Kucoin vs Binance: Which Powerhouse Wins?

Can Kucoin, ranked 4th in our best crypto exchange rankings, really compete with the sheer size and market dominance of Binance? What special features or advantages could Kucoin offer to potential users to prize them away from the market leader? Let’s find out.

Exchange Trading Fees

Kucoin Trading Fees

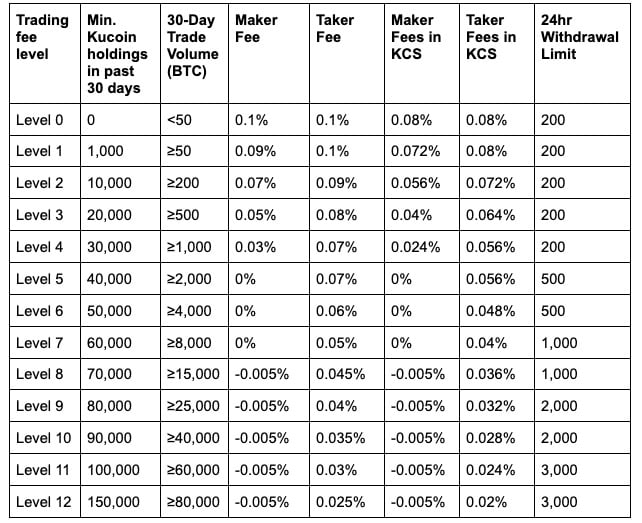

Kucoin and Binance are similar; they both have created a native token for users to hold, trade, and earn rewards. Kucoin Shares, abbreviated to KCS, costs 20% less than Bitcoin (BTC) when paying maker and taker fees, giving a robust incentive to buy it and keep it in large amounts. Their trading fees are in the table below. Notice that from level eight and onwards, users receive refunds instead of charges; this is significant:

Did you know? Kucoin boasts hundreds of cryptocurrencies on its platform, each of which has a different withdrawal fee for leaving the Kucoin system. Find the full withdrawal fee schedule here.

Binance Trading Fees

Users of Binance can unlock 10 different VIP levels of trading discounts based on how much Bitcoin they’ve traded in the last 30 days. If the user also holds large amounts of BNB coin, Binance’s native cryptocurrency (equivalent to Kucoin’s KCS) can receive 25% more in trading fee discounts. On top of that, users who participate in Binance’s referral scheme can get 20% more discounted from their trading fee, bringing the total to 40% (see more here).

Here’s how the VIP system works:

Crypto-withdrawal fees on Binance: Each cryptocurrency has a vastly different fee for withdrawals, with Bitcoin’s 0.001 BTC fee being worth a lot more than Ethereum’s 0.001 ETH fee. This means that users can reduce their withdrawal fees by converting cryptocurrencies and withdrawing in a different coin (see here).

What are maker fees and taker fees?

Both of the tables above feature the terms ‘maker fees’ and ‘taker fees.’ If these terms are new to you, essentially, a taker is someone whose order is fulfilled instantly, and a maker is someone whose order is placed and will be fulfilled later. Makers are rewarded with lower fees for adding liquidity to a marketplace.

Winner: Tie. Both are highly competitive and with similar discount systems. Kucoin’s reward system, which offers rebates for high trading volumes, is just as valuable as Binance’s referral scheme discounts. For beginner traders, the fees are equal and won’t be very noticeable.

Sign up and KYC experience

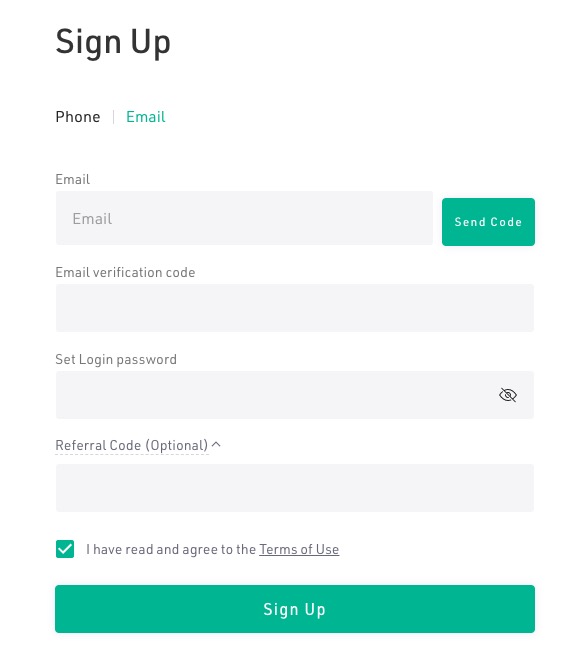

How to sign up on Kucoin

The sign-up process is rapid and straightforward:

- Visit Kucoin’s website and click ‘Sign up.’

