The OKX Proof of Reserves is a reporting system that proves OKX deposits are handled correctly and OKX holds enough money to back every customer deposit.

As an investor, you may wonder how OKX establishes its proof of reserves. The company utilises the zk-STARK technology, a sophisticated cryptographic technique that offers robust verification of its cryptocurrency holdings. This builds trust with their users and plays a significant role in fostering accountability within the industry.

Key Takeaways

- OKX Proof of Reserves enhances transparency and trust in the crypto exchange.

- The methodology implemented is based on the advanced zk-STARK technology.

- Greater accountability benefits users and paves the way for prospects in the industry.

Overview of OKX

OKX History

OKX is a leading global Web3 technology company and crypto exchange. Since its launch, it has been at the forefront of industry innovations, ensuring user fund security through transparency and platform integrity.

Services Offered

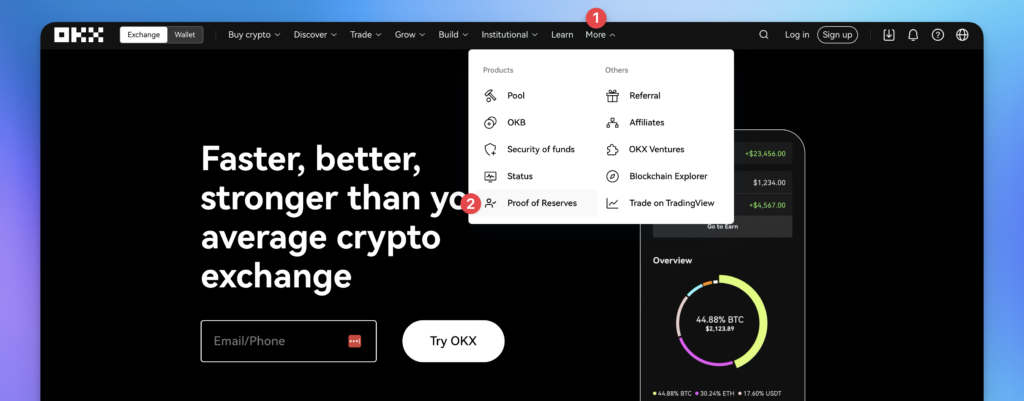

To enhance users’ experience, OKX provides services such as crypto trading and an NFT marketplace. The platform offers a secure, user-friendly wallet to store and manage digital assets. Moreover, OKX has introduced Proof of Reserves (PoR) to verify the platform’s asset holdings for added transparency and trust.

Market Position

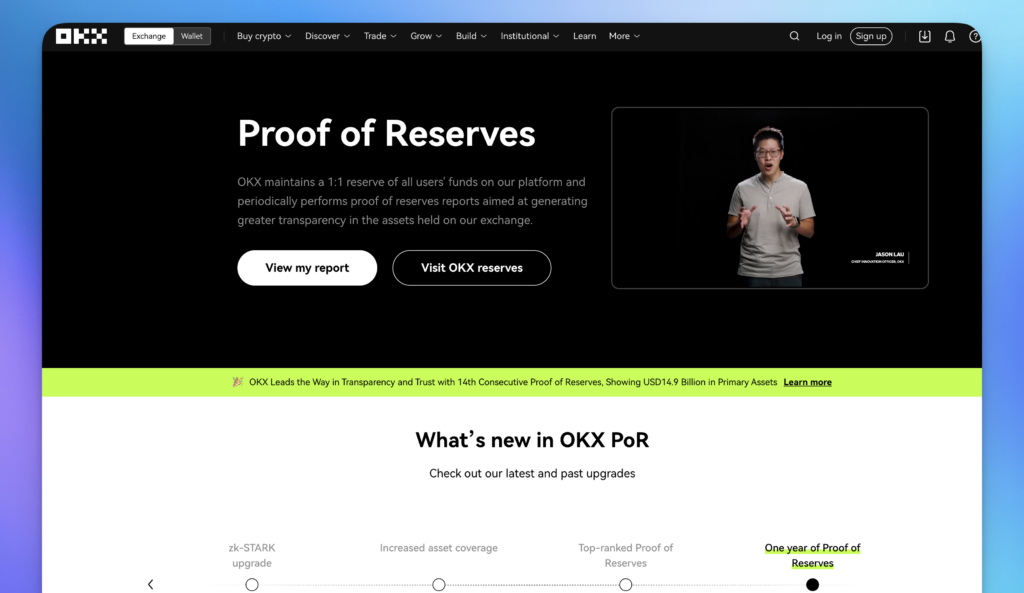

Standing as one of the industry leaders, OKX continually strives to improve and expand its platform. The platform has attracted users worldwide with a commitment to transparency and the availability of advanced features. Their monthly Proof of Reserves reports and consistent enhancements have solidified OKX’s reputation in the crypto exchange sphere.

Principles of Proof of Reserves

Importance of Audits

In the context of cryptocurrency exchanges, Proof of Reserves is vital. It demonstrates the solvency and financial health of an exchange like OKX, ensuring transparency and security for its users.

