Best Bitcoin Exchange in Australia

G’day mates! Today we are looking Down Under to learn about the best crypto exchanges that our friends in Australia love to use. Of the four crypto exchange winners, three are native to Australia and operate exclusively for Australians and British residents. Over the last few years, Australians looking for a solid, economical, and well-stocked crypto exchange to trade with have been very pleased with the growing number of reliable options, but which one is the best? That’s what we are here to figure out.

So, what qualities are we looking for?

Ranking methodology – How we decided which exchanges to consider

Our Top-Ranked Austrlian Crypto Exchanges

CoinSpot – Best Range of Altcoins in Australia

We are pleased to award our top spot to CoinSpot, a truly impressive exchange founded by Russell Wilson in 2013, in the Australian city of Melbourne. In truth, when we were doing our research, CoinSpot wasn’t at the top of our list, but the more we learned, the more it climbed, and ultimately, we realised that it is exactly the type of cryptocurrency exchange that can go on to dominate a market. Now, we are going to share those findings and explain why CoinSpot is the best out of all the cryptocurrency exchanges in Australia and why over the next few years, it is likely to corner the Aussie market.

Quick Look

- Launched in 2013 in Melbourne by Russell Wilson

- Verified over one million users as of February 2021

- PayID, Poli, and bank transfer deposits

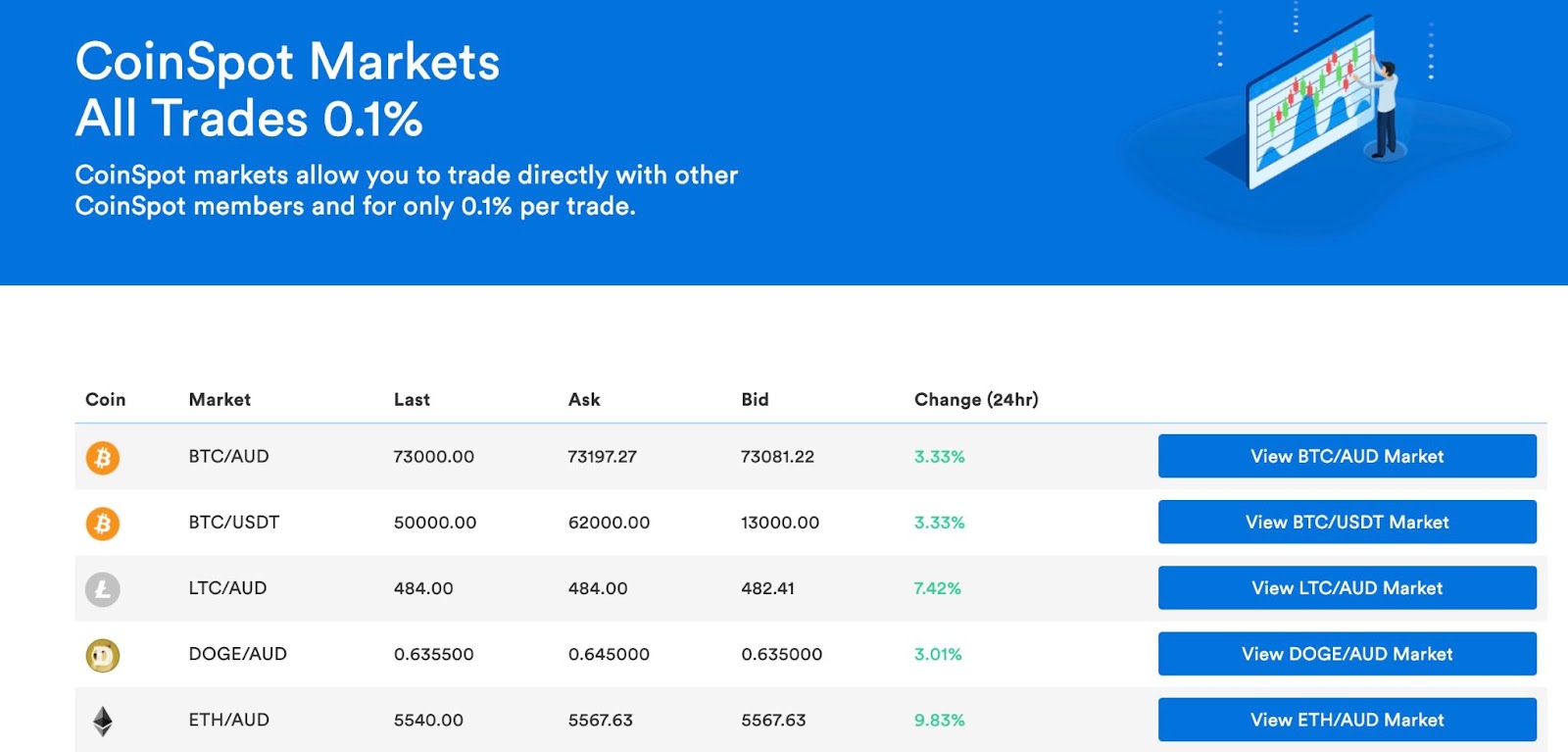

- 0.1% maker and taker fees (the lowest of any Australian cryptocurrency exchange)

- 290+ cryptocurrencies to buy or sell directly, making CoinSpot perhaps the most diverse cryptocurrency brokerage in the world

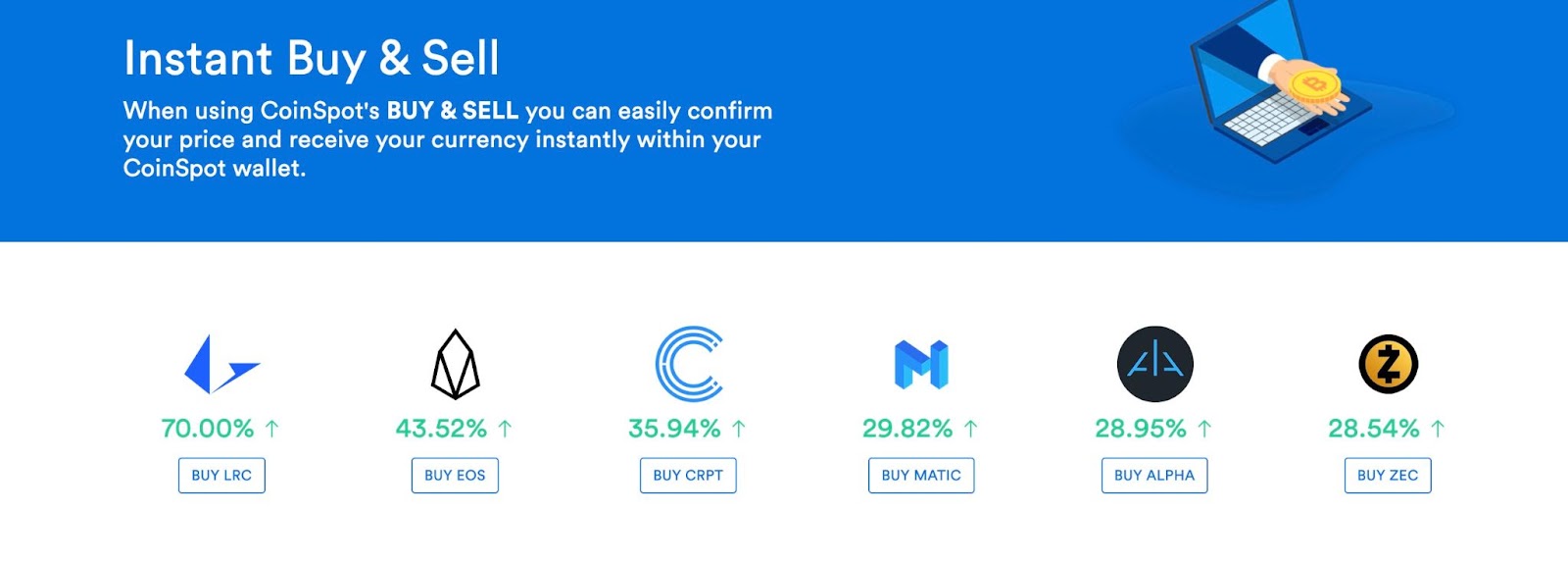

- As well as being able to buy or sell crypto directly from CoinSpot, they offer a dynamic swap feature that allows you to swap any two of the 290+ cryptocurrencies with each other for a fixed 1% fee (Coinbase should be quite worried about this!)

