Centralized vs. Decentralized Crypto Exchanges: Which Are Right For You?

As a cryptocurrency investor, one of your most important decisions will be whether to use a centralized or decentralized exchange to purchase your coins.

How can you know the differences between them and which is right for you?

In this article, we’ll answer these questions in the following sections:

- What are centralized crypto exchanges?

- What are decentralized crypto exchanges?

- How do you decide between centralized and decentralized crypto exchanges and which is best for you?

What are centralized crypto exchanges?

If you’re new to cryptocurrency or just want a refresher, a centralized cryptocurrency exchange is one of the most important platforms you will use for buying and selling your assets.

The term “centralized” refers to how buyers and sellers use a third party or middleman–the exchange–to conduct transactions, as a bank would.

In fact, they are the most common type investors use. Check out some of the main features of centralized exchanges below.

1) You can use fiat to purchase assets

You can use your fiat money (i.e. government-issued currencies, like USD, GBP, CAD, etc.) to buy assets like you would at a bank or broker. The only difference is that, rather than stocks and ETFs, you are using your money to buy crypto.

For example, you can use your USD to purchase Bitcoin on Coinbase. You just have to transfer funds from your bank to the centralized exchange to use them.

If you want to trade non-volatile assets, you can use stablecoins. Stablecoins are a type of crypto whose value is pegged to a fiat currency or another asset class. For example, DAI, USDT, and USDC are all worth 1 US dollar. They are a stable cryptocurrency that eliminates the volatility other cryptocurrencies have.

You can also trade crypto for crypto on many centralized exchanges, like trading Solana for Ethereum on Binance.

2) Centralized exchanges have stricter security measures

In traditional finance, banks offer higher security measures than an individual would have on their own. Centralized crypto exchanges follow the same principle. Rather than holding your own assets, you trust the exchange to safeguard them.

In Gemini’s case, the company deploys sector-leading safety precautions. Most of their crypto is held in offline, air-gapped cold storage, with a small amount in an insured hot wallet.

Centralized exchanges face more regulation from governments and financial authorities, although this can vary considerably by jurisdiction. For example, federal law in the United States mandates KYC data collection and anti-money laundering issues, but other regulation aspects, such as licensing, vary depending on the state.

These security measures begin by having each person identify themselves, through a process known as know your customer (KYC). This is how centralized exchanges confirm you are who you say you are. If you use Coinbase, they will ask for personal information, including your name, address, and even a photo of your government-issued ID.

These robust security measures can be a huge benefit if a centralized exchange is hacked. One good example is when this happened to Coinbase in March and May 2021. While many users had their accounts drained, the company reimbursed users for their lost funds.

3) You have access to customer support

Centralized exchanges also give you access to customer support services. In other words, there’s an actual person or team you can speak to if you encounter any issues or need to recover lost funds.

On Binance, unforeseeable problems can be quickly resolved by a reliable live chat support team.

4) Earn interest on your crypto

Traditional banking offers savings accounts that usually pay around 0.05% interest, which is incredibly low considering the ridiculously high inflation in 2021.

On a centralized exchange, you have similar interest-bearing features. The difference is that centralized exchanges can offer much higher rates than a bank. For example, on Gemini, you can get up to 8.05% on your crypto, blowing banks out of the water.

Centralized exchanges are able to pay high interest rates by lending customer assets in custody to borrowers.

What are decentralized crypto exchanges?

Compared to centralized exchanges, decentralized exchanges (DEXs) are less well-known by the general population but are popular among people interested in decentralized finance (DeFi).

All trades on DEXs happen on the blockchain and smart contracts are the most common methods. As such, no third party oversees transactions.

Smart contracts are computer programs that can automate transactions and guarantee a particular outcome (i.e. selling ETH at a particular price) without the need for an intermediary. In essence, smart contracts are essential to DEXs, making transactions more efficient.

By relying solely on automated computer code, DEXs are by nature, trustless. This means that peer-to-peer transactions are executed without having to trust the other person thanks to the unbiased smart contract. Eliminating the middleman also minimizes the risk of hacks.

Nevertheless, there are several other things that make decentralized crypto exchanges unique.

1) You can only trade crypto for crypto

If you use a DEX, such as Pancakeswap or SushiSwap, you’ll notice there is no option to buy crypto with fiat currency. That’s because you cannot transact with fiat on the blockchain.

You can only trade one cryptocurrency for another.

2) You can remain anonymous

Unlike KYC on a centralized exchange, a DEX requires no such identification. This means you can buy and sell all the crypto you’d like without anyone knowing who you are.

