Margin trading is a popular method among traders, offering the opportunity to amplify profits through leveraged positions. With OKX, individuals can borrow assets from the exchange and leverage their margin in multiples, giving them the chance to earn profits by either buying (long) or selling (short) a token, depending on the price movement.

OKX’s trading platform provides users with a user-friendly experience, including various modes to suit their needs. By setting up an account and understanding the margin trading process, users can trade a full range of contracts and margin products.

Key Takeaways

- Set up an OKX account to access a variety of trading modes and tools.

- Learn and understand margin trading to maximize profits on the OKX trading platform.

- Familiarise yourself with risk management strategies and advanced trading techniques through OKX Express Buy and other resources on the platform.

Account Setup and Verification

Creating an Account

To begin with, you’ll need to create an OKX account. Follow the steps provided, and ensure the necessary information is accurate and up-to-date.

Identity Verification

After account creation, you must verify your identity. Different levels of verification require various documentation, so ensure you’re prepared for this step.

Deposit Methods

Please note, OKX supports only cryptocurrency deposits. Fiat currencies such as USD or EUR aren’t directly supported for depositing funds.

Understanding Margin Trading

Margin Trading Basics

Margin trading is a method where traders borrow assets from an exchange like OKX and leverage their margin in multiples, amplifying potential profits and risks. You can either buy (long) or sell (short) a token to gain profits as the price goes up or falls.

Leverage Explained

Leverage allows you to open larger positions than you could with your available capital. For example, with a leverage of 10x, you can trade £1,000 by just putting up £100 of your own capital. Keep in mind that both potential profits and losses are magnified when trading with leverage.

Margin Calls

A margin call happens when the value of your position drops below a certain threshold, causing the exchange to ask you to either add more funds or close your positions to minimise losses. If you don’t respond to the margin call, the exchange may liquidate your position to cover the borrowed amount. Be aware of the risks associated with margin trading, and consider exploring other strategies such as OKX Options Trading for managing market volatility.

OKX Trading Interface

Navigating the Dashboard

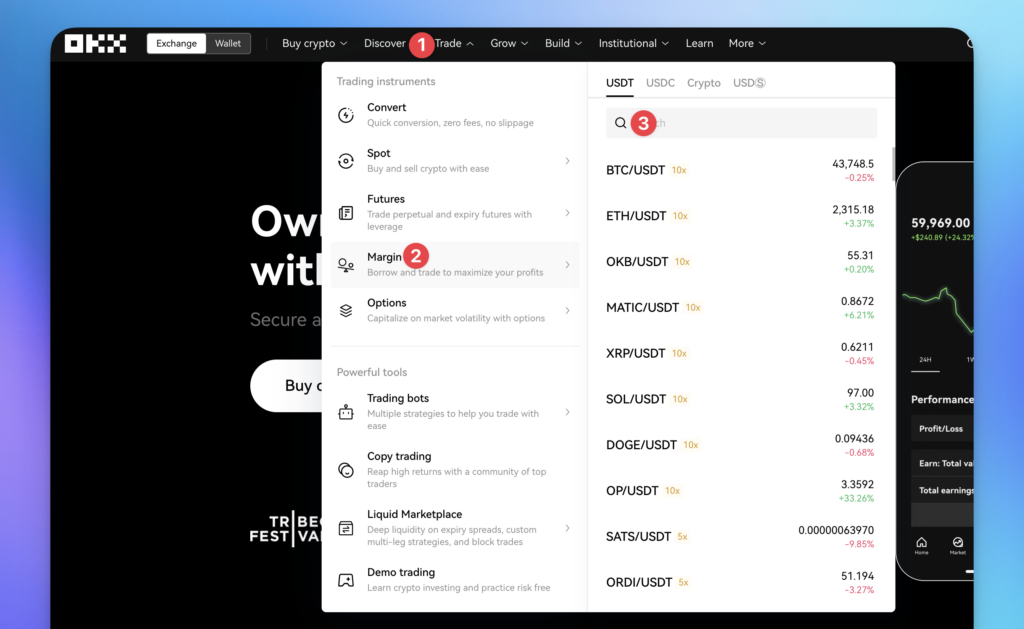

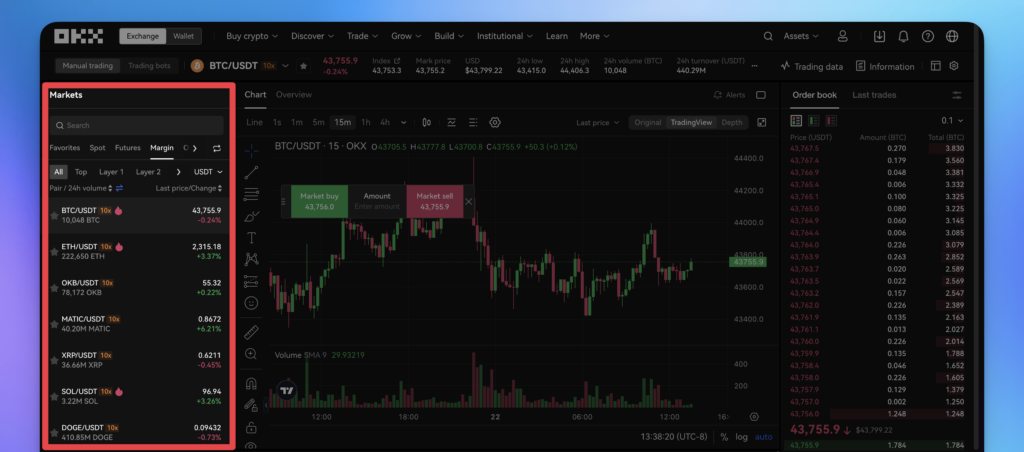

Once you’ve logged into your OKX account, you’ll find a well-organised trading dashboard. The top menu provides access to various trading options like margin trading, P2P trading, and more. You can easily swap between different products by using this menu.

