The Simplest Guide to Crypto Liquidity (EVER!)

Liquidity in the cryptocurrency world is something that many beginners overlook simply because it appears complicated at the surface level. So let’s undo that notion together, ok?

With the help of this resource, the Simplest Guide to Crypto Liquidity (EVER!), you’re going to familiarize yourself with:

- What liquidity is

- Why it’s good for you, your trades, and the market

- What factors affect it

- How to find good liquidity

You will not be learning about the more complicated stuff, such as liquidity pools and liquidity mining, so don’t worry about those for now.

Don’t let jargon put you off!

Liquidity: A Gentle Introduction

Liquidity is the degree of ease with which you can quickly buy or sell an asset without affecting its price stability. It is also about how smoothly you can convert one asset for another.

Let’s take cash, for example. Cash is perfectly liquid, and all other assets shall measure against cash. Cash has perfect liquidity because you can immediately use it to purchase goods and services on any readily-available and open market.

The alternative would be an asset that is not traded regularly and traded privately. Due to this, there are significant price discrepancies, and transactions are slow and irregular. They’re less liquid than cash, cars, art, and houses, right?

Simplest:

- The easier it is to turn an asset into cash, the better its liquidity

- The harder it is to turn an asset into cash, the more illiquid it is

Pure, unadulterated liquidity, in the green flesh

What is Liquidity in Crypto?

In every market, there are liquidity providers. Forex, Futures, Commodities, CFDs – they all have liquidity providers who keep a readily available supply of assets in circulation. They’re essential. Without them, the market would be slow, awkward, and irregular.

Liquidity in crypto demonstrates the level of ease that an asset can be bought or sold by an investor.

Low liquidity = high volatility. But why? If there is a shortage of something, the supply is low, making it vulnerable to large changes in the asset’s price. If there is an abundant supply or something (high liquidity), it means the price is stable, and your transaction won’t typically affect the price.

Simplest:

- The easier it is to turn a cryptocurrency into a fiat currency (USD, GBP, EUR, etc.) or another cryptocurrency, the better its liquidity

- The harder it is to turn a cryptocurrency into a fiat currency (USD, GBP, EUR, etc.) or another cryptocurrency, the more illiquid it is

Why is High Liquidity Good for You and the Market?

Prices are Fairer and more Stable

Many buyers and sellers work together to create a reasonably priced marketplace liquidity. The thing is, they don’t realize they’re doing it; this is because everyone is trying to remain competitive in real-time in a place of large activity volumes.

Sellers want the highest price, and buyers want the lowest price. For this same reason, Forex markets fluctuate far less than cryptocurrency markets, because typically the volume of traders and trades is much higher, and the price movements are more fractional.

This same mechanism creates not only fairer prices but more stable prices too. Of course, you might see cryptocurrencies gaining 100% value in a day, or losing 40%, or even more drastic percentages than those. That’s typical because of ‘Whales.’ A Whale is someone who has a disproportionately large amount of an asset.

Not these kinds of Whales!

Imagine our Whale is Elon Musk, and he takes $100 BILLION and trades it for Russian Rubles – do you think the prices would change? Of course, they would! That’s a lot of money! However, the price change would be small due to the enormous amount of both currencies in circulation. There’s $40+ trillion in circulation, so that hypothetical $100 billion is just a speck (0.25%).

In the cryptocurrency market, it’s much easier for Whales to create these large price swings simply by moving vast amounts of cryptocurrency. It’s even easier to do with coins that have low liquidity. High liquidity coins, by contrast, can better fight Whale movements and withstand the substantial price fluctuations.

