Best Crypto Exchanges in the UK

Tea, crumpets, and crypto, true British staples, right? It would appear that way, given how popular crypto is in the UK and how friendly cryptocurrency exchanges are to the British. Aside from crypto derivatives trading, which is banned in the UK, there is pretty much a full range of exchanges and services to pick from. Furthermore, despite not being in the EU anymore, UK residents can still own SEPA bank accounts if they wish to conduct activity in Euros and Pound Sterling.

Another positive position the UK has taken is being transparent and providing well-defined information on the taxation and legality of digital currencies. Rather than taking an ambiguous or grey-area approach, hovering around the idea of banning cryptocurrencies entirely as some other nations have done, or over-regulating and sucking the fun out of it (*cough* America *cough*), the UK got on board early and saw the massive potential and benefits it could bring to their shores.

So, knowing what we know, which is the best place to buy and trade Bitcoin in the UK?

Ranking methodology – How we decided which exchanges to consider

Our Top-Ranked UK Crypto Exchanges

When Binance left China and moved its headquarters to Malta, the crypto world took stock, but it wasn’t such big news when they registered in London and Jersey. This is perhaps because these aren’t really offices but addresses required to operate legally in a jurisdiction.

“Money is evolving, it’s time to adapt” was the slogan used by Binance’s marketing campaign across London, which primarily targeted bus stops and showed a physical Bitcoin massively oversizing a £2 coin. There’s some truth to this, as on April 14th, 2021, Bitcoin did overtake the British Pound Sterling to become the world’s sixth-largest currency. However, BTC must be over $61,000 for this to happen, and so GBP retook the lead when BTC later dipped. UK users can expect to see Binance.uk as a more simplified version of Binance, with fewer coins and features, but with greater ease of use and an experience tailored precisely to GBP and EUR activities.

Quick Look

- London and Jersey presences

- 13.5 million-plus users

- 358 coins and 1205 market pairs

- The largest cryptocurrency exchange in the world

- 16 GBP-to-crypto trading pairs

- Currently building a special platform just for UK users

- Instant buying and selling of 65 cryptocurrencies thanks to a partnership with Faster Payments

- Users can buy and sell crypto directly with one another in GBP on the P2P platform

- Offers a great debit card for UK users

When announcing the platform’s development in June 2020, the press release stated: ‘The marketplace will provide access to fast and easy deposits and withdrawals for the buying and selling of digital currencies through direct bank transfers via the UK Faster Payments Service (FPS) and Single Euro Payments Area (SEPA) network. Additional features will include fiat-to-crypto currency on-ramps via debit cards and options for customers to open their own virtual bank accounts, each with dedicated sort codes & account numbers, combined with some of the lowest fees in the market. In addition, verified users will be able to trade spot pairs with deep liquidity while leveraging Binance.com’s advanced trading platform. Up to 65 digital assets are being considered to be available at launch.’

The Best Bitcoin Exchange in UK Trader’s Eyes?

