In the ever-evolving world of cryptocurrency trading, OKX has introduced a groundbreaking tool – Copy Trading. This innovative feature allows you to either share your own trading strategies for profit or learn from professional traders by copying their trades across 600+ trading pairs. Managing your crypto investments just got a whole lot easier.

By getting started with OKX Copy Trading, you’ll enjoy a new level of convenience, as you can follow and copy the moves of lead traders with just a few clicks. It’s an effective way to diversify your cryptocurrency portfolio and potentially increase your overall return on investment.

Key Takeaways

- OKX Copy Trading lets you share your strategies or learn from professional traders.

- Quickly follow and copy top performers in the crypto market to manage your investments.

- Diversify and potentially boost your portfolio returns using this innovative tool from OKX.

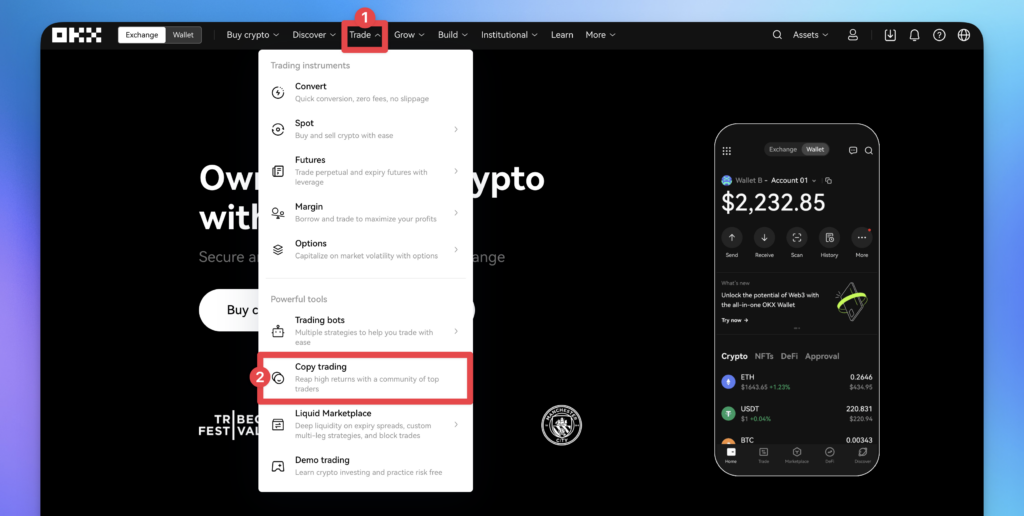

Getting Started with OKX Copy Trading

Creating an OKX Account

To begin, you’ll need to register an account with OKX. After registration, completing the OKX KYC process will unlock additional features. Check out our OKX review for more info about getting started.

Understanding the Interface

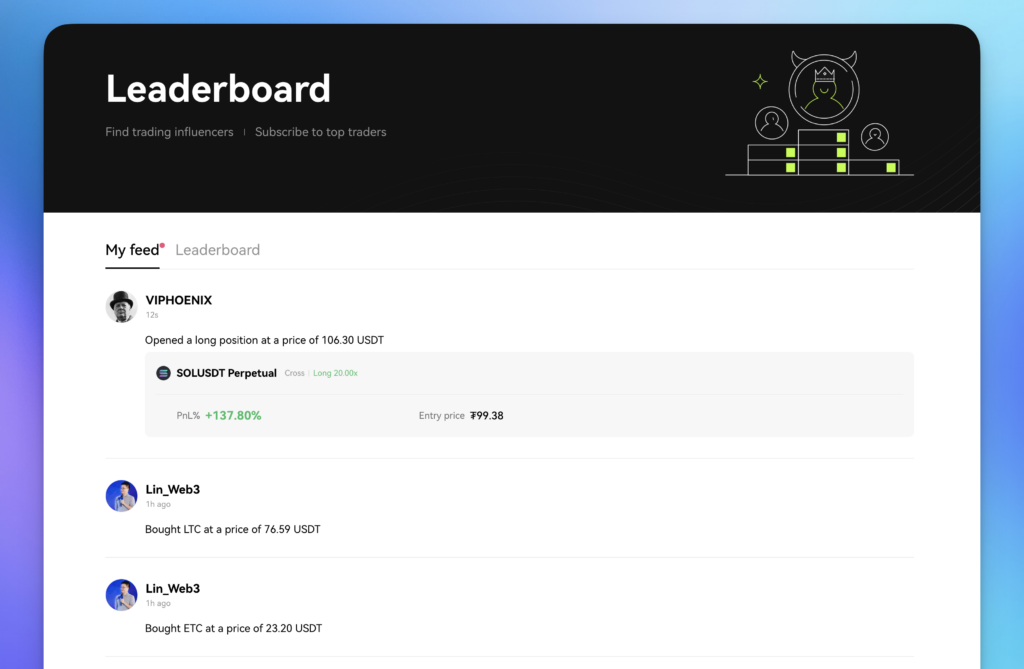

Once you have an account, familiarise yourself with the OKX user interface. This will help you navigate the platform with ease.