Simplest:

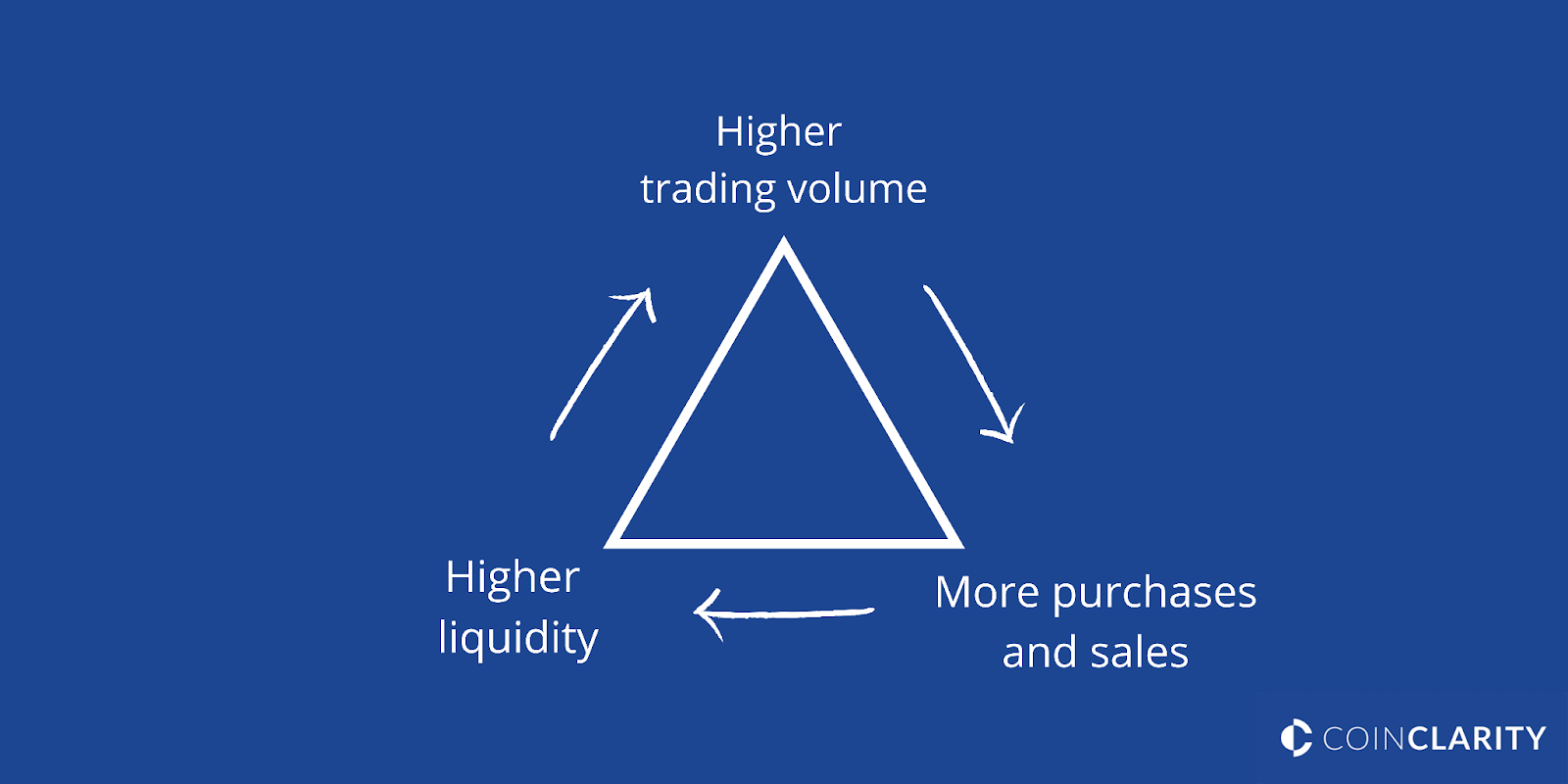

- Lots of activity = lots of liquidity

- Lots of liquidity = lots of stability

- Lots of stability = fair pricing

- Fair pricing = lots of activity (and the loop continues)

Faster transaction times

When there’s higher liquidity, it means there’s a lot of activity, which means the market is perfect for making your purchase or sale. Due to the increased activity and the competing buy and sell prices, you will be able to fulfill your order immediately.

In the opposite scenario, there’s low liquidity, not much activity, and a wide gap between the price sellers want to sell at and the price the buyers want to buy. In this case, it will take a while for the gap to close and your orders to be executed – not ideal if you’re regularly trading.

Simplest:

- High liquidity = faster transaction times

- Low liquidity = slow transaction times

An instant transaction

What Factors Affect Liquidity?