- Live chat in English for Australian users

- Sells bundles of crypto to ease the purchase process for new investors

- A great trading interface that keeps things simple and clean

With over one million registered and verified users on the exchange as of February 2021, it’s safe to say that CoinSpot is the biggest cryptocurrency exchange Down Under. To attract so many users, they needed a really great offering, and that starts by keeping costs low. PayID, Poli, and Bank Transfers (via Osko) are all completely free to use, BPAY is just 0.9%, and cash deposits can be made for 2.5%. All of these deposit methods, except for BPAY, are instant, too, though you will need to go through an online ID verification process the first time you attempt to make a deposit. Staying on the theme of costs, CoinSpot’s cryptocurrency-trading fees are fixed at 0.1%, with no potential to reduce the percentage through high monthly trading volumes or a utility token. Still, though, this is incredibly low compared to the other cryptocurrency exchanges in Australia.

After working dutifully to list new, exciting, and quality coin projects, CoinSpot now boasts more than 290 cryptocurrencies on the exchange website, enough to interest every altcoin investor in the southern hemisphere. Trading and investing, with such a diverse range of altcoins, does come with its drawbacks, and we must be transparent about those negatives.

If it sounds too good to be true…

One of the main problems that we found with CoinSpot was its incredibly high spreads on low-liquidity coins. Those coins that are not bought or sold very often that are in short supply and are not so popular have reportedly been found with a spread of up to 20%! This can really sting traders who fail to make price comparisons. This same spread issue can cause problems when trying to do direct swaps. On CoinSpot, you can swap any two cryptocurrencies on the platform with a fixed fee of 1% (not including the spread) applied. This is remarkable and is much lower than Coinbase’s 2% fee for the same service. However, Coinbase has a spread of just 0.5%, and so it’s probable their overall costs are much lower. If you think the price is wrong or overly inflated, be sure to double-check or risk losing a big chunk of your crypto in the exchange process.

What about customer service and user experience on CoinSpot?

There are five key facts and features that win a big thumbs up from us:

- There is an English live chat feature for quickly resolving your problems, available 24/7

