Coinbase vs Bitfinex: Both Excellent – Which is Right for You?

Welcome to our Coinbase vs Bitfinex comparison, pitting the world’s most popular crypto-broker, Coinbase, against one of the oldest and most established cryptocurrency exchanges in the marketplace. In this piece, we will explore their fees, how to sign up, how you can buy crypto and deposit money, how secure they are, throwing in some insightful facts along the way. Let’s go!

Fees

Coinbase – Convenience Is Costly

Constantly rising in popularity, Coinbase has become the go-to entry point for beginners who want to purchase their first digital assets. Operating primarily as a broker, they sell dozens of different cryptocurrencies with comparably high fees and a straightforward process.

Here’s the critical breakdown of their fees when purchasing crypto directly. Note that you will pay the greater of condition one or condition two:

Condition one states a flat fee for transactions under $200:

- $0-10 – fee: $0.99 | €0,99 | £0,99 | C$.99

- $10-25 – fee: $1.49 | €1,49 | £1,49 | C$1.49

- $25-50 – fee: $1.99 | €1,99 | £1,99 | C$1.99

- $50-200 – fee: $2.99 | €2,99 | £2,99 | C$2.99

Condition two states that bank transfer purchases will incur a 1.49% charge, and debit or credit card purchases will charge 3.99%. The math is that 1.49% of $200 is $2.98, and so the 1.49% bank transfer cost doesn’t kick in until the purchase is over $200. Equally, the 3.99% debit or credit card fee will always be greater than the fee for condition one.

What other Coinbase fees should you know about?

- The spread is the difference between the current market price and what a broker is selling the crypto for; in Coinbase’s case, their 0.5% spread is relatively low.

- Coinbase is not an exchange that allows you to trade with other users (see Coinbase Pro for that), but you can trade crypto-to-crypto for a 2% fee.

- Crypto withdrawals to external web wallets are free on most platforms, but Coinbase charges 1%.

Bitfinex – Responsibly Low Trading Fees

Unless you’re planning on trading more than $500,000 worth of cryptocurrency per month, the essential fees you need to know are the 0.1% maker fee and the 0.2% taker fee.

A maker adds liquidity to a cryptocurrency exchange by placing an order above the current market price. In contrast, a taker takes liquidity from an exchange by purchasing at the current market price. Exchanges typically prefer makers, as liquidity makes them look good, so makers are rewarded with lower trading fees (both fees are meager compared to Coinbase’s 2% trade fee).

Bitfinex also has its own cryptocurrency, known as a ‘utility token,’ which helps them run the exchange and, if held in enough quantity, can help you get a 25% discount on trading fees.

Bitfinex’s fees for their different trading services can be found here.

Winner: Bitfinex.

Sign up and KYC experience

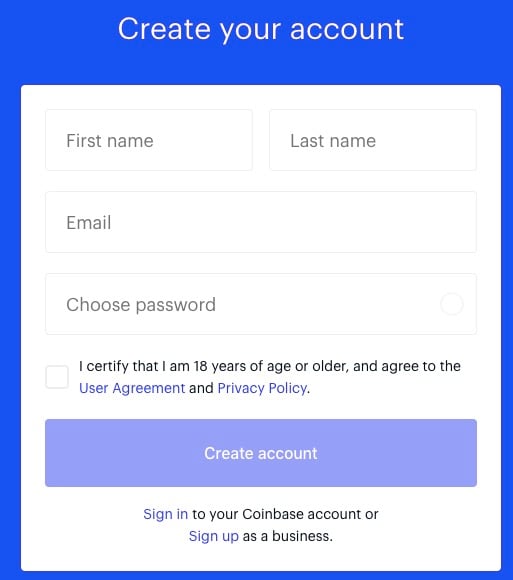

Opening An Account On Coinbase

Readers who are new to the cryptocurrency world signing up for a broker or exchange service will have to provide some personal information and photos of your documents. This is known as KYC – Know your Customer, which is part of crypto companies’ Anti-Money Laundering (AML) obligations.