Here’s a simple explanation for what affects liquidity. Some of these we’ve already mentioned:

- Trading Volume – Trading volume is the primary factor. In crypto, trading volume is typically measured in 24-hour periods and shows how often it is trading.

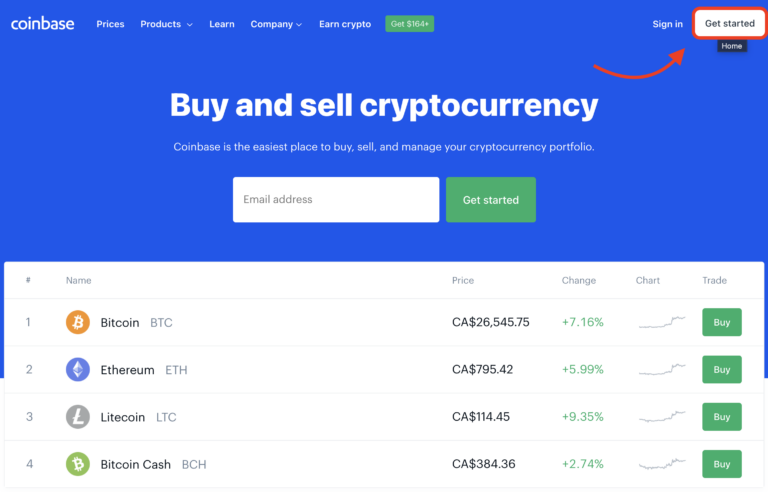

- The Cryptocurrency Exchange – Example: Binance is the most significant and most-used exchange globally, with daily trading volumes usually of more than $20 billion. CEX.IO is a fairly small (but very reliable) exchange that handles around $25 million per day. Which exchange do you think offers better liquidity to users?

- The Coin – Tether (USDT) has the highest liquidity globally, with over $70 billion USDT often changing hands (or wallets) in a single day. DeFi token NXM (NXM) only moves around $15,000 worth of coins on average each day – does this offer good liquidity? Probably not, although all of the liquidity is in just one trading pair on a single exchange

- Mass Adoption – If we say that cash has perfect liquidity because you can use it to buy goods and services instantly, then the way for cryptocurrencies to improve their liquidity would be to do the same, right? Hundreds of thousands of vendors and some massive businesses accept crypto, but it’s still a tiny percentage. As more merchants and vendors worldwide accept crypto en-masse, its liquidity will improve. Governments, like El Salvador’s, embracing crypto is a huge forward step

- Regulations – The rules and laws regarding crypto vary massively from country to country, and for that reason, liquidity is a national consideration as well as an international one. Specific cryptocurrencies are banned in the US, damaging their liquidity there, making it hard for people to buy and sell. The same goes for China, India, and Russia, where governments are anti-crypto – but people still invest and trade without their government’s support, guaranteeing liquidity issues. If the governments do a good job of enforcing their bans, buyers and sellers must work privately, in secret, or on specialist networks, where prices are typically high because liquidity is usually low

Simplest:

- Loads of things can affect crypto liquidity, which is why this new and emerging industry is particularly volatile

Where to Find the Best Liquidity?