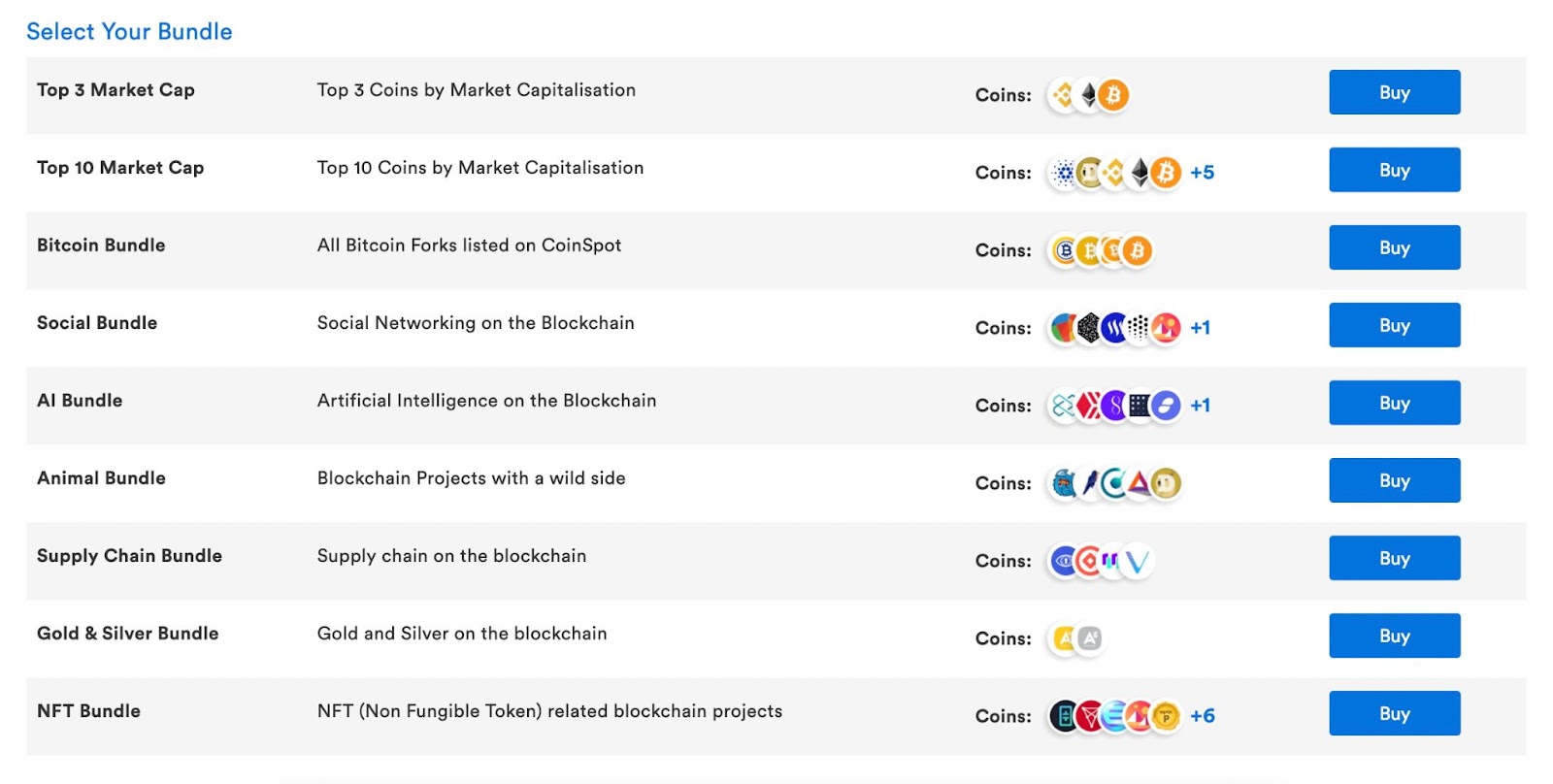

- CoinSpot sells bundles, which essentially put different cryptocurrencies together into a package for sale, removing the need for many small individual transactions for investors. There’s not much room for customisation, but the bundles are themed, like ‘Top 10 market cap’, ‘NFT projects’, and ‘Bitcoin Forks’

- The trading platform and user interface are super easy to use, even if you’ve never traded before, in fact, CoinSpot’s slogan is ‘The crypto exchange you already know how to use’

- CoinSpot is fully audited and has proven that customer funds are kept safely in cold storage and that data protection is managed securely. This audit secured them an ISO stamp of approval, the first crypto exchange in Australia to do so. Founder, Russell Wilson, is quoted as saying “We always hold 100% of our customer assets and the assets are always held in the corresponding asset.” and “The exchange would be able to cope with a large volume of withdrawals without any significant issues.”

- CoinSpot is partnered with Chainalysis to improve KYC, KYT, and the overall level of compliance, which all helps to build trust and confidence with users

Before we move on to our next winning Australian exchange, we need to talk about CoinSpot’s lack of transparency. Despite having a million users and arguably the biggest trading volume in Australia, they don’t share their data and nobody quite knows exactly how well they’re performing. In this industry, transparency equals trust.

