Best Bitcoin Exchanges in India

India now boasts the second-biggest population globally, with over 1.3 billion people, making it an extraordinary opportunity-filled market for cryptocurrency. In a land where millions of people are unbanked, and the government can make money worthless overnight, crypto provides an alternative financial system that can lift people out of relative poverty and provide them with a payment gateway to the rest of the world. For many Indians, cryptocurrency symbolizes opportunity.

Ranking methodology – How we decided which exchanges to consider

Our Top-Ranked Crypto Exchanges in India

WazirX launched in India back in March 2018 by Nischal Shetty, Sameer Mhatre, and Siddharth Menon. It was well-received, grew faster than many anticipated, and quickly became the most trusted and respected Bitcoin exchange in India. WazirX truly hit the nail on the head. For more advanced users, this is an exchange built by hardcore traders providing the best experience possible.

Quick Look

- 0.2% maker fee (fixed)

- 0.2% taker fee (fixed)

- Launched in India in March 2018

- Acquired by Binance in November 2019

- 140 cryptocurrencies & 227 market pairs

- Only Indian Rupees (INR) are compatible

- Boasts a P2P cryptocurrency exchange with bank account purchases enabled

- Flourishing despite uncertain crypto-regulations in India

It’s no wonder Binance decided to purchase WazirX in November 2019, though with a non-disclosure agreement in place, we can only speculate that the deal would have cost at least tens of millions of dollars. Binance has set about improving the security and widespread appeal of the web, mobile apps, and desktop application.

At 0.2% for makers and takers, the platform is well-aligned with other exchanges, though it’s by no means the most economical. In this industry, convenience and quality typically come at a premium. In India, WazirX offers the highest liquidity and daily trade volume in the market. Many traders opt to use the native utility token WRX to pay discounted trading fees of up to 50%.