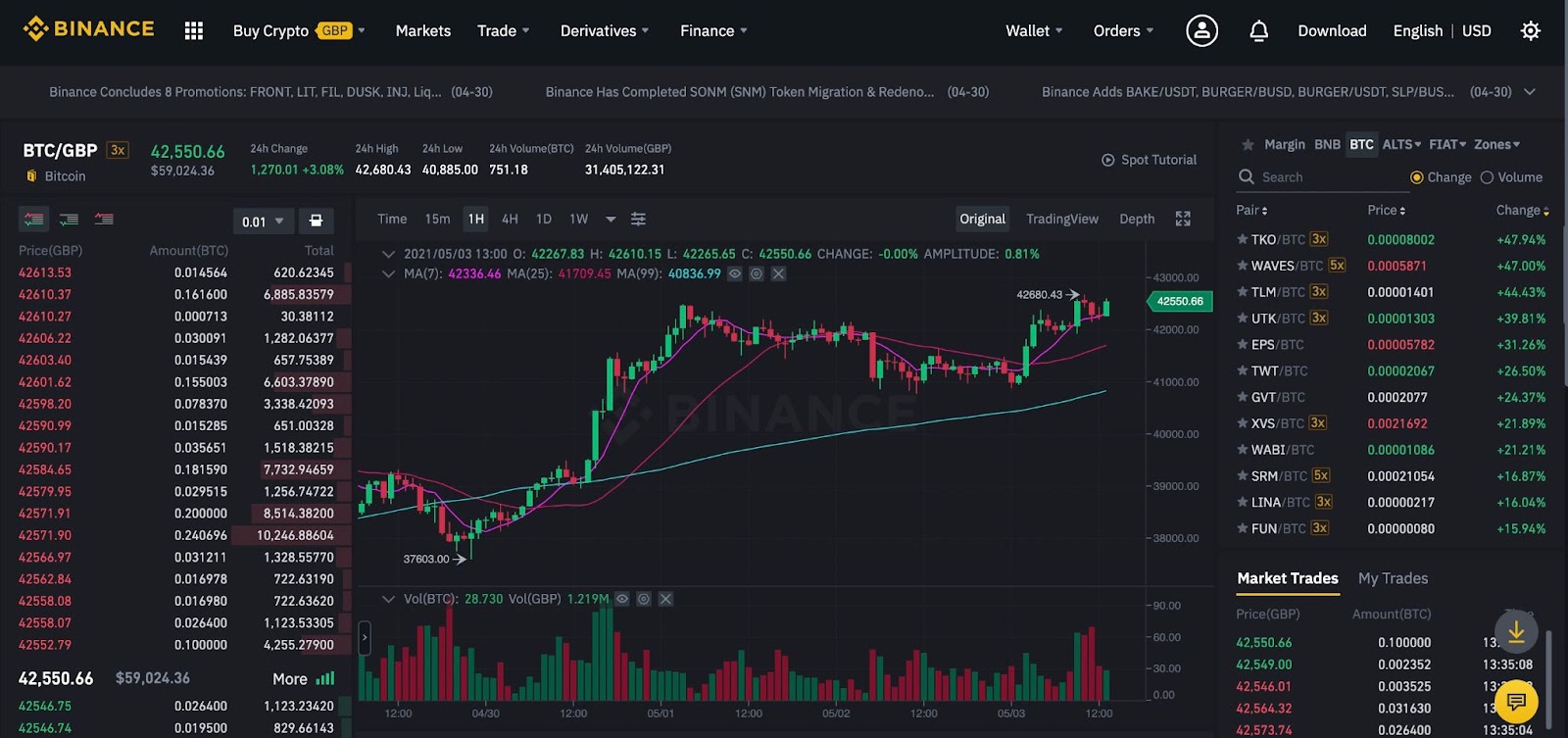

So, moving on to the facts, perks, and advantages of Binance (the original platform), perhaps the biggest appeal for traders in the United Kingdom is the ease of depositing and withdrawing funds and the 16 different cryptocurrencies paired with GBP. In fact, beyond those 16 cryptocurrencies, the platform boasts a total of 358 coins that form 1205 market pairs, far more than their competitors on this list.

When it comes to altcoin diversity, this is the best exchange in the UK. It’s a great Bitcoin exchange, too, with ample liquidity for Bitcoin purchases and sales (around eight times as much liquidity as Kraken!). On top of the liquidity and coin diversity, you also have the lowest exchange fees out of all of our winners, starting at just 0.1% for spot trading and with discounts available for high volume traders (measured monthly) or account holders paying their trading fees in Binance Coin (BNB).

For payment methods, UK traders have the following options:

- Credit or debit card – Visa & Mastercard (3DS enabled)

- Bank Deposit (free if using Faster Payments)

- Third-party payments through Simplex or Banxa

- P2P trading – enables options like PayPal, Revolut, Transferwise (Wise), and more

More than 13.5 million people have signed up to Binance and become traders there, to the point where Binance has far outgrown all of their competitors, aside from Coinbase perhaps. With daily trading volumes often exceeding $50 billion, it’s no wonder the platform is going from strength to strength and creating exciting new products and expansions. The founder of Binance, Changpeng Zhao, even predicts that they could post as much as $1 billion in profit in 2021! On the other hand, Coinbase, with higher fees and more than four times as many users, is expected to make about 30% as much profit as Binance, so we can safely say that trading figures on Binance are much higher. Unfortunately, however, Coinbase does not share their data, so we can’t explore this information.

