.

- Loan Tenure: The duration of the loan will impact your eligibility. Shorter loan periods may have lower collateral requirements, whereas longer loan tenures might entail higher collateral.

By understanding the loan products offered by OKX Loan Services and meeting the eligibility requirements, you can access various financial benefits of the platform and expand your crypto investment options.

Getting Started with OKX Loans

Registration Process

To begin using OKX Loans, you first need to create an account on the platform. Registering for an account on OKX is a straightforward process. For a step-by-step guide on registration, you can find assistance here.

Loan Application Procedure

Once your account is set up, you will need to deposit funds into your OKX wallet.

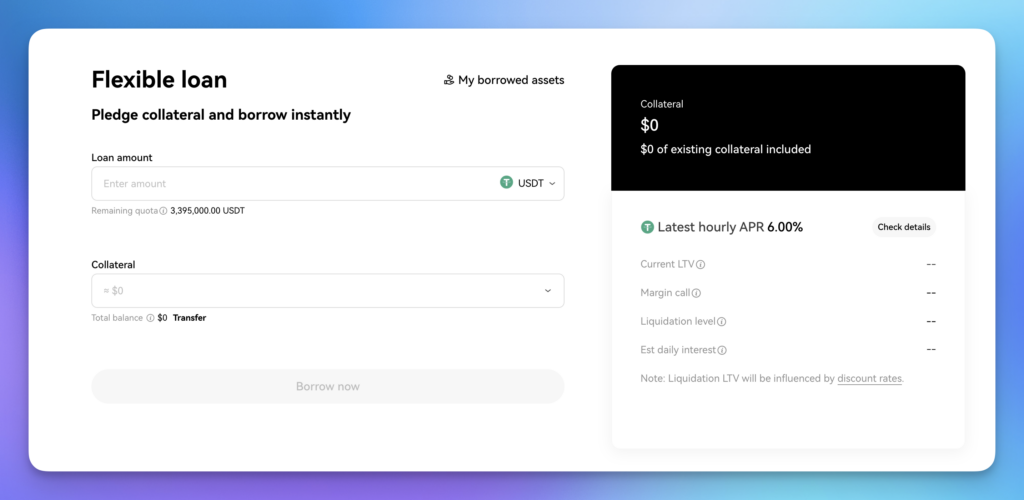

After depositing your funds, you can now apply for an OKX Loan. Start by selecting your desired loan terms, such as borrowed amount, collateral type, and repayment term. Then submit your loan application for approval.

Understanding Loan Terms

When applying for an OKX Loan, it’s crucial to comprehend the key terms associated with the process. These include:

- Loan-to-value ratio (LTV): This is the ratio of the amount you’re borrowing compared to the value of your collateral. A higher LTV means higher risk for the lender.

- Collateral: The cryptocurrency you pledge to secure your loan. Examples include Bitcoin (BTC), Ethereum, Litecoin, and OKB.

- Interest rate: The percentage of the loan amount that you’ll pay as interest on your borrowed funds. Different loans will have varying interest rates depending on factors like loan term and collateral type.

By fully understanding these terms, you can select the best loan option for your situation and confidently manage your OKX Loan.

Loan Management and Repayment

Repayment Schedule

In managing your OKX Loan, you’ll be responsible for a repayment schedule. This schedule will outline the dates on which you’ll need to make payments towards the principal and interest of your loan. Being aware of these dates and meeting your obligations will help ensure that your loan stays in good standing.

Interest Rates and Fees

OKX Loans come with various interest rates and fees, depending on factors like the type of collateral, loan term, and loan amount. These rates can be as low as 1% APR, making them competitively priced in the lending market. Keep in mind that the interest rates and fees associated with your loan will directly impact the overall cost of borrowing.

Loan Monitoring Tools

To facilitate the management of your loan, OKX offers a range of loan monitoring tools. These tools can help you track your loan’s progress, assess the value of your collateral, and monitor any potential risks associated with market fluctuations.

By effectively managing your repayment schedule, staying informed about interest rates and fees, and utilising OKX’s loan monitoring tools, you can successfully navigate your OKX Loan experience.

Risks and Safeguards

Understanding Collateralisation

When using OKX Loan Services, you need to be aware of the collateralisation process. To borrow digital assets, you agree to pledge a certain amount of digital assets held in your OKX account as collateral. This ensures that you’ll repay the loan to investors on a timely basis.