Here’s how to open and verify your Coinbase account:

- Head over to Coinbase.com and click the ‘Get Started’ button.

- Fill in the form, giving your name, email address, password, and country of residence.

- Accept the terms and conditions and head over to your email client (Gmail, Hotmail, Apple Mail, etc.).

- You will receive an email from Coinbase asking you to click the email verification link.

- On the page that opens, enter your password again.

- Now, provide a telephone number and type in the 7-digit code that you receive by SMS message on your phone.

- Next comes the KYC procedure, so provide:

- Your name

- Date of birth

- Home address

- Reasons for joining Coinbase

- Source of funds

- Occupation / Employment

- Employer name

- Last digits of your Social Security Number (US only)

- Go back to your email client and find a link to verify your identity documents. Using web or mobile, you will take photos of your identity documents front and back and a selfie for facial verification.

- Now, wait for confirmation, and then you will be able to purchase cryptocurrencies on Coinbase.

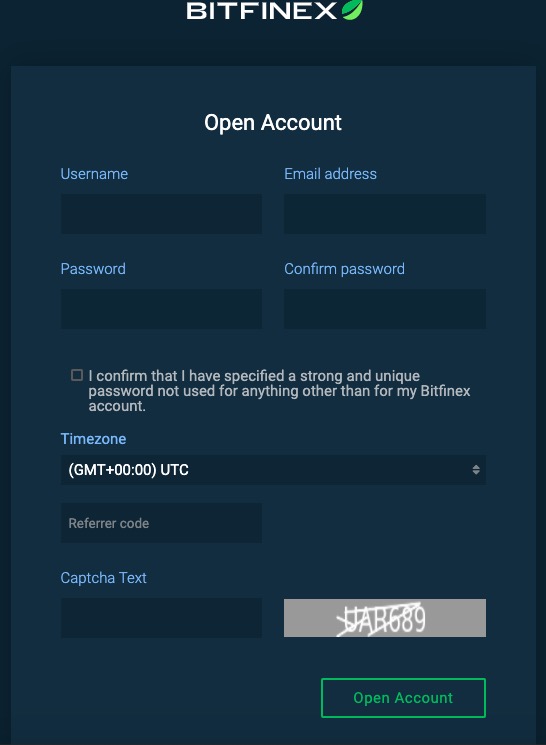

Becoming A Bitfinex User

Let’s get you signed up on Bitfinex:

- Head to Bitfinex.com and click ‘Open Account.’

- Provide a username, email address, and a secure password.

- Go to your email provider and click the link in the email from Bitfinex to verify your email address.

- In the new window, log in with your username and password.

- Once logged in, you will need to verify your ID. Find the verification option in your user area and provide your:

- Name

- Age

- Contact details

- Address

- Two forms of Government ID (submitted via mobile or webcam)

- A selfie holding your ID

- A bank statement

- Proof of your residential address (like a rental contract)

- Confirmation can take up to three days.

In the meantime, Bitfinex offers some pretty robust security options that you can apply even before your verification is confirmed, such as:

- 2-Factor Authentication

- Blocking withdrawals from new IP addresses

- A withdrawal confirmation phrase

- PGP mail encryption

Scroll down to ‘Deposit Methods’ to find out how to deposit fiat currency onto Bitfinex or ‘Instant Buy Options’ to purchase cryptocurrency directly from them.

Winner: Bitfinex. We like the offered security enhancements.

