Perpetual swaps are a popular financial instrument in the cryptocurrency market, allowing traders to gain exposure to digital assets without the constraints of expiration dates. OKX, a leading cryptocurrency exchange, offers a wide range of perpetual swap contracts, enabling traders to take long and short positions on various cryptocurrencies.

On the OKX platform, users can leverage up to 125 times their initial investment, which magnifies profits but also increases potential losses. Crypto-margined perpetual swaps on OKX are settled in cryptocurrencies like BTC, with a contract size of $100 USD.

Key Takeaways

- Perpetual swaps let traders profit from cryptocurrency price fluctuations without expiration constraints.

- OKX provides a variety of perpetual swap contracts for multiple cryptocurrencies.

- Leveraged trading on OKX can boost profits but requires careful risk management.

Understanding Perpetual Swaps

Definition and Overview

Perpetual swaps are a type of cryptocurrency derivative that enables traders to take long or short positions on an underlying asset. They offer additional flexibility, like leverage and the ability to settle contracts without owning the asset itself, and differ from futures primarily in their absence of an expiration date.

Trading Perpetual Swaps on OKX

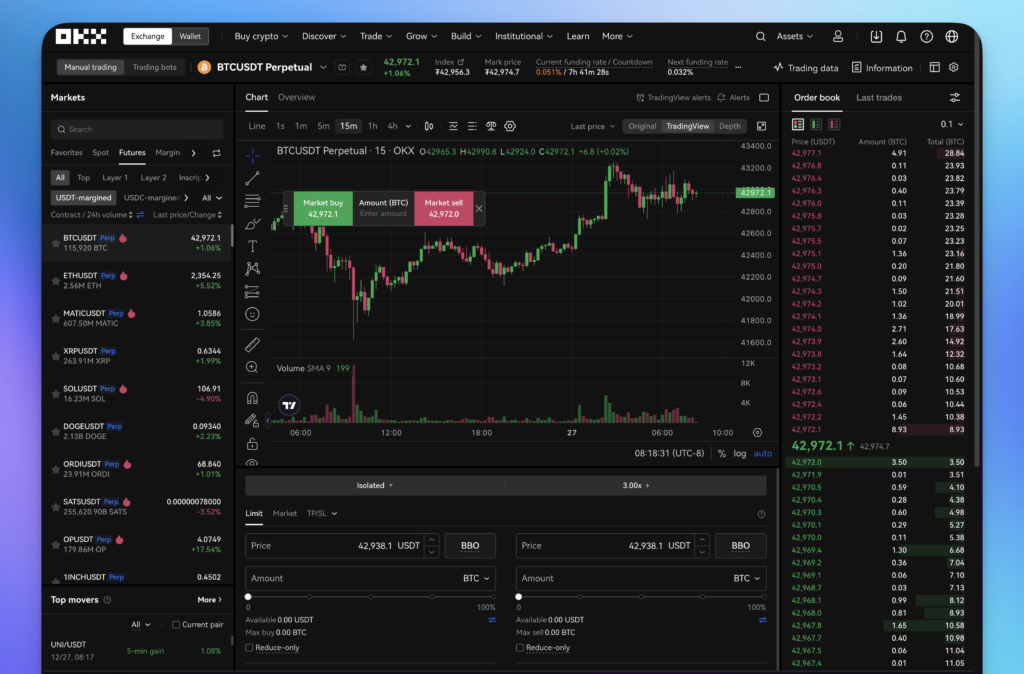

On OKX Exchange, you can trade perpetual swaps with up to 125x leverage, depending on the position tiers. Additionally, you must consider the minimum initial margin ratio and maintenance margin ratio, both of which are listed on the position tiers page. To begin trading, visit the OKX homepage, navigate to the ‘Trade’ section, and click on ‘perpetual futures’.

Contract Specifications

OKX Crypto-Margined Perpetual Swaps involve the settlement of cryptocurrencies, like BTC, with a contract size of $100 USD. You can take long or short positions on cryptocurrencies with up to 125x leverage, aiming to make a profit when the price rises or falls.

Price Discovery Mechanism

The price discovery mechanism of perpetual swaps is essential for maintaining a fair and transparent trading environment. OKX employs a Mark Price mechanism, which is calculated using an index price and a funding rate. This approach mitigates the risk of price manipulation and ensures a stable trading environment for all participants.

OKX Trading Platform

How to Access Perps on OKX

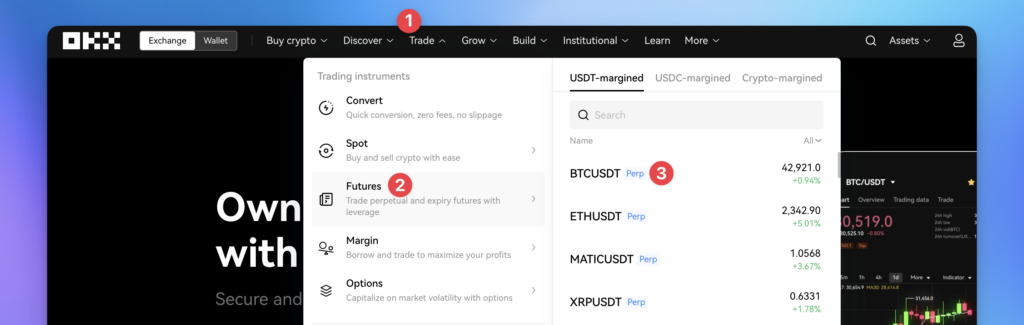

From any page on the OKX website, first hover over “Trade” in the top menu, then hover over “Futures.”