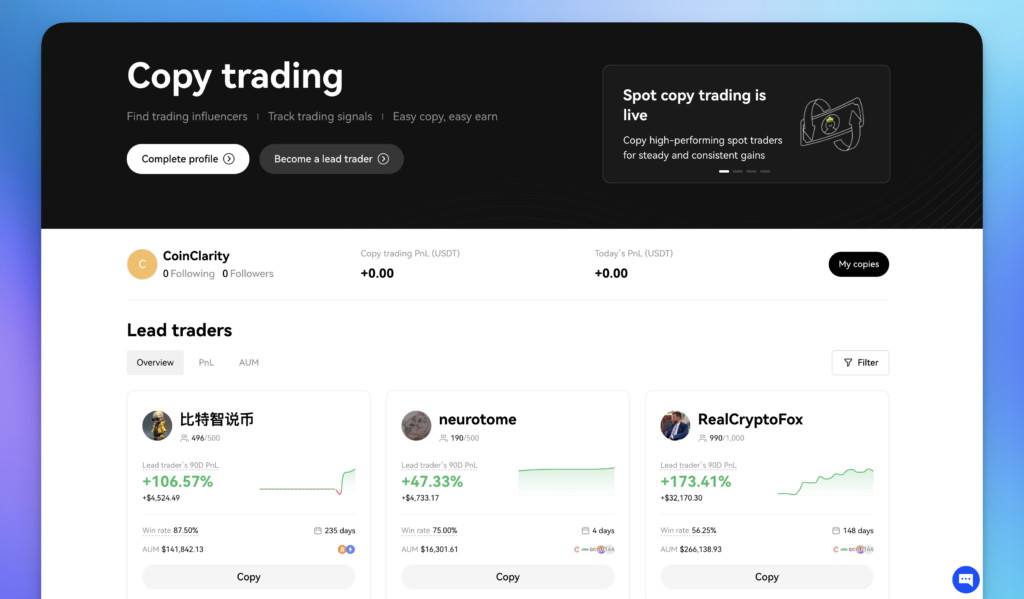

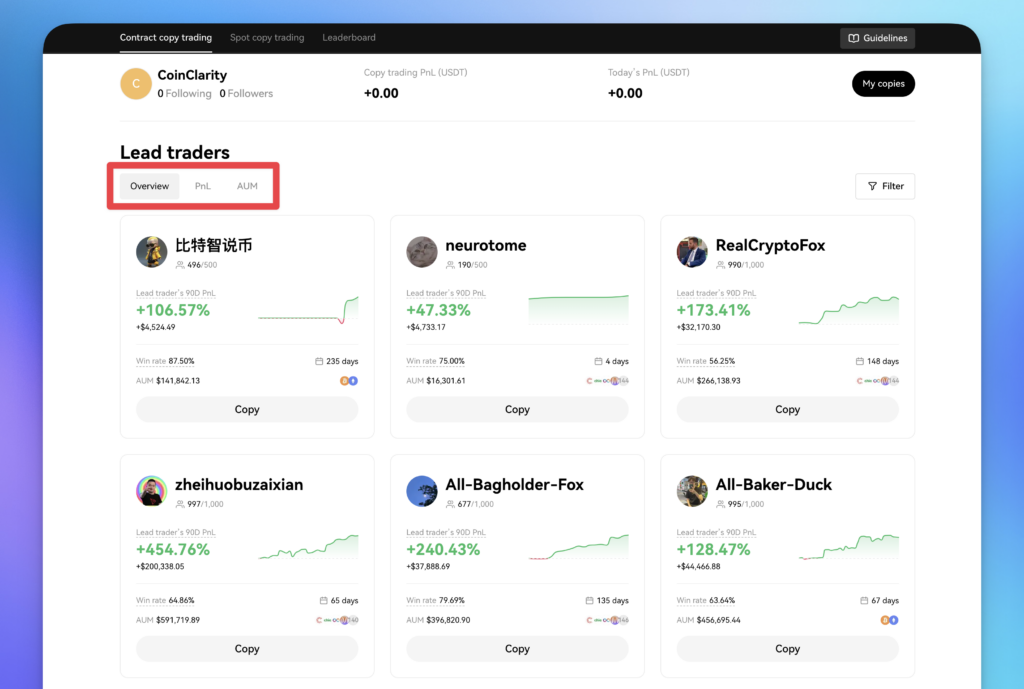

Selecting a Trader to Copy

When you’re ready, explore the copy trading feature and choose a trader to follow. Pay attention to their portfolio breakdown, transaction history, PnL, and risk level. Remember to evaluate each trader carefully before deciding to copy their trades.