Verification Process

OKX employs a Merkle Tree Proof of Reserves to verify the reserves independently. You can use OKX’s open-source verification tool, zk-STARK Validator, to confirm the accuracy of the reserve figures. This involves downloading the related files, such as sum_proof.json and sum_value.json, and placing them in the appropriate folders.

Third-Party Assessment

OKX’s Proof of Reserves undergoes third-party evaluation, further increasing trustworthiness. By allowing external auditors to verify its solvency, OKX demonstrates its commitment to maintaining a secure and transparent exchange environment for its users.

OKX’s Proof of Reserves Methodology

Cryptographic Verification

OKX uses a cryptographic Merkle tree to verify all user assets on the exchange securely. This data structure ensures data encryption, helping build trust in their Proof of Reserves process. OKX continually upgrades its process, with an update to zk-STARK technology slated for March 2023.

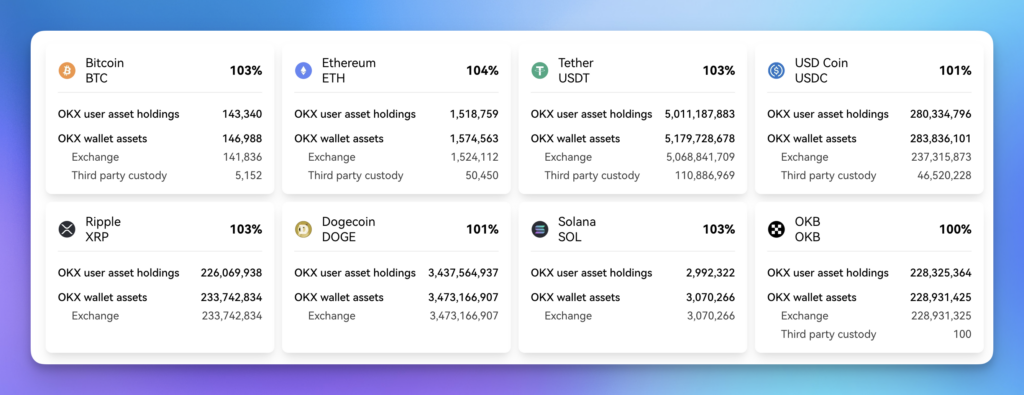

User Verification

Two main steps are involved in confirming OKX’s reserves. First, the ownership of OKX on-chain wallet addresses is verified. Second, the total OKX wallet holdings are checked. OKX’s commitment to transparency can be seen in their monthly Proof of Reserves reports, having celebrated their first year of industry leadership with 12 published reports. Users can independently verify their assets on the platform, ensuring their peace of mind.

Implications for OKX Users

Account Safety

OKX aims to protect your assets by ensuring reserves are well-managed. The Proof of Reserves verifies that no user accounts have negative balances, providing a safer investment environment.

Transparency Impact

The availability of Proof of Reserves (PoR) increases transparency, allowing users to verify OKX’s solvency. PoR helps build trust, particularly when 84% of surveyed users consider it important in assuaging solvency fears.

Investment Decisions

Transparent and accurate reserves information aids your investment decisions. OKX’s 100% clean assets, as confirmed by CryptoQuant, attest to the exchange’s high-quality reserves. Secure your investments with robust cold storage security measures implemented by OKX.

Challenges and Limitations

Potential Risks

While OKX’s Proof of Reserves (PoR) demonstrates over-collateralisation, it’s vital to acknowledge that certain risks may still exist. For example, a hacker attack could potentially jeopardise the exchange’s assets. Moreover, the PoR itself may inadvertently reveal vulnerabilities. Regularly updating the PoR and implementing robust security measures, such as two-factor authentication, are essential to mitigate these risks.

Counterparty Transparency

In conducting their business, cryptocurrency exchanges often rely on third-party custodians for asset management. While OKX strives for transparency, investors must be aware that third-party custodians may share a different level of transparency. OKX and other exchanges must work closely with such custodians and continuously review their performance, ensuring they maintain the regulatory standards required by the industry, as outlined in this article on compliance.

Future Prospects

Innovation in Audit

In the rapidly evolving crypto industry, OKX’s consistent commitment to transparency, demonstrated by its monthly PoR reports, highlights a shift towards trustless audit methods. By researching and adopting innovative tools like zk-STARK technology, which makes it increasingly simpler for users to verify their balances, OKX paves the way for other exchanges to follow suit.

As this focus on technology-led transparency expands, it’s conceivable that more crypto exchanges will soon prioritise these types of solutions. Consequently, users of these platforms can expect enhanced safety and confidence in their digital assets.

Regulatory Trends

Amidst increasing scrutiny in the crypto market, regular PoR reports make a strong case for OKX’s commitment to meeting regulatory requirements. This proactive approach keeps them ahead of the competition, as the drive to ensure the security and transparency of user funds aligns them with emerging regulatory trends.

With a rise in regulatory developments globally, stakeholders in the crypto ecosystem can envisage further exchanges adopting policies in line with those established by OKX. Thus, increased confidence among end users can benefit the entire market, leading to long-term, sustainable growth.