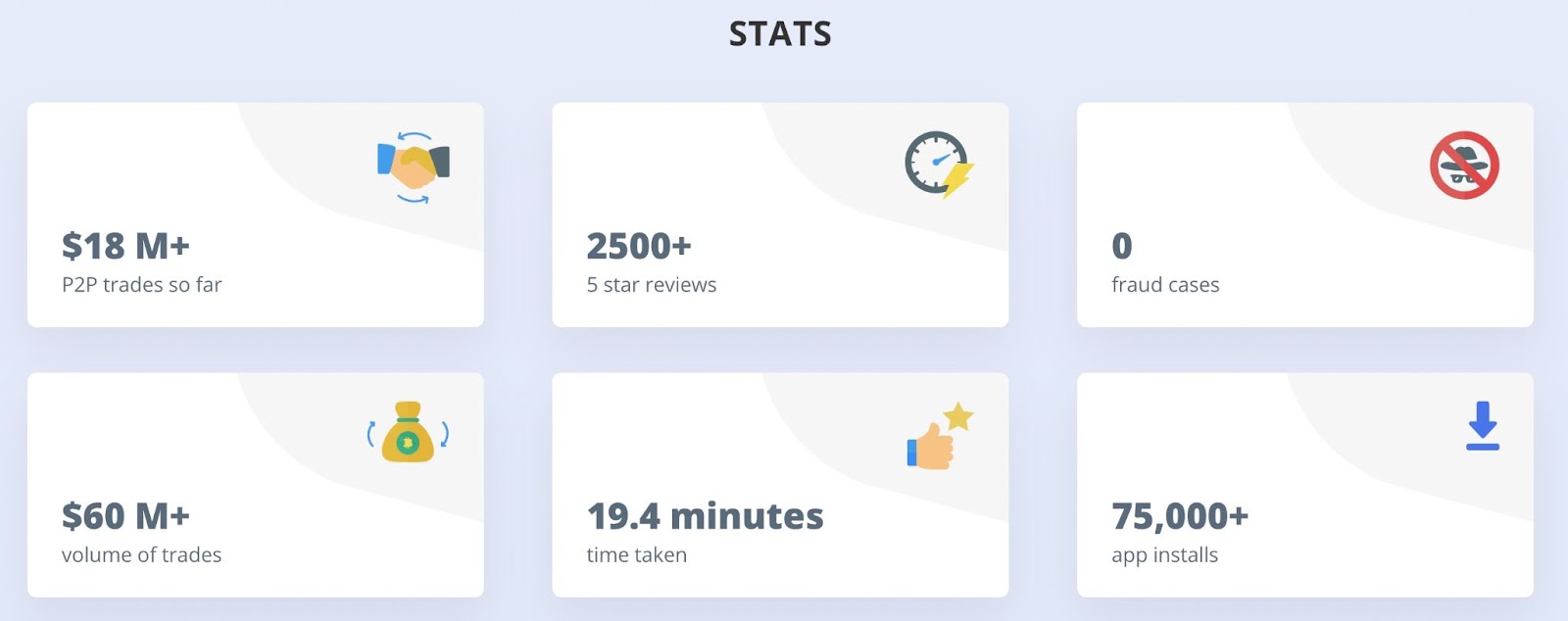

WazirX P2P

One of our favorite innovations is the P2P platform WazirX offers, which pairs private buyers and sellers together, offering an escrow service that guarantees safety in these transactions (virtually the same as Binance C2C). They claim that most deals conclude in under 20 minutes. Thanks to this platform, users can turn their Indian Rupees into cryptocurrencies and vice versa, with more payment options and flexibility than buying directly from the exchange. It also opens a whole new world of arbitrage opportunities without paying any commission fees to WazirX!

What is WazirX’s stance on India’s Crypto Ban?

WazirX’s biggest boom was fortunate timing. India’s large and established crypto exchanges suffered when India announced a blanket ban on virtual currencies in March 2018. The developers at WazirX knew that they were a small startup and so they could nimbly find a way around the ban, which they managed by launching a peer-to-peer exchange just two days later. Their position on the crypto ban is pretty impressive. They work with all of the other Indian cryptocurrency exchanges to self-regulate, they voluntarily impose KYC and AML checks, and they punish attempted scammers as best they can.

As of March 2020, courts struck down the cryptocurrency ban. As it stands, cryptocurrency is legal but unregulated in India. The government wants to ban it (again), the courts want it treated constitutionally, and the exchanges are willing to self-regulate to show that they are open to compromise.

Very close behind WazirX in second place is CoinDCX for our Indian readers, although we are sure you’ve heard of this exchange if you know about crypto.

Quick Look

- 0.04% taker fee

- 0.06% maker fee

- 210 cryptocurrencies

- 379 trading pairs

- Compatible with Indian Rupees (INR) only

- Margin trading with leverage up to 20x

- Launched in Singapore in 2018, however, it only serves the Indian market and has a large office in Mumbai

- 24-hour customer support

- UPI and IMPS available for quick payments

- KYC-free trading up to 10,000 Rupees

With a smooth user experience, some of the best security (though it was hacked once for three Bitcoin), and one of the largest ranges of cryptocurrencies in the Indian market, user-friendly CoinDCX wins over customers from their rivals. Limitless trading, instant buy and sell features, 24-hour support, and the lowest fees in India make them WazirX’s toughest competition.

By being registered in Singapore, CoinDCX has the advantage of developing its exchange and services in a country that is very supportive of cryptocurrency in general and does not seek to regulate it heavily – unless the industry moves towards using crypto for purchases, rather than for trading. Of course, to grow their offering in India, their headquarters are in Mumbai. If the government in India does decide to enforce a new crypto ban, having Singaporean ties can play to CoinDCX’s advantage.

As we’ve mentioned already, Indian exchanges openly self-regulate for things like KYC checks, which means insisting upon identity verification for traders over a certain amount or who want to make crypto purchases with fiat currency. On the CoinDCX platform, users in India can trade up to 5 million rupees per day with KYC checks, while those who want to trade anonymously are limited to 10,000 rupees per trade.

With the lowest fees of any Bitcoin exchange in India, at just 0.04% and 0.06% for makers and takers, respectively, many will ask if they can operate successfully on such small margins? Well, the funds are recuperated in part through withdrawal fees, which are mighty pricey. When you consider the typical trading volume of users on cryptocurrency exchanges in India, a withdrawal fee of 0.001BTC (around $55) is relatively high. That being said, if this is one of the best places to buy Bitcoin in India, there’s not much reason to leave.

The Importance of Customer Service

For users who want to enjoy the trading services, buy and sell Bitcoin, engage with cryptocurrency lending, and enjoy it all with low commissions, this is the place to go. But, is the customer support as comprehensive as the rest of the platform? They offer 24-hour support through the ticketing system and a live chat feature that turns on for around 17 hours per day. You can also reach the support team by email at [email protected].