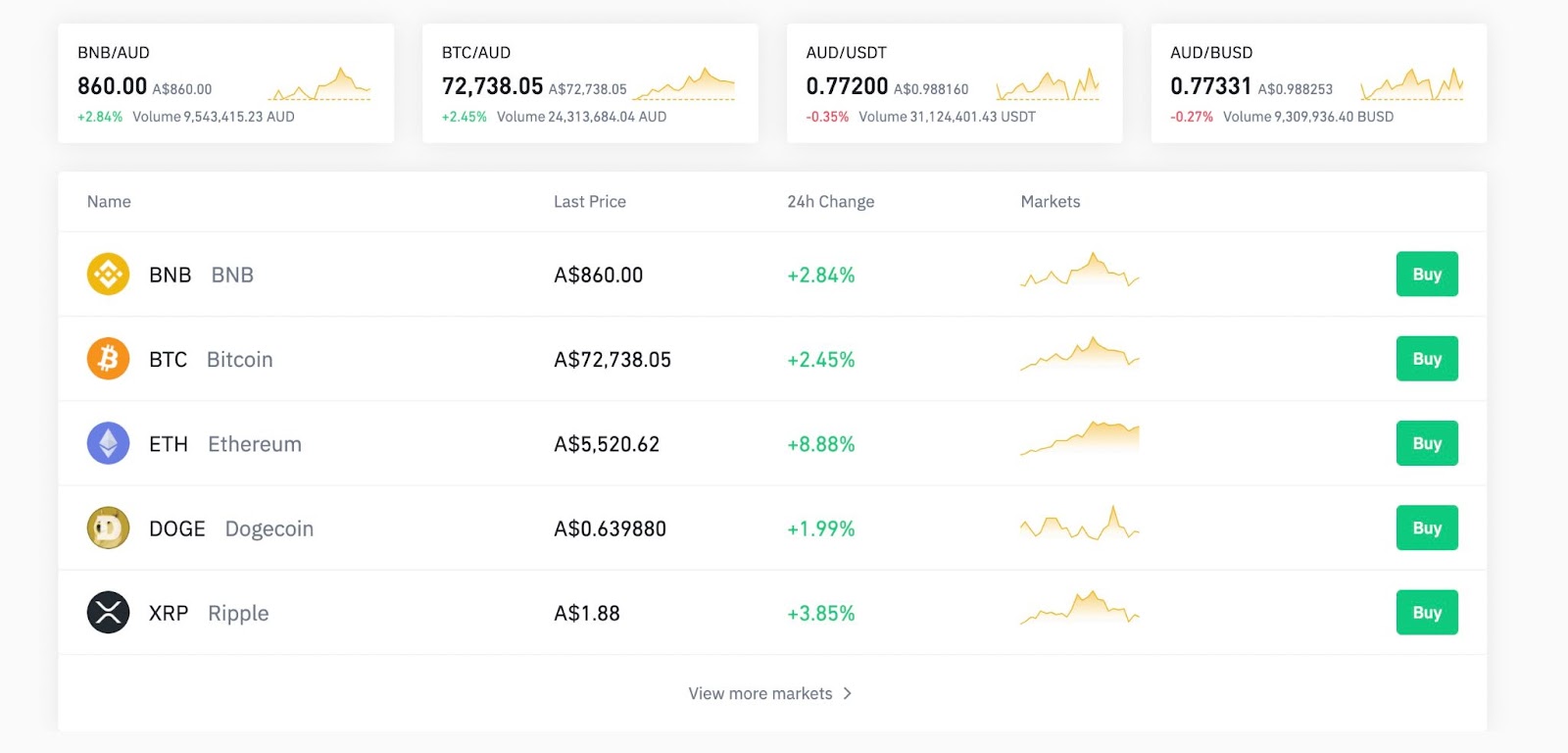

With over 400,000 users, billions of dollars traded, and at least $75m worth of crypto under custody, CoinJar is a small but rapidly growing exchange based out of Melbourne. Serving Aussies and Brits, the crypto exchange has surged in 2021, going from typical trading volumes of $1-10m per day, to experiencing massive trading days where around $200m worth of coins are moved. The majority of that movement and the platform’s liquidity is tied up in just 5 coins – Bitcoin, Ethereum, Litecoin, USDC, and Ripple. With 24 cryptocurrencies in total, the other 19 coins make up just 15% of the liquidity, which isn’t such a great situation to be in. However, since we are looking for the best place to exchange or buy Bitcoin in Australia, the 25% Bitcoin dominance on the exchange may actually be a good thing.

Quick Look

- Launched in 2013 in Melbourne, serves only Australian and UK customers

- Trading fees are 0.2% for both makers and takers

- Free deposits with BPAY, NPP, Direct debit (on bundles)