Binance offers a Visa debit card that allows traders to spend their cryptocurrency, offering a great real-time exchange rate and up to 8% cashback! All you need to do is transfer your crypto from your spot wallet to your card wallet, and you’re good to go. Read more here.

Sign up with UK’s top-ranked Binance.

For those of you reading who have seen The Social Network movie, which depicts the rise of Facebook, you might remember the Winklevoss Twins, who came up with the original ideas for the social media site. They were awarded a relatively large legal settlement for their intellectual property and invested a large portion of that money into Bitcoin. Over the years, the already-wealthy pair into billionaires. It’s a remarkable story, but it doesn’t end there because the twins took their riches and decided to give back to the crypto exchange marketplace and build a new service that would offer the most secure and legitimate place to buy Bitcoin ever seen. Thus Gemini was born — named after the astronomical symbol for twins.

Quick Look

- Payment methods for users in the UK include debit card payments or GBP deposits from your bank account using Faster Payments, CHAPS, or SWIFT.

- Once upon a time, Gemini started as a USD-only platform designed to comply with and overcome tough American financial regulations; however, once it had achieved that, it started opening up to users in over 50 countries and adding further fiat money services.

- Gemini now offers brokerage services (buying and selling) for users with British Pound Sterling, Australian Dollars, Canadian Dollars, Hong Kong Dollars, Singaporean Dollars, and Euros.

- Gemini is now seen as one of the best Bitcoin exchanges in the UK since getting their license to trade under the Electronic Money Regulations.

- Crypto traders in the UK have access to 39 cryptocurrencies and two fiat currencies on their version of Gemini.

- Gemini offers a maker fee of 0.1% and a taker fee of 0.35% for crypto-to-crypto trades on the platform, with these percentages reducing once users trade over $1 million per month. Such a high benchmark for discounts offers an incentive to institutions to use the platform.

- For direct purchases via the website or mobile app, please refer to this fee schedule.

- Gemini is arguably the most legitimate, regulated, and secure exchange globally, with FDIC insurance for USD and banking protection for EUR and GBP funds. They have expert security processes in place to guard against theft, hackings, and human error.

- Gemini has become the go-to platform for businesses and institutions entering the crypto space for the first time, thanks to a wonderful ease-of-use and more financial feel than chief rival Coinbase.

Two minds are better than one in many cases, as is the case for Gemini, after creating a rock-solid and secure foundation in the US. By achieving the highest levels of compliance and jumping over every legal and regulatory hurdle possible, they made an exchange that was perfectly exportable to over 50 other countries where restrictions are less intense.

Transition into the UK Market

One of those 50 countries was the United Kingdom. Since September 2020, users have opened an account, purchased, and traded 39 different cryptocurrencies, with 34 offering staking options. What this means is that you can lock in your crypto for as long as you like and earn rewards for helping to provide liquidity, with the returns offered on some coins as high as 7.4% per year. In addition, if you wish to trade, transaction fees are 0.1% for makers and 0.35 for takers.

Gemini’s venture in the United Kingdom started once granted an Electronic Money Institution (EMI) license, which shows further intent to work directly with regulators rather than trying to work around them! The high levels of licensing and compliance on the platform complement the UK’s regulations, ensuring that GBP and EUR funds for the UK account holders are protected and insured.

Despite allowing GBP services, Gemini still charges for their brokerage service in USD, with prices starting at $0.99 and increasing based on the order size. This means that you’ll have to pay whatever their exchange rate dictates as the cost for fiat currency exchanges.

Gemini Clearly Isn’t Finished

Finally, we’d like to compliment Gemini on the actual design and user interface. It’s tricky for crypto exchange developers to create a friendly, welcoming, and professional product for beginners, day traders, and institutions alike. Most crypto exchanges are way off the mark, but Gemini is spot on, and that makes their rivals anxious. In the future, we hope to see Gemini offer more payment methods, a wider range of cryptocurrency choices, and more unique services for Bitcoin and altcoin traders.