Lending Bitcoin in India?

In a recent article, we looked at the best cryptocurrency lending platforms in the world. For the Indian market, in particular, the clear winner is CoinDCX, which offers holders of specific cryptocurrencies another form of investment or passive income. Users can lend their crypto to borrowers at an agreed interest rate for a maximum of 7 days and a maximum annualized interest rate of 16.25%.

What is CoinDCX’s position on the cryptocurrency ban?

CoinDCX decided to push ahead with their cryptocurrency exchange in India, having faith that the RBI (Reserve Bank of India) would eventually lift its crypto ban. They led two seed rounds, raising over $3m in investment, and promised all investors 0% transaction fees for any future Bitcoin exchanges. In March 2020, when the RBI ban lifted and exchanges in India suddenly had more freedom, the user base grew ten-fold, allowing CoinDCX to become the powerful exchange it now is.

Next up, our third and final winner…

WazirX wins for size and strength (options and liquidity), CoinDCX wins for low fees and P2P options, and CoinSwitch Kuber wins for ease of use, simplicity, and overall user experience mobile app. CoinSwitch, the parent company, is a global aggregator, which is great for many international users, but created complications for users based in their native India. That is why ‘Kuber’ was added, presenting an app that would solve this problem and provide liquidity exclusively from Indian Bitcoin exchanges directly to investors who want to buy Bitcoin in India.

Quick Look

- 4.5 million users

- Valued at over $500m

- Claims a brokerage fee of 0%, but due to the large spread, it’s closer to 5%, not including the payment provider fee

- No transparency about the cost of making trades

- Huge brokerage with over 100 cryptocurrencies available for purchase

- Fastest INR-to-crypto, crypto-to-crypto, and crypto-to-INR exchange

- Owned by CoinSwitch, which is partnered with more than 10 cryptocurrency exchanges to pool liquidity, services, and crypto availability