Key Features of OKX Copy Trading

Risk Management Tools

OKX Copy Trading provides numerous risk management tools to keep your investments secure. You can set stop-loss, take-profit limits, or use advanced API settings to customise your strategies.

Diversification Options

Copy trading allows for diversification options as you can explore multiple trading pairs and strategies provided by professional traders. This helps reduce risk and generate more consistent returns in your portfolio.

Benefits and Risks of Copy Trading

Potential Returns

By employing OKX Copy Trading, you can benefit from the expertise of professional traders. By copying their trades, you can potentially increase your returns by utilising their trading strategies in real-time. With over 600 trading pairs available, the scope for diversification and potential returns is significant.

Copy Trading Risks

Naturally, copy trading carries its own set of risks. Market volatility and loss potential cannot be eliminated despite following expert traders. Additionally, the success of your investments still depends on the effectiveness of the trader being followed. To minimise these risks, it’s essential to research the traders you choose to follow and monitor their performance.

Social Trading Vs. Traditional Trading

While traditional trading requires you to independently analyse markets, devise strategies, and execute trades, copy trading provides a lower learning curve and a more passive approach to investing. However, it’s essential to be aware of potential drawbacks to this approach, such as the risk of following a poor-performing trader.

In summary, OKX Copy Trading enables you to tap into the potential returns from following expert traders while reducing the time and effort required in traditional trading. Copy trading does carry inherent risks, but with careful selection of traders and the added security measures of OKX’s platform, you can cautiously manage these risks for a more balanced investment approach.

Strategies for Selecting Top Performers

Analysing Trader Performance

To succeed in copy trading, you should analyse the performance of potential lead traders. Examine their historical data, including win rates, profits, and consistency.

Understanding Trader Risk Profiles

Assess a trader’s risk profile by evaluating their risk-reward ratios, stop losses, and portfolio diversification. This helps you manage your own risk when following their strategies.

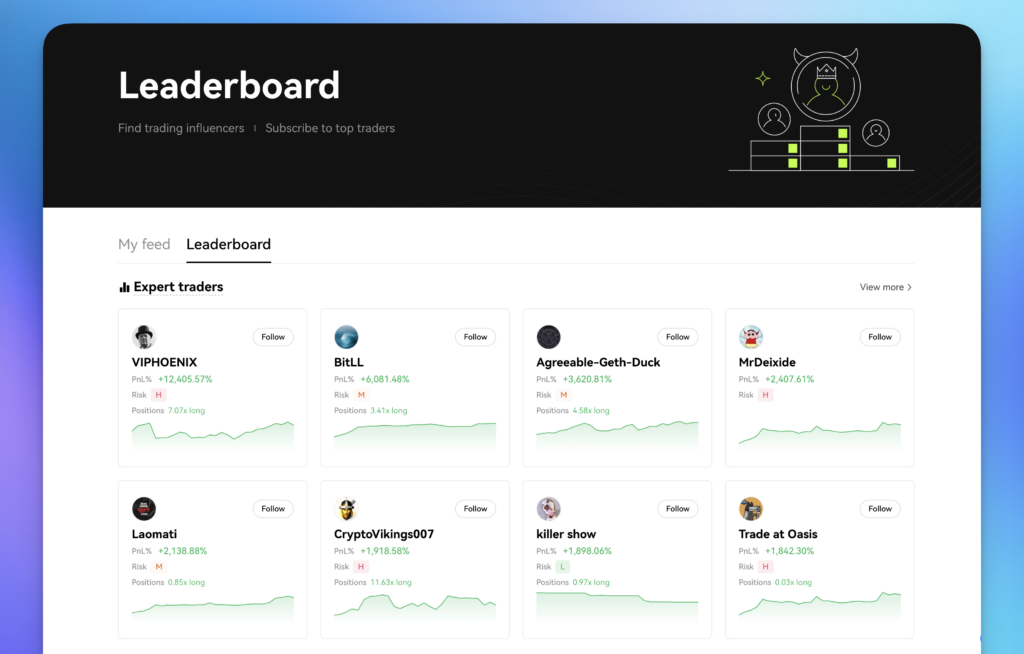

Following Market Leaders

Identify top performers by tracking traders with strong reputations in the community. Look for those who maintain transparency about their trades and communicate effectively with their followers.

Making the Most of OKX Copy Trading

Setting Up Notifications

Setting up notifications in the mobile app for real-time updates is essential to stay informed about the trades you’re copying. This allows you to monitor your copy trading progress and make any necessary adjustments along the way.

Continuous Learning and Adaptation

Success in copy trading requires constant learning and adaptation. To better understand top traders’ strategies, use OKX’s educational resources. You can make informed decisions and maximise your copy trading experience by continually improving your knowledge.