OKX offers a range of structured products designed to help investors navigate the ever-evolving digital asset landscape. By combining different financial instruments, these products provide unique opportunities for investors to manage risks while potentially earning significant returns.

Among the available structured products on OKX are Seagull and Snowball. Seagull was launched on November 8, 2023, offering an innovative investment option for those interested in diversifying their cryptocurrency portfolios. On the other hand, Snowball enables investors to strategise and manage risk while enjoying estimated annual percentage rates (APRs) of 20% to 50% on leading cryptocurrencies such as Bitcoin, Ethereum, and USDT.

Key Takeaways

- OKX structured products offer investment opportunities with risk management features.

- Seagull and Snowball are two examples of structured products provided by OKX.

- Investors can enjoy high estimated APRs and partial downside protection with Snowball.

Fundamentals of Structured Products

Definition and Overview

Structured products are investment tools, which are designed to provide customised exposure to different asset classes. They typically consist of a combination of underlying assets, such as stocks, bonds, or cryptocurrencies, and derivative instruments like options and futures contracts. Thanks to their structured nature, they allow investors to manage their risk exposure and diversify their investment portfolio more effectively.

Types of Structured Products

There are various types of structured products available on platforms like OKX. These can be broadly categorised into three main types:

- Trading tools: These products are focused on assisted trading, helping you to optimise your trading strategies and manage risks.

- Basic structured products: Designed for investors seeking low-risk investments, these products are typically principal-protected, offering a reliable and conservative investment option.

- Advanced structured products: For more experienced investors, such products offer higher returns with increased risk exposure. Examples include futures trading and options trading, allowing you to take advantage of market movements and volatility.

Benefits and Risks

Some benefits of investing in structured products include:

- Customisation: Tailored to suit your investment needs and risk tolerance.

- Diversification: Exposure to different asset classes, helping to mitigate risk.

- Risk management: Opportunities to hedge or protect your investments from market volatility.

However, there are also potential risks associated with structured products:

- Complexity: They can be more difficult to understand compared to traditional investments.

- Liquidity: Some structured products may have limited liquidity, making it difficult to sell or exit the investment in certain situations.

- Issuer risk: The performance and safety of structured products can be impacted by the issuer’s financial health.

OKX Structured Product Offerings

Dual-Currency Products

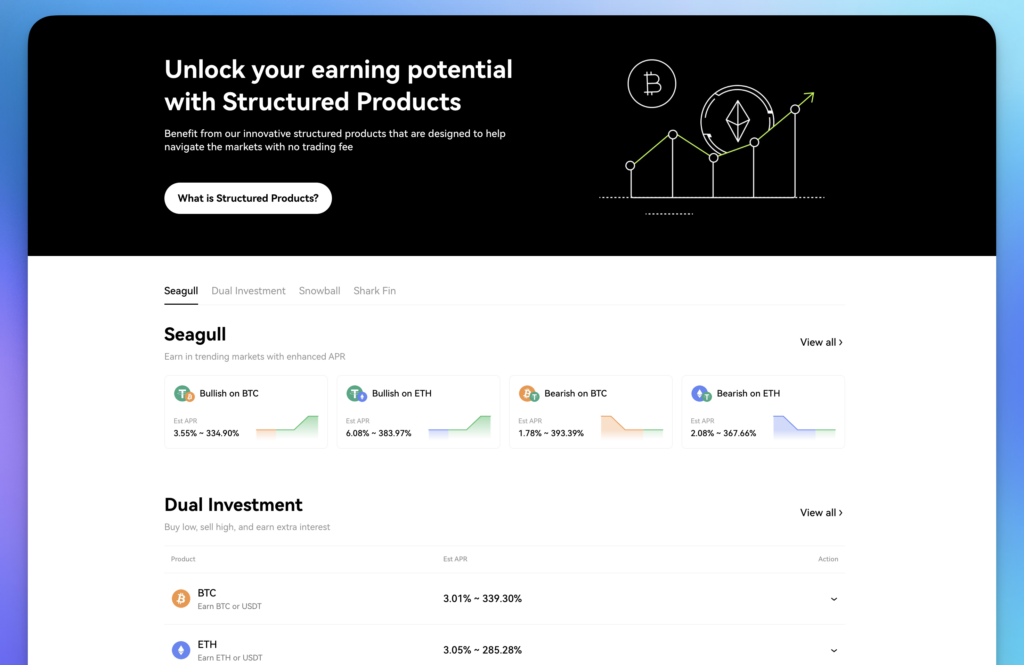

OKX offers a range of dual-currency structured products, designed for different risk appetites. These provide potential for high returns in both bullish and bearish market conditions. For example, Seagull products can generate enhanced APR in trending markets, with estimated returns ranging from 4.12% to 206.20% for BTC and 5.25% to 236.42% for ETH.