Ease of Use & Feel of Website/App

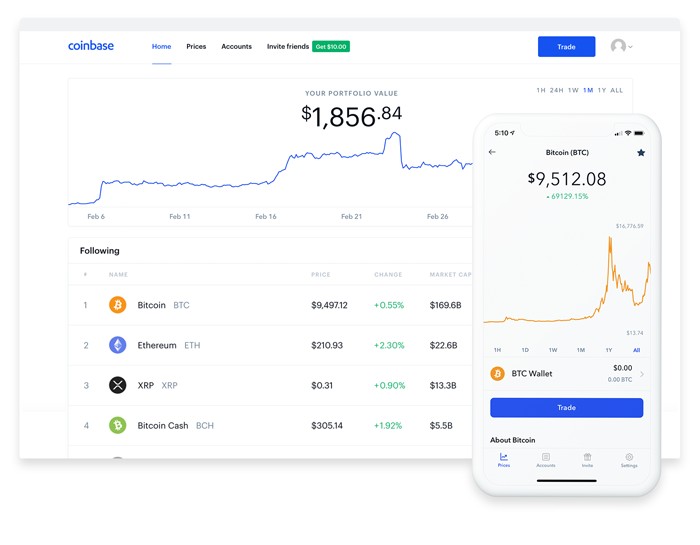

Coinbase- ‘As Easy As Online Shopping’

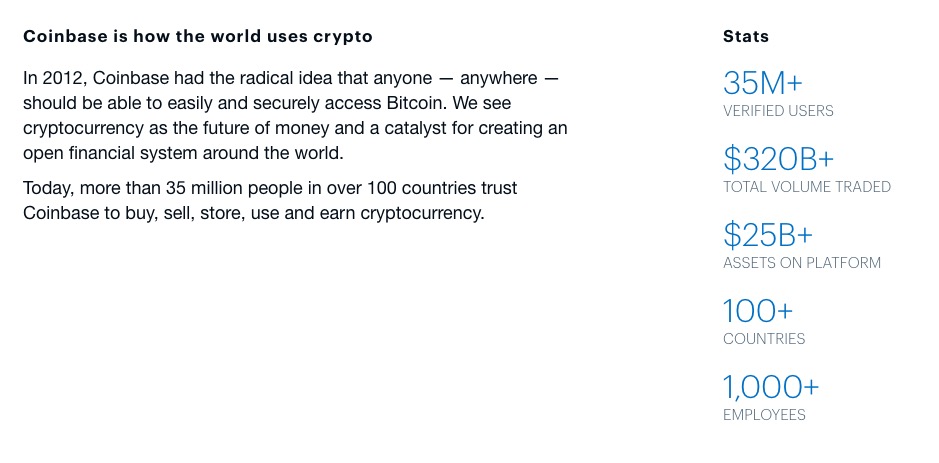

It’s fair to say that Coinbase is in a league of its own when it comes to brokering crypto. No other brokerage service can claim to attract and have attracted more novice crypto-enthusiasts than Coinbase, who boast more than 35,000,000 verified accounts. The reasons for this A+ popularity and how they’ve become best-in-show is through a clean user interface and user experience. What was once a frustrating and confusing process of buying crypto is now as easy as online shopping.

They deserve a round of applause.