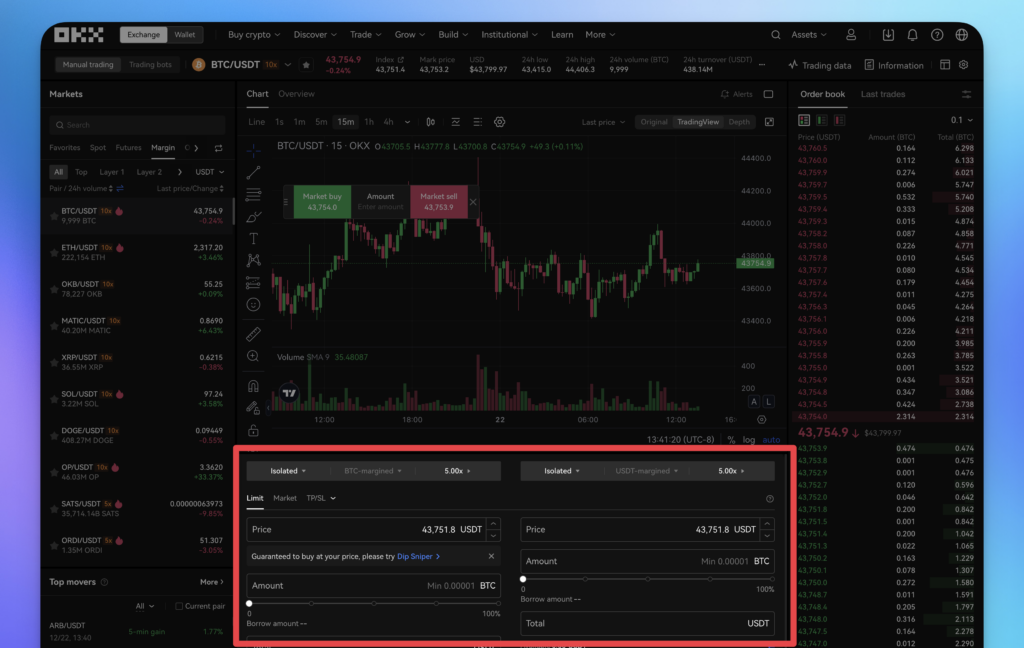

Order Types

In the margin trading interface, you’ll come across various order types. The common ones are market, limit, and stop orders. Each order type serves a distinct purpose and can be used based on your trading strategy or risk tolerance. For a breakdown of the fee structure while trading, refer to this detailed explanation.

Trade Execution

To execute a trade on the OKX margin trading platform, select the trading pair and input the desired amount. Choose the relevant order type, confirm your selection, and execute the trade.

Risk Management Strategies

Using Stop Losses

Utilising stop losses can help you manage risks in margin trading. They automatically close a position when the market reaches a specified price, limiting your losses.

For instance, you could set a stop loss at 10% below your entry price, which ensures that your losses won’t exceed that percentage. Make sure to adjust stop loss levels as needed based on market conditions and your risk tolerance.

Diversification

Another risk management strategy is diversification. It involves setting up multiple positions across several assets with varying performance correlations. By spreading your assets, you reduce the potential impact of a single market event or poor-performing asset on your overall portfolio.

Consider researching the cryptocurrency market to identify different assets with low correlations. Building a diversified margin trading portfolio can help you mitigate risks and enhance long-term results.

Remember, effective risk management strategies are crucial when trading on OKX or any other platform. Employing stop losses and diversification techniques can improve your trading outcome and safeguard your portfolio from unwarranted risks.

Advanced Trading Tools and Techniques

APIs and Bots

To enhance your trading experience, OKX provides a powerful API that enables you to connect your account to third-party services and applications. You may also employ trading bots to automate your strategies, ensuring optimal execution and minimising human error.

By leveraging these advanced tools, you can easily develop, backtest and implement automated strategies to stay ahead in fast-paced markets. OKX’s API provides reliable, secure access to account management, market data and trading functionality.

Technical Analysis

OKX has incorporated TradingView integration into their platform, offering a robust suite of charting tools and technical indicators. This integration enables you to conduct in-depth analyses to identify trends, support and resistance levels, as well as make informed trading decisions.

Among the available trading tools on OKX, you’ll find various chart types, drawing tools, moving averages, oscillators, and more. By mastering these tools and applying technical analysis techniques, you can gain a better understanding of market sentiment and make data-driven decisions in your margin trading journey.