Crypto Exchanges Accepting PayPal

As of 2021, PayPal welcomes over 400 million registered account holders — far more than the total number of people holding cryptocurrency, estimated to be slightly more than 100 million by comparison. PayPal is the world’s payment gateway of choice, allowing millions of merchants globally to accept purchases in a vast number of currencies, and now, a selection of digital or cryptocurrencies too. Those who want to buy Bitcoin with PayPal might not have the easiest time embracing this payment method yet, but as you will read, it’s getting easier. We are just getting over the first major hurdles.

While doing our research, we found that so few exchanges accept PayPal or offer functionality with it that we had to overlook the small exchanges and stick with the significant trusted marketplaces. We were excited to list Binance P2P until they delisted PayPal as a payment method earlier this year. We also wanted to discuss KuCoin P2P, but liquidity is so low that we can’t honorably recommend it to you for its PayPal integration. So for now, there’s only one winner.

A Quick Look at Coinbase

- Coinbase’s US user base received a huge boost in April 2021 when the crypto exchange and brokerage announced that PayPal could be used to purchase Bitcoin and other major cryptocurrencies (other nationalities are still patiently waiting).

- With crypto becoming more mainstream, the intention of partnering with PayPal is to encourage a more familiar and trusted customer experience.

- Like making an online shopping purchase, users select the crypto they want to buy, and when asked for a payment method, they choose PayPal, at which point they are transferred to a PayPal login screen.

- Daily purchase limits are $25,000, with users also able to cash out large amounts each day, which is much larger than the $5,000 limit that currently exists for those who use a bank transfer, credit, or debit card.

- The major downside for those who want to buy Bitcoin with PayPal is the ~4% PayPal specific fees, on top of Binance’s small spread. For those who want to deposit funds from their PayPal account into Coinbase, there is a 2.5% levy.

- Users in Canada, the UK, and the EU have been able to withdraw fiat currencies from their accounts to PayPal for a while now. This means that users must first sell their crypto for fiat currency within the website or app and then withdraw it.

- The PayPal purchase integration will reportedly be rolled out to other countries in late 2021.

- eChecks and PayPal-linked credit cards cannot be used to purchase crypto with Coinbase.

- There are a few terms and conditions involved in the account linking procedure, such as: if your PayPal email and Coinbase email don’t match you have to do 2-Factor Authentication; your PayPal country and Coinbase country need to be the same; you can only link your PayPal to one Coinbase account; prepaid cards, business cards, and credit cards are not permitted as a payment method; and finally, you cannot use your PayPal balance — a debit card or bank account must be linked.

- From PayPal’s perspective, this move was another impressive step into the crypto-sphere, building on the decision in early 2021 to allow their users to buy, hold, and sell cryptocurrency, essentially allowing millions of their online merchants the decision and opportunity to engage in this financial revolution.

- Coinbase’s Product Manager, Eddie Lo, is quoted as saying (about the PayPal integration), “We’re looking forward to meeting you where you already spend, pay, send, and save, and enabling more options with brands you already use. Simplicity and ease of use are core tenets of Coinbase and we are committed to delivering on this promise.”

PayPal’s New Best Friend

In April 2021, Coinbase coolly announced that they were the first major cryptocurrency exchange for accepting PayPal as a payment method to purchase Bitcoins and a small range of other digital currency tokens. It was big news and came not long after PayPal announced that they would be allowing their merchants to accept cryptocurrency as a payment method, which created a huge wave of excitement that resulted in coin prices jumping up. But, of course, any major news of institutional adoption tends to have that effect.

Coinbase’s side of things already offered many payment methods and supported countries, so what benefit was there to enabling US users to choose PayPal as their payment option? Well, for one thing, the largest demographics of cryptocurrency users is relatively young, with many investors having grown up with PayPal as their preferred payment method for online purchases. In addition, by allowing them to buy crypto with PayPal, the site acts as a more friendly, mainstream, and trusted brokerage service than their rivals. Everyone’s a winner.

How does a PayPal purchase work on Coinbase?

If you want to purchase Bitcoin directly with PayPal, you’ll need to go through a few steps first to reach that point. Fortunately, we are going to explain how.