Originally launched in China back in 2017, Gate.io was one of the many Chinese platforms forced to pack up and relocate somewhere a bit more welcoming as the Far East nation clamped down on unregulated companies. Like Binance, Gate.io is headquartered in the Cayman Islands, where crypto tax and regulations are very friendly. However, to comply with US regulations, all Bitcoin exchanges must have a US address. For this purpose, Gate.io is also in Chicago.

Quick Look

- Those looking for a place to trade Bitcoin in the UK will enjoy the immaculately designed trading interface and user investment platform.

- The trading fee structure offers beginners low fees of just 0.2% per trade, with the percentage reducing once users trade over 1.5 BTC per month. Rebates are even available for mega-traders or those who hold a lot of GT tokens.

- British users will be pleased to know that Gate.io has now introduced partnerships with liquidity providers such as Banxa and Mercuryo to sell cryptocurrencies directly via debit or credit card transactions.

- New account holders will be able to trade, deposit, and withdraw cryptocurrencies up to a certain amount without going through KYC checks. Those who want to lift restrictions will need to go through an ID verification process and give up some personal information.

- At the time of writing, Gate offers more than 680 cryptocurrencies and 1,275-plus trading pairs.

- Account-holders have the option not only to buy Bitcoin with their USDT but instead to stake different cryptocurrencies for a financial reward.

- With such a vast range of altcoins comes more market risk, with the lesser-known coins presenting much more volatility.

The Most Diverse of all Bitcoin Exchanges

So, what makes Gate.io stand out and be worthy of a place amongst the best crypto exchanges in the United Kingdom? Well, the biggest factor is the huge diversity of cryptocurrencies. Of the 300+ cryptocurrency exchanges operating globally, Gate is third on the list regarding the number of altcoins listed, which presents a huge opportunity to altcoin hunters who want to exploit the increased volatility and unpredictability of lesser-known projects. Furthermore, the 680+ cryptocurrencies offered on the platform are more than Binance, Gemini, and Kraken combined to put things into context!

Over the last couple of years, we’ve seen Gate climb from relative obscurity to become one of the frontrunners in the cryptocurrency exchange industry. They’ve done that through some pretty savvy decision-making. One decision was to allow users to trade without a KYC check, meaning those who valued their privacy and anonymity could deposit, trade, and withdraw up to $100,000 in USDT each day. To remove this limit, users would have to voluntarily give up personal details and go through an ID verification process (it’s unclear how many do this, especially as there are no fiat services to bend to). This kind of privacy trading is perfect for altcoin hunters who want to dabble and experiment without making a big commitment. Let’s not forget, too, that Gate’s iOS and Android mobile platforms offer account holders a perfect handheld route towards trading cryptocurrency with great ease.

Another reason for Gate’s success is the staking service called HODL&Earn, which features a merry-go-round of staking products that chop and change weekly. This keeps users on their toes about the exciting ways to earn interest through their crypto holdings. Beyond staking, many Gate members are pretty pleased with the GT token system, which allows for reduced trading fees of about 25%. In addition, a tiny section of traders, in particular those trading over 40,000 BTC or 50,000 GT per month, can unlock negative fees (rebates).

British traders can now purchase many cryptocurrencies directly through the Gate.io platform and remove the need to sign up on multiple trading platforms. In addition, debit and credit card transactions are permitted thanks to Banxa, Mercuryo, and Simplex, with the purchased crypto being delivered quickly to your crypto wallet.

What is ‘Faster Payments’ and why does it benefit British Traders?

Each of the four Bitcoin exchanges in this article uses a payment system called Faster Payments, which is used only for GBP deposits. Thanks to this service, these crypto exchanges can guarantee same-day deposits and withdrawals free of charge. Whether it’s wire transfers, Simplex, or bank deposits, there’s no other country or service that can get the same deposit speed, and for free, as British traders. The Faster Payments service is, however, only for UK residents. Non-UK traders can still engage with the GBP-to-crypto trading pairs, but they won’t be able to make deposits and withdrawals in GBP.

There you have it. Our top-rated UK exchanges. Each exchange has a lot to offer, so we wish you the best of luck out there.