You will then notice that the trading pairs that open up in the right side of the menu, such as “BTC/USDT” have a label “Perp.” Click on the trading pair you want to trade perpetual contracts on or search in the search field for any that you don’t see in the menu.

User Interface

The OKX trading platform offers a user-friendly experience with a well-designed interface that makes trading perpetual swaps simple. Features like real-time charts, order book, and trade history provide you with all the information needed to make informed decisions.

Account Types

OKX offers a Unified Account feature, which allows you to effortlessly manage your perpetual futures, expiry futures, and options contracts in one place. This feature also includes real-time settlement for a seamless trading experience.

Security Features

On OKX, protecting your account and assets is a top priority. The platform employs multiple security measures, such as two-factor authentication. Additionally, wallet features and other security measures are constantly being updated to ensure the highest level of protection.

Funding Your Account

To fund your account, you can deposit cryptocurrencies like BTC or USDT, as explained in this simple guide. OKX does not support fiat currency deposits directly, but other methods like P2P trading can be used to deposit funds.

Customer Support

OKX provides responsive and helpful customer support, ensuring that any issues or concerns are addressed promptly. Whether you need assistance with trading, account security, or funding, the OKX team is available to help.

Risk Management in Perpetual Swaps

Risk Mitigation Tools

OKX provides risk management tools to safeguard your investments. These tools help traders to mitigate potential risks, and monitor their trades effectively.

Margin Requirements

To trade perpetual swaps, you need to maintain sufficient margin requirements. Ensure you have adequate margin in your account, as insufficient margin may lead to liquidations.

Leverage Limits

OKX offers leverage limits ranging from 1x to 100x. Be cautious when using high leverage, as it increases both your profit potential and risk exposure. Select your leverage based on your risk appetite, and the margin trading information provided.

Profit and Loss Calculation

Understand how profit and loss are calculated in perpetual swaps before trading. This is crucial to manage your positions and risk effectively. Keep in mind that higher leverage may result in greater profit, but also greater potential loss.

Market Analysis and Strategies

Technical Analysis

To better understand the price movements of perpetual swaps on OKX, apply technical analysis techniques. This includes studying patterns in historical price data, such as candlestick charts, to identify possible trends or reversals. Make use of tools like moving averages, Bollinger Bands, and the Relative Strength Index (RSI) to strengthen your analysis.

Fundamental Analysis

In addition to technical analysis, study the underlying assets and market factors affecting perpetual swaps. Assess the health of the cryptocurrency industry through indicators like market capitalisation and trading volume. Keep an eye on industry developments, regulatory changes, and overall market sentiment to make informed decisions about your trading strategy.

Market Sentiment Analysis

Judge the market sentiment by analysing social media platforms, news articles, and forums. Crowd sentiment can heavily influence price movements, so understanding how the wider community perceives the market can provide a significant advantage. Gauging sentiment allows you to properly adjust your strategy and anticipate potential market shifts.

Trading Strategies

There are various trading strategies that you can employ while trading perpetual swaps on OKX. A few examples are:

- Scalping: Benefit from short-term price fluctuations by executing multiple small trades throughout the day.

- Range trading: Capitalise on consistent price movements within a specific range by placing buy and sell orders at key support and resistance levels.

- Breakout trading: Identify and trade during periods when an asset’s price moves beyond key levels of support or resistance.

Enhance your trading strategy with the help of OKX’s trading tools to maximise your profit potential. Remember to manage risk, adjust positions, and stay informed about market changes.

Regulatory Compliance and Legal Framework

Regulatory Overview

As the cryptocurrency industry evolves, exchanges like OKX are adapting to regulatory changes to ensure compliance. In the UK, the Financial Conduct Authority (FCA) has imposed new regulations for financial promotions, which took effect on 8 October 20231. These changes apply to retail users, and OKX has developed a compliant user experience to meet these requirements.

OKX also faces substantial regulatory transformation due to new licensing rules in Hong Kong, implemented on 1 June 2023. These regulations require all virtual asset service providers to obtain a license from the Securities and Futures Commission. OKX ensures that it is in compliance with these robust requirements.

Legal Considerations

To maintain a secure platform and prioritise user safety, OKX UK streamlines token offerings in response to FCA regulations. Furthermore, it offers its users transparency through a proof of reserves policy.

OKX also implements a comprehensive Know Your Customer (KYC) process to verify user accounts. With multiple levels of account verification, OKX ensures that it adheres to legal guidelines while also protecting its users from potential fraud and money laundering activities.

Considering the various legal frameworks and compliance requirements, OKX strives to maintain trust and safeguard its users in the ever-evolving cryptocurrency landscape.