- Your Coinbase account must be fully verified, which means performing all KYC checks. Now, if you’ve never used Coinbase before and you want to make an account, this is now part of the standard signup process. If you are a regular Coinbase user and you buy Bitcoins all the time, you will have done your KYC checks already

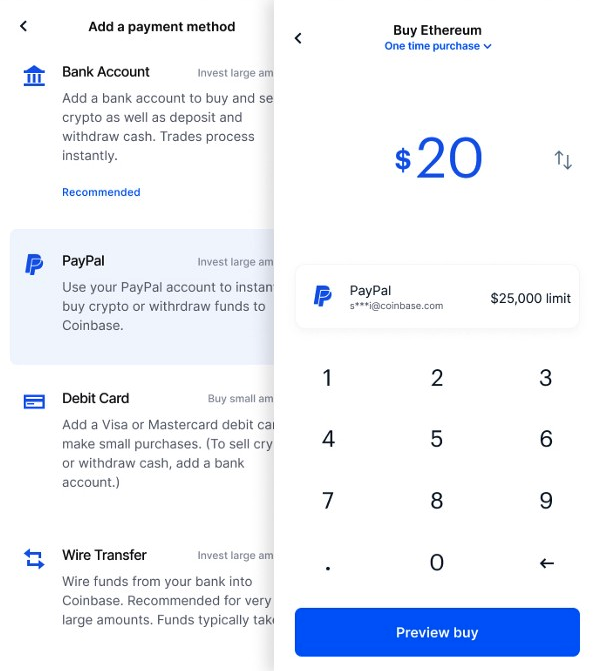

- Once fully verified, head to ‘Settings’ and from there, go to ‘Payment Methods’ and choose ‘Add a New Payment Method’. In the mobile app, there’s an option within setting that simply says ‘Add a Payment Method’

- On the next page will be several options, among which you’ll see PayPal. When you select it, you’ll be redirected to a PayPal login page

- If your Coinbase and PayPal email addresses are not the same, you will be required to do 2-Factor Authentication at this stage. If they do match, you’ll proceed immediately

- If you’re having trouble proceeding, it is because

- Your PayPal and Coinbase accounts are registered in different countries

- You can only link a PayPal account to one Coinbase account (and it seems to the system that yours is registered elsewhere)

- Now, there are millions of people out there who use PayPal for accepting payments from friends, family, and customers, and so they may have built up a considerable PayPal balance. Unfortunately, this balance cannot be used to buy Bitcoins and the like. Your PayPal account must be connected to a bank account or debit card (prepaid or credit cards won’t work either), which is where payment will be withdrawn from

- Once all of the above is done, you can start making Bitcoin purchases with basic retail investor accounts on Coinbase

- To make a purchase, simply select the amount you want to buy and proceed with the transaction

Before we move on, we should note that if you wish to change your desired payment method from PayPal to another option, you’ll need to unlink the Paypal account first.

Another tidbit of info here. When you make a PayPal transfer to buy Bitcoins (or altcoins), you’ll see that bank accounts and debit cards register one transaction, but the Coinbase USD wallet registers two. Why is this? Well, PayPal is a fiat currency service, so as soon as you make your purchase, the fiat amount is added to Coinbase and is used to purchase crypto instantly. The two transactions are recorded for transparency.

What about fees, limits, and restrictions?

Those who want to purchase cryptocurrencies on Coinbase are held back by a $5,000 daily limit, which applies to debit cards and bank transfers but doesn’t apply to PayPal. In fact, despite Coinbase requiring users to connect their PayPal to a bank account or debit card, they permit a daily purchase limit of $25,000. In essence, this higher limit is a major incentive for large volume investors to get some virtual currency in their portfolio immediately before Coinbase changes its policy.

There is a 3.99% payment processing fee for purchases and a 2.5% charge for depositing US dollars when it comes to fees. There’s also a spread of about 0.5%, the difference between the exact market price and the price Coinbase sells cryptocurrency to you. They are, after all, just a middle man before you and your coins, and this is part of the trading process. Unlike a person-to-person marketplace (P2P), you will have to pay fees pretty much everywhere in the crypto world. Customers who make large purchases will also receive better deals than those who make lots of smaller transactions, as the former will be losing money rapidly through unfavorable fee structures.

If reports are accurate, the restrictions mean users in the UK, EU, and Canada can currently only withdraw Bitcoin profits as fiat money is lifted. However, by the end of 2021, users in these nations should be able to start buying Bitcoin too! This is excellent news for the platform as a whole.

The Perks of PayPal

Buying and selling Bitcoin is easy on a trading platform, but when you want to sell Bitcoin for a currency like dollars, pounds, euros, or rubles, it can get a little bit tricky. Regulators are doing their best to keep on top of an industry doing its best to outgrow them. It’s a game of cat and mouse, but thanks to the integration of PayPal, buying Bitcoin in the US is a lot simpler than before. People like, trust, and accept PayPal — they’ve become accustomed to using it for online purchases; why should crypto be any different? Whether buying or selling coins, your Bitcoin exchange should offer plenty of methods to get BTC in or out of your Bitcoin wallet. In the future, we envision a time where we can convert Bitcoin to cash out in a matter of minutes (as long as it takes ours to the block).