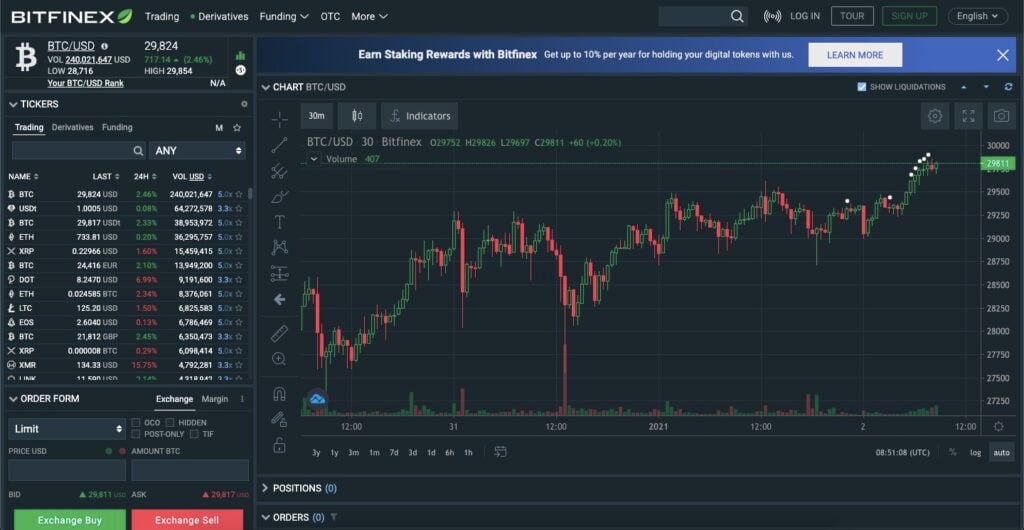

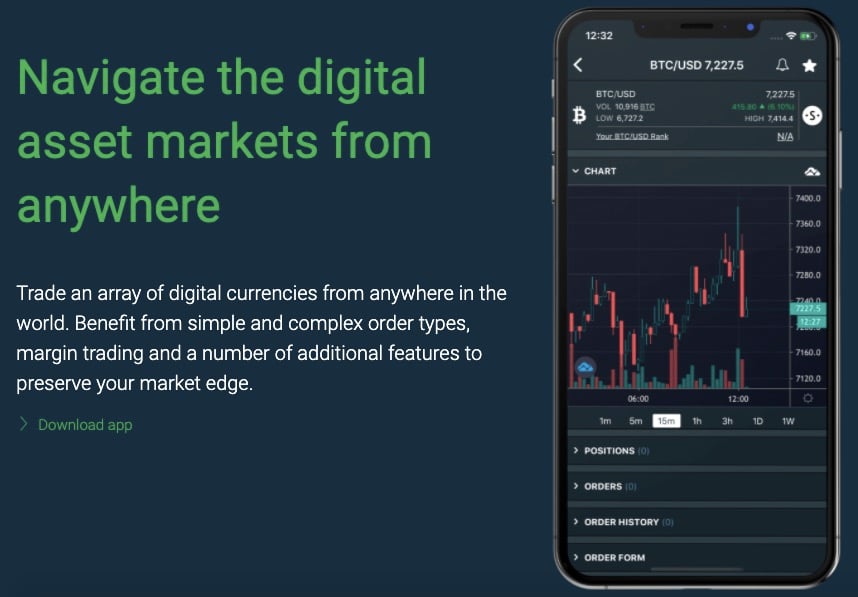

Bitfinex – Get To Grips With Trading Quickly

That rapturous ovation for Coinbase isn’t to say Bitfinex UI and UX are terrible; in fact, it’s hard to compare because Bitfinex’s primary function is running a cryptocurrency exchange (although you’ll see in the next section that they are also a broker). Bitfinex is the sort of exchange where you go once you already have your crypto because it is a reliable, fast, and well-reputed exchange that professionals, institutions, and beginners can all quickly get to grips with. Sadly, hackers are also quite fond of Bitfinex, but we’ll cover that later.

We like to mention one feature because not many exchanges care to develop: their demo account, or rather, their ‘Paper Trading Account’ feature. Learn the platform and test out your strategies with imaginary funds before putting your own money in and mitigate your own risk in the process.

Note: Customers in the US are not permitted to trade on Bitfinex in any way, shape, or form. Sorry guys!

Winner: Coinbase. Ease of use is what attracts millions of would-be traders to Coinbase each year.

Deposit Methods

Coinbase – 30+ Currencies Accepted

Since Coinbase doesn’t allow you to interact with other users, it doesn’t make much of a difference to them whether you deposit money and buy crypto or purchase crypto directly via bank transfer, debit, or credit card. That’s perhaps why they have some great deposit options around the world, for more than 30 different currencies, including:

- US – Wire transfer, Bank transfer (ACH – free), Bank account connection

- Europe – SEPA (free), iDEAL, Sofort

- UK – Bank transfer, SWIFT

- Global – Cryptocurrency or digital asset transfer

In other countries outside of Europe and the US, search in Coinbase’s help section to determine your country’s specific deposit method or currency. If your primary currency is the US dollar, read this.