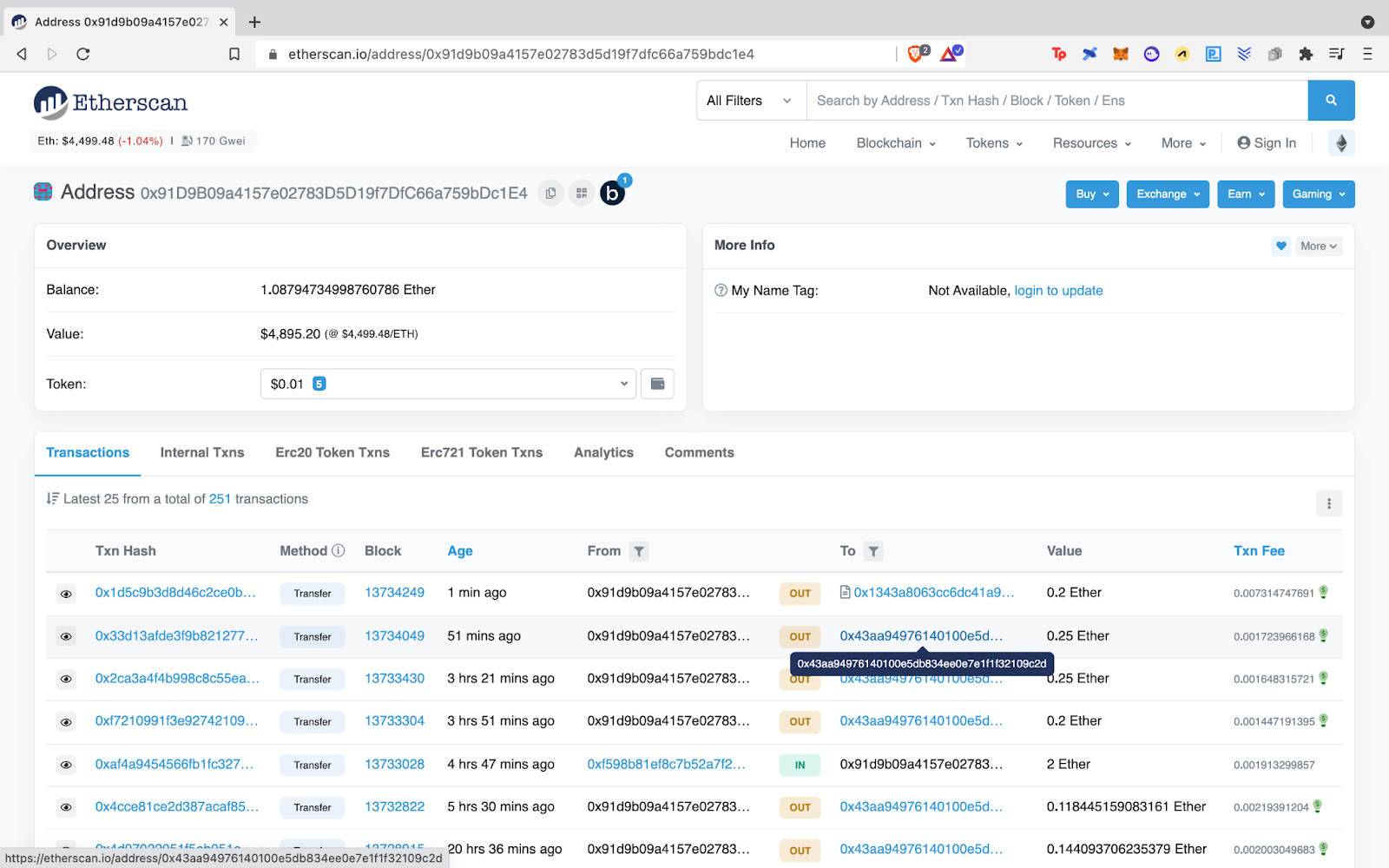

That said, all transactions are tracked on the blockchain or public ledger to ensure full transparency. Therefore, everyone can see your wallet address and what you do with your crypto, even if they don’t know your identity.

3) You have full custody of your assets

When you use a DEX, you don’t depend on someone else to hold your crypto. You are the sole owner of your assets.

To transact on a DEX like Uniswap, you will require a private wallet. MetaMask and Trust Wallet are among the most popular. That said, a DEX will never actually have custody over your coins. Remember, you always retain full ownership.

In this case, it is essential that you remember to store your private keys and seed phrase in a safe, offline location to guarantee the safety of your funds. This is especially crucial if you are a beginner to cryptocurrency.