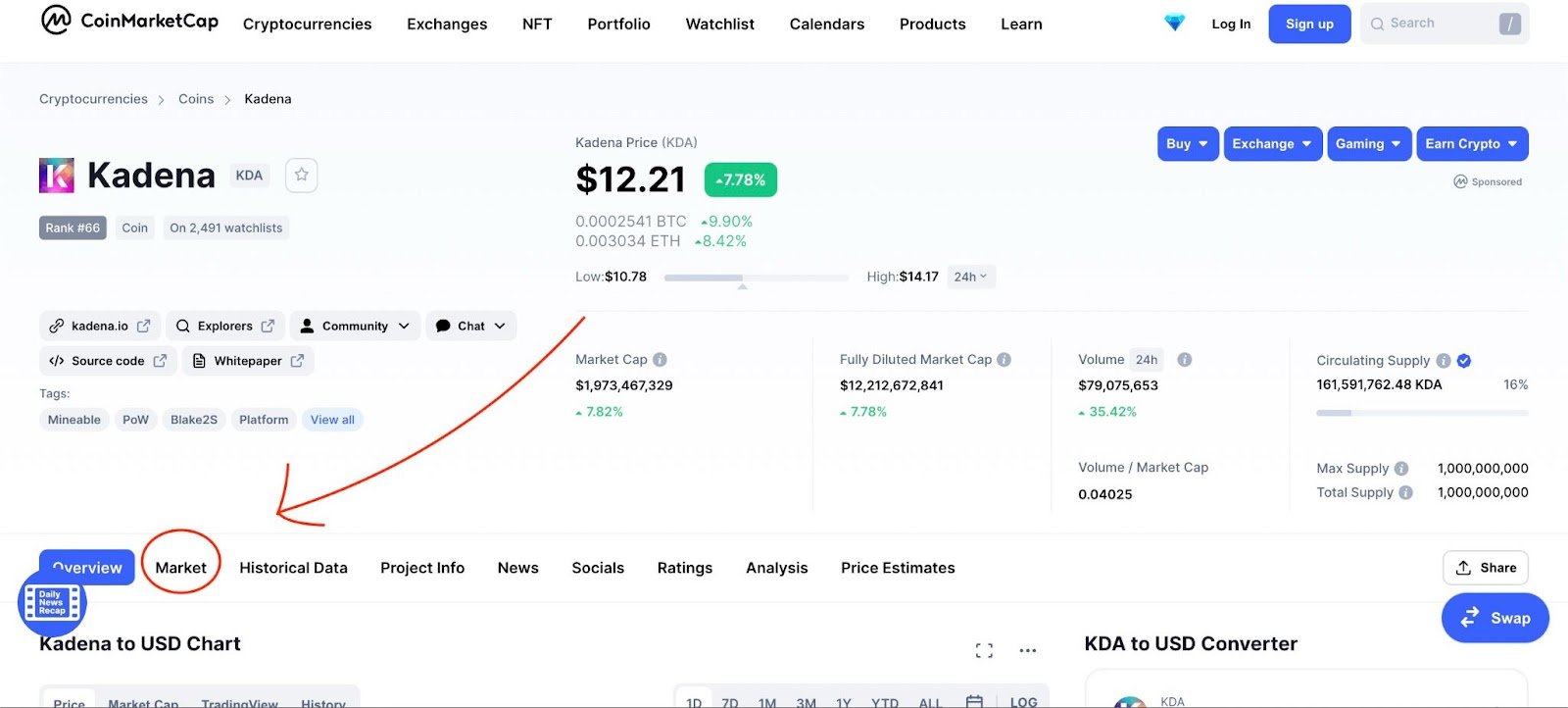

The best data centers for crypto are Coinmarketcap and CoinGecko, which make it easy to see where to find the best liquidity.