- Most withdrawals are free or incur a small dynamic fee

- Designed for everyday use, regular traders, and institutions

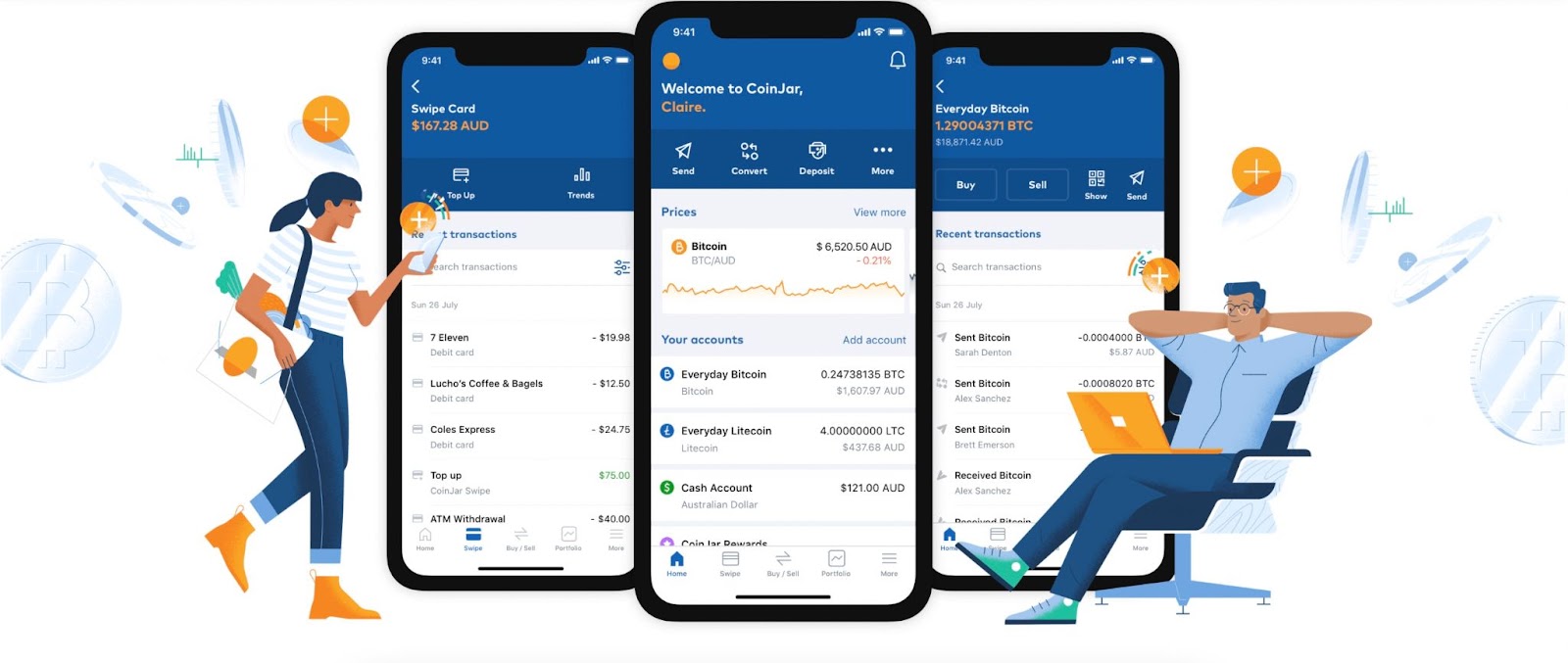

- The Digital currency account and cryptocurrency card make it possible for Australian (and British) residents to spend their crypto in-store on a debit card

- CoinJar users can send funds to each other for free

- Only 24 different cryptocurrencies, however, each one does have a fiat currency pairing with AUD

- Instant AUD withdrawals

Let’s move on to the range of payment methods and deposit options offered by CoinJar. First, BPAY, NPP, and Direct Debit (for bundle purchases) are all free of charge. They also offer Blueshyft cash deposits with fees of 1.5%. Withdrawing AUD to your bank account is free, unless you use BPAY Biller, which has fees of 0.5% plus a currency conversion charge. CoinJar also allows users to transfer funds to each other completely free of charge, which, in theory, can be used as a payment method if your payee is also a CoinJar user.

Trading on the platform is very cost-effective, at just 0.2% for both makers and takers. This is pretty much in line with the global cryptocurrency industry average, although for Australia, it’s slightly below average.

CoinJar offers a range of different products that are aimed at three different sections of the market. For beginners, everyday users, and first-time investors, the CoinJar digital currency account, the debit card, and the bundles. The digital currency account is a wallet that holds both cryptocurrency and fiat currency; the debit card is a Visa card that allows users to spend their Bitcoin in Australia, to buy and sell things as they would with a bank card, and to make the most of their crypto assets from a consumer point of view. The bundles, competing with those sold on CoinSpot, are convenient cryptocurrency packages that wrap up the best crypto tokens into a deal.

The user interface and customer experience throughout are of great quality and make trading cryptocurrency as easy as it needs to be to welcome the masses. The best cryptocurrency trading platforms all do this very well, they make the experience logical, non-technical, and ultimately empowering to the user.