- Give an email and password for your new account.

- Check your email inbox for an activation link.

- Connect with Google’s 2-step verification tool.

- You’re in; now go through the ‘KYC Verification’ process if you want to add fiat currency to your account. You will need a state ID, driving license, or passport.

Users can remain non-verified, but their accounts will be heavily restricted.

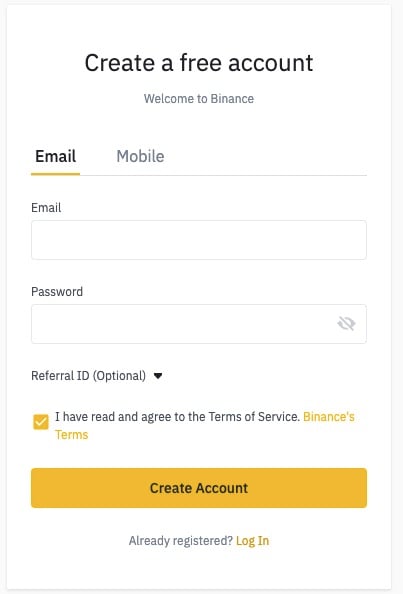

How to get started on Binance

Binance has one of the fastest sign-up processes and verifications in the industry. We just ran a test and managed to get signed up and our identity verified in under 30 minutes:

- Users in the US should go to Binance.US; international users can go to Binance.com; once there, tap ‘register’ to get started.

- Type in your email address and password.

- Open your email client to find a 6-digit email verification code from [email protected].

- Now you’re registered, you need to add some funds (more on that later).

Suppose you want to do anything involving fiat currency, use the P2P marketplace, or lift your withdrawal restrictions. In that case, you will need to do some identity verification and connect your phone number (Google Authenticator is an approved alternative). We scanned the front and back of our ID card and then took a smiley selfie. It was all approved very fast.

Winner: It’s a tie. The process is virtually identical.

Ease of Use & Feel of Website/App

Kucoin

As our #4-ranked exchange, Kucoin offers a web trading platform and a well-designed app for new and experienced traders. The exchange trading view feels very similar to Binance but subjectively cooler, with more aesthetically pleasing colors and buttons.

Where Kucoin stands out is its opportunities to reward users. Their KCS coin is part of a mining program for users to make additional funds, a bonus scheme that splits dividends amongst KCS holders, a referral scheme, and soft staking to earn interest on held cryptocurrencies. These should be thoroughly researched, especially by new users, as they are incentives to lure you to the platform.

Everything from signing up and making a deposit to buying funds and looking at your portfolio is incredibly straightforward, even for beginners.

Binance

With low fees, high liquidity, more market pairings than anyone else, and a simple trading service, Binance makes you feel smart. Rather than dumbing down their service, it’s a comprehensive exchange that makes all transactions follow a logical set of steps. If there’s a complication, Binance will have an explainer or a pop-up to give the user extra assurances. This is true user-friendliness.

Winner: Binance. It’s hard to put your finger exactly on what they do so well, but the micro-support along the way shows us they can put themselves in the shoes of beginner traders and support them through the platform. Kucoin could provide more to guide beginners, even if their products are well-designed.

Deposit Methods

Making deposits on Kucoin

Kucoin does not allow users to transfer fiat currency into their accounts, which essentially means you have no fiat wallet capabilities on this platform. This leaves you with two options presented in a pop-up window stating ‘I don’t have digital assets’ or ‘I do have digital assets.’

Users who do have digital assets (cryptocurrencies) can already transfer them into Kucoin using the addresses that Kucoin provides.

The other option is to purchase cryptocurrency directly from the platform, which we will cover in the ‘Instant Buy Options’ section.