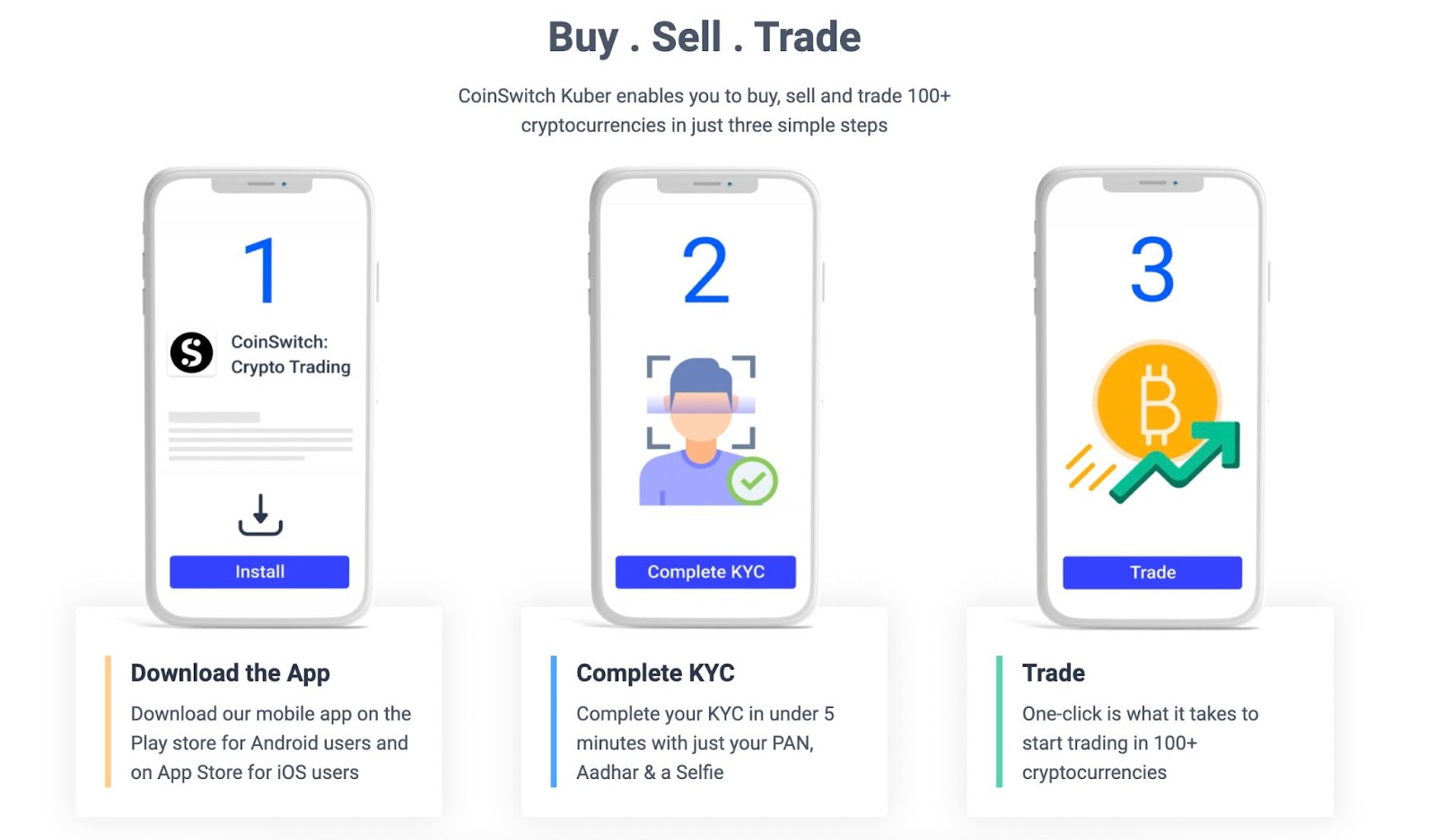

- KYC is required to get started, but it’s super fast

- Accepts: debit cards, credit cards, UPI, bank transfer, and net banking

Starting with just 100 Rupees, this is the top cryptocurrency exchange in India for beginners who want to buy and sell crypto with as little fuss as possible. More than 100 cryptocurrencies to choose from, and their marketing material claims to offer the best rates and liquidity (without evidence). Their claim to providing the best liquidity may be genuine, and that’s because their exchange operates by pooling and aggregating liquidity from all of their exchange partners in India. Claiming to offer the lowest trading fee charges is harder to confirm or disprove, as they don’t share an exact figure but say that it varies from 0-0.49%.

Users will need to complete KYC checks before using CoinSwitch Kuber, a very straightforward process designed for non-technological mobile users at the beginning of their crypto journey. There is no web service at this time.

Despite India’s troubles with the banning and unbanning cryptocurrency by the RBI, CoinSwitch Kuber has managed to thrive. The process has opened up many payment channels for those who want to buy Bitcoin in India. Debit cards, credit cards, UPI, bank transfer, and net banking are all facilitated through a straightforward user interface.

Because of how CoinSwitch Kuber is designed, in theory, all cryptocurrencies can be traded ‘directly’ with any other cryptocurrency on the exchange. So if you’re not looking to buy and sell Bitcoin or altcoins (such as Ethereum, Bitcoin Cash, or Litecoin) from a broker but would instead make instant swaps to keep up with market movements, there are an estimated 45,000 possible trades! When you select the pair you want to trade, you will be presented with a list of options, and you can choose the rate you want to swap at based on the compatible offers.

In terms of security, we give CoinSwitch Kuber a big gold star, as they are one of the few exchanges in India that has never been hacked. Given that they are something of a middle man, pooling liquidity from elsewhere, they do not need cold storage, so their security protocols are much more straightforward.

What is their position regarding the RBI crypto ban in India?

For CoinSwitch, serving Indian users is currently a priority, but they are realistic about what can happen in the future, with many expecting to see New Delhi outlaw cryptocurrency. Due to the volatility and lack of support from the government for cryptocurrency trading, building the best cryptocurrency exchange in Inda is only part of their strategy. The greater mission for CoinSwitch is to grow and become a popular platform for overseas users, which, based on the $25m in investment funds they’ve received and over $5 billion in trades that they’ve already handled, would appear to be going very well.

rnrnHold up! Risk-free trading? Sure, imagine a Bitcoin exchange where you can trade all day long and be sure to make zero losses! Sadly, you can’t make any profits either, but that’s beside the point. Bitbns testnet is essentially a practice platform for beginners who can learn how to trade crypto without putting their capital at risk. The trading environment is simulated, with made-up testnet coins, but it operates the same as the main platform, so when you’re ready to invest your rupees, you can end your experiment and begin to take some risks.rnrn

rn

- rn t

- Coin Staking for Bitcoin, Ethereum, and Tether </strong>- Bitbns offers a system that they call ‘Fixed Income Plans,’ which are essentially coin staking opportunities with a fixed return of up to 20%.</li>rn t