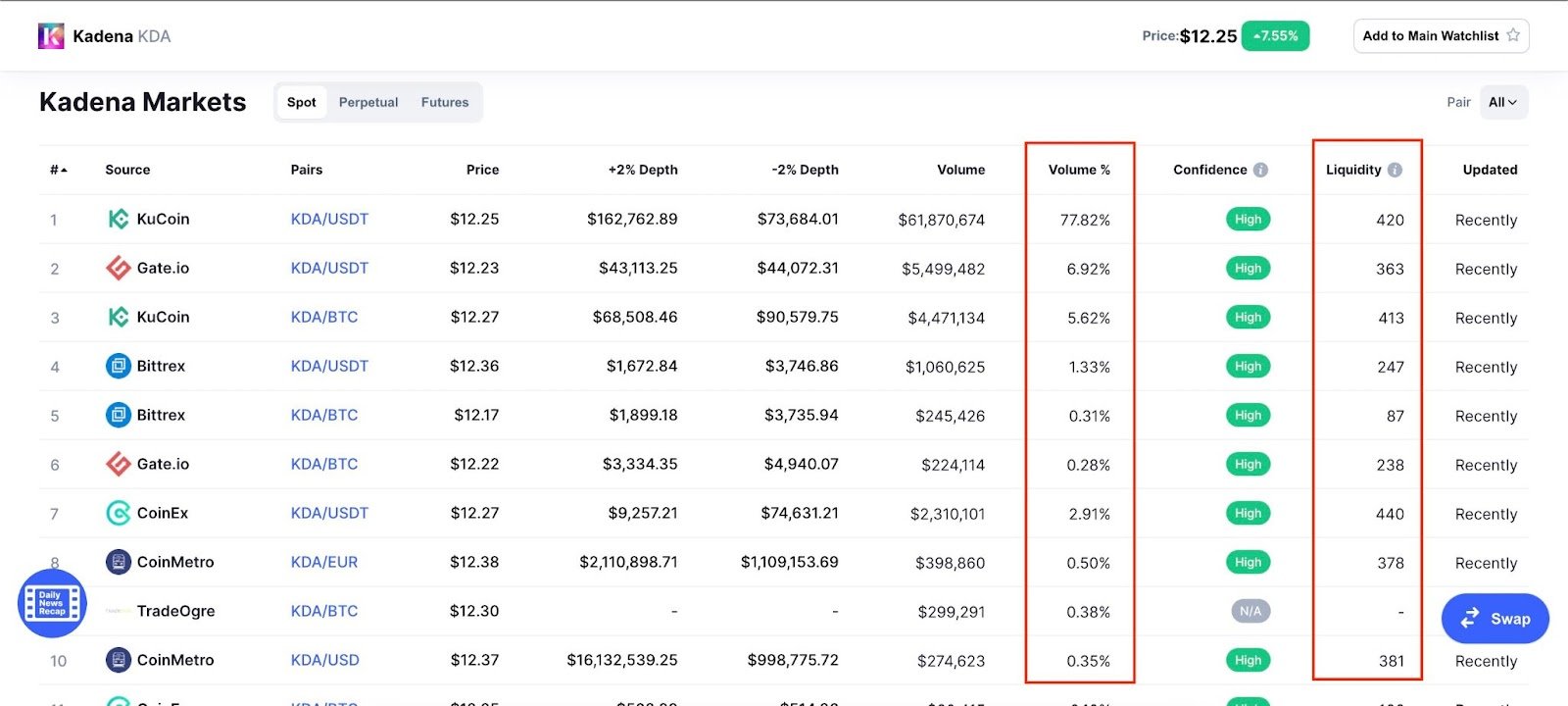

We’ve picked a random coin called Kadena (KDA) to help provide an example. On Coinmarketcap, we search Kadena and go to the coin’s page. We then find the tab labeled ‘Market’ and go there.

On this page (see below), all of the indexed market pairings for Kadena are shown. The most critical columns (marked red) are ‘Volume %’ and ‘Liquidity.’

Volume % tells you how much the coin’s overall supply within that market pairing. In this case, we can see that 77.82% of all active Kadena coins can be found on KuCoin, in the KDA/USDT pair, suggesting that there is excellent liquidity to be found there.

In the liquidity column (see above), we can see that Gate.io has a high liquidity score of 238 for KDA/BTC, and CoinEx has a liquidity score of 440 for KDA/USDT, despite these pairs having 0.28% and 2.91% of the Kadena volume % respectively. How can this be? Remember that liquidity is about how easy it is to buy and sell your asset at your desired price, so, in this case, CoinEx must have a lot of orders on the order book and minimal slippage*.

*Slippage is a term used to define the discrepancy between the price requested and the price at the execution of a trade. The difference is due to a movement in the asset price at the time of order and the time of execution. It can be very costly for regular traders and Whales.