Bitfinex – Massive Minimum Deposit Limits

While Coinbase is pretty easygoing on deposits, Bitfinex most certainly is not. Unless you’ve got 10,000 USD, EUR, or GBP, or 1m JPY to deposit, the platform will not accept your worthless scraps of tender. They argue that removing small deposits increases overall security, but we suspect that diverting users to make direct purchases with better commission rates is the game at play.

With a considerable amount to deposit — above the mentioned minimum limits — this is done by wire transfer for just 0.1% + €0.60, a pretty reasonable sum.

Oh, and crypto deposits aren’t charged.

Winner: Coinbase.

Instant Buy Options (Buying with credit or debit card)

Buy Crypto Right Now on Coinbase

Debit and credit card purchases vary by region, but it’s easiest to simplify by saying that US users are no longer allowed to use credit cards, but in the meantime, European and UK users still are. Debit cards are viable with instant purchases by all verified users, as long as the local currency is accepted.

As mentioned in the fees section, credit and debit cards incur 3.99% and 1.49% fees, respectively, with debit card fees kicking in for purchases over $200 in value.

International Coinbase feature restrictions, as well as a list of the cryptocurrencies available for direct purchase, can be seen here.

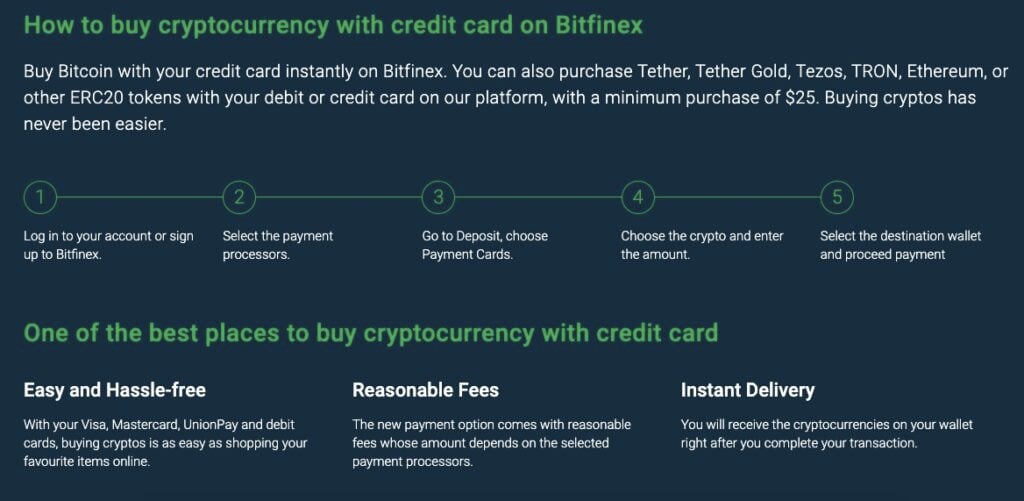

Making An Instant Bitfinex Purchase

So, let’s assume you’re not trying to put $10,000 into crypto on your first day in the business and that you’re just testing the waters and looking for an exchange to use. Is that closer to the mark? So, the good news is that credit card purchases allow a minimum purchase of just $25 for verified users.

Direct purchases can be made for these cryptocurrencies:

Bitfinex’s fees are not very transparent, so we don’t know how much they will charge you, as there is a complicated algorithm that decided the fees as opposed to a fixed percentage.

Winner: Bitfinex.

Trading Experience

Trading On Coinbase?