Chinese cryptocurrency exchange Binance, which is now based in Malta and the Cayman Islands, has been described by founder Changpeng Zhao as a business that goes beyond borders. This is especially the case for Binance Australia, which like many regional ‘lite’ versions of Binance, offers additional perks to traders who are resident in the country the crypto exchange is tailored for, though Binance is yet to open an official office in the country.

Quick Look

- Not an Australian cryptocurrency exchange, unlike the others, but rather, it’s the world’s biggest exchange and so offers superior liquidity, trading volume, and the biggest selection of coins (360)

- Credit and debit card purchases and deposits enabled

- 0.1% maximum trading fees

- Instant AUD withdrawals permitted

- PayID and Osko allows customers of over 100 Aussie banks (NPP-enabled) to deposit AUD instantly into your fiat wallet on the exchange

- Binance Australia is operated by InvestbyBit Pty Ltd and is regulated by the Australian Transaction Reports and Analysis Centre (AUSTRAC)

- Since March 2019, Australian users have had the option of making free cash deposits to buy Bitcoin and other cryptocurrencies on Binance. By getting verified on www.binancelite.com, Australian users can place an order online and then deposit cash at their nearest Newsagent store. The crypto will then arrive in their wallet shortly after

- Despite not having a physical office in Australia, Binance has reportedly hired many talented remote workers

- Before the bushfires and subsequent Covid-19 pandemic, the exchange was gearing up to have more of a presence in the country. Perhaps we will see more of a Binance presence in Australia in the future, but in the meantime, Binance did make a nice gesture by donating $1m to the bushfire recovery

As one of the world’s biggest and best cryptocurrency exchanges, Binance has built a reputation on high liquidity, low transaction fees (0.1% for makers and takers), compatibility with debit and credit cards, excellent privacy, and secure wallet options. All of those things are true on Binance Australia too, this is really an exceptional place to buy and sell cryptocurrency, but why has Binance won a spot in our top 3 rather than a native Australian crypto exchange?

First of all, there are zero fees of AUD deposits, which is also true of the other Bitcoin exchanges in this article and for almost all exchanges in Australia, so that’s not it. The trading fees as low as CoinSpot too (although Binance fees shrink with higher trading volumes), so that’s not what sets them apart. Binance also offers the same deposit methods and fiat currency services as their rivals, if not more. What places Binance on our list of the best cryptocurrency exchanges in Australia is their constant desire to innovate, forge partnerships, encourage progress, and contribute to society. For example, Binance forged a huge partnership with Australian fiat-to-crypto gateway Banxa and embedded it into their global platform, helping the company to get exposure to a worldwide audience.

When the bushfires took place in early 2020, devastating much of Australia, Binance sold some of their own crypto holdings so that they could donate $1m to the recovery project, as well as launching a fundraising scheme that encouraged their traders to donate even more crypto to the cause.

As well as trying to provide extra value and support to Australia through business, Binance has also joined Blockchain Australia, taking a chair on the industry body in September 2020. “Australia needs to seize the opportunities presented by blockchain technology and digital currencies, which is why we’re so thrilled to join Blockchain Australia to use our voice to work with industry to promote a continued focus on financial services innovation,” Binance Australia CEO Jeff Yew said.

With 360 coins to choose from, cryptocurrency investing has never been so ripe with choice, plus, there’s a payment method for everyone, with PayID, Osko, credit and debit card, Simplex, Banxa (as mentioned), Poli, and more (including cash deposits in Newsagent stores) enabled. Note that ID verification is mandatory when making crypto purchases. For the trader who likes a little more risk in their life, Binance also offers margin trading, which no other major crypto exchange in Australia can boast.

What else do you need to know?

What is the Australian Government’s position on cryptocurrency and the blockchain?

- As it stands, Australian law doesn’t see digital currencies like Bitcoin and Ethereum as being equal to fiat currency. As it’s not a legal tender or ‘money,’ it is treated differently.

- The Governor of the Reserve Bank of Australia (RBA) announced no plans to create and issue a digital Australian dollar.

- There has not yet been any special legislation drawn up to specifically handle cryptocurrencies since existing financial regulations do a good job covering digital currency and can be applied to cryptocurrency assets. What is important is whether the crypto holdings are financial instruments or are credit (such as crypto lending).

- Smart Contracts have been permitted since 1999 and are treated the same as paper contracts in Australia.

Good luck out there, mates!