Yield Enhancement Products

Yield enhancement products like Snowball help you manage risk while making lucrative returns in various market conditions. Snowball offers incredible estimated APRs of 20-50% on leading cryptocurrencies like BTC, ETH, or USDT, along with partial downside protection.

Capital Protected Notes

Capital protected notes are structured products which focus on protecting your initial investment. Although these notes typically have lower returns, they also provide a safety net for investors in uncertain markets. These products can be a good choice for those who prioritise preserving their invested capital over chasing high yields.

How to Invest in Structured Products on OKX

Account Setup

To begin, register for an account on OKX. After that, make sure to implement recommended security measures for keeping your funds safe. For a faster account verification, complete the OKX KYC process; it has different levels based on your trading needs.

Choosing a Product

OKX offers various structured products, like Seagull, Dual Investment, and Snowball. Familiarise yourself with the expected returns, risks, and durations. Review the market conditions to select a suitable product for your investment.

Investment Process

Once you’ve picked a product, follow the steps on the OKX platform to place your investment. Employ the OKX API for better automation and more control over your investments. Ensure that you have enough funds in your account to invest in the chosen product.

Monitoring Investments

Track your investments regularly for performance updates. Keep an eye on market trends to make informed decisions regarding your structured products. Study your returns and consider reinvesting them for maximised earning potential.

Risk Management Strategies

Hedging Techniques

One effective way to mitigate risk is through hedging. This technique involves taking an opposite position in a related asset to offset potential losses on your initial investment. For example, you might invest in a cryptocurrency like Bitcoin and then also open a short position on a related asset to protect your portfolio from market fluctuations. Visit this page on OKX margin trading to learn more about how to hedge using margin trading.

Diversification Principles

Another risk management strategy is diversification—spreading your investments across different assets to minimise the impact of any single poor-performing asset on your overall portfolio. By diversifying, you can reduce your exposure to specific market risks and improve the stability of your portfolio. One way to employ diversification is by investing in a variety of structured products on the OKX platform, such as their diverse range of structured products.

Understanding Volatility

Monitoring and understanding volatility is key to managing risk in the cryptocurrency market. High volatility can increase the potential for both profits and losses, making it essential to closely track the market and be aware of when to take advantage of price fluctuations. You can minimise your exposure to volatility by using features like OKX’s 2FA authentication to ensure your account’s safety during volatile market periods.

In addition to implementing these risk management strategies, it’s important to take additional security measures such as OKX cold storage security to protect your assets and maintain control over your funds. Remember to also regularly review OKX withdrawal limits as part of your risk management strategy.

Future of Structured Products on OKX

As a user of OKX, you might be curious about the future of structured products on the platform. With a suite of offerings like Shark Fin, Dual Investment, and Snowball, OKX aims to cater to users with varying risk appetites. The goal is to develop a structured product system that can help users find opportunities in any market condition.

In the coming years, expect OKX to introduce even more diverse structured products. They will likely focus on providing customisable options to suit individual trading strategies and risk preferences. Additionally, users can anticipate further enhancements to existing products, such as Snowball, which currently boasts estimated annualised returns of 20% to 50% with partial downside protection.

The future also holds potential collaborations with third-party providers to broaden the scope of structured products on OKX. This will further expand the platform’s appeal to users who seek innovative, sophisticated investment products. By doing so, OKX will continue to position itself as a leader in the digital asset domain, offering comprehensive solutions for a growing user base.

Lastly, it is worth noting that the regulatory landscape around the world may impact the future development and availability of such products. As regulations continue to mature, OKX is committed to maintaining compliance with legal and regulatory requirements. This will ensure the platform’s offerings remain up-to-date and adaptable to the ever-changing financial landscape.