Since Coinbase’s trading experience is done entirely with them, and not with other traders on an exchange, how does it differ, and is it any good? Well, yes, it’s pretty good if you overlook the 2% commission, which just about compensates for the convenience of being able to instantly convert about 50 different cryptocurrencies (fewer in the US). Other services with instant conversions often cost a lot more, so this isn’t bad. If you are looking for a place to trade your Coinbase wallet holdings with other users, you’ll want to check out Coinbase Pro.

Bitfinex Appeals To The Masses

We have to commend Bitfinex on the fact that they’ve built a brokerage and exchange that do an excellent job of appealing to users of all levels of experience, as well as institutional traders. The platform is made with a great deal of logic, and one of the best features for beginners is that they can find the market pair they want to trade before they enter the trading view. Once you click the pair and arrive in the order form, all you need to do is enter the trade’s size and price. Having a ‘Market Order’ button is something every exchange should include, but many fail to, and what this button does is allows you to make a trade at the current market price so that it transacts immediately.

Trading on the app is pretty straightforward. If you can make trades on the web platform, you won’t have much trouble using the app, which is a simplified replica.

Winner: Tie. Both are very good, yet very different.

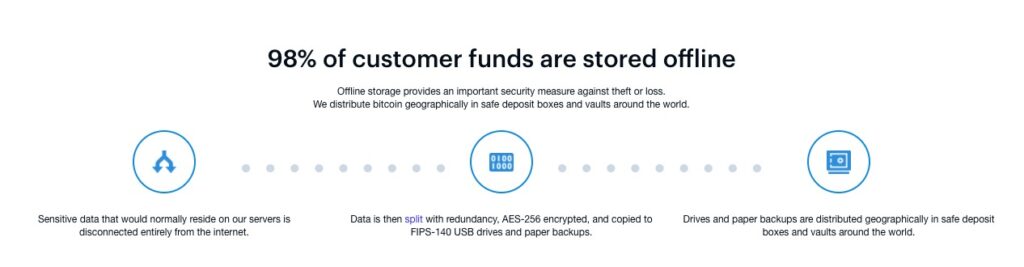

Reputation & Security

Coinbase’s Gold Star

Give a round of applause to Coinbase. Their management and security team are yet to be hacked or compromised. How many brokers and exchanges can make the same claim in 2021? Your funds are pretty secure on Coinbase, though we would always advise you to get an external wallet for improved security.

Along with an excellent security reputation, Coinbase is the leading example of how ultimate convenience and user-experience can be the winning ticket when it comes to attracting first-time buyers in the crypto-sphere.

Bitfinex Wooden Spoon

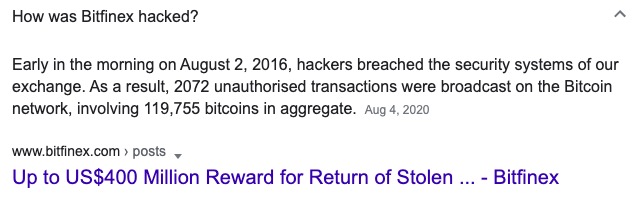

We feel a little bit sorry for Bitfinex, as their 120,000 BTC hacking — worth several billion dollars now — makes them the second-biggest exchange hacking victim ever. But our pity party stops there because where Mt.Gox (the biggest hack) completely crumbled and became a cautionary tale of the past, Bitfinex managed to overcome this adversity and recover from what should have been a fatality. With strengthened defenses and new procedures, perhaps it’s time to trust them once again.

Winner: Coinbase.

Coinbase vs Bitfinex: Who wins?

With Coinbase at fourth and Bitfinex fifth in our list of the best cryptocurrency exchanges, we’ve decided that the winner is Coinbase, but barely. Now, for almost all purposes other than trading with other users, Coinbase is your winner. But if you want to make a start in the cryptocurrency day-trading game, Bitfinex is an excellent option for you. Coinbase’s increased security, beginner-targeted platform, and abundance of international payment options make it the reason for many of our readers.