Best Crypto Exchanges in the USA

Howdy! We want to send our deepest condolences regarding the massively unfair crypto exchange situation we are faced with. With major exchanges barring their doors to us, the selection at our disposal is limited. Despite being dealt a bad hand, there are a few solid options we can rely on. Who needs those other exchanges anyway? Not us, not the US!

Are you an American in the same boat? Then, join us as we present the best crypto exchanges in the USA. To avoid any bias, we’ve added our ranking methodology below to give further assurance about which crypto exchanges American traders can use in the US, despite the incredible levels of financial regulation.

Ranking methodology – How we decided which exchanges to consider

Our Top-Ranked USA Crypto Exchanges

In 2004, Cameron and Tyler Winklevoss sued Mark Zuckerberg for stealing their ConnectU idea, later becoming Facebook. In 2008, the lawsuit finished, with the twins receiving around $65 million in a settlement. Of this $65m, they used $11m to buy Bitcoin, which, at the time, got them around 1% of the total circulating supply. As the market price of Bitcoin rose, they sold off chunks here and there (to fund Gemini’s development), and by 2018, they were officially Bitcoin billionaires. After first launching a Bitcoin trust to protect their assets, the twins began building Gemini in 2015, fulfilling their vision of the ideal cryptocurrency exchange. Gemini’s 2016 launch was met with great reception, and it has become one of the best cryptocurrency exchanges in the USA, thanks to its core principles. Loyalists may even say it’s the best crypto exchange in the world if what you’re looking for is risk-averse trading.

Quick Look

- More than 40 different cryptocurrencies available to purchase directly

- Credit cards are accepted (Visa, Mastercard, and American Express)

- Gemini is a USD-only platform tailored for an American audience; however, those from most crypto-friendly countries around the world are welcome to use it

- The fee schedule is based on the size of the order rather than monthly trading volume, as is typical with other exchanges

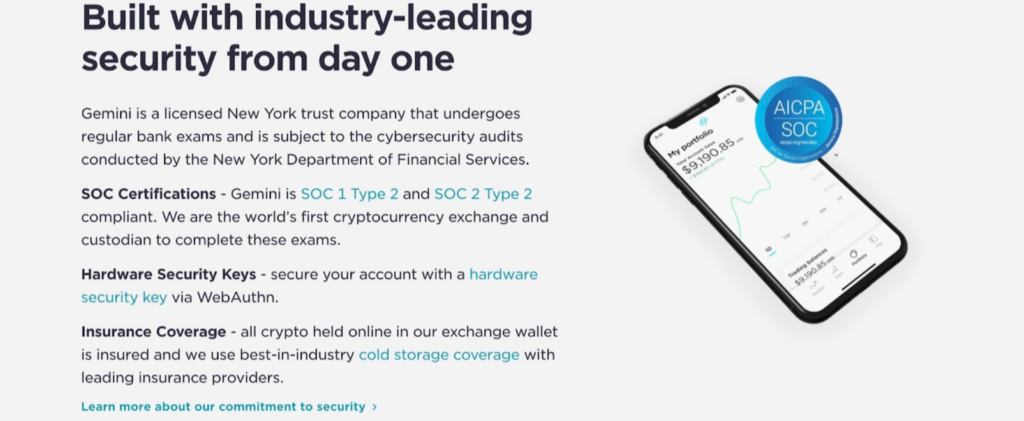

- This is the most legitimate and regulated exchange globally — even users’ funds are insured against hacking

- The platform boasts 38 coins and 58 trading pairs

- Tough US banking and security laws are too much for some exchanges to handle, but not Gemini; they are fully compliant and proud to have never been hacked

- Tied for ease of use with Coinbase. By removing all of the complicated parts of trading, you are left with a very straightforward interface, both on the web and mobile

- US customers will be pleased to know that Gemini is now permitted in all US states

- More suitable for a beginner in their crypto exchange search than the other winners in this article

Legitimacy, security, regulation, safety — these are the sort of things that the Winklevoss twins set out to achieve. They wanted a fully compliant exchange, fully regulated, and that the US financial sector could not have any doubts about. They succeeded. Gemini is the only available exchange in its entirety in all US states (Coinbase isn’t too far behind, though). It’s also never been hacked and offers insurance if cybercriminals steal your funds.

Now, we have to be unbiased here and say that if you are looking for a wide selection of cryptocurrencies to trade, Gemini probably isn’t the best cryptocurrency exchange for you. 40 is a pretty small selection of coins in the grand scheme of things, but what’s essential for Gemini is the quality, not the quantity, so you’ll find Bitcoin, Ethereum, Litecoin, and most of the well-known coins.