- Margin Trading up to 4x on Bitcoin – </strong>read how it works here</a></li>rn t

- A very useful testnet for risk-free trading</strong></li>rn</ol>rn

- rn t

- Maker and taker fees fixed at 0.25% unless paying in BNS rn t

- Around 100 cryptocurrencies listed rn t

- Transaction fees are reduced if paying in BNS, the platform’s native cryptocurrency, to a minimum of 0.03% rn t

- Deposits via UPI, Bank Transfer, or Mobikwik (Credit card, debit card, or online banking) rn t

- Launched in December 2017 rn t

- Leverage up to 4x for margin traders rn t

- Customer support available through Telegram, Twitter, Facebook, and a customer ticket service, all with quick response times rn t

- Bitbns offer ‘Fixed Income Plans,’ which are essentially coin staking opportunities for Bitcoin, Ethereum, and USDT, with rates up to 20% rn

What are the questions surrounding cryptocurrency exchanges in India?

Will there be another cryptocurrency ban?

While it’s virtually impossible to ban Bitcoin and other coins in their entirety, due to the inherently decentralized nature of the technology, a country can make business more difficult. Many might think that not having a government’s support might not matter, but it’s a big deal. In India’s case, they are concerned that scammers are winning against private individuals, and they are considering banning ‘private cryptocurrencies’ and launching a Digital Rupee in response.

Our verdict? We expect to see India ban cryptocurrencies in 2021 or 2022, so for Indian traders, the best course of action is to find creative ways to future proof their activities.

Is the best cryptocurrency exchange the one with the lowest fees, the highest liquidity, the most cryptocurrencies, or the largest diversity of services?

The answer depends on who you ask. All of these factors are important, but as a trader, do you want an exchange with bulletproof security, an exchange with a vast range of coins, the exchange with the easiest user journey to buy and sell Bitcoin, or simply an exchange that does its best to serve users in India? Bitcoin exchanges come in all different shapes and sizes, so don’t be afraid to experiment with each of these options to find your perfect fit.

rn- rn t

- Coin Staking for Bitcoin, Ethereum, and Tether – Bitbns offers a system that they call ‘Fixed Income Plans,’ which are essentially coin staking opportunities with a fixed return of up to 20%. rn t

- Margin Trading up to 4x on Bitcoin – read how it works here rn t

- A very useful testnet for risk-free trading rn

- rn t

- Maker and taker fees fixed at 0.25% unless paying in BNS rn t

- Around 100 cryptocurrencies listed rn t

- Transaction fees are reduced if paying in BNS, the platform’s native cryptocurrency, to a minimum of 0.03% rn t

- Deposits via UPI, Bank Transfer, or Mobikwik (Credit card, debit card, or online banking) rn t

- Launched in December 2017 rn t

- Leverage up to 4x for margin traders rn t

- Customer support available through Telegram, Twitter, Facebook, and a customer ticket service, all with quick response times rn t

- Bitbns offer ‘Fixed Income Plans,’ which are essentially coin staking opportunities for Bitcoin, Ethereum, and USDT, with rates up to 20% rn

What are the questions surrounding cryptocurrency exchanges in India?

Will there be another cryptocurrency ban?

While it’s virtually impossible to ban Bitcoin and other coins in their entirety, due to the inherently decentralized nature of the technology, a country can make business more difficult. Many might think that not having a government’s support might not matter, but it’s a big deal. In India’s case, they are concerned that scammers are winning against private individuals, and they are considering banning ‘private cryptocurrencies’ and launching a Digital Rupee in response.

Our verdict? We expect to see India ban cryptocurrencies in 2021 or 2022, so for Indian traders, the best course of action is to find creative ways to future proof their activities.

Is the best cryptocurrency exchange the one with the lowest fees, the highest liquidity, the most cryptocurrencies, or the largest diversity of services?

The answer depends on who you ask. All of these factors are important, but as a trader, do you want an exchange with bulletproof security, an exchange with a vast range of coins, the exchange with the easiest user journey to buy and sell Bitcoin, or simply an exchange that does its best to serve users in India? Bitcoin exchanges come in all different shapes and sizes, so don’t be afraid to experiment with each of these options to find your perfect fit.