4) You can earn incredibly high interest

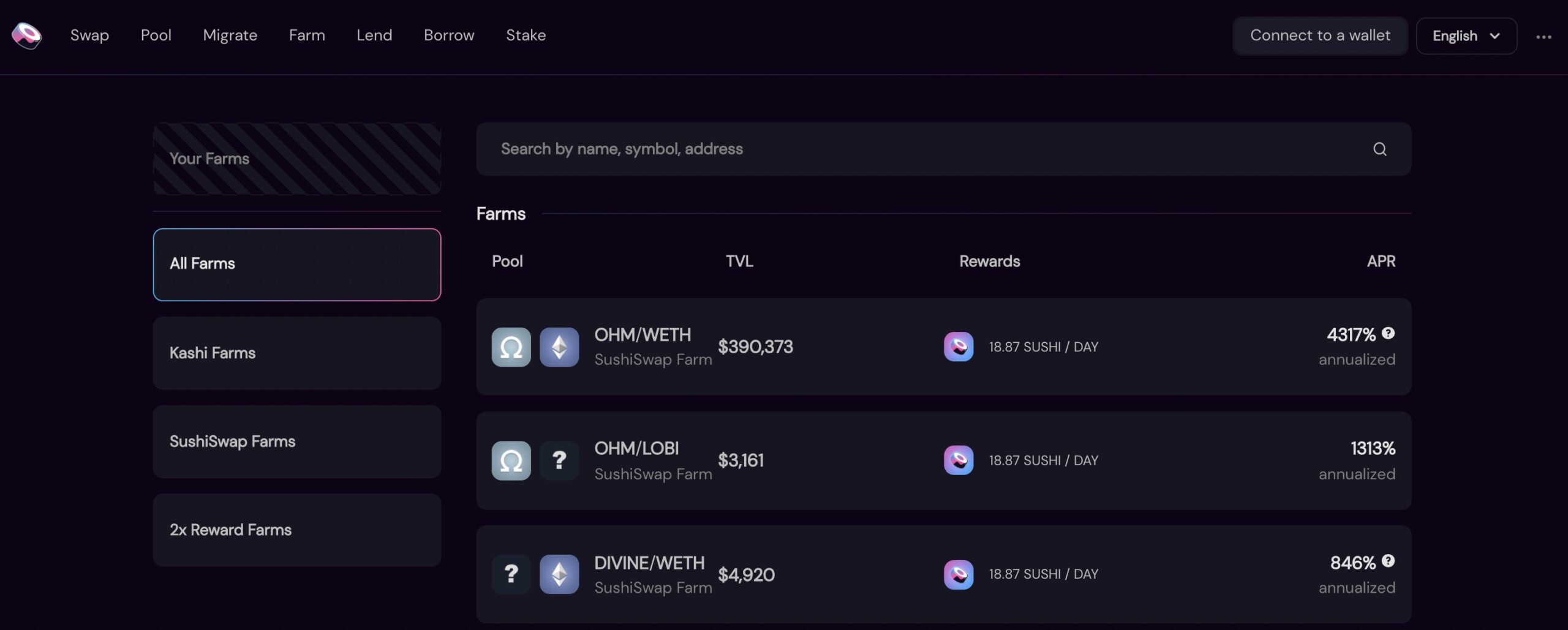

Compared to traditional finance, centralized exchanges have high interest rates. But when you compare that to what you can earn on DEXs, there’s no comparison. Just take a look at the +4300% interest you can get on SushiSwap!

There are four main ways to earn a high yield on DEXs: yield farming, liquidity pools, lending, and staking. Other than lending, which is also available on several centralized exchanges, each of these methods is beyond the scope of this article.

That said, there are some things you should keep in mind. Though you can earn significantly more, none of these methods are without risk. Usually, the higher the APY, the higher the risk, so you’ll want to do your own research before deciding to invest.

How to decide between centralized and decentralized crypto exchanges

Everyone will have to use a centralized exchange when they first enter the space in order to convert their fiat currency into crypto.

However, once you’re in, using a centralized or decentralized cryptocurrency exchange becomes a personal choice that comes down to a few factors:

- Your familiarity with the crypto space

- What kind of security you seek

- What risk you’re comfortable with

- Fees

Do not make the mistake of thinking that centralized exchanges are for amateurs and DEXs are for experts. Both experienced and new investors use both, but for different purposes.

Note: Each exchange will have a different fee structure, which is why we haven’t covered them in detail in this article. Whether you use Binance, Coinbase, Gemini or a DEX, research the fees before making a decision.

Coin Clarity’s Recommendation

If you’re new to crypto, centralized exchanges might be your best bet. They’re straightforward, user-friendly, and don’t require as much crypto knowledge. Coinbase is considered one of the most straightforward and trustworthy exchanges for beginners. Because they’re more similar to banks than DEXs, they make entering the crypto space much more accessible.

Once you’re more comfortable with the basics and have done your research, you can start to look into setting up your own wallet and exploring DEXs and the world of DeFi. Be warned, it’s very complex. You will have to learn a wealth of new terms, some of which have been covered in this article.

Get Started With a Trusted Centralized Exchange

If you’re looking for the best centralized crypto exchanges, look no further than Gemini, Coinbase, and Binance (or Binance.US if you’re in the States). They are all industry leaders in terms of safety and customer support, and provide great trading and earning opportunities.