Will you find Gemini complicated? No. Will you need to look at moving charts, candlesticks, and constantly changing prices? Also, no. Will you have to provide a lot of personal information and banking details? Yes. Are you going to get frustrated with Gemini if you are a high-volume trader? Almost certainly. Gemini offers simplicity and convenience at a premium, making it ideal for beginners but unsuitable for day traders.

Gate.io is a shining example of how an ‘overseas’ exchange can function perfectly in the USA market. CER.live has ranked Gate.io the number one crypto exchange for cybersecurity for two years running, and CoinGecko places them as the third-best exchange, with a 10/10 trust score.

Quick Look

- Low fees (0.2%), high liquidity, and a quality user experience (whoever said you couldn’t be fast, cheap, and good?)

- Low withdrawal fees (0.0005 BTC for Bitcoin)

- Traders on the platform can choose from a huge selection of 564 coins and 1,062 trading pairs

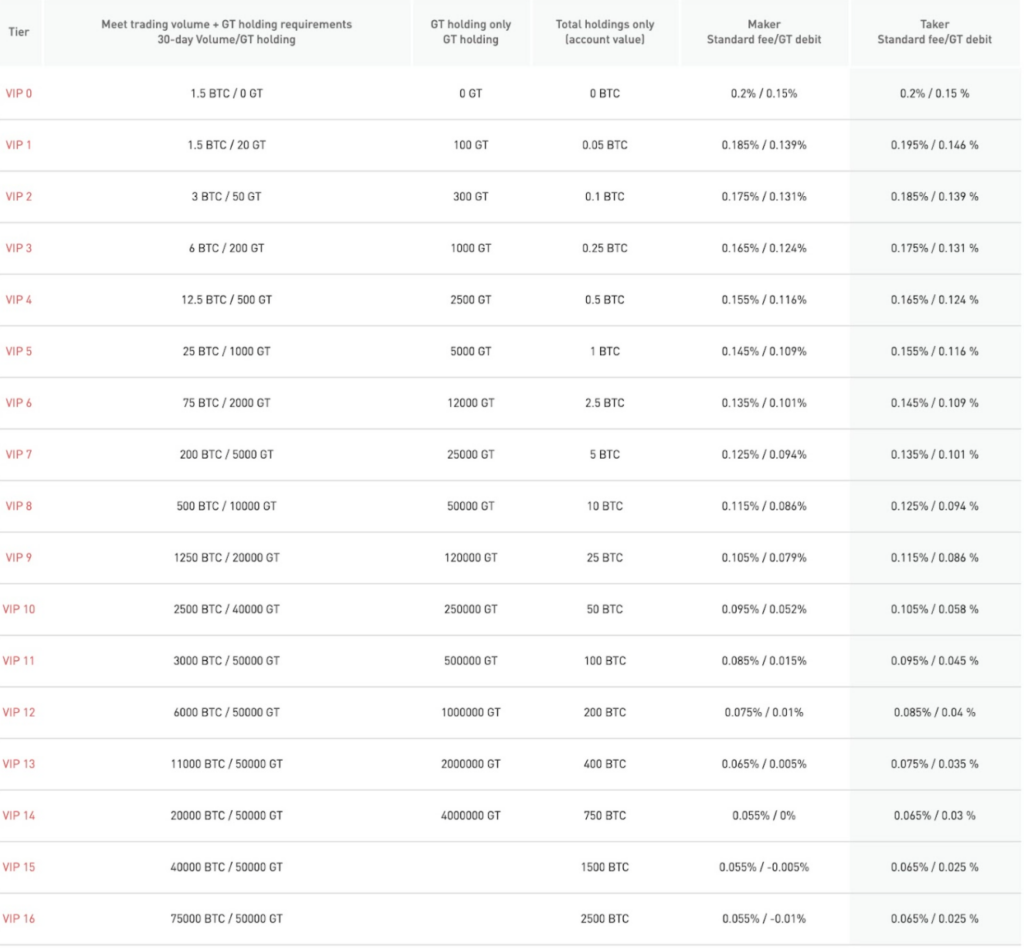

- Rebate scheme for high volume traders or GT token holders

- Hacked once, but by a white-hat hacker, who hacks only to help improve the service

- New York and Washington State are not permitted

What about its history? Bter.com was a Chinese crypto exchange that decided to rebrand and relocate after the 2017 crypto ban in China. It changed its name to Gate.io (yes, the domain suffix stays, so the name is gate-dot-io), and it set up an office in Virginia, USA. This is one of the many Bitcoin exchanges that found new homes in the wake of China’s legislation change and has arguably gone on to greater success ever since. However, since it is primarily marketed at East Asian traders, many Americans (and blogging sites) don’t realize it is US-friendly.