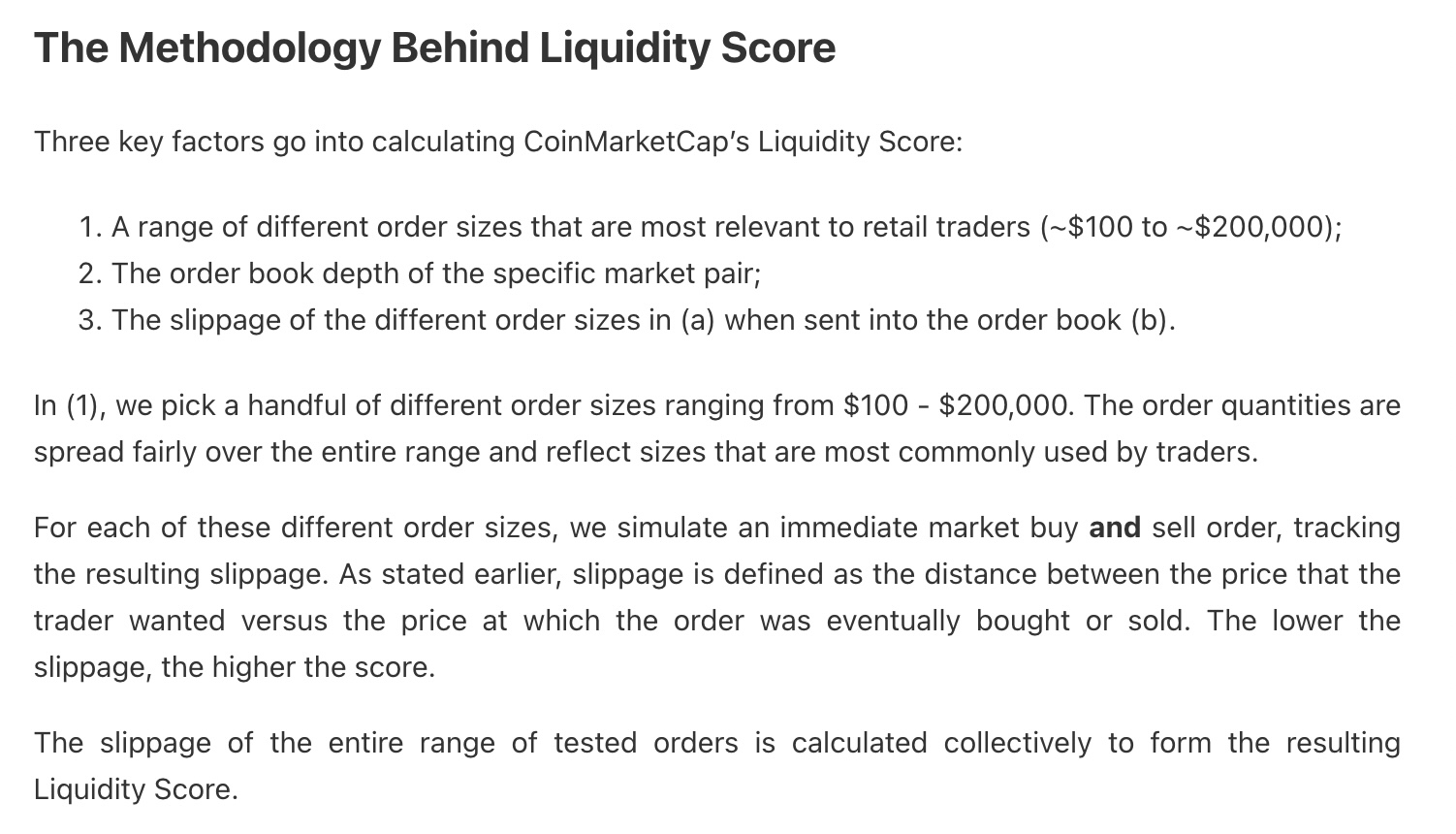

What is a Liquidity Score?