Depositing funds into Binance

While Binance has opted against introducing deposit fees for their users, the payment gateways they partner with, such as Simplex, charge fees. The three ways of adding funds are:

- SWIFT Bank transfer (3.5% Simplex charge)

- Make a wire through the Paxos service. This is similar to a crypto-purchase as you are buying the PAX stablecoin (worth $1) for zero fees. With PAX, you effectively have USD to use on Binance — read more

- Cryptocurrency/digital asset transfer (mining cost depending on the coin)

Winner: Binance offers one method to deposit fiat currency, helping them skate by winning this category.

Instant Buy Options (Buying with credit or debit card)

Kucoin

The following are all accepted on Kucoin for purchasing cryptocurrencies directly, with the exchange working as a broker. Check to see which of these providers is compatible with your local currency before getting started.

- Bank transfer

- Sepa

- Paypal

- Interac

- POLi

- iDEAL

- Credit card

- Simplex

- Banxa

- WeChat Pay

- Alipay

- PayMIR

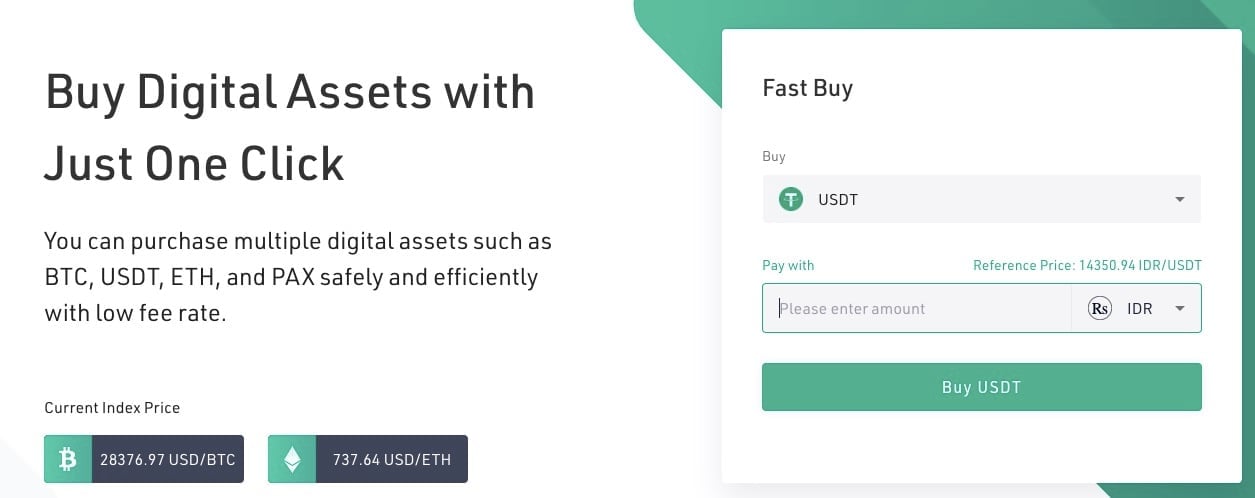

Another method is through Kucoin Fast Buy, which allows users to purchase Bitcoin, Ethereum, and Tether instantly with the following currencies:

- Australian Dollar

- Bangladeshi Taka

- Indonesian Rupiah

- Canadian Dollar

- US Dollar

- Philippine Peso

- Indian Rupee

- Vietnamese Dong

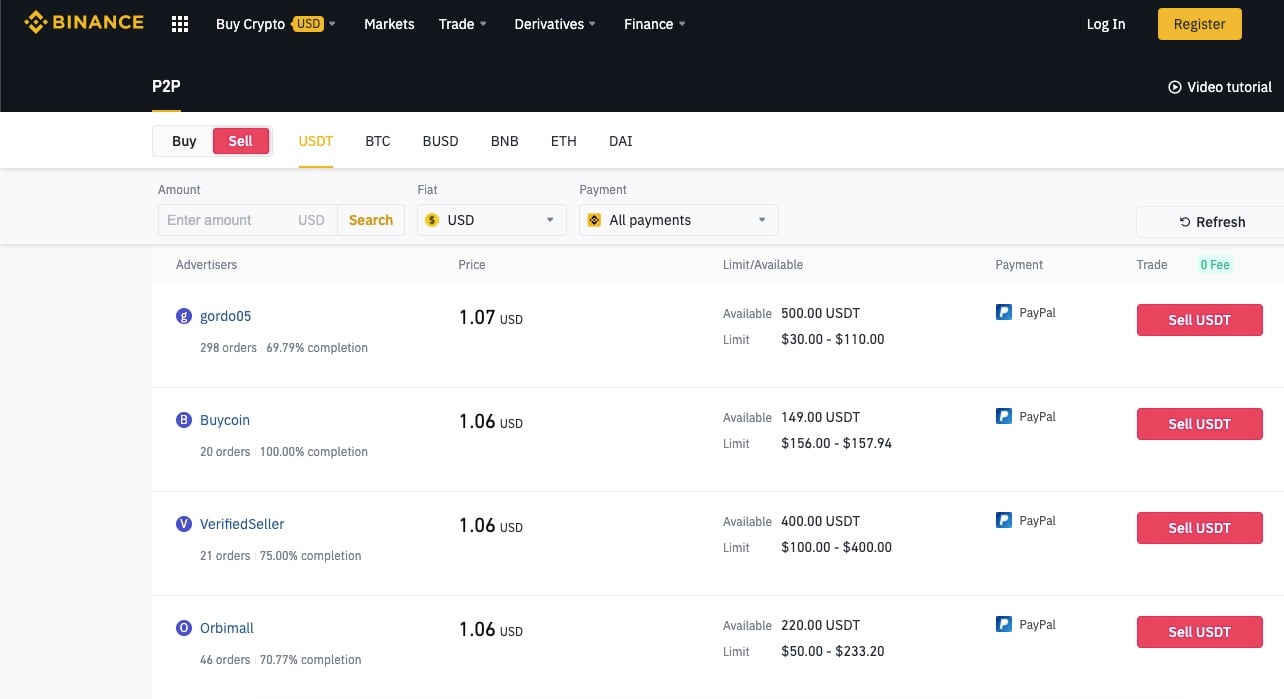

Binance

Users can take advantage of their debit and credit cards to buy cryptocurrencies instantly. Binance also welcomes several widely-accepted stablecoins, including:

Winner: Kucoin edges this category, offering more options for users in developing markets to enter the cryptosphere.

Trading Experience

Kucoin

At the time of writing, Kucoin boasts 520 market pairings and average liquidity of 301, approximately half as many as Binance, which is quite impressive when scaled. What is less impressive is that they have the lowest trading volume of any top-12 ranked exchange, which signals that their users are making their big trades elsewhere or that the platform isn’t comfortable enough for day-traders to use. For beginners, the sheer amount of numbers, flashing colors, clickable boxes, and options within the trading view make this aspect of Kucoin quite overwhelming.