So, what’s the big deal with Gate.io, and why does it make our list? Well, the range of 564 cryptocurrencies and 1,062 trading pairs (at the time of writing) is a pretty big start. No other US-friendly exchange or platform comes close to this extraordinary figure. The more altcoins there are, the more opportunity for one of them to blow up and bring you significant trading profits. On the fee side, the 0.2% maker and taker trading fees place them more or less on a par with Kraken and CEX.io; however, serious traders moving major volumes may be entitled to rebates.

Gate Token (GT) offers another system of paying trading fees and earning rebates in the USA. Trading as little as $90,000 worth of GT per month can result in trading rebates instead of fees. Another notable fee is the cryptocurrency withdrawal fee which is around 40% lower than other platforms.

Are there any pitfalls to Gate.io? Well, perhaps the low daily trading volume could be one. Gate.io is still growing and looking to gain more of the market share from their rival crypto exchanges. Its trading volume of $400-500m per day is about half the size of Kraken’s and 2% the size of Binance’s. It’s larger than Gemini and CEX.io, with the latter being one of the smallest major exchanges in operation.

Summer 2021 update – Gate.io has introduced partnerships with liquidity providers Banxa, Mercuryo, and Simplex to enable debit and credit card purchases directly to your crypto wallets. This is great news for Americans looking for a cryptocurrency exchange that can sell them some coins and facilitate trades.

When Binance was forced to eject American users from the exchange in 2020, it was a sad day for many traders, but pretty quickly, they set up this great transitional exchange to soothe the pain. Rather than simply letting their users down gently, Binance.US became a competitive exchange, winning some market share from Coinbase and competing to attract beginners who were new to crypto. Remarkably, it has since become one of the world’s best exchanges.

Quick Look

- Impressively low trading fees starting at just 0.1%, with the fees dropping down to 0% for mega-volume traders

- Fees can be discounted by 25% for those who wish to pay their cryptocurrency exchange transaction fees in BNB, Binance’s native coin

- Offers a 0.5% instant buy and sell fee, providing a high level of convenience

- The free digital wallet and trading platform are very easy to use, with over 50 cryptocurrencies to enjoy

- Available in 43 states, with the exclusions being: Connecticut, Hawaii, Idaho, Louisiana, New York, Texas and Vermont

The platform is by no means perfect, and it lacks the sheer diversity and quantity of cryptocurrencies that Gate.io and the original Binance service have. However, it does still offer a strong option in the current climate. This is unless you’re living in one of the 7 states that have not yet permitted a Money Transmitter License: Connecticut, Hawaii, Idaho, Louisiana, New York, Texas, and Vermont.

With trading fees starting at 0.1%, the cost of transactions for swapping Bitcoin and other cryptocurrencies is comparatively lower than the other exchanges in this article. What makes Binance.US fees even better is that by opting to pay them in BNB, users can unlock a further 25% discount. BNB is Binance’s native cryptocurrency, and it performs much the same function on Binance and Binance.US. The other fees worth mentioning are the 0.5% instant buy and sell fees.

Coin Clarity’s Sleeper Pick

What else do you need to know?

Why are New York and Washington DC often excluded from accepted states for US cryptocurrency exchanges?

In 2017, Washington State published a bill that would strictly regulate the digital currency market. Unfortunately, the regulations presented were not easy to meet, and so the vast majority of Washington’s crypto businesses, platforms, and community relocated or stopped trading rather than comply. Overnight, Bitstamp, Bitfinex, Kraken, and Poloniex pulled out of the state and regrettably informed their users they could no longer serve them. This event gave Washington a poor reputation among tech companies, who see their bill as regressive.

In New York, a regulatory regime called BitLicense was drawn up and implemented to handle the state’s introduction of crypto-businesses. Unfortunately, it was not met with a lot of enthusiasm, making entrepreneurial endeavors in this industry incredibly difficult. To date, only 16 businesses have successfully been licensed, among them cryptocurrency exchanges such as Gemini and Robinhood. Why is New York so strict? It’s all down to Wall Street and creating a semblance of parity with the high level of financial regulation that this market must face.

What is an on-ramp or an off-ramp?

When you use something that isn’t crypto (such as fiat currency, like USD) to purchase crypto, the platform facilitating this transaction is an on-ramp. Most cryptocurrency exchanges and brokers are, by definition, on-ramps.

An off-ramp is a platform that lets you exchange your cryptocurrency for something that isn’t crypto, such as fiat currency. However, an off-ramp can also be a place that accepts cryptocurrency payments in place of legal tender. For example, if you buy a Tesla with Bitcoin, Tesla becomes an off-ramp.

There we have it, the best cryptocurrency exchanges in the USA. Do you agree? Let us know on social media. We wish our fellow Americans the best of luck out there.