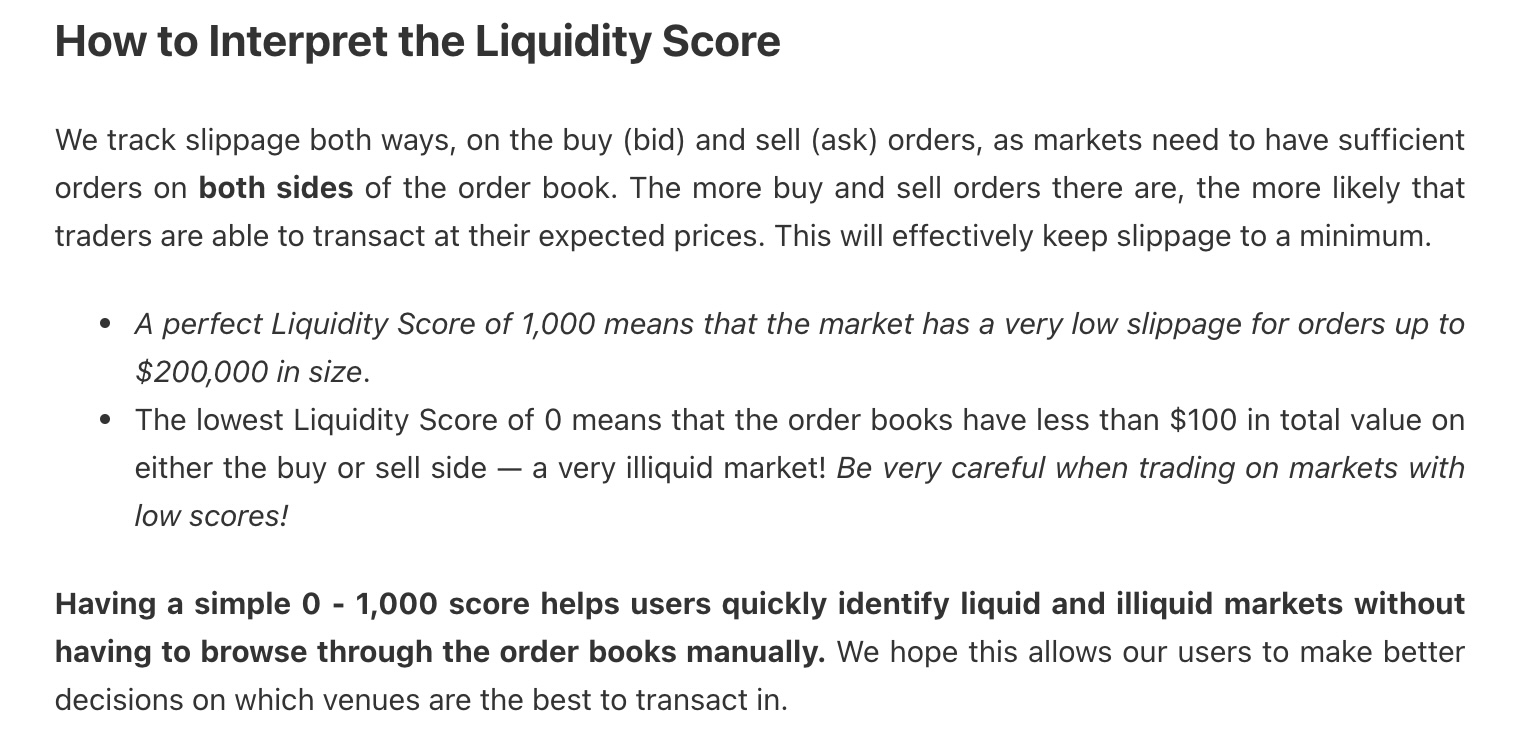

Below, we’ve included Coinmarketcap’s explanation of their liquidity score, which is something used only on their site and to the benefit of their users. It is not a metric that cryptocurrency exchanges use; even CoinGecko does not offer it. Instead, they use a traffic light system to suggest whether liquidity is reasonable, fair, low, or unknown.

Coin Clarity: We are big fans of the liquidity score and using it to

find the best place to buy and sell particular cryptocurrencies

Now you’ve read Coinmarketcap’s methodology, and this short interpretation guide will help further digest how to use the number:

Simplest:

- High liquidity score = good place to trade

- Low liquidity score = bad (unreliable) place to trade

Simplest:

- High liquidity score = good place to trade

- Low liquidity score = bad (unreliable) place to trade

Conclusion: Is Liquidity Something to Worry About?

Not really. It’s something to know about. Like market capitalization, circulating supply, coin price, and trading volumes, it’s part of a larger puzzle of information there to help you make educated investment decisions. Finding good liquidity is essential to help you trade quickly, which gives beginners more confidence – waiting around causes impatience and FUD (fear, uncertainty, doubt).

Tell us honestly, did we explain liquidity as simply as possible? If not, let us know what you need further clarity on, and we will update this article.