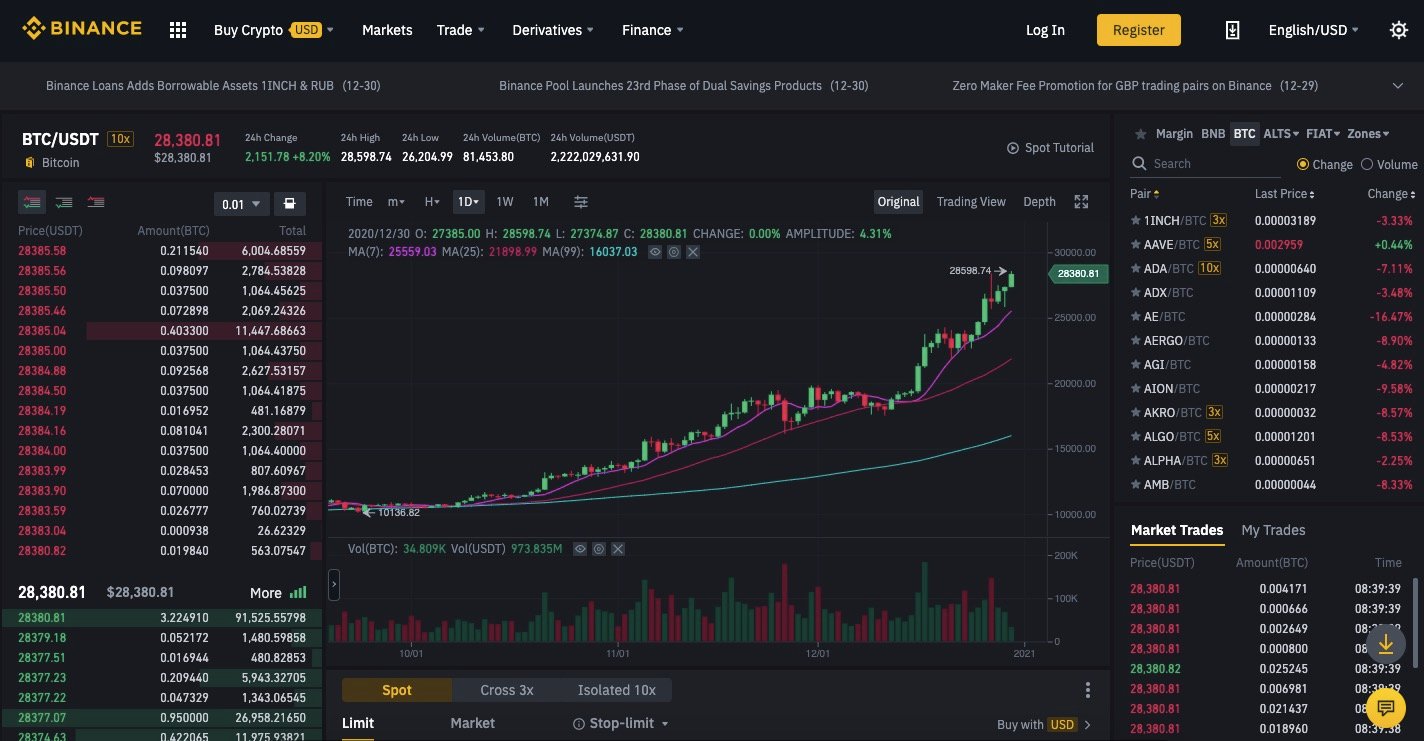

Binance

It’s hard to believe that an exchange launched in July 2017 could so rapidly climb the market and reach the top of the pile. Still, Binance managed it thanks in part to an exceptional trading experience highly valuable to experienced users and simple to use for beginners. New users can easily make the most of their decisions from within their wallet. From there, the platform sends them directly to the trading view with their trade set up ready for them; this cuts out the guesswork and exchange anxiety.

Industry-high liquidity (516) means they offer the fastest trades, and a vast amount of market pairings (1009) indicates that the crypto or fiat combination you are looking for is more likely to be there than on other platforms. Combine these trading features with their P2P and DeFi products, as well as their additional US-only platform, and you can see why they are ranked #1.

Winner: Binance. They’ve discovered the secret algorithm that makes for a pleasant trading experience for all users.

Reputation & Security

Kucoin’s big setback

Back in September 2020, Kucoin became one of the year’s biggest crypto-victims when hackers got away with $281m in Bitcoin ($30m), Stellar ($87m), and some other altcoins ($147m).

As soon as the hack occurred, the emergency measures kicked in, with on-chain tracking, contract upgrade, and judicial recovery processes enacted. Partnerships with other exchanges came in handy, too, with Bitfinex freezing $13m USDT and Tether freezing another $20m. Within just a few days, over $160m had been recovered and returned to Kucoin. As of December, around $235m has been recovered.

In the end, these cyber-criminals managed to successfully cash out $13m through decentralized protocols, with over $25m still in the wind.

As a result of this hack, Kucoin lost many users and many allies in the industry. 60% of the altcoin projects listed were heavily affected, causing them to upgrade contracts and block the hackers. Smaller projects with large amounts of tokens stolen had a large percentage of their tokens sitting with a malicious entity and not with supporters, which is difficult when trying to grow.

Whether Kucoin’s reputation recovers from this remains to be seen.

Binance regaining composure…

2019 saw many exchanges come up against serious hacking syndicates and lose. Binance was one of the victims, losing 7,000 BTC, worth around $40m at the time (and almost $200m at the time of writing). Fortunately, their insurance reserve compensated the users who were hacked, and everyone moved on quickly. Since then, the exchange has beefed up security, and users can feel very safe on a platform that is working hard to reestablish their secure reputation.

Winner: Tie. Both exchanges were poorly hit and are trying to make amends.

Kucoin vs Binance – Concluding the Comparison

Is Kucoin doing enough to knock Binance off of its perch? They’re having a good go at it, but they’ll have to try harder. The big September hack was an enormous setback, but Kucoin remains on its projected target path. In 2017, they claimed they would be a top 10 exchange by 2020, and they did just that. If they want to grow trading volumes and become a bigger and better exchange in 2021, they’ll have to do more to help beginner traders. Binance can keep doing what it is doing because